|

市场调查报告书

商品编码

1822297

全球膜市场(按材料、技术、应用和地区划分)-预测至2030年Membranes Market by Material (Polymeric, Ceramic), Technology (Reverse Osmosis, Ultrafiltration, Microfiltration, Nanofiltration), Application (Water & Wastewater Treatment, Industrial Processing), and Region - Global Forecast to 2030 |

||||||

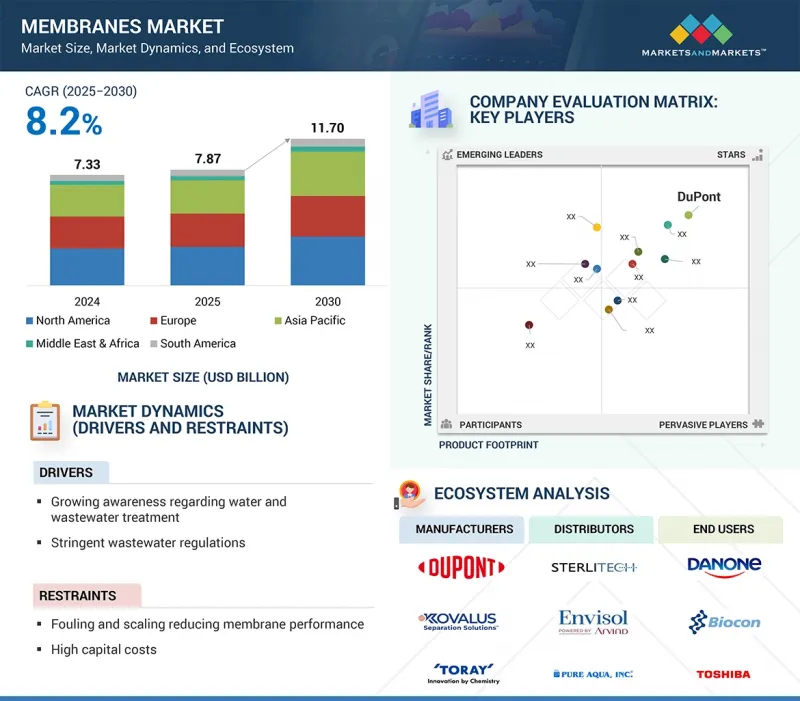

膜市场预计将从 2025 年的 78.7 亿美元成长到 2030 年的 117 亿美元,复合年增长率为 8.2%。

日益增长的污水处理需求刺激了薄膜技术的使用,因为薄膜技术能够有效去除污染物,帮助满足严格的处理标准,并降低废水和处理水再利用的风险。快速的工业化和都市化导致污水产量增加和污染水平上升,推动了膜过滤等先进处理技术的采用和持续使用,以实现永续的水资源管理和资源回收。

| 调查范围 | |

|---|---|

| 调查年份 | 2022-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 1,000平方公尺,金额(100万美元) |

| 部分 | 按材料、技术、应用和地区 |

| 目标区域 | 亚太地区、北美、欧洲、中东和非洲、南美 |

此外,透过回收和再利用解决水资源短缺问题的重点预计将推动全球市政和工业领域对薄膜的需求。

以金额为准,微过滤因其在水和污水处理系统、药品和医疗产品以及食品和饮料领域的广泛应用,占据了薄膜市场的第二大份额。微过滤具有独特的特性,使其在实际应用中受益匪浅:它能够高效去除悬浮固体、细菌和大分子,且能耗低。由于能耗低,微过滤与许多其他处理方法相比成本相对较低。日益严格的水质监管标准以及全行业对净化废水日益增长的需求是全球微过滤应用日益广泛的关键原因。

聚合物薄膜是薄膜市场中成长速度第二快的细分市场,因为它们提供高度客製化和灵活的生产选择,成本效益最高,并且具有很强的耐化学性。这些薄膜采用多种聚合物,具有优异的选择性和耐用性,因此在水处理、製药和食品开发应用中广受欢迎。聚合物化学的进步提高了抗污性和渗透性,有助于满足严格的环境法规。这也导致了对永续液体过滤解决方案的关注和需求不断增加。预计这些趋势将为整个预测期内聚合物薄膜过滤器的使用增加创造机会。

亚太地区是成长最快的地区,得益于中国、印度和东南亚地区快速的工业化、都市化以及对清洁水和污水处理解决方案日益增长的需求,亚太地区占据了薄膜市场的大部分份额。此外,强有力的政府倡议、基础设施资本投入以及技术的持续进步正在扩大市场成长,为膜技术的推广和创新提供了机会。

本报告研究了全球膜市场,提供了材料、技术、应用和地区的趋势信息,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 波特五力分析

