|

市场调查报告书

商品编码

1844328

电动自行车驱动装置市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测E-Bike Drive Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

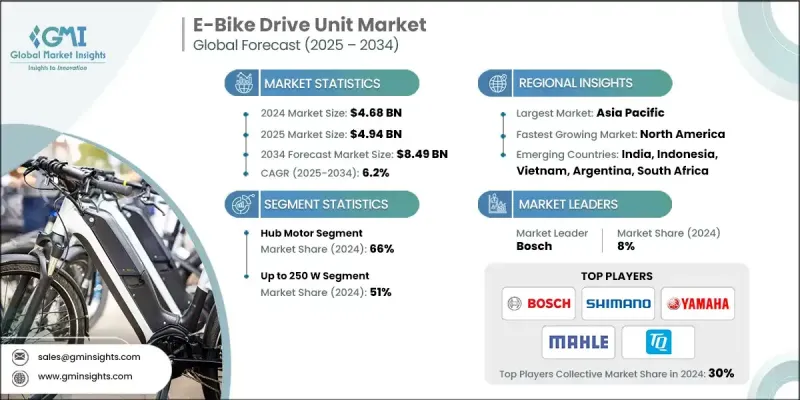

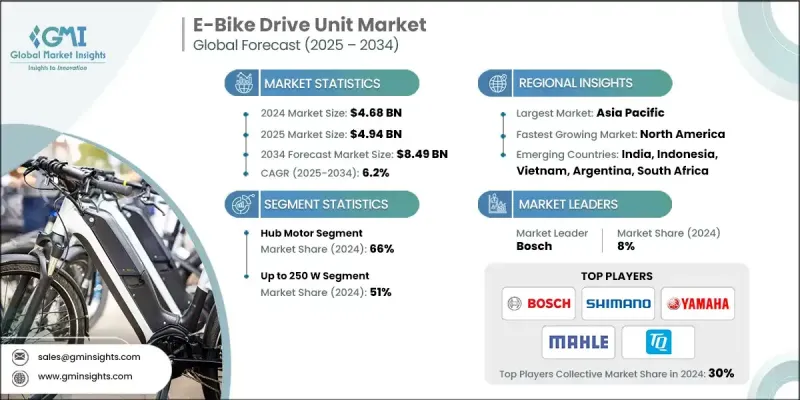

2024 年全球电动自行车驱动装置市场价值为 46.8 亿美元,预计将以 6.2% 的复合年增长率成长,到 2034 年达到 84.9 亿美元。

随着电动车日益成为主流,对高效能智慧驱动系统的需求持续成长。这些驱动装置结合了马达、控制系统和感测器,可为电动自行车提供辅助或全程动力,从而提升使用者体验。多年来,技术已从基本的轮毂马达发展到整合电子元件和软体的复杂系统。驱动装置通常配备扭力感测器、再生煞车和智慧互联功能,使其高效智能,适用于各种地形和城市道路。中置驱动装置因其均衡的重量分布、更佳的扭矩以及与现有传动系统的无缝集成,在徒步自行车、山地自行车和货运自行车中越来越受欢迎。模组化电池设计和互联功能的改进正在提升这些系统的整体价值。原始设备製造商 (OEM) 主导供应链,为自行车製造商提供完整的解决方案,并在产品开发过程中建立重要的合作关係。虽然改装套件和替换马达的售后市场存在,但它仅占总收入的一小部分,大部分销售额来自OEM製造商主导的製造管道。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 46.8亿美元 |

| 预测值 | 84.9亿美元 |

| 复合年增长率 | 6.2% |

2024年,轮毂马达市场占66%的市场份额,预计到2034年将以5.5%的复合年增长率成长。轮毂马达可内建于前轮或后轮,设计简化,所需组件更少,从而降低生产和维护成本。它们独立于自行车传动系统运行,是城市通勤者和入门级骑行者的理想选择。这种分离有助于减少链条和飞轮的磨损,进一步缩短维护週期。其经济实惠且操作简便的特点使其非常适合城市骑行应用。

