|

市场调查报告书

商品编码

1844335

皮卡车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pickup Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

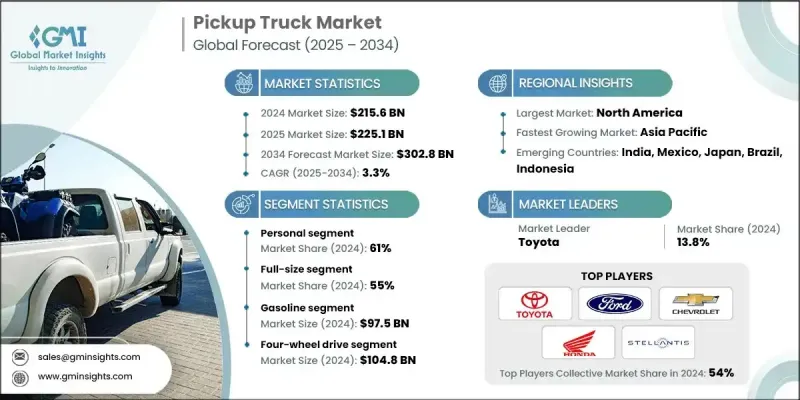

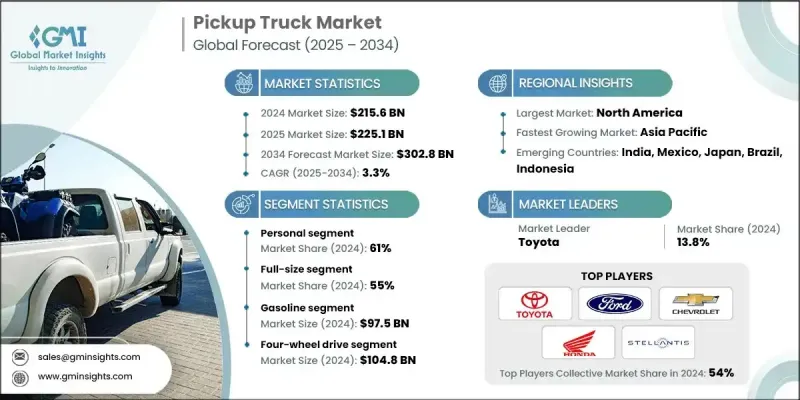

2024 年全球皮卡市场价值为 2,156 亿美元,预计将以 3.3% 的复合年增长率成长,到 2034 年达到 3,028 亿美元。

作为全球汽车产业的重要细分市场,皮卡在个人、商业、工业和休閒领域持续受到青睐。消费者越来越青睐那些兼具实用性和日常实用性的皮卡,它们集空间、坚固性和舒适性于一身。随着人们对电动和混合动力车型的兴趣日益浓厚,皮卡细分市场也在不断发展。这些车型的势头强劲,不仅是因为环保法规的出台,还源于创新和日益增长的消费者兴趣。汽车製造商正在整合高端舒适性、资讯娱乐和先进的安全系统,同时保持强大的牵引力和有效载荷能力,这使得皮卡对家庭和车队车主都极具吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2156亿美元 |

| 预测值 | 3028亿美元 |

| 复合年增长率 | 3.3% |

业界正经历向电动车的重大转变,製造商纷纷加大对电动车技术的投入,以应对环保目标和未来的监管要求。为了因应全产业的颠覆性变革,许多公司也建立了合作联盟,以降低开发成本并简化供应链。这些合作促成了连网技术、电气化和多功能设计功能的融合,从而提升了客户参与度,并适应了快速变化的汽车市场格局。

2024年,个人用途皮卡占据了61%的市场份额,并将以3%的复合年增长率持续成长,直至2034年。这一领先地位的驱动力源于市场对能够轻鬆应对通勤、家庭出行和户外生活方式的多功能车辆日益增长的需求。买家追求性能卓越且兼顾便捷性的皮卡,这促使製造商在其高端车型中引入豪华内饰、触控萤幕控制、智慧安全功能和顶级资讯娱乐系统。这些不断变化的偏好正在重塑皮卡的形象,使其从单纯的实用型车辆转变为功能全面的日常生活方式用车。