- 总体经济指标

第六章 产业趋势

- 介绍

- 主要相关人员和采购标准

- 价值链分析

- 生态系/市场地图

- 贸易分析

- 定价分析

- 监管状况

- AI/GEN 人工智慧的影响

- 影响客户业务的趋势/中断

- 技术分析

- 案例研究分析

- 2025-2026 年重要会议与活动

- 投资金筹措场景

- 专利分析

- 2025年美国关税的影响—概述

第七章 膜市场(依材料)

- 介绍

- 聚合物

- 陶瓷製品

- 其他的

第 8 章 膜市场(按技术)

- 介绍

- 逆渗透

- 超过滤

- 微滤

- 奈米过滤

- 其他的

第九章 膜市场(依应用)

- 介绍

- 水和污水处理

- 工业加工

第 10 章 膜市场(按地区)

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 西班牙

- 德国

- 法国

- 英国

- 义大利

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

第十一章 竞争格局

- 概述

- 主要参与企业的策略/优势

- 2022-2024年收益分析

- 2024年市占率分析

- 估值和财务指标

- 品牌/产品比较分析

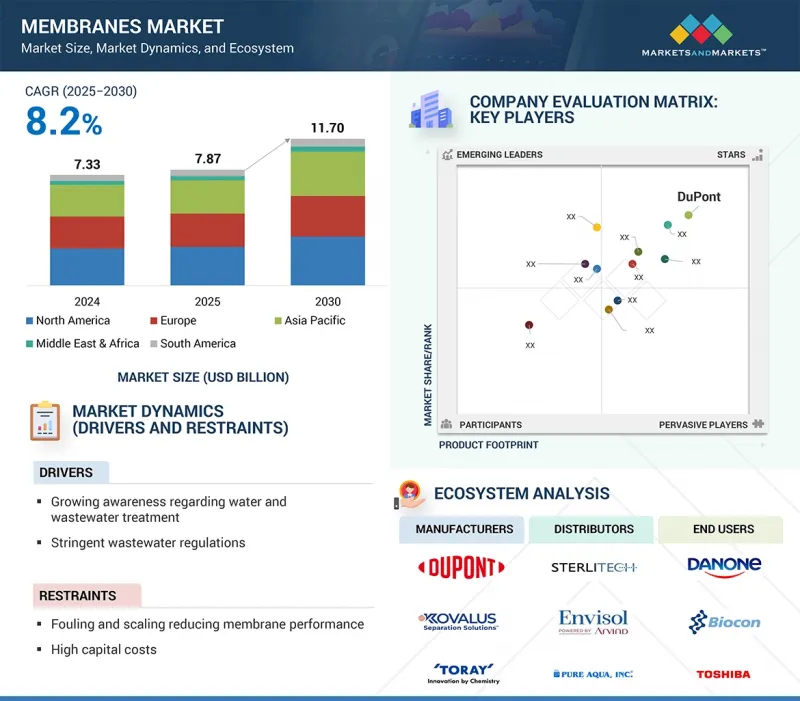

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2023 年

- 竞争情境和趋势

第十二章:公司简介

- 主要参与企业

- DUPONT

- TORAY INDUSTRIES, INC.

- HYDRANAUTICS(A NITTO DENKO GROUP COMPANY)

- KOVALUS SEPARATION SOLUTIONS

- PALL CORPORATION

- VEOLIA

- PENTAIR

- ASAHI KASEI CORPORATION

- LG CHEM

- MANN+HUMMEL

- SOLVENTUN

- BEIJING ORIGINWATER TECHNOLOGY CO., LTD.

- 其他公司

- ALSYS

- APPLIED MEMBRANES, INC.

- AQUAPORIN

- AXEON WATER TECHNOLOGIES

- GEA GROUP AKTIENGESELLSCHAFT

- LANXESS

- LENNTECH BV

- MEMBRANE SOLUTIONS(NANTONG)

- MEMBRANIUM

- MERCK KGAA

- PARKER-HANNIFIN CORP

- PERMIONICS

- SYNDER FILTRATION, INC.

- SCINOR WATER AMERICA, LLC

- TOYOBO CO., LTD.

第十三章 附录

The membranes market is expected to reach USD 11.70 billion by 2030, up from USD 7.87 billion in 2025, with a CAGR of 8.2%. The rising demand for wastewater treatment is fueling membrane use because they effectively remove contaminants, helping meet strict disposal standards and reducing risks associated with discharges or reusing treated water. Rapid industrialization and urbanization have led to increased wastewater production and higher pollution levels, prompting the adoption or continuation of advanced treatment technologies like membrane filtration for sustainable water management and resource recovery.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Thousand Square Meters; Value (USD Million) |

| Segments | Material, Technology, and Application |

| Regions covered | Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

Additionally, the focus on reducing water shortages through recycling and reuse is expected to boost demand for membranes in both municipal and industrial sectors worldwide.