2024年,功率高达250瓦的电动自行车驱动装置占了51%的市场份额,预计2025年至2034年的复合年增长率将达到5.2%。这些装置构成了全球电动自行车马达的主要组成部分,并符合主要地区的监管标准。大多数市场,尤其是北美、日本和欧洲,将电动自行车驱动装置的连续额定功率限制在250瓦。这种监管协调鼓励大规模采用,确保合规性,同时满足大多数骑乘者的动力需求。

亚太地区电动自行车驱动单元市场占38%的市场份额,2024年市场规模达17.8亿美元。该地区的政府政策和战略性城市规划正在加速电动出行的转型。在一些国家,电动自行车的待遇与传统自行车类似,这减少了监管摩擦,并提高了使用者的使用率。旨在补贴电动自行车购买的大规模公共项目也在推动驱动单元需求方面发挥了重要作用,尤其是在广泛零售网路支持的情况下。

活跃于电动自行车驱动单元市场的主要公司包括禧玛诺、雅马哈、八方、通盛电机、博世、博泽、大普电机、TQ集团、法雷奥和马勒。这些公司正在采取多种策略来巩固其市场地位。公司专注于研发,以提高扭力响应、电池效率和智慧整合。许多公司已经扩大了与OEM) 的合作伙伴关係,以确保其驱动单元能够应用于高端高性能电动自行车。针对通勤、健行和货运等不同用例的可客製化驱动系统正在帮助品牌扩大其消费者群体。应用程式连接和无线更新等智慧功能的整合正成为竞争格局中的关键差异化因素。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预报

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 城市拥挤和通勤挑战

- 政府激励和补贴

- 健身与环保生活方式的兴起

- 驱动系统的技术进步

- 扩大电动自行车共享和租赁服务

- 燃油价格和车辆拥有成本上涨

- 产业陷阱与挑战

- 先进驱动装置成本高

- 充电基础设施有限

- 市场机会

- 轻量化、紧凑型驱动装置的开发

- 智慧互联技术的融合

- 新兴市场的扩张

- 货运和多功能电动自行车的成长

- 成长动力

- 成长潜力分析

- 专利分析

- 波特的分析

- PESTEL分析

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 人工智慧自适应控制系统

- 机器学习整合能力

- 预测性维护和故障预防

- 能源优化和范围扩展

- 无线充电整合和基础设施

- 固态电池整合的影响

- 车辆到电网整合和能源服务

- 自主和自平衡系统

- 新兴技术

- 当前的技术趋势

- 价格趋势

- 按地区

- 按产品

- 投资与融资趋势分析

- 安全实施策略

- 硬体安全模组集成

- 加密通讯协定

- 安全启动和韧体保护

- 入侵侦测和回应系统

- 监管格局

- 资料保护法规合规性

- 网路安全框架要求

- 业界特定的安全标准

- 认证和审核要求

- 诊断工具和设备要求

- 製造商特定的诊断系统

- 服务设备标准化

- 永续性和 ESG 影响分析

- 永续性和 ESG 影响分析

- 社会影响力和社区关係

- 治理与企业责任

- 保固服务和成本分析

- 保固范围比较

- 保固索赔分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 市场进入策略

- 客户满意度基准测试

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按马达支架,2021 - 2034

- 主要趋势

- 轮毂电机

- 后部

- 正面

- 中置驱动马达

第六章:市场估计与预测:依产能,2021 - 2034

- 主要趋势

- 高达 250 瓦

- 250 瓦 - 550 瓦

- 550瓦以上

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 货运自行车

- 高达 250W

- 250瓦 - 550瓦

- 550W以上

- 健行自行车

- 高达 250W

- 250瓦 - 550瓦

- 550W以上

- 城市自行车

- 高达 250W

- 250瓦 - 550瓦

- 550W以上

第八章:市场估计与预测:依分布,2021 - 2034

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 印尼

- 菲律宾

- 泰国

- 韩国

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- 全球参与者

- Bosch

- Shimano

- Brose (Acquired by Yamaha)

- Yamaha

- Valeo

- Mahle

- Dapu Motors

- 区域参与者

- Fazua

- TQ-Group

- Pinion

- Zehus

- SHINWIN

- Ananda Drive Technology

- Bafang

- Tongsheng Motor

- 新兴参与者/颠覆者

- To7 Motor

- Tamobyke

- Karmina E-bike

- GOBAO

- Suzhou Shengyi Motor

- SEG Automotive

The Global E-Bike Drive Unit Market was valued at USD 4.68 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 8.49 billion by 2034.