全尺寸皮卡市场在2024年占据了55%的市场份额,预计在2025年至2034年期间的复合年增长率将达到2.6%。全尺寸皮卡因其强大的动力、宽敞的空间和强大的牵引力而广受青睐。製造商正在升级这些车型,为其配备电动车传动系统和专属内饰,提供客製化功能、更广泛的续航里程和更先进的性能套件。全尺寸皮卡豪华内装的吸引力提升了客户的期望,促使原始设备製造商开发全面的拥有体验,包括更便捷的体验、忠诚度奖励和数位优先的服务解决方案。

美国皮卡市场占90%的市场份额,2024年市场规模达998亿美元。由于消费者普遍偏好全尺寸卡车的文化和功能性,皮卡仍然是美国最畅销的汽车类别。个人和休閒用途显着增长,消费者对高规格电动车型的需求持续飙升。汽车製造商正在推出先进的车型和科技含量更高的内饰,以在吸引新客户的同时留住忠实用户。

在全球皮卡市场积极竞争的主要公司包括日产、Stellantis(Ram Trucks)、福特、Alpha Motor、丰田、本田、雪佛兰、GMC、Bollinger 和 Canoo。为了保持和加强其在竞争激烈的皮卡市场中的地位,领先的製造商正在推行多项战略倡议。他们大力投资电动车平台和电池技术,以符合环境法规和客户对永续旅行的期望。同时,该公司正在扩展产品线,推出针对特定客户生活方式的豪华型和性能型装饰。策略联盟和合资企业在加速产品开发、优化生产和增强供应链弹性方面发挥作用。此外,许多参与者正在建立直接面向消费者的数位零售平台并增强售后服务,以提高客户忠诚度和长期参与度。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 製造商

- 经销商

- 最终用途

- 成本结构

- 利润率

- 每个阶段的增值

- 影响供应链的因素

- 破坏者

- 供应商格局

- 对部队的影响

- 成长动力

- 基础设施扩张刺激皮卡需求

- 技术进步提高了皮卡车的效率和安全性

- 政府对交通基础设施的投资刺激了需求

- 采矿业成长推动皮卡车销量

- 产业陷阱与挑战

- 经济衰退减少了建筑和采矿活动

- 严格的排放法规增加了製造成本

- 市场机会

- 电动和混合动力皮卡的普及率不断上升

- 智慧车队管理和远端资讯处理集成

- 成长动力

- 技术趋势与创新生态系统

- 现有技术

- 动力总成技术演变

- 电动皮卡的电池技术

- 自动驾驶集成

- 连接和资讯娱乐系统

- 高级驾驶辅助系统(ADAS)