"Based on technology, microfiltration segment to account for second-largest share of membranes market during forecast period, in terms of value"

In terms of value, microfiltration holds the second-largest share of the membranes market because of its extensive use in water and wastewater treatment systems, pharmaceuticals and medical products, food and beverage, and more. Microfiltration has a unique feature that benefits its applications: its ability to effectively and efficiently remove suspended solids, bacteria, and large macromolecules with less energy consumption. Its low energy requirement makes microfiltration relatively inexpensive compared to many other treatment methods. The rising regulatory standards for water quality and the growing industry-wide demand for purified effluents are among the key reasons driving the increased adoption of microfiltration applications worldwide.

"Based on material, polymeric segment to be second fastest-growing segment in membranes market during forecast period, in terms of value"

Polymeric membranes are the second fastest-growing segment in the membranes market because they offer significant customization and flexible production options, are the most cost-effective, and have high chemical resistance. These membranes operate with various polymers that provide good selectivity and durability, making them common in water treatment, pharmaceuticals, and food development applications. Advances in polymer chemistry have led to improved fouling resistance, increased permeability, and a better ability to meet strict environmental regulations. There is also a growing focus and demand for sustainable liquid filtration solutions. It is expected that these trends will create opportunities for increased use of polymeric membrane filters throughout the forecast period.

"Based on region, Asia Pacific to account for largest share of membranes market, in terms of value"

Asia Pacific dominates the membranes market share and is the fastest-growing region due to rapid industrialization, urbanization, and the increased demand for clean water and wastewater treatment solutions in China, India, and Southeast Asia. Additionally, with strong government initiatives, capital investments in infrastructure, and ongoing advancements in technology, Asia Pacific has amplified market growth, thereby providing an opportunity to adopt and innovate membrane technologies.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors- 35%, Managers - 25%, and Others - 40%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, Middle East & Africa - 7%, and South America - 4%

Key players in this market are Dupont (US), Toray Industries Inc (Japan), Hydranautics (Nitto Denko Group Company) (US), Kovalus Separation Solutions (US), Pall Corporation (US), Veolia (France), Pentair (US), Asahi Kasei Corporation (Japan), LG Chem (South Korea), and Mann+Hummel (Germany).

Research Coverage

This report segments the membranes market by material, technology, application, and region, and offers estimates of the market's overall value across various regions. A detailed analysis of key industry players has been performed to provide insights into their business overviews, products and services, main strategies, new product launches, expansions, and mergers and acquisitions related to the membranes market.

Key Benefits of Buying this Report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles. Together, these provide an overall view of the competitive landscape, emerging and high-growth segments of the membranes market, high-growth regions, and the market's drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (Increasing awareness about water & wastewater treatment, Stringent wastewater regulations), restraints (Fouling and scaling in membranes, High capital costs of raw materials), opportunities (Rising demand for water treatment in emerging economies, Pressing need for freshwater supply in industries) and challenges (Issues related to lifespan and efficiency of membranes, Discharge of brine as waste from RO membranes).

- Market Penetration: Comprehensive information on the membranes market share is offered regarding the top players in the global membranes market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the membranes market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the membranes market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global membranes market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the membranes market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MEMBRANES MARKET

- 4.2 MEMBRANES MARKET, BY MATERIAL

- 4.3 MEMBRANES MARKET, BY TECHNOLOGY

- 4.4 MEMBRANES MARKET, BY APPLICATION

- 4.5 MEMBRANES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing awareness about water & wastewater treatment

- 5.2.1.2 Stringent wastewater regulations

- 5.2.1.3 Shift from chemical to membrane treatment of water

- 5.2.1.4 Increasing demand for membranes from end-use industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fouling and scaling in membranes

- 5.2.2.2 High capital costs of raw materials

- 5.2.2.3 Limited compatibility and high energy consumption

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for water treatment in emerging economies

- 5.2.3.2 Pressing need for freshwater supply in industries

- 5.2.3.3 Circular economy initiatives

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues related to lifespan and efficiency of membranes

- 5.2.4.2 Discharge of brine as waste from RO membranes

- 5.2.4.3 High initial cost of equipment

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GLOBAL GDP TRENDS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM/MARKET MAP

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO (HS CODE 842129)

- 6.5.2 IMPORT SCENARIO (HS CODE 842129)

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION (2022-2024)

- 6.6.2 AVERAGE SELLING PRICE TREND OF APPLICATION, BY KEY PLAYER (2022-2024)

