|

市场调查报告书

商品编码

1844369

再生鼓风机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Regenerative Blower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

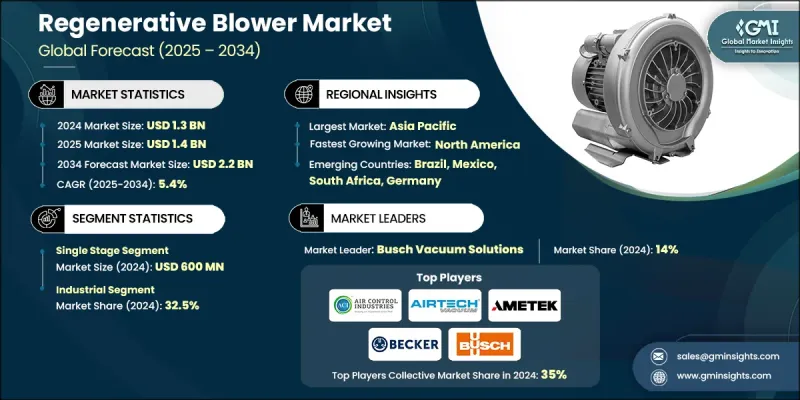

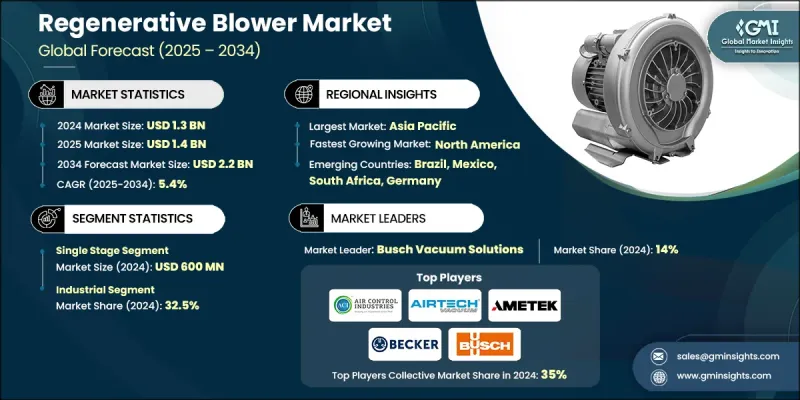

2024 年全球再生鼓风机市场价值为 13 亿美元,预计到 2034 年将以 5.4% 的复合年增长率增长至 22 亿美元。

需求的成长主要源自于自动化技术的快速发展以及自动化系统在各领域的广泛应用。再生鼓风机因其在冷却、物料处理、干燥和气力输送等基本功能中发挥重要作用,已成为这些环境中的关键部件。其无油、稳定的气流和低维护需求使其在高性能工业环境中备受青睐。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 22亿美元 |

| 复合年增长率 | 5.4% |

再生鼓风机设计和工程的持续创新显着提高了效率、性能和多功能性。增强型材料和智慧控制系统已将其应用扩展到成熟和新兴领域。清洁能源系统、积层製造和先进气动处理等新兴领域的应用进一步推动了其应用。在这些场景中,再生鼓风机可提供精确的空气流动、节能和无污染运行,使其成为现代製造业和注重环保的行业的理想选择。其价值主张不仅在于营运效率,还在于促进永续生产和降低营运风险。

单级鼓风机市场在2024年达到6亿美元,这得益于其在重型和轻型工业应用中的广泛应用。这些鼓风机在需要稳定气流的系统中至关重要,支援诸如化学品搅拌、燃烧空气输送、除尘、抽吸应用和气刀吹扫等任务。其广泛应用归因于其能够以最低的复杂性提供高可靠性,从而支援正常运行时间并降低营运成本。

2024年,工业应用领域占了32.5%的市场份额,凸显了再生鼓风机在重工业中的重要性。这些系统专为需要高流量和压力稳定性的操作而设计。这些鼓风机通常用于废水管理、气动输送和曝气等领域,在保持无油运转的同时提供高效的性能,这对于必须避免产品或製程污染的环境至关重要。

随着美国国内各行各业纷纷采用自动化和节能解决方案,2024年美国再生式鼓风机市场占了76%的市场。随着排放、工作场所安全和设备噪音水平的监管力度不断加强,促使人们转向更安静、更智慧的鼓风机技术。美国製造商正透过提供具有更高效率、数位整合和先进变速功能的鼓风机来满足这一需求。这些发展与智慧製造和工业製程控制领域对精密气流系统日益增长的需求相契合。

全球再生鼓风机市场的主要参与者包括 Airtech Vacuum Incorporated、Goorui、The Spencer Turbine Company、FPZ SpA、Hitachi Ltd.、Eurus Blowers、Becker Pump Corporation、Gardner Denver Holdings, Inc.、Air Control Industries Ltd.、Buschity SE / Busch Vacuum Solutions、Gast Maners Ltd.、Busch) KNB Corporation。参与再生鼓风机市场竞争的公司正专注于创新、客製化和能源效率,以巩固其在全球市场的地位。许多公司正在投资整合物联网功能、远端诊断和先进控制系统的智慧鼓风机技术。策略合作伙伴关係和收购正在帮助製造商扩大产品组合,同时提高供应链的弹性。各公司也强调研发,以开发适用于清洁能源和自动化驱动应用的降噪、无油鼓风机。生产设施的本地化和客製化服务正被用于满足特定地区的需求。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 工业自动化需求不断成长

- 促进能源效率的环境法规

- 扩大废水处理与空气处理应用

- 产业陷阱与挑战

- 製造和维护成本压力大

- 替代解决方案的技术取代

- 机会

- 与智慧监控系统集成

- 新兴市场和基础建设发展

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依阶段类型,2021-2034

- 主要趋势

- 单阶段

- 两阶段

- 三阶段

第六章:市场估计与预测:依压力范围,2021-2034

- 主要趋势

- 低压(最高 1 巴)

- 中压(1至2巴)

- 高压(超过 2 巴)

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 水和废水

- 食品和饮料

- 工业的

- 化学

- 石油和天然气

- 医疗的

第 8 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- Air Control Industries Ltd.