- 新兴技术

- 轻质材料和结构

- 製造技术进步

- 充电基础设施建设

- 车辆到电网(V2G)技术

- 无线 (OTA) 更新功能

- 现有技术

- 成长潜力分析

- 监管格局

- CAFE燃油经济性标准

- EPA排放法规

- NHTSA安全标准

- 州级零排放汽车强制规定

- 商用车辆法规

- 未来监理趋势

- 价格趋势分析

- 各细分市场的历史价格演变

- 区域价格差异

- 装饰级别定价策略

- 电动车与内燃机汽车价格平价时间表

- 车队与零售定价动态

- 选项和配件定价

- 产销统计

- 全球产能分析

- 製造工厂利用率

- 各车型销售趋势

- 季节性销售模式

- 库存管理分析

- 生产弹性评估

- 供应链交付週期

- 成本分解分析

- 车辆开发成本

- 製造成本结构

- 材料成本分析

- 劳动成本评估

- 技术整合成本

- 监理合规成本

- 专利与创新分析

- 动力总成技术专利

- 电动车专利

- 自动驾驶专利

- 轻质结构专利

- 製造製程专利

- OEM专利组合分析

- 波特的分析

- PESTEL分析

- 永续性和环境方面

- 环境影响评估与生命週期分析

- 社会影响力和社区关係

- 治理与企业责任

- 永续技术发展

- 投资格局分析

- OEM资本投资模式

- 电动车投资

- 製造设施投资

- 研发投资分配

- 合资和合作投资

- 客户行为分析

- 购买决策因素

- 品牌忠诚度模式

- 使用模式分析

- 更换週期趋势

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依规模,2021 - 2034

- 主要趋势

- 袖珍的

- 中型

- 全尺寸

第六章:市场估计与预测:按动力传动系统,2021 - 2034 年

- 主要趋势

- 汽油

- 柴油引擎

- 电的

- 杂交种

第七章:市场估计与预测:依牵引能力,2021 - 2034 年

- 主要趋势

- 轻型牵引皮卡车(最高 7,500 磅)

- 中型牵引皮卡车(7,501-12,000磅)

- 重型牵引皮卡车(12,001 磅以上)

第八章:市场估计与预测:按驱动力,2021 - 2034

- 主要趋势

- 后轮驱动

- 全轮驱动

- 四轮驱动

第九章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 个人的

- 商业的

- 建筑和重型设备

- 农业和耕作

- 园艺与户外服务

- 公用事业和市政用途

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- Ford

- GMC

- Stellantis (Ram Trucks)

- Toyota

- Nissan

- Honda

- Rivian Automotive

- Tesla

- Isuzu Motors

- Mahindra & Mahindra

- Chevrolet

- 区域参与者

- Great Wall Motors

- Canoo

- Alpha Motor

- Bollinger

- SAIC Motor

- Tata Motors

- Volkswagen Commercial Vehicles

- Mitsubishi Motors

- Hyundai Motor Company

- JAC Motors

- Foton Motor

- SsangYong Motor

- Changan Automobile

- 新兴企业

- Lordstown Motors

- Atlis Motor Vehicles

- Fisker

- Hercules Electric Vehicles

- Nikola

- Workhorse

- XOS

The Global Pickup Truck Market was valued at USD 215.6 billion in 2024 and is estimated to grow at a CAGR of 3.3% to reach USD 302.8 billion by 2034.

As a critical segment within the global automotive industry, pickup trucks continue to gain traction across personal, commercial, industrial, and recreational applications. Consumers are increasingly drawn to trucks that blend utility and everyday usability, offering space, ruggedness, and comfort in one package. The segment is evolving with rising interest in electric and hybrid-powered options, which are gaining momentum not just because of environmental regulations but also due to innovation and growing buyer interest. Automakers are integrating high-end comfort, infotainment, and advanced safety systems while maintaining strong towing and payload capabilities, making pickups appealing to both families and fleet owners.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $215.6 Billion |

| Forecast Value | $302.8 Billion |

| CAGR | 3.3% |

The industry has seen a major shift toward electric mobility, with manufacturers channeling investments into EV technology to address environmental goals and future regulatory requirements. In response to industry-wide disruptions, many companies also established collaborative alliances to reduce development expenses and streamline supply chains. These partnerships resulted in the integration of connected tech, electrification, and versatile design features, driving customer engagement and adapting to the fast-changing auto landscape.

In 2024, the personal-use category held 61% share and will grow at a CAGR of 3% through 2034. This leadership is driven by rising demand for multipurpose vehicles that can handle commuting, family travel, and outdoor lifestyles with ease. Buyers are looking for performance-driven trucks that don't sacrifice convenience, leading manufacturers to introduce luxury-grade interiors, touchscreen controls, smart safety features, and top-tier infotainment in their higher-end variants. These evolving preferences are reshaping the image of pickup trucks from utilitarian machines to well-rounded, daily-use lifestyle vehicles.