- 6.7 REGULATORY LANDSCAPE

- 6.8 IMPACT OF AI/GEN AI

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 Block copolymer membranes

- 6.10.1.2 Flux enhancement technology

- 6.10.2 COMPLEMENTARY TECHNOLOGIES

- 6.10.2.1 Combined crystallization and diffusion

- 6.10.2.2 Membrane distillation

- 6.10.3 ADJACENT TECHNOLOGIES

- 6.10.3.1 Membrane contactor

- 6.10.3.2 Pervaporation for hydrocarbon separation

- 6.10.3.3 Forward osmosis, direct contact membrane distillation, and integrated FO-DCMD

- 6.10.1 KEY TECHNOLOGIES

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 TORAY'S MEMBRANE TECHNOLOGIES ACHIEVED ZERO LIQUID DISCHARGE IN INDIA'S SPECIAL ECONOMIC ZONE

- 6.11.2 HYDRANAUTICS TREATED INDUSTRIAL WASTEWATER WITH PRO-LF IN A COAL-CHEMICAL ZLD PROJECT

- 6.11.3 SUEZ CONSTRUCTED WEST WASTEWATER TREATMENT PLANT IN DOHA

- 6.11.4 PENTAIR OFFERED WATER TREATMENT SOLUTIONS IN SWEDEN

- 6.11.5 DUPONT OFFERED UPGRADED RO SYSTEM TO INCREASE PERMEATE CAPACITY AND REDUCE CONCENTRATE VOLUME

- 6.12 KEY CONFERENCES AND EVENTS IN 2025-2026

- 6.13 INVESTMENT AND FUNDING SCENARIO

- 6.14 PATENT ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 LEGAL STATUS OF PATENTS

- 6.14.3 JURISDICTION ANALYSIS

- 6.15 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.15.1 INTRODUCTION

- 6.15.2 KEY TARIFF RATES

- 6.15.3 PRICE IMPACT ANALYSIS

- 6.15.4 IMPACT ON COUNTRY/REGION

- 6.15.4.1 US

- 6.15.4.2 Europe

- 6.15.4.3 Asia Pacific

- 6.15.5 IMPACT ON END-USE INDUSTRIES

7 MEMBRANES MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- 7.2 POLYMERIC

- 7.2.1 POLYAMIDE

- 7.2.1.1 Primarily used in NF and RO membranes

- 7.2.2 POLYSULFONE AND POLYETHERSULFONE

- 7.2.2.1 Offer high thermal and chemical stability

- 7.2.3 FLUOROPOLYMERS

- 7.2.3.1 Possess high mechanical strength and chemical resistance

- 7.2.4 OTHER POLYMERIC MEMBRANES

- 7.2.1 POLYAMIDE

- 7.3 CERAMIC

- 7.3.1 ALUMINA

- 7.3.1.1 Improves production efficiency of membranes

- 7.3.2 TITANIA

- 7.3.2.1 Primarily used in MF and NF membranes

- 7.3.3 ZIRCONIA

- 7.3.3.1 High strength and fracture toughness

- 7.3.4 OTHER CERAMIC MEMBRANES

- 7.3.1 ALUMINA

- 7.4 OTHER MATERIALS

8 MEMBRANES MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 REVERSE OSMOSIS

- 8.2.1 WIDELY USED IN DESALINATION

- 8.3 ULTRAFILTRATION

- 8.3.1 HIGHER FLUX RATE THAN REVERSE OSMOSIS

- 8.4 MICROFILTRATION

- 8.4.1 USED AS PRETREATMENT TO REVERSE OSMOSIS AND NANOFILTRATION

- 8.5 NANOFILTRATION

- 8.5.1 WORKS AT REDUCED OPERATING PRESSURES WITH HIGHER FLOW RATES THAN REVERSE OSMOSIS

- 8.6 OTHER TECHNOLOGIES

9 MEMBRANES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 WATER & WASTEWATER TREATMENT

- 9.2.1 DESALINATION

- 9.2.1.1 Used to separate dissolved salts from water

- 9.2.2 UTILITY WATER TREATMENT

- 9.2.2.1 Produces high-purity or potable water from contaminated sources

- 9.2.3 WASTEWATER REUSE

- 9.2.3.1 Efficient in eliminating contaminants from process streams

- 9.2.1 DESALINATION

- 9.3 INDUSTRIAL PROCESSING

- 9.3.1 FOOD & BEVERAGE

- 9.3.1.1 Removal of pathogenic substances from liquid streams

- 9.3.2 CHEMICAL & PETROCHEMICAL

- 9.3.2.1 Reduced operational cost

- 9.3.3 PHARMACEUTICAL & MEDICAL

- 9.3.3.1 Superior filtration and temperature resistance

- 9.3.4 TEXTILE

- 9.3.4.1 Desalting & purification of dyes

- 9.3.5 POWER

- 9.3.5.1 Advanced membrane technology to improve water quality

- 9.3.6 PULP & PAPER

- 9.3.6.1 Wastewater treatment for pulp preparation and bleaching

- 9.3.7 OTHER APPLICATIONS

- 9.3.1 FOOD & BEVERAGE

10 MEMBRANES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Rapid industrialization and urbanization to drive market

