|

市场调查报告书

商品编码

1844363

膜式空气干燥机市场机会、成长动力、产业趋势分析及2025-2034年预测Membrane Air Dryers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

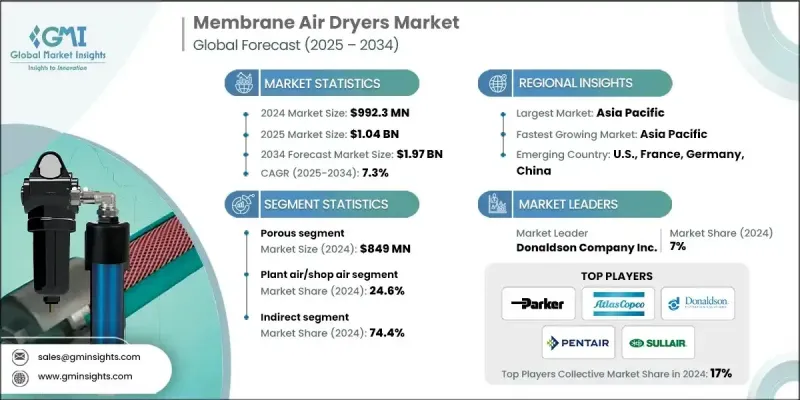

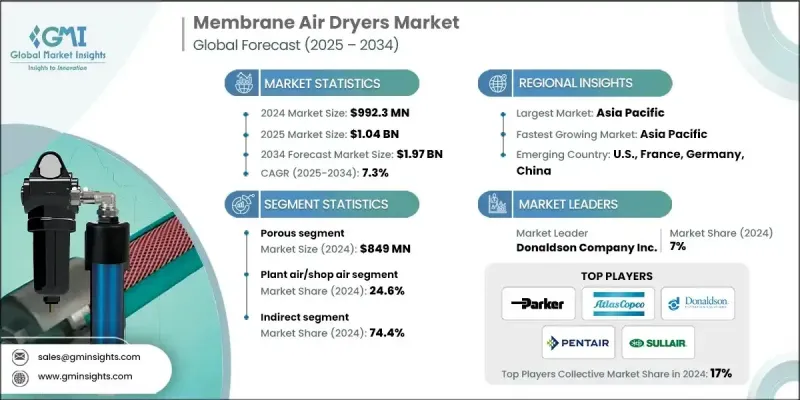

2024 年全球膜式空气干燥机市值为 9.923 亿美元,预计到 2034 年将以 7.3% 的复合年增长率成长至 19.7 亿美元。

这一上升趋势归因于对高纯度压缩空气日益增长的需求、工业自动化的不断扩展以及膜系统提供的显着运营优势,尤其是其节能和极低的维护要求。清洁、无湿气的压缩空气对许多行业至关重要,因为即使是微量的湿气也可能损害敏感组件、中断生产或导致腐蚀。全球对空气品质标准的日益严格促使越来越多的製造商采用膜式空气干燥器,这种干燥器无需庞大的基础设施即可提供可靠的空气净化。其紧凑的设计和持续运作使其在空间受限的高性能环境中占据优势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.923亿美元 |

| 预测值 | 19.7亿美元 |

| 复合年增长率 | 7.3% |

自动化热潮是关键的成长引擎。随着自动化系统日益普及,为机器人、CNC设备和气动工具提供动力,对持续干燥空气的需求也日益增长。这些系统对污染物高度敏感,因此膜式干燥机对于维持正常运作时间和避免系统故障至关重要。其模组化紧凑的结构使其能够在使用点轻鬆部署,尤其适合现代工业设备和工业 4.0 应用。

2024年,多孔膜市场规模达8.49亿美元,预计到2034年复合年增长率将达到7.4%。这类薄膜因其高效的湿气传输能力和持续的空气流通能力而备受青睐。其卓越的压力降和干燥效率使其在空气纯度至关重要的关键产业中具有极强的适应性。

2024年,工厂空气/车间空气市场占24.6%的份额,预计2025年至2034年的复合年增长率将达到7.4%。该市场仍将占据主导地位,因为干燥压缩空气是通用工业应用的主要组成部分,从驱动工具和执行器到防止腐蚀和提高设备可靠性。製造业、汽车业、食品加工和电子业都严重依赖清洁空气系统,这使得清洁空气系统成为膜式干燥机的核心应用场景。