As electric mobility becomes more mainstream, the demand for efficient and intelligent drive systems continues to rise. These drive units combine motors, control systems, and sensors that assist or fully power the e-bike, improving user experience. Over the years, technology has evolved from basic hub motors to sophisticated systems with integrated electronics and software. Drive units often feature torque sensors, regenerative braking, and intelligent connectivity, making them highly efficient and smarter for varied terrains and urban use. Mid-drive units are increasingly popular in trekking, mountain, and cargo bikes due to their balanced weight distribution, better torque, and seamless integration with existing drivetrains. Improvements in modular battery design and connectivity features are driving up the overall value of these systems. OEMs dominate the supply chain, offering complete solutions to bicycle manufacturers and forming critical partnerships during product development. Although the aftermarket for conversion kits and replacement motors exists, it contributes only a small portion to total revenue, with most sales rooted in OEM-led manufacturing channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.68 Billion |

| Forecast Value | $8.49 Billion |

| CAGR | 6.2% |

In 2024, the hub motor segment held a 66% share and is projected to grow at a CAGR of 5.5% through 2034. Built into either the front or rear wheel, hub motors offer a simplified design that requires fewer components, lowering both production and maintenance costs. Their independent operation from the bike's drivetrain makes them ideal for urban commuters and entry-level riders. This separation helps reduce wear on chains and cassettes, further improving maintenance cycles. Their affordability and simplicity keep them highly relevant for city-focused applications.

The e-bike drive units up to 250 W segment held a 51% share in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2034. These units represent the bulk of e-bike motors globally and align with regulatory standards in key regions. Most markets, especially in North America, Japan, and Europe limit e-bike drive units to a continuous power rating of 250 W. This regulatory alignment encourages mass adoption, ensuring compliance while meeting the power needs of most riders.

Asia Pacific E-Bike Drive Unit Market held 38% share and generated USD 1.78 billion in 2024. Government policies and strategic urban planning across the region are accelerating the shift to e-mobility. In several countries, e-bikes are treated similarly to traditional bicycles, reducing regulatory friction and increasing user adoption. Large-scale public programs aimed at subsidizing e-bike purchases have also played a major role in boosting demand for drive units, especially when supported through wide-reaching retail networks.

Key companies active in the E-Bike Drive Unit Market include Shimano, Yamaha, Bafang, Tongsheng Motor, Bosch, Brose, Dapu Motors, TQ-Group, Valeo, and Mahle. These players are adopting multiple strategies to strengthen their market position. Companies are focusing on R&D to improve torque response, battery efficiency, and intelligent integration. Many have expanded OEM partnerships to ensure their units are adopted in premium and performance e-bikes. Customizable drive systems for different use cases, commuting, trekking, and cargo, are helping brands widen their consumer base. Integration of smart features such as app connectivity and over-the-air updates is becoming a key differentiator in a competitive landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Motor mounting

- 2.2.3 Capacity

- 2.2.4 Application

- 2.2.5 Distribution

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urban congestion and commuting challenges

- 3.2.1.2 Government incentives and subsidies

- 3.2.1.3 Growth in fitness and eco-conscious lifestyles

- 3.2.1.4 Technological advancements in drive systems

- 3.2.1.5 Expansion of e-bike sharing and rental services

- 3.2.1.6 Rising fuel prices and vehicle ownership costs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced drive units

- 3.2.2.2 Limited charging infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Development of lightweight, compact drive units