- 10.2.2 JAPAN

- 10.2.2.1 Development of advanced technologies and boom in industrial sector to boost market

- 10.2.3 INDIA

- 10.2.3.1 Growth of end-use industries and increasing awareness of wastewater treatment to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Growth of food & beverage industry to drive market

- 10.2.5 AUSTRALIA

- 10.2.5.1 Surge in seawater desalination centers to drive market

- 10.2.6 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Increase in oil production activities and rising demand for potable drinking water to drive market

- 10.3.2 CANADA

- 10.3.2.1 Increase in food processing establishments to drive market

- 10.3.3 MEXICO

- 10.3.3.1 Growth of manufacturing sector to boost market

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 SPAIN

- 10.4.1.1 Surge in demand for desalinated water to drive market

- 10.4.2 GERMANY

- 10.4.2.1 Stringent EU standards for wastewater treatment to boost market

- 10.4.3 FRANCE

- 10.4.3.1 Advancements in water treatment infrastructure to drive market

- 10.4.4 UK

- 10.4.4.1 Rising oil & gas production fields in offshore and onshore platforms to drive market

- 10.4.5 ITALY

- 10.4.5.1 Growth of pharmaceutical and electronics sectors to drive market

- 10.4.6 REST OF EUROPE

- 10.4.1 SPAIN

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Presence of tapped aquifers and network of large desalination projects to drive market

- 10.5.1.2 UAE

- 10.5.1.2.1 Extensive use of membranes in brackish water treatment to drive market

- 10.5.1.3 Kuwait

- 10.5.1.3.1 Strong capacity for brackish water and seawater desalination to boost market

- 10.5.1.4 Rest of GCC

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Addressing water scarcity through advanced membrane technologies in South Africa

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Rising need for safe drinking water to drive demand for membranes

- 10.6.2 ARGENTINA

- 10.6.2.1 Emphasis on wastewater treatment activities and foreign investments to boost market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT

- 11.7.5.1 Material footprint

- 11.7.5.2 Technology footprint

- 11.7.5.3 Application footprint

- 11.7.5.4 Region footprint

- 11.7.5.5 Overall company footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 DUPONT

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 TORAY INDUSTRIES, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 HYDRANAUTICS (A NITTO DENKO GROUP COMPANY)

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 KOVALUS SEPARATION SOLUTIONS

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 PALL CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 VEOLIA

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threats

- 12.1.7 PENTAIR

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.4 MnM view

- 12.1.7.4.1 Key strengths

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 ASAHI KASEI CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Expansions

- 12.1.8.4 MnM view

- 12.1.8.4.1 Key strengths

- 12.1.8.4.2 Strategic choices

- 12.1.8.4.3 Weaknesses and competitive threats

- 12.1.9 LG CHEM

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Other developments

- 12.1.9.4 MnM view

- 12.1.9.4.1 Key strengths

- 12.1.9.4.2 Strategic choices

- 12.1.9.4.3 Weaknesses and competitive threats

- 12.1.10 MANN+HUMMEL

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.10.3.1 Key strengths

- 12.1.10.3.2 Strategic choices

- 12.1.10.3.3 Weaknesses and competitive threats

- 12.1.11 SOLVENTUN

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.2.1 Other developments

- 12.1.11.3 MnM view

- 12.1.11.3.1 Key strengths

- 12.1.11.3.2 Strategic choices

- 12.1.11.3.3 Weaknesses and competitive threats

- 12.1.12 BEIJING ORIGINWATER TECHNOLOGY CO., LTD.

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 MnM view

- 12.1.12.3.1 Key strengths

- 12.1.12.3.2 Strategic choices

- 12.1.12.3.3 Weaknesses and competitive threats

- 12.1.1 DUPONT

- 12.2 OTHER PLAYERS

- 12.2.1 ALSYS

- 12.2.2 APPLIED MEMBRANES, INC.

- 12.2.3 AQUAPORIN

- 12.2.4 AXEON WATER TECHNOLOGIES

- 12.2.5 GEA GROUP AKTIENGESELLSCHAFT

- 12.2.6 LANXESS

- 12.2.7 LENNTECH B.V.

- 12.2.8 MEMBRANE SOLUTIONS (NANTONG)

- 12.2.9 MEMBRANIUM

- 12.2.10 MERCK KGAA

- 12.2.11 PARKER-HANNIFIN CORP

- 12.2.12 PERMIONICS

- 12.2.13 SYNDER FILTRATION, INC.

