|

市场调查报告书

商品编码

1844330

皮肤病药物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dermatology Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

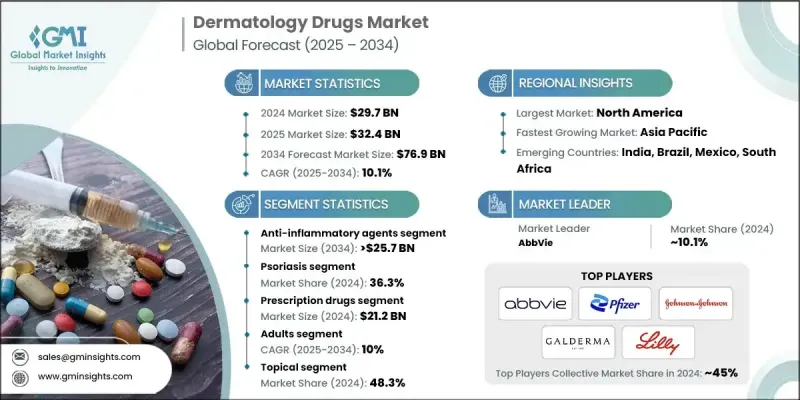

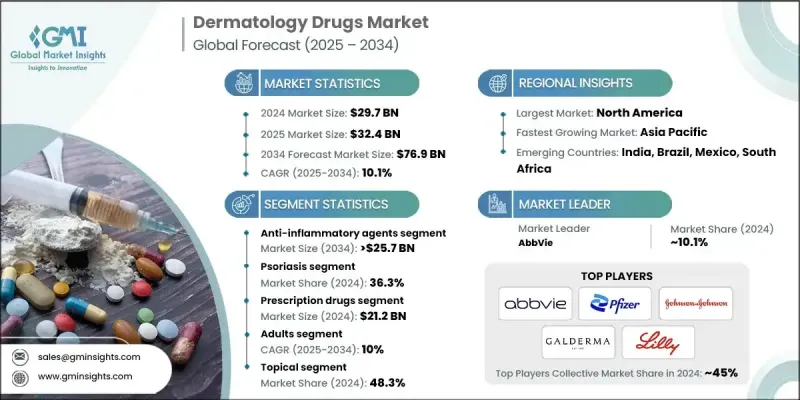

2024 年全球皮肤病药物市场价值为 297 亿美元,预计将以 10.1% 的复合年增长率成长,到 2034 年达到 769 亿美元。

这一上升趋势的驱动因素包括痤疮、湿疹和牛皮癣等慢性和急性皮肤病的日益流行,以及人们对罕见皮肤病的日益关注。由于单株抗体和小分子抑制剂等标靶治疗技术的进步,市场正呈现强劲成长势头,这些技术正在带来更有效、更利于患者的治疗结果。针对抗药性皮肤病的治疗需求也在不断增长,这为旨在控制症状和减缓病情进展的新剂型创造了空间。医院、皮肤科诊所和居家医疗服务可近性的持续扩大,持续推动了药物的采用,尤其是在已开发地区和新兴地区。病患意识的不断提升,加上消费者对个人化医疗的偏好不断变化,也正在推动药物的成长。领先的製药公司正在大力投资研发,以获得监管部门的批准,并推出针对特定发炎或免疫途径的疗法。这些努力加强了向精准皮肤病学的转变,并优化了给药平台,旨在最大限度地减少副作用并提高患者的长期依从性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 297亿美元 |

| 预测值 | 769亿美元 |

| 复合年增长率 | 10.1% |

2024年,抗发炎疗法市场占32.6%的市场份额,预计到2034年将达到257亿美元,复合年增长率为10.4%。皮质类固醇和非类固醇类药物在治疗多种发炎性皮肤病方面的高效性支撑了这一市场主导地位。这些製剂能够快速缓解症状,使其成为治疗急性和慢性疾病的标准方法。随着异位性皮肤炎和牛皮癣等皮肤病的发病率持续上升,这些药物的应用也随之增加,其中大多数已成为临床实践中的一线疗法。