The full-size pickup segment held a 55% share in 2024 and is forecasted to grow at a CAGR of 2.6% between 2025 and 2034. Full-size pickups are widely preferred for their strength, space, and towing capabilities. Manufacturers are upgrading these models with EV drivetrains and exclusive trims offering customized features, expanded range, and sophisticated performance packages. The appeal of luxury trims in full-size pickups has elevated customer expectations, pushing OEMs to develop comprehensive ownership experiences with added convenience, loyalty perks, and digital-first service solutions.

U.S. Pickup Truck Market held 90% share and generated USD 99.8 billion in 2024. The segment remains the country's best-selling vehicle category, due to a widespread cultural and functional preference for full-size trucks. Personal and recreational usage has grown significantly, and consumer appetite for high-spec, electrified models continues to surge. Automakers are launching advanced variants and tech-rich trims to retain loyalty while attracting new audiences.

Major companies actively competing in the Global Pickup Truck Market include Nissan, Stellantis (Ram Trucks), Ford, Alpha Motor, Toyota, Honda, Chevrolet, GMC, Bollinger, and Canoo. To maintain and strengthen their positions in the competitive pickup truck market, leading manufacturers are pursuing multiple strategic initiatives. They are heavily investing in electrified vehicle platforms and battery technology to align with environmental regulations and customer expectations for sustainable mobility. Simultaneously, companies are expanding product lines with luxury-oriented and performance-driven trims tailored for specific customer lifestyles. Strategic alliances and joint ventures are playing a role in accelerating product development, optimizing production, and enhancing supply chain resilience. Additionally, many players are building direct-to-consumer digital retail platforms and enhancing aftersales service offerings to improve customer loyalty and long-term engagement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.6.1.1 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Size

- 2.2.3 Power Train

- 2.2.4 Towing Capability

- 2.2.5 Drive

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Manufacturer

- 3.1.1.3 Distributor

- 3.1.1.4 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure expansion fuels demand for pickup trucks

- 3.2.1.2 Technological advancements enhance pickup truck efficiency and safety

- 3.2.1.3 Government investments in transportation infrastructure spur demand

- 3.2.1.4 Mining sector growth boosts pickup truck sales

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Economic downturns reduce construction and mining activities

- 3.2.2.2 Stringent emissions regulations increase manufacturing costs

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of electric and hybrid pickup trucks

- 3.2.3.2 Smart fleet management and telematics integration

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Powertrain technology evolution

- 3.3.1.2 Battery technology for electric pickups

- 3.3.1.3 Autonomous driving integration

- 3.3.1.4 Connectivity & infotainment systems

- 3.3.1.5 Advanced Driver Assistance Systems (ADAS)

- 3.3.2 Emerging technologies

- 3.3.2.1 Lightweight materials & construction

- 3.3.2.2 Manufacturing technology advances

- 3.3.2.3 Charging infrastructure development

- 3.3.2.4 Vehicle-to-Grid (V2G) technology

- 3.3.2.5 Over-the-Air (OTA) update capabilities

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 CAFE fuel economy standards