- 12.2.14 SCINOR WATER AMERICA, LLC

- 12.2.15 TOYOBO CO., LTD.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 MEMBRANES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2018-2025

- TABLE 3 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP FOUR APPLICATIONS

- TABLE 4 KEY BUYING CRITERIA FOR TOP FOUR APPLICATIONS

- TABLE 5 MEMBRANES MARKET: ECOSYSTEM

- TABLE 6 EXPORT SCENARIO FOR HS CODE 842129-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 IMPORT SCENARIO FOR HS CODE 392190-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MEMBRANES MARKET: KEY CONFERENCES & EVENTS

- TABLE 13 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 14 MEMBRANES MARKET, BY MATERIAL, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 15 MEMBRANES MARKET, BY MATERIAL, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 16 MEMBRANES MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 17 MEMBRANES MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 18 MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 19 MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 20 MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 21 MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 22 MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 23 MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 24 MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 25 MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 26 ASIA PACIFIC: MEMBRANES MARKET, BY COUNTRY, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 27 ASIA PACIFIC: MEMBRANES MARKET, BY COUNTRY, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 28 ASIA PACIFIC: MEMBRANES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 29 ASIA PACIFIC: MEMBRANES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 30 ASIA PACIFIC: MEMBRANES MARKET, BY MATERIAL, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 31 ASIA PACIFIC: MEMBRANES MARKET, BY MATERIAL, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 32 ASIA PACIFIC: MEMBRANES MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 33 ASIA PACIFIC: MEMBRANES MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 34 ASIA PACIFIC: MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 35 ASIA PACIFIC: MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 36 ASIA PACIFIC: MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 37 ASIA PACIFIC: MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 38 ASIA PACIFIC: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 39 ASIA PACIFIC: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 40 ASIA PACIFIC: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 41 ASIA PACIFIC: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 CHINA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 43 CHINA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 44 CHINA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 45 CHINA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 46 JAPAN: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 47 JAPAN: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 48 JAPAN: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 49 JAPAN: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 50 INDIA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 51 INDIA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 52 INDIA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 53 INDIA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 54 SOUTH KOREA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 55 SOUTH KOREA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 56 SOUTH KOREA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 57 SOUTH KOREA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 58 AUSTRALIA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 59 AUSTRALIA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 60 AUSTRALIA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 61 AUSTRALIA MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 63 REST OF ASIA PACIFIC: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 64 REST OF ASIA PACIFIC: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: MEMBRANES MARKET, BY COUNTRY, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 67 NORTH AMERICA: MEMBRANES MARKET, BY COUNTRY, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 68 NORTH AMERICA: MEMBRANES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 69 NORTH AMERICA: MEMBRANES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: MEMBRANES MARKET, BY MATERIAL, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 71 NORTH AMERICA: MEMBRANES MARKET, BY MATERIAL, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 72 NORTH AMERICA: MEMBRANES MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: MEMBRANES MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 75 NORTH AMERICA: MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 76 NORTH AMERICA: MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 79 NORTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 80 NORTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 US: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 83 US: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 84 US: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 85 US: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 86 CANADA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 87 CANADA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 88 CANADA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 89 CANADA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 MEXICO: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 91 MEXICO: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 92 MEXICO: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 93 MEXICO: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: MEMBRANES MARKET, BY COUNTRY, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 95 EUROPE: MEMBRANES MARKET, BY COUNTRY, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 96 EUROPE: MEMBRANES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 97 EUROPE: MEMBRANES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: MEMBRANES MARKET, BY MATERIAL, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 99 EUROPE: MEMBRANES MARKET, BY MATERIAL, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 100 EUROPE: MEMBRANES MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 101 EUROPE: MEMBRANES MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 102 EUROPE: MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 103 EUROPE: MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 104 EUROPE: MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 105 EUROPE: MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 106 EUROPE: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 107 EUROPE: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 108 EUROPE: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 109 EUROPE: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 SPAIN: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 111 SPAIN: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 112 SPAIN: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 113 SPAIN: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 GERMANY: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 115 GERMANY: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 116 GERMANY: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 117 GERMANY: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 FRANCE: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 119 FRANCE: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 120 FRANCE: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 121 FRANCE: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 UK: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 123 UK: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 124 UK: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 125 UK: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 ITALY: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 127 ITALY: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 128 ITALY: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 129 ITALY: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 REST OF EUROPE: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 131 REST OF EUROPE: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 132 REST OF EUROPE: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 133 REST OF EUROPE: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY COUNTRY, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 135 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY COUNTRY, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 136 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY MATERIAL, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 139 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY MATERIAL, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 140 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 143 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 144 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 147 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 148 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 150 SAUDI ARABIA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 151 SAUDI ARABIA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 152 SAUDI ARABIA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 153 SAUDI ARABIA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 154 UAE: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 155 UAE: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 156 UAE: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 157 UAE: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 158 KUWAIT: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 159 KUWAIT: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 160 KUWAIT: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 161 KUWAIT: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 REST OF GCC: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 163 REST OF GCC: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 164 REST OF GCC: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 165 REST OF GCC: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 166 SOUTH AFRICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 167 SOUTH AFRICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 168 SOUTH AFRICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 169 SOUTH AFRICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 170 REST OF MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 174 SOUTH AMERICA: MEMBRANES MARKET, BY COUNTRY, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 175 SOUTH AMERICA: MEMBRANES MARKET, BY COUNTRY, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 176 SOUTH AMERICA: MEMBRANES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 177 SOUTH AMERICA: MEMBRANES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 178 SOUTH AMERICA: MEMBRANES MARKET, BY MATERIAL, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 179 SOUTH AMERICA: MEMBRANES MARKET, BY MATERIAL, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 180 SOUTH AMERICA: MEMBRANES MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 181 SOUTH AMERICA: MEMBRANES MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 182 SOUTH AMERICA: MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 183 SOUTH AMERICA: MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 184 SOUTH AMERICA: MEMBRANES MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 185 SOUTH AMERICA: MEMBRANES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 186 SOUTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 187 SOUTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 188 SOUTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 189 SOUTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 190 BRAZIL: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 191 BRAZIL: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 192 BRAZIL: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 193 BRAZIL: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 194 ARGENTINA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 195 ARGENTINA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 196 ARGENTINA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 197 ARGENTINA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 198 REST OF SOUTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (THOUSAND SQUARE METERS)