2024年,处方药市场规模达212亿美元。强有力的临床证据、持续的创新以及标靶品牌药物的开发,为处方药的持续应用提供了支持。这些疗法对于治疗中度至重度皮肤病至关重要,尤其是那些需要长期使用生物製剂、皮质类固醇和抗真菌药物治疗的皮肤病。监管部门的批准和配方的优化正在推动处方药的市场渗透,尤其是在患者需要客製化、持续性医疗护理的领域。

2024年,北美皮肤科药物市场占据40.4%的市场份额,这得益于人们的认知度提高、先进医疗服务可及性的提升以及慢性皮肤病患者数量的增加。该地区的成长也受到个人化皮肤科治疗(例如基于生物标记的药物开发和基因分析)的推动。包括加拿大和美国在内的该地区各国正在完善其医疗保健框架,以改善皮肤科治疗的可及性,并辅以优惠的报销政策和公共卫生推广计划。

塑造全球皮肤科药物产业格局的关键参与者包括高德美、辉瑞、因塞特、赛诺菲、礼来、阿斯特捷利康、艾伯维、葛兰素史克、利奥製药、博士伦、Dermavant Sciences、诺华、安进、强生、罗氏、Almirall 和默克。为了扩大市场份额,领先的皮肤科药物製造商正在采取多管齐下的策略。许多公司正在投资下一代生物製剂和基因标靶疗法,以丰富其产品组合併满足不断变化的治疗需求。与生物技术公司和研究机构的策略合作有助于加速药物发现和产品线开发。各公司也优先考虑地理扩张,尤其是进入医疗基础设施日益完善的新兴市场。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 慢性皮肤病盛行率不断上升

- 人口结构变化与生活方式因素

- 生物製剂和小分子药物的进展

- 人们对皮肤健康和美学的认识不断提高

- 产业陷阱与挑战

- 不良反应和抗药性

- 资源匮乏环境下的取得受限

- 市场机会

- 个人化皮肤病学的扩展

- 人工智慧与远距医疗皮肤病学的整合

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 未来市场趋势

- 技术格局

- 投资和融资格局

- 专利分析

- 报销场景

- 管道分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- 免疫调节剂

- 类视黄醇

- 抗生素

- 抗发炎药

- 抗真菌药物

- 其他药物类别

第六章:市场估计与预测:按适应症,2021 - 2034 年

- 主要趋势

- 牛皮癣

- 异位性皮肤炎

- 粉刺

- 皮肤癌

- 其他适应症

第七章:市场估计与预测:按模式,2021 - 2034

- 主要趋势

- 处方药

- 非处方药

第八章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 儿科

- 成年人

- 老年

第九章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 肠外

- 外用

- 口服

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 皮肤科诊所

- 居家照护环境

- 其他最终用途

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- AbbVie

- Almirall

- Amgen

- AstraZeneca

- Bausch Health

- Dermavant Sciences

- Eli Lilly and Company

- F. Hoffmann La Roche

- Galderma

- GlaxoSmithKline

- Incyte

- Johnson & Johnson

- Leo Pharma

- Merck KGaA

- Novartis

- Pfizer

- Sanofi

The Global Dermatology Drugs Market was valued at USD 29.7 billion in 2024 and is estimated to grow at a CAGR of 10.1% to reach USD 76.9 billion by 2034.

This upward trend is driven by the increasing prevalence of chronic and acute skin conditions such as acne, eczema, and psoriasis, along with a growing focus on rare dermatological disorders. The market is witnessing strong momentum due to technological advances in targeted therapies, including monoclonal antibodies and small molecule inhibitors, which are delivering more effective and patient-friendly outcomes. Demand is also rising for treatments addressing drug-resistant skin diseases, which is creating space for new formulations designed to control symptoms and slow disease progression. The expanding access to care across hospitals, dermatology clinics, and home-based healthcare continues to boost drug adoption, particularly in both developed and emerging regions. Rising patient awareness, coupled with evolving consumer preference for personalized medicine, is also shaping growth. Leading pharmaceutical players are investing heavily in R&D to secure regulatory approvals and launch therapies that act on specific inflammatory or immune pathways. These efforts have strengthened the shift toward precision dermatology and optimized drug delivery platforms aimed at minimizing side effects and improving long-term patient adherence.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.7 Billion |

| Forecast Value | $76.9 Billion |

| CAGR | 10.1% |

The anti-inflammatory therapies segment held a 32.6% share in 2024 and is projected to reach USD 25.7 billion by 2034, growing at a CAGR of 10.4%. This dominance is supported by the high efficacy of corticosteroids and non-steroidal agents in addressing a wide range of inflammatory skin disorders. These formulations offer quick relief, making them the standard approach in managing both acute and persistent conditions. As skin disorders such as atopic dermatitis and psoriasis continue to rise, the adoption of these medications increases, with most being first-line therapies in clinical practice.