- Airtech Vacuum Incorporated

- Atlantic Blowers

- Ametek Inc.

- Becker Pump Corporation

- Busch SE / Busch Vacuum Solutions

- Eurus Blowers

- FPZ SpA

- Gardner Denver Holdings, Inc.

- Gast Manufacturing, Inc.

- Goorui

- Hitachi Ltd.

- KNB Corporation

- Rietschle Thomas

- The Spencer Turbine Company

The Global Regenerative Blower Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 2.2 billion by 2034.

Rising demand is largely fueled by the rapid advancement of automation and the widespread implementation of automated systems across diverse sectors. Regenerative blowers have become a key component in these environments due to their role in supporting essential functions like cooling, material handling, drying, and pneumatic conveying. Their oil-free, consistent airflow and low maintenance needs make them highly favored in high-performance industrial settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 5.4% |

Continued innovation in regenerative blower design and engineering has significantly improved efficiency, performance, and versatility. Enhanced materials and intelligent control systems have expanded their use across both established and emerging sectors. Applications in newer fields such as clean energy systems, additive manufacturing, and advanced pneumatic handling are further driving adoption. In these scenarios, regenerative blowers provide precise air movement, energy savings, and contamination-free operation, making them ideal for modern manufacturing and environmentally focused industries. Their value proposition lies not only in operational efficiency but also in contributing to sustainable production and lower operational risks.

The single-stage segment accounted for USD 600 million in 2024 owing to its extensive use in both heavy-duty and light industrial applications. These blowers are essential in systems where consistent airflow is required, supporting tasks like chemical agitation, combustion air delivery, dust removal, suction applications, and air knife blow-offs. Their widespread use is attributed to their ability to deliver high reliability with minimal complexity, which supports uptime and lowers operational costs.

The industrial application segment held a 32.5% share in 2024, highlighting the importance of regenerative blowers in heavy industries. These systems are tailored for operations that demand both high flow rates and pressure stability. Commonly used in sectors such as wastewater management, pneumatic transport, and aeration, these blowers provide efficient performance while maintaining oil-free operation, which is critical for environments where product or process contamination must be avoided.

United States Regenerative Blower Market held a 76% share in 2024 as domestic industries embraced automation and energy-efficient solutions. Increased regulatory scrutiny around emissions, workplace safety, and equipment noise levels has encouraged the shift toward quieter, smarter blower technologies. U.S. manufacturers are addressing this demand by delivering blowers with enhanced efficiency, digital integration, and advanced variable speed capabilities. These developments align with the growing need for precision airflow systems in smart manufacturing and industrial process control.

Key players in the Global Regenerative Blower Market include Airtech Vacuum Incorporated, Goorui, The Spencer Turbine Company, FPZ SpA, Hitachi Ltd., Eurus Blowers, Becker Pump Corporation, Gardner Denver Holdings, Inc., Air Control Industries Ltd., Busch SE / Busch Vacuum Solutions, Gast Manufacturing, Inc., Atlantic Blowers, Rietschle Thomas, Ametek Inc., and KNB Corporation. Companies competing in the Regenerative Blower Market are focusing on innovation, customization, and energy efficiency to solidify their presence across global markets. Many are investing in smart blower technologies that integrate IoT features, remote diagnostics, and advanced control systems. Strategic partnerships and acquisitions are helping manufacturers expand product portfolios while improving supply chain resilience. Firms are also emphasizing R&D to develop noise-reduced, oil-free blowers suitable for clean energy and automation-driven applications. Localization of production facilities and tailored service offerings are being used to address region-specific needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type trends

- 2.2.3 Method trends

- 2.2.4 Application trends

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for industrial automation

- 3.2.1.2 Environmental regulations promoting energy efficiency

- 3.2.1.3 Expansion of wastewater treatment and air handling applications

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Cost pressure due to high manufacturing and maintenance

- 3.2.2.2 Technological displacement by alternative solutions

- 3.2.3 Opportunities

- 3.2.3.1 Integration with smart monitoring systems

- 3.2.3.2 Emerging markets and infrastructure development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Stage Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single staged

- 5.3 Two-staged

- 5.4 Three-staged

Chapter 6 Market Estimates and Forecast, By Pressure Range, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low pressure (up to 1 bar)

- 6.3 Medium pressure (1 to 2 bar)

- 6.4 High pressure (more than 2 bar)

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Water and wastewater

- 7.3 Food & beverage

- 7.4 Industrial

- 7.5 Chemical

- 7.6 Oil & gas

- 7.7 Medical

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Air Control Industries Ltd.

- 10.2 Airtech Vacuum Incorporated

- 10.3 Atlantic Blowers

- 10.4 Ametek Inc.

- 10.5 Becker Pump Corporation

- 10.6 Busch SE / Busch Vacuum Solutions

- 10.7 Eurus Blowers

- 10.8 FPZ SpA

- 10.9 Gardner Denver Holdings, Inc.

- 10.10 Gast Manufacturing, Inc.

- 10.11 Goorui

- 10.12 Hitachi Ltd.

- 10.13 KNB Corporation

- 10.14 Rietschle Thomas

- 10.15 The Spencer Turbine Company