|

市场调查报告书

商品编码

1844361

电子驻车煞车 (EPB) 系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electronic Parking Brake (EPB) System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

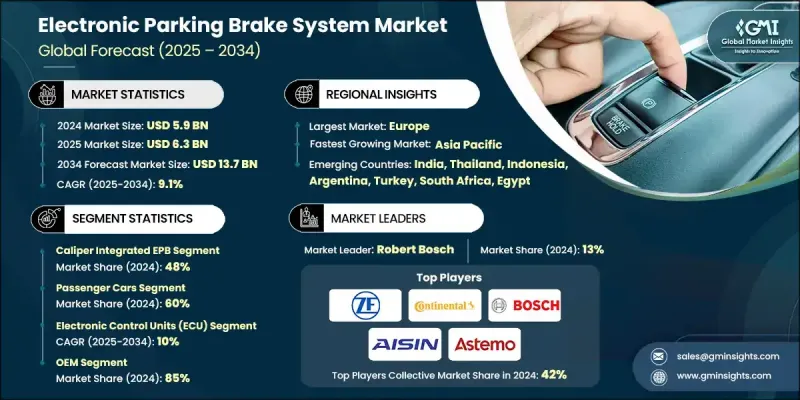

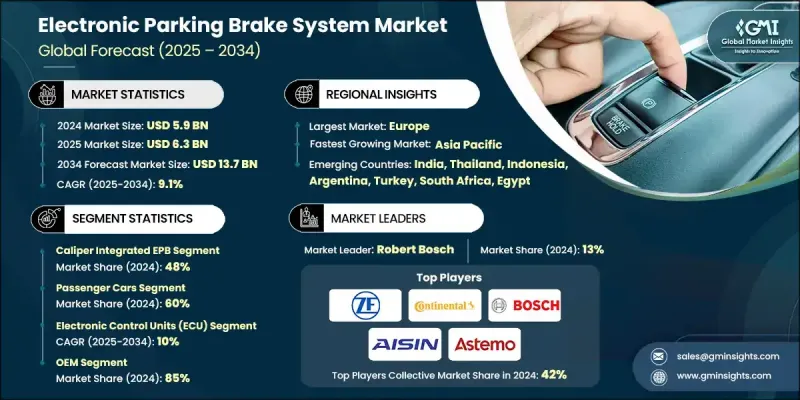

2024 年全球电子驻车煞车 (EPB) 系统市场价值为 59 亿美元,预计到 2034 年将以 9.1% 的复合年增长率增长至 137 亿美元。

汽车产业对自动化、电气化和先进安全功能的追求推动了市场成长。电子驻车煞车 (EPB) 系统凭藉其增强的性能、优化的空间以及与现代驾驶辅助技术的无缝集成,正日益取代传统的手煞车。汽车製造商正在嵌入 EPB 来支援自动驻车、上坡起步辅助和智慧紧急煞车等功能,尤其是在纯电动车、混合动力车和插电式混合动力车中。 EPB 与再生煞车和车辆能源系统的兼容性进一步推动了其被纳入下一代电动平台。新兴车型还配备了紧凑型致动器和无线控制,从而实现了更高的模组化和设计灵活性。随着全球监管部门对道路安全和智慧煞车的日益重视,EPB 正成为各类车辆的必备部件。此外,软体控制的煞车功能正在将 EPB 转变为智慧安全系统,提供即时响应和诊断功能。永续发展趋势也在影响 EPB 的设计,製造商专注于可回收材料、低能耗组件和减少环境影响,这与全球更广泛的绿色出行运动保持一致。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 59亿美元 |

| 预测值 | 137亿美元 |

| 复合年增长率 | 9.1% |

卡钳整合式电子驻车煞车系统 (EPB) 在 2024 年占据 48% 的市场份额,预计到 2034 年将以 10% 的复合年增长率成长。这种类型的电子驻车煞车系统 (EPB) 因其能够最大程度地减轻系统重量、简化安装并比传统的液压或拉线机构提供更卓越的性能而广受青睐。其日益普及反映了业界对高效能紧凑煞车系统架构的偏好。

2024年,乘用车市场占了60%的市场份额,预计到2034年将以9.4%的复合年增长率成长。紧凑型、中型车、轿车和SUV中EPB的普及率不断提高,正在推动其成长,尤其是在汽车製造商寻求与ADAS平台相契合的先进煞车技术的情况下。由于安全要求的提高以及消费者对日常驾驶舒适性和自动化的需求,北美、亚太和欧洲的监管标准持续加速EPB在该领域的渗透。

2024年,欧洲电子驻车煞车 (EPB) 系统市场占35%的市场份额,这得益于配备智慧煞车系统的高阶豪华汽车的快速普及。强而有力的政策架构、严格的汽车安全基准以及汽车电子领域持续的研发投入,巩固了欧洲在 EPB 技术方面的领先地位。而向连网汽车、电动平台和自动驾驶解决方案的持续转变,则进一步巩固了该地区的主导地位。