The prescription drugs segment generated USD 21.2 billion in 2024. Their continued use is supported by strong clinical evidence, consistent innovation, and the development of targeted branded drugs. These therapies are central in managing moderate to severe skin conditions, especially those that require long-term treatment using biologics, corticosteroids, and antifungals. Regulatory approvals and enhanced formulations are fueling their market penetration, particularly in segments where patients require customized, ongoing medical care.

North America Dermatology Drugs Market held a 40.4% share in 2024, driven by high awareness levels, better access to advanced medical care, and an increasing number of individuals affected by chronic skin conditions. The region's growth is also being influenced by the adoption of personalized dermatological treatments, such as biomarker-based drug development and genetic profiling. Countries across the region, including Canada and the U.S., are enhancing their healthcare frameworks to improve dermatological access, aided by favorable reimbursement policies and public health outreach programs.

Key players shaping the landscape of the Global Dermatology Drugs Industry include Galderma, Pfizer, Incyte, Sanofi, Eli Lilly and Company, AstraZeneca, AbbVie, GlaxoSmithKline, Leo Pharma, Bausch Health, Dermavant Sciences, Novartis, Amgen, Johnson & Johnson, F. Hoffmann La Roche, Almirall, and Merck KGaA. To expand their presence, leading dermatology drug manufacturers are embracing multi-pronged strategies. Many are investing in next-generation biologics and gene-targeted therapies to diversify their portfolios and meet evolving treatment needs. Strategic collaborations with biotech firms and research institutions help accelerate drug discovery and pipeline development. Companies are also prioritizing geographic expansion, particularly into emerging markets with growing healthcare infrastructure.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug class trends

- 2.2.3 Indication trends

- 2.2.4 Mode trends

- 2.2.5 Age group trends

- 2.2.6 Route of administration

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic skin conditions

- 3.2.1.2 Demographic shifts and lifestyle factors

- 3.2.1.3 Advancements in biologics and small molecule drugs

- 3.2.1.4 Growing awareness of skin health and aesthetics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects and drug resistance

- 3.2.2.2 Limited access in low-resource settings

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of personalized dermatology

- 3.2.3.2 Integration of AI and telehealth dermatology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.7 Investment and funding landscape

- 3.8 Patent analysis

- 3.9 Reimbursement scenario

- 3.10 Pipeline analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Immunomodulators

- 5.3 Retinoids

- 5.4 Antibiotics

- 5.5 Anti-inflammatory agents

- 5.6 Antifungal drugs

- 5.7 Other drug classes

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Psoriasis

- 6.3 Atopic dermatitis

- 6.4 Acne

- 6.5 Skin cancer

- 6.6 Other indications

Chapter 7 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Prescription drugs

- 7.3 Over the counter drugs

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Paediatric

- 8.3 Adults

- 8.4 Geriatric

Chapter 9 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Parenteral

- 9.3 Topical

- 9.4 Oral

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Dermatologist clinics

- 10.4 Homecare settings

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AbbVie

- 12.2 Almirall

- 12.3 Amgen

- 12.4 AstraZeneca

- 12.5 Bausch Health

- 12.6 Dermavant Sciences

- 12.7 Eli Lilly and Company

- 12.8 F. Hoffmann La Roche

- 12.9 Galderma

- 12.10 GlaxoSmithKline

- 12.11 Incyte

- 12.12 Johnson & Johnson

- 12.13 Leo Pharma

- 12.14 Merck KGaA

- 12.15 Novartis

- 12.16 Pfizer

- 12.17 Sanofi