美国膜式空气干燥机市场占78.5%的市场份额,2024年市场规模达2.351亿美元。这一领先地位源自于其强大的工业基础和先进生产技术的广泛应用。各主要行业的高性能标准以及严格的效率和安全规范正在推动膜式干燥器的应用。此外,主要製造商的布局、良好的监管框架以及清洁压缩空气系统的持续创新,使美国始终处于市场成长的前沿。

影响全球薄膜空气干燥机市场的关键参与者包括 Zeks Compressed Air Solutions、Norgren、Atlas Copco、SMC Corporation、Mikropor、Donaldson Company、Ingersoll Rand、Kaeser Compressors、Wilkerson Corporation、AIRPAX、SPX FLOW、Hankison International、Graco、Gardner Denver 和 Parker Hannifin Corporation。为了巩固市场地位,膜空气干燥机市场的公司正专注于技术升级、产品创新和市场扩张。许多公司正在投资研发,以开发更紧凑、更节能、更高性能的膜系统,以满足不同的工业需求。与自动化和气动系统供应商的策略合作伙伴关係使这些製造商能够将其产品整合到更大的工业生态系统中。一些参与者也致力于模组化和可自订的解决方案,以满足空间受限环境中的利基应用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 对清洁干燥压缩空气的需求不断增长

- 工业自动化的成长

- 能源效率与维修优势

- 产业陷阱与挑战

- 初始资本投入高

- 露点范围有限

- 机会

- 与智慧和物联网压缩空气系统集成

- 环保节能解决方案

- 客製化和高容量解决方案

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规要求

- 区域监理框架

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 多孔

- 无孔

第六章:市场估计与预测:依技术类型,2021 - 2034 年

- 主要趋势

- 中空纤维膜干燥机

- 聚合物/复合膜干燥机

- 混合膜干燥器

第七章:市场估计与预测:依产能,2021 - 2034

- 主要趋势

- 低容量(<100 cfm / 170 m³/h)

- 中等容量(100-500 cfm / 170-850 m³/h)

- 高容量(>500 cfm / 850 m³/h)

第八章:市场估计与预测:按操作压力,2021 - 2034 年

- 主要趋势

- 低压(<10 bar / 145 psi)

- 中压(10-20 bar / 145-290 psi)

- 高压(>20 bar / 290 psi)

第九章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 工厂空气/车间空气

- 仪表空气

- 处理空气

- 呼吸空气

- 其他的

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 化学

- 石油和天然气

- 医疗的

- 食品和饮料

- 电子产品

- 一般製造业

- 其他的

第 11 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十三章:公司简介

- AIRPAX

- Atlas Copco

- Donaldson Company

- Gardner Denver

- Graco

- Hankison International

- Ingersoll Rand

- Kaeser Compressors

- Mikropor

- Norgren

- Parker Hannifin Corporation

- SMC Corporation

- SPX FLOW

- Wilkerson Corporation

- Zeks Compressed Air Solutions

The Global Membrane Air Dryers Market was valued at USD 992.3 million in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 1.97 billion by 2034.

The upward trajectory is attributed to increasing demand for high-purity compressed air, the growing footprint of industrial automation, and the clear operational advantages membrane systems offer, particularly their energy efficiency and minimal maintenance requirements. Clean, moisture-free compressed air is essential across several industries where even trace humidity can compromise sensitive components, disrupt production, or lead to corrosion. Rising global adherence to air quality benchmarks is pushing more manufacturers to adopt membrane air dryers, which provide reliable air purification without requiring bulky infrastructure. Their compact design and continuous operation give them an edge in space-constrained, high-performance environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $992.3 Million |

| Forecast Value | $1.97 Billion |

| CAGR | 7.3% |

The automation boom is a critical growth engine. As automated systems become widespread, powering robotics, CNC equipment, and pneumatic tools, the demand for consistently dry air increases. These systems are highly sensitive to contaminants, making membrane dryers vital for maintaining uptime and avoiding system failures. Their modular and compact structure allows easy deployment right at the point of use, making them particularly well-suited to modern industrial setups and Industry 4.0 applications.