塑造全球电子驻车煞车 (EPB) 系统市场竞争格局的关键参与者包括采埃孚 (ZF Friedrichshafen)、大陆集团 (Continental)、现代摩比斯 (Hyundai Mobis)、万都 (Mando)、罗伯特·博世 (Robert Bosch)、曙光製动工业 (Akebono Brake Bustry)、日立阿斯泰莫氏系统 (Hboste)、布雷克诺尔 (Brbo)、Bustry) (Knorr-Bremse) 与爱信精机 (Aisin Seiki)。在电子驻车煞车系统市场运营的公司正专注于创新、模组化设计以及与数位车辆平台的集成,以增强其市场影响力。关键参与者正在投资软体驱动的 EPB 解决方案,以支援 ADAS 相容性、自动驾驶功能和电子紧急控制。与原始设备製造商 (OEM) 进行基于平台的开发的策略合作,实现了不同车型之间的无缝整合。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 向车辆自动化和ADAS转变

- 汽车平台电气化(电动车、油电混合车)

- OEM推动轻量化和模组化煞车系统

- 消费者对便利性和安全性的需求

- 线控制动系统的监理要求

- 产业陷阱与挑战

- 极端条件下的电子可靠性

- 与 ADAS 和 ECU 的整合复杂性

- 市场机会

- 市场和动力系统整合机会

- 与电动和混合动力系统的集成

- 执行器和ECU技术的进步

- 扩展 ADAS 和线控制动平台

- 新兴市场和中檔汽车需求不断成长

- 未来的创新机会

- 先进的整合概念

- 智慧EPB系统开发

- 自动驾驶汽车准备

- 连网汽车集成

- 市场和动力系统整合机会

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTEL分析

- 技术和创新格局

- ESC 和 ABS 集成

- 上坡起步辅助与自动驻车功能

- 紧急煞车辅助集成

- ADAS 和自主系统集成

- EPB系统成本结构与价值链分析

- 组件成本细分与分析

- 按系统类型分類的製造成本结构

- 整合成本对车辆定价的影响

- 总拥有成本与传统系统相比

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 专利分析

- 按技术类别和系统类型分類的有效专利

- EPB技术的专利申请趋势

- 智慧财产权授权和技术转移模式

- 专利诉讼风险评估

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

- 投资与融资分析

- 按 EPB 技术类别分類的研发投资

- OEM对EPB系统整合的投资

- 供应商投资和产能扩张

- 政府资助和安全研究项目

- 供应链动态和组件集成

- 执行器马达和驱动组件采购

- 电子控制单元开发生态系统

- 感测器和反馈系统集成

- 软体开发和验证流程

- 标准化格局和互通性

- ISO 标准的製定与实施

- SAE国际EPB标准

- 区域标准协调工作

- OEM特定要求和变化

- 案例研究和实施范例

- Tesla EPB整合分析

- 传统OEM EV EPB策略

- 中国电动车製造商的做法

- 经验教训和最佳实践

- 连网汽车与网路安全集成

- 联网EPB系统架构

- 网路安全要求和威胁

- 数据分析和服务增强

- EPB系统可靠度与故障模式分析

- 常见故障模式和根本原因

- 可靠性测试和验证

- 预测性维护和诊断

- 品质保证与控制

- 未来展望与技术颠覆时间表

- 近期中断(2025-2027)

- 大众市场 EPB 采用加速

- 电动车整合成熟度

- 基本自主功能整合

- 车连网服务开发

- 中期中断(2028-2030)

- 先进的自动驾驶汽车集成

- 线控制动技术商业化

- 人工智慧预测性维护

- 整车系统集成

- 长期中断(2031-2034)

- 全自动车辆 EPB 系统

- 先进材料与製造

- 量子计算集成

- 下一代行动解决方案

- 近期中断(2025-2027)

- 市场演变情景

- 乐观的成长前景

- 保守的成长情景

- 中断场景

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按系统,2021 - 2034

- 主要趋势

- 缆索牵引系统

- 电动液压卡钳系统

- 卡钳集成 EPB

- 其他的

第六章:市场估计与预测:依车辆分类,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车

- 中型商用车

- 重型商用车

第七章:市场估计与预测:依组件,2021 - 2034

- 主要趋势

- 电子控制单元(ECU)

- 执行器

- 感应器

- 开关和线束

- 其他的

第 8 章:市场估计与预测:按销售管道,2021 年至 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 内燃机(ICE)

- 混合动力电动车(HEV/PHEV)

- 纯电动车(BEV)

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 葡萄牙

- 克罗埃西亚

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 泰国

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 埃及

第 11 章:公司简介

- 全球参与者

- Aisin Seiki

- Akebono Brake Industry

- Brembo

- Continental

- Hitachi Astemo

- Mando

- Robert Bosch

- ZF Friedrichshafen

- 区域参与者

- Advics

- BWI

- Chassis Brakes International

- Haldex

- Hyundai Mobis

- Knorr-Bremse

- Nissin Kogyo

- WABCO

- 新兴玩家

- Aptiv

- Autoliv

- Denso

- Magna International

- Nexteer Automotive

- Schaeffler

- Tenneco

- Valeo

The Global Electronic Parking Brake (EPB) System Market was valued at USD 5.9 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 13.7 billion by 2034.