- TABLE 199 REST OF SOUTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (THOUSAND SQUARE METERS)

- TABLE 200 REST OF SOUTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 201 REST OF SOUTH AMERICA: MEMBRANES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 202 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MEMBRANES MARKET BETWEEN JANUARY 2020 AND JUNE 2025

- TABLE 203 MEMBRANES MARKET: DEGREE OF COMPETITION

- TABLE 204 MEMBRANES MARKET: MATERIAL FOOTPRINT

- TABLE 205 MEMBRANES MARKET: TECHNOLOGY FOOTPRINT

- TABLE 206 MEMBRANES MARKET: APPLICATION FOOTPRINT

- TABLE 207 MEMBRANES MARKET: REGION FOOTPRINT

- TABLE 208 MEMBRANES MARKET: KEY STARTUPS/SMES

- TABLE 209 MEMBRANES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 210 MEMBRANES MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 211 MEMBRANES MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 212 MEMBRANES MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 213 MEMBRANES MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JULY 2025

- TABLE 214 DUPONT: COMPANY OVERVIEW

- TABLE 215 DUPONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 DUPONT: DEALS, JANUARY 2020-JULY 2024

- TABLE 217 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 218 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 220 TORAY INDUSTRIES, INC.: DEALS, JANUARY 2020-JULY 2024

- TABLE 221 HYDRANAUTICS (A NITTO DENKO GROUP COMPANY): COMPANY OVERVIEW

- TABLE 222 HYDRANAUTICS (A NITTO DENKO GROUP COMPANY): PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 223 HYDRANAUTICS (A NITTO DENKO GROUP COMPANY): PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 224 HYDRANAUTICS (A NITTO DENKO GROUP COMPANY): DEALS, JANUARY 2020-JULY 2024

- TABLE 225 KOVALUS SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 226 KOVALUS SEPARATION SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 KOVALUS SEPARATION SOLUTIONS: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 228 KOVALUS SEPARATION SOLUTIONS: DEALS, JANUARY 2020-JULY 2024

- TABLE 229 KOVALUS SEPARATION SOLUTIONS: EXPANSIONS, JANUARY 2020-JULY 2024

- TABLE 230 PALL CORPORATION: COMPANY OVERVIEW

- TABLE 231 PALL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 PALL CORPORATION: DEALS, JANUARY 2020-JULY 2024

- TABLE 233 VEOLIA: COMPANY OVERVIEW

- TABLE 234 VEOLIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 VEOLIA: DEALS, JANUARY 2020-JULY 2024

- TABLE 236 PENTAIR: COMPANY OVERVIEW

- TABLE 237 PENTAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 PENTAIR: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 239 PENTAIR: DEALS, JANUARY 2020-JULY 2024

- TABLE 240 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 241 ASAHI KASEI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 ASAHI KASEI CORPORATION: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 243 ASAHI KASEI CORPORATION: EXPANSIONS, JANUARY 2020-JULY 2024

- TABLE 244 LG CHEM: COMPANY OVERVIEW

- TABLE 245 LG CHEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 LG CHEM: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 247 LG CHEM: DEALS, JANUARY 2020-JULY 2024