- 3.2.3.2 Integration of smart and connected technologies

- 3.2.3.3 Expansion in emerging markets

- 3.2.3.4 Growth of cargo and utility e-bikes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Growth potential analysis

- 3.8 Regulatory landscape

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Technology and innovation landscape

- 3.11.1 Current technological trends

- 3.11.1.1 AI-powered adaptive control systems

- 3.11.1.2 Machine learning integration capabilities

- 3.11.1.3 Predictive maintenance & failure prevention

- 3.11.1.4 Energy optimization & range extension

- 3.11.1.5 Wireless charging integration & infrastructure

- 3.11.1.6 Solid-state battery integration impact

- 3.11.1.7 Vehicle-to-grid integration & energy services

- 3.11.1.8 Autonomous & self-balancing systems

- 3.11.2 Emerging technologies

- 3.11.1 Current technological trends

- 3.12 Price trends

- 3.12.1 By region

- 3.12.2 By product

- 3.13 Investment & funding trends analysis

- 3.14 Security implementation strategies

- 3.14.1 Hardware security module integration

- 3.14.2 Encrypted communication protocols

- 3.14.3 Secure boot & firmware protection

- 3.14.4 Intrusion detection & response systems

- 3.15 Regulatory landscape

- 3.15.1 Data protection regulation compliance

- 3.15.2 Cybersecurity framework requirements

- 3.15.3 Industry-specific security standards

- 3.15.4 Certification & audit requirements

- 3.16 Diagnostic tools & equipment requirements

- 3.16.1 Manufacturer-specific diagnostic systems

- 3.16.2 Service equipment standardization

- 3.17 Sustainability & ESG impact analysis

- 3.17.1 Sustainability & ESG impact analysis

- 3.17.2 Social impact & community relations

- 3.17.3 Governance & corporate responsibility

- 3.18 Warranty service & cost analysis

- 3.18.1 Warranty coverage comparison

- 3.18.2 Warranty claim analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Go-to-market strategies

- 4.7 Customer satisfaction benchmarking

- 4.8 Key developments

- 4.8.1 Mergers & acquisitions

- 4.8.2 Partnerships & collaborations

- 4.8.3 New product launches

- 4.8.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Motor Mounting, 2021 - 2034 (USD Bn, Million Units)

- 5.1 Key trends

- 5.2 Hub motor

- 5.2.1 Rear

- 5.2.2 Front

- 5.3 Mid-drive motor

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 - 2034 (USD Bn, Million Units)

- 6.1 Key trends

- 6.2 Up to 250 W

- 6.3 250 W - 550 W

- 6.4 Above 550 W

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Bn, Million Units)

- 7.1 Key trends

- 7.2 Cargo bike

- 7.2.1 Up to 250W

- 7.2.2 250W - 550W

- 7.2.3 Above 550W

- 7.3 Trekking bike

- 7.3.1 Up to 250W

- 7.3.2 250W - 550W

- 7.3.3 Above 550W

- 7.4 City/urban bike

- 7.4.1 Up to 250W

- 7.4.2 250W - 550W

- 7.4.3 Above 550W

Chapter 8 Market Estimates & Forecast, By Distribution, 2021 - 2034 (USD Bn, Million Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn, Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Bosch

- 10.1.2 Shimano

- 10.1.3 Brose (Acquired by Yamaha)

- 10.1.4 Yamaha

- 10.1.5 Valeo

- 10.1.6 Mahle

- 10.1.7 Dapu Motors

- 10.2 Regional Players

- 10.2.1 Fazua

- 10.2.2 TQ-Group

- 10.2.3 Pinion

- 10.2.4 Zehus

- 10.2.5 SHINWIN

- 10.2.6 Ananda Drive Technology

- 10.2.7 Bafang

- 10.2.8 Tongsheng Motor

- 10.3 Emerging Players / Disruptors

- 10.3.1. To7 Motor

- 10.3.2 Tamobyke

- 10.3.3 Karmina E-bike

- 10.3.4 GOBAO

- 10.3.5 Suzhou Shengyi Motor

- 10.3.6 SEG Automotive