Market growth is propelled by the automotive industry's push toward automation, electrification, and advanced safety features. EPB systems are increasingly replacing traditional handbrakes due to their enhanced performance, space optimization, and seamless integration with modern driver assistance technologies. Automakers are embedding EPBs to support features like auto-hold, hill-start assist, and smart emergency braking, particularly in EVs, hybrids, and plug-in hybrids. Their compatibility with regenerative braking and vehicle energy systems further drives their inclusion in next-gen electric platforms. Emerging models also feature compact actuators and wireless control, allowing for greater modularity and design flexibility. With rising global regulatory emphasis on road safety and intelligent braking, EPBs are becoming essential components across various vehicle categories. In addition, software-controlled braking capabilities are transforming EPBs into smart safety systems, offering real-time responsiveness and diagnostics. Sustainability trends are also influencing EPB design, with manufacturers focusing on recyclable materials, low-energy components, and reduced environmental impact, aligning with the broader green mobility movement worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.9 Billion |

| Forecast Value | $13.7 Billion |

| CAGR | 9.1% |

The caliper-integrated EPB segment held a 48% share in 2024 and is expected to grow at a CAGR of 10% through 2034. This type of EPB is widely favored for its ability to minimize overall system weight, simplify installation, and deliver superior performance over traditional hydraulic or cable-pull mechanisms. Its rising adoption reflects industry preference for efficient and compact brake system architectures.

The passenger cars segment held a 60% share in 2024 and is projected to grow at a CAGR of 9.4% through 2034. Increasing implementation of EPBs in compact and mid-size vehicles, sedans, and SUVs is driving growth, particularly as automakers seek advanced braking technologies that align with ADAS platforms. Regulatory standards across North America, Asia-Pacific, and Europe continue to accelerate EPB penetration across this segment due to enhanced safety mandates and consumer demand for comfort and automation in everyday driving.

Europe Electronic Parking Brake (EPB) System Market held a 35% share in 2024, supported by the rapid adoption of premium and luxury vehicles equipped with intelligent braking systems. Strong policy frameworks, stringent automotive safety benchmarks, and ongoing R&D across the vehicle electronics sector have cemented Europe's position at the forefront of EPB technology. The continued shift toward connected vehicles, electrified platforms, and autonomous driving solutions further strengthens the region's dominance.

Key players shaping the competitive landscape in the Global Electronic Parking Brake (EPB) System Market include ZF Friedrichshafen, Continental, Hyundai Mobis, Mando, Robert Bosch, Akebono Brake Industry, Hitachi Astemo, Brembo, Knorr-Bremse, and Aisin Seiki. Companies operating in the electronic parking brake system market are focusing on innovation, modular design, and integration with digital vehicle platforms to strengthen their market presence. Key players are investing in software-driven EPB solutions that support ADAS compatibility, autonomous functionality, and electronic emergency control. Strategic collaborations with OEMs for platform-based development allow for seamless integration across various vehicle models.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Vehicles

- 2.2.4 Component

- 2.2.5 Sales Channel

- 2.2.6 Propulsion

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Shift toward vehicle automation and ADAS

- 3.2.1.3 Electrification of vehicle platforms (EVs, HEVs)

- 3.2.1.4 OEM push for lightweight and modular brake systems

- 3.2.1.5 Consumer demand for convenience and safety

- 3.2.1.6 Regulatory mandates for brake-by-wire systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Electronic reliability under extreme conditions

- 3.2.2.2 Integration complexity with ADAS and ECUs

- 3.2.3 Market opportunities

- 3.2.3.1 Market & powertrain integration opportunities

- 3.2.3.1.1 Integration with electric and hybrid powertrains

- 3.2.3.1.2 Advancements in actuator and ECU technologies

- 3.2.3.1.3 Expansion of ADAS and brake-by-wire platforms

- 3.2.3.1.4 Rising demand in emerging markets and mid-range vehicles

- 3.2.3.2 Future innovation opportunities

- 3.2.3.2.1 Advanced integration concepts

- 3.2.3.2.2 Smart EPB system development

- 3.2.3.2.3 Autonomous vehicle preparation

- 3.2.3.2.4 Connected vehicle integration

- 3.2.3.1 Market & powertrain integration opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 ESC & ABS integration