- TABLE 248 LG CHEM: OTHER DEVELOPMENTS, JANUARY 2020-JULY 2024

- TABLE 249 MANN+HUMMEL: COMPANY OVERVIEW

- TABLE 250 MANN+HUMMEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 SOLVENTUM: COMPANY OVERVIEW

- TABLE 252 SOLVENTUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 SOLVENTUM: OTHER DEVELOPMENTS, JANUARY 2020-JULY 2024

- TABLE 254 BEIJING ORIGINWATER TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 255 BEIJING ORIGINWATER TECHNOLOGY CO., LTD: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 256 ALSYS: COMPANY OVERVIEW

- TABLE 257 APPLIED MEMBRANES, INC.: COMPANY OVERVIEW

- TABLE 258 AQUAPORIN: COMPANY OVERVIEW

- TABLE 259 AXEON WATER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 260 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 261 LANXESS: COMPANY OVERVIEW

- TABLE 262 LENNTECH B.V.: COMPANY OVERVIEW

- TABLE 263 MEMBRANE SOLUTIONS (NANTONG): COMPANY OVERVIEW

- TABLE 264 MEMBRANIUM: COMPANY OVERVIEW

- TABLE 265 MERCK KGAA: COMPANY OVERVIEW

- TABLE 266 PARKER-HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 267 PERMIONICS: COMPANY OVERVIEW

- TABLE 268 SYNDER FILTRATION, INC.: COMPANY OVERVIEW

- TABLE 269 SCINOR WATER AMERICA, LLC: COMPANY OVERVIEW

- TABLE 270 TOYOBO CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MEMBRANES MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MEMBRANES MARKET: RESEARCH DESIGN

- FIGURE 3 MEMBRANES MARKET: BOTTOM-UP APPROACH

- FIGURE 4 MEMBRANES MARKET: TOP-DOWN APPROACH

- FIGURE 5 MEMBRANES MARKET SIZE ESTIMATION USING TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 MEMBRANES MARKET: DATA TRIANGULATION

- FIGURE 8 POLYMERIC SEGMENT TO ACCOUNT FOR LARGEST SHARE OF OVERALL MEMBRANES MARKET

- FIGURE 9 REVERSE OSMOSIS TO BE LARGEST TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 10 WATER & WASTEWATER TREATMENT TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO WITNESS FAST GROWTH DURING FORECAST PERIOD

- FIGURE 13 POLYMERIC SEGMENT TO LEAD MEMBRANES MARKET DURING FORECAST PERIOD

- FIGURE 14 REVERSE OSMOSIS TO BE LARGEST TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 15 WATER & WASTEWATER TREATMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 SOUTH AFRICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MEMBRANES MARKET

- FIGURE 18 MEMBRANES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FOUR APPLICATIONS

- FIGURE 20 KEY BUYING CRITERIA FOR TOP FOUR APPLICATIONS

- FIGURE 21 OVERVIEW OF MEMBRANES MARKET VALUE CHAIN

- FIGURE 22 MEMBRANES MARKET: ECOSYSTEM/MARKET MAP

- FIGURE 23 EXPORT DATA FOR HS CODE 842129-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 24 IMPORT DATA FOR HS CODE 842129-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 25 AVERAGE SELLING PRICE TREND, BY REGION (2022-2024) (USD/SQUARE METER)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF APPLICATION, BY KEY PLAYER (2022-2024) (USD/SQUARE METER)

- FIGURE 27 MEMBRANES MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 29 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 30 LEGAL STATUS OF PATENTS (2014-2024)

- FIGURE 31 TOP JURISDICTIONS

- FIGURE 32 POLYMERIC TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 33 RO TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 34 WATER & WASTEWATER TREATMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 35 SOUTH AFRICA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC: MEMBRANES MARKET SNAPSHOT

- FIGURE 37 NORTH AMERICA: MEMBRANES MARKET SNAPSHOT

- FIGURE 38 EUROPE: MEMBRANES MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES IN MEMBRANES MARKET, 2022-2024

- FIGURE 40 SHARES OF LEADING COMPANIES IN MEMBRANES MARKET, 2024

- FIGURE 41 VALUATION OF LEADING COMPANIES IN MEMBRANES MARKET, 2024

- FIGURE 42 FINANCIAL METRICS OF LEADING COMPANIES IN MEMBRANES MARKET, 2024

- FIGURE 43 MEMBRANES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 44 MEMBRANES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 MEMBRANES MARKET: COMPANY FOOTPRINT

- FIGURE 46 MEMBRANES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 DUPONT: COMPANY SNAPSHOT

- FIGURE 48 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 49 HYDRANAUTICS (A NITTO DENKO GROUP COMPANY): COMPANY SNAPSHOT

- FIGURE 50 PENTAIR: COMPANY SNAPSHOT

- FIGURE 51 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 LG CHEM: COMPANY SNAPSHOT

- FIGURE 53 MANN+HUMMEL: COMPANY SNAPSHOT