In 2024, the porous membrane segment generated USD 849 million and is expected to grow at a CAGR of 7.4% through 2034. These membranes are favored for their effective moisture vapor transfer capabilities while maintaining uninterrupted air flow. Their superior performance in pressure drop and drying efficiency makes them highly adaptable to key industries where air purity is non-negotiable.

The plant air/shop air segment held a 24.6% share in 2024 and is forecasted to grow at a 7.4% CAGR from 2025 to 2034. This segment remains dominant because dry compressed air is a staple across general-purpose industrial applications, from driving tools and actuators to preventing corrosion and improving equipment reliability. Manufacturing, automotive, food processing, and electronics sectors all rely heavily on clean air systems, making this a core use case for membrane dryers.

U.S. Membrane Air Dryers Market held 78.5% share and generated USD 235.1 million in 2024. This leadership stems from a strong industrial foundation and widespread implementation of advanced production technologies. High-performance standards across major sectors, along with stringent efficiency and safety norms, are pushing the adoption of membrane dryers. Additionally, the presence of key manufacturers, a favorable regulatory framework, and continuous innovation in clean compressed air systems keep the U.S. at the forefront of market growth.

Key players shaping the Global Membrane Air Dryers Market include Zeks Compressed Air Solutions, Norgren, Atlas Copco, SMC Corporation, Mikropor, Donaldson Company, Ingersoll Rand, Kaeser Compressors, Wilkerson Corporation, AIRPAX, SPX FLOW, Hankison International, Graco, Gardner Denver, and Parker Hannifin Corporation. To strengthen their market foothold, companies in the Membrane Air Dryers Market are focusing on technology upgrades, product innovation, and market expansion. Many are investing in R&D to develop more compact, energy-efficient, and high-performance membrane systems tailored to diverse industrial requirements. Strategic partnerships with automation and pneumatic system providers allow these manufacturers to integrate their products into larger industrial ecosystems. Several players are also working on modular and customizable solutions to serve niche applications in space-constrained environments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Technology type

- 2.2.4 Capacity

- 2.2.5 Operating pressure

- 2.2.6 Application

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for clean and dry compressed air

- 3.2.1.2 Growth of industrial automation

- 3.2.1.3 Energy efficiency and maintenance advantages

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Limited dew point range

- 3.2.3 Opportunities

- 3.2.3.1 Integration with smart & IoT-enabled compressed air systems

- 3.2.3.2 Eco-friendly & energy-saving solutions

- 3.2.3.3 Customized & high-capacity solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Porous

- 5.3 Non-Porous

Chapter 6 Market Estimates & Forecast, By Technology Type, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Hollow fiber membrane dryers

- 6.3 Polymeric/composite membrane dryers

- 6.4 Hybrid membrane dryers

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Low capacity (<100 cfm / 170 m³/h)

- 7.3 Medium-capacity (100-500 cfm / 170-850 m³/h)

- 7.4 High capacity (>500 cfm / 850 m³/h)

Chapter 8 Market Estimates & Forecast, By Operating Pressure, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Low pressure (<10 bar / 145 psi)

- 8.3 Medium pressure (10-20 bar / 145-290 psi)

- 8.4 High pressure (>20 bar / 290 psi)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 Plant air/ Shop air

- 9.3 Instrument air

- 9.4 Process air

- 9.5 Breathing air

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Thousand Units)

- 10.1 Key trends

- 10.2 Chemical

- 10.3 Oil & gas

- 10.4 Medical

- 10.5 Food and beverage

- 10.6 Electronics

- 10.7 General manufacturing

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 AIRPAX

- 13.2 Atlas Copco

- 13.3 Donaldson Company

- 13.4 Gardner Denver

- 13.5 Graco

- 13.6 Hankison International

- 13.7 Ingersoll Rand

- 13.8 Kaeser Compressors

- 13.9 Mikropor

- 13.10 Norgren

- 13.11 Parker Hannifin Corporation

- 13.12 SMC Corporation

- 13.13 SPX FLOW

- 13.14 Wilkerson Corporation

- 13.15 Zeks Compressed Air Solutions