- 3.7.2 Hill start assist & auto hold functions

- 3.7.3 Emergency brake assist integration

- 3.7.4 ADAS & autonomous system integration

- 3.8 EPB system cost structure & value chain analysis

- 3.8.1 Component cost breakdown & analysis

- 3.8.2 Manufacturing cost structure by system type

- 3.8.3 Integration cost impact on vehicle pricing

- 3.8.4 Total cost of ownership vs traditional systems

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Patent analysis

- 3.11.1 Active patents by technology category & system type

- 3.11.2 Patent filing trends in EPB technology

- 3.11.3 IP licensing & technology transfer models

- 3.11.4 Patent litigation risk assessment

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment & funding analysis

- 3.13.1 R&D investment by EPB technology category

- 3.13.2 OEM investment in EPB system integration

- 3.13.3 Supplier investment & capacity expansion

- 3.13.4 Government funding & safety research programs

- 3.14 Supply chain dynamics & component integration

- 3.14.1 Actuator motor & drive component sourcing

- 3.14.2 Electronic control unit development ecosystem

- 3.14.3 Sensor & feedback system integration

- 3.14.4 Software development & validation processes

- 3.15 Standardization landscape & interoperability

- 3.15.1 ISO standards development & implementation

- 3.15.2 SAE international EPB standards

- 3.15.3 Regional standards harmonization efforts

- 3.15.4 OEM-specific requirements & variations

- 3.16 Case studies & implementation examples

- 3.16.1 Tesla EPB integration analysis

- 3.16.2 Traditional OEM EV EPB strategies

- 3.16.3 Chinese EV manufacturer approaches

- 3.16.4 Lessons learned & best practices

- 3.17 Connected vehicle & cybersecurity integration

- 3.17.1 Connected EPB system architecture

- 3.17.2 Cybersecurity requirements & threats

- 3.17.3 Data analytics & service enhancement

- 3.18 EPB system reliability & failure mode analysis

- 3.18.1 Common failure modes & root causes

- 3.18.2 Reliability testing & validation

- 3.18.3 Predictive maintenance & diagnostics

- 3.18.4 Quality assurance & control

- 3.19 Future outlook & technology disruption timeline

- 3.19.1 Near-term disruptions (2025-2027)

- 3.19.1.1 Mass market EPB adoption acceleration

- 3.19.1.2 Electric vehicle integration Maturity

- 3.19.1.3 Basic autonomous function integration

- 3.19.1.4 Connected vehicle service development

- 3.19.2 Medium-term disruptions (2028-2030)

- 3.19.2.1 Advanced autonomous vehicle integration

- 3.19.2.2 Brake-by-wire technology commercialization

- 3.19.2.3 AI-powered predictive maintenance

- 3.19.2.4 Full vehicle system integration

- 3.19.3 Long-term disruptions (2031-2034)

- 3.19.3.1 Fully autonomous vehicle EPB systems

- 3.19.3.2 Advanced materials & manufacturing

- 3.19.3.3 Quantum computing integration

- 3.19.3.4 Next-generation mobility solutions

- 3.19.1 Near-term disruptions (2025-2027)

- 3.20 Market evolution scenarios

- 3.20.1 Optimistic growth scenario

- 3.20.2 Conservative growth scenario

- 3.20.3 Disruption scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Cable-pull systems

- 5.3 Electric-hydraulic caliper systems

- 5.4 Caliper integrated EPB

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicles, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUVS

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Electronic control unit (ECU)

- 7.3 Actuators

- 7.4 Sensors

- 7.5 Switches & wiring harnesses

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Propulsion, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Internal combustion engine (ICE)

- 9.3 Hybrid electric vehicle (HEV / PHEV)

- 9.4 Battery electric vehicle (BEV)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

- 10.6.5 Egypt

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aisin Seiki

- 11.1.2 Akebono Brake Industry

- 11.1.3 Brembo

- 11.1.4 Continental

- 11.1.5 Hitachi Astemo

- 11.1.6 Mando

- 11.1.7 Robert Bosch

- 11.1.8 ZF Friedrichshafen

- 11.2 Regional Players

- 11.2.1 Advics

- 11.2.2 BWI

- 11.2.3 Chassis Brakes International

- 11.2.4 Haldex

- 11.2.5 Hyundai Mobis

- 11.2.6 Knorr-Bremse

- 11.2.7 Nissin Kogyo

- 11.2.8 WABCO

- 11.3 Emerging Players

- 11.3.1 Aptiv

- 11.3.2 Autoliv

- 11.3.3 Denso

- 11.3.4 Magna International

- 11.3.5 Nexteer Automotive

- 11.3.6 Schaeffler

- 11.3.7 Tenneco

- 11.3.8 Valeo