- 3.5.2 EPA emissions regulations

- 3.5.3 NHTSA safety standards

- 3.5.4 State-Level ZEV mandates

- 3.5.5 Commercial vehicle regulations

- 3.5.6 Future regulatory trends

- 3.6 Price trends analysis

- 3.6.1 Historical price evolution by segment

- 3.6.2 Regional price variations

- 3.6.3 Trim level pricing strategies

- 3.6.4 Electric vs ICE price parity timeline

- 3.6.5 Fleet vs retail pricing dynamics

- 3.6.6 Options & accessories pricing

- 3.7 Production & sales statistics

- 3.7.1 Global production capacity analysis

- 3.7.2 Manufacturing plant utilization

- 3.7.3 Sales volume trends by model

- 3.7.4 Seasonal sales patterns

- 3.7.5 Inventory management analysis

- 3.7.6 Production flexibility assessment

- 3.7.7 Supply chain lead times

- 3.8 Cost breakdown analysis

- 3.8.1 Vehicle development costs

- 3.8.2 Manufacturing cost structure

- 3.8.3 Material cost analysis

- 3.8.4 Labor cost assessment

- 3.8.5 Technology integration costs

- 3.8.6 Regulatory compliance costs

- 3.9 Patent & innovation analysis

- 3.9.1 Powertrain technology patents

- 3.9.2 Electric vehicle patents

- 3.9.3 Autonomous driving patents

- 3.9.4 Lightweight construction patents

- 3.9.5 Manufacturing process patents

- 3.9.6 Patent portfolio analysis by OEM

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Environmental impact assessment & lifecycle analysis

- 3.12.2 Social impact & community relations

- 3.12.3 Governance & corporate responsibility

- 3.12.4 Sustainable technological development

- 3.13 Investment Landscape Analysis

- 3.13.1 OEM capital investment patterns

- 3.13.2 Electric vehicle investment

- 3.13.3 Manufacturing facility investments

- 3.13.4 R&D investment allocation

- 3.13.5 Joint venture & partnership investments

- 3.14 Customer behavior analysis

- 3.14.1 Purchase decision factors

- 3.14.2 Brand loyalty patterns

- 3.14.3 Usage pattern analysis

- 3.14.4 Replacement cycle trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Size, 2021 - 2034 ($ Bn & Units)

- 5.1 Key trends

- 5.2 Compact

- 5.3 Mid-size

- 5.4 Full-size

Chapter 6 Market Estimates & Forecast, By Power Train, 2021 - 2034 ($ Bn & Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

- 6.5 Hybrid

Chapter 7 Market Estimates & Forecast, By Towing Capability, 2021 - 2034 ($ Bn & Units)

- 7.1 Key trends

- 7.2 Light towing pickup trucks (Up to 7,500 lbs)

- 7.3 Medium towing pickup trucks (7,501-12,000 lbs)

- 7.4 Heavy towing pickup trucks (12,001+ lbs)

Chapter 8 Market Estimates & Forecast, By Drive, 2021 - 2034 ($ Bn & Units)

- 8.1 Key trends

- 8.2 Rear-wheel drive

- 8.3 All wheel drive

- 8.4 Four-wheel drive

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn & Units)

- 9.1 Key trends

- 9.2 Personal

- 9.3 Commercial

- 9.3.1 Construction and heavy equipment

- 9.3.2 Agriculture and farming

- 9.3.3 Landscaping and outdoor services

- 9.3.4 Utility and municipal use

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn & Units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Ford

- 11.1.2 GMC

- 11.1.3 Stellantis (Ram Trucks)

- 11.1.4 Toyota

- 11.1.5 Nissan

- 11.1.6 Honda

- 11.1.7 Rivian Automotive

- 11.1.8 Tesla

- 11.1.9 Isuzu Motors

- 11.1.10 Mahindra & Mahindra

- 11.1.11 Chevrolet

- 11.2 Regional players

- 11.2.1 Great Wall Motors

- 11.2.2 Canoo

- 11.2.3 Alpha Motor

- 11.2.4 Bollinger

- 11.2.5 SAIC Motor

- 11.2.6 Tata Motors

- 11.2.7 Volkswagen Commercial Vehicles

- 11.2.8 Mitsubishi Motors

- 11.2.9 Hyundai Motor Company

- 11.2.10 JAC Motors

- 11.2.11 Foton Motor

- 11.2.12 SsangYong Motor

- 11.2.13 Changan Automobile

- 11.3 Emerging players

- 11.3.1 Lordstown Motors

- 11.3.2 Atlis Motor Vehicles

- 11.3.3 Fisker

- 11.3.4 Hercules Electric Vehicles

- 11.3.5 Nikola

- 11.3.6 Workhorse

- 11.3.7 XOS