|

市场调查报告书

商品编码

1871092

罗特鼓风机市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Root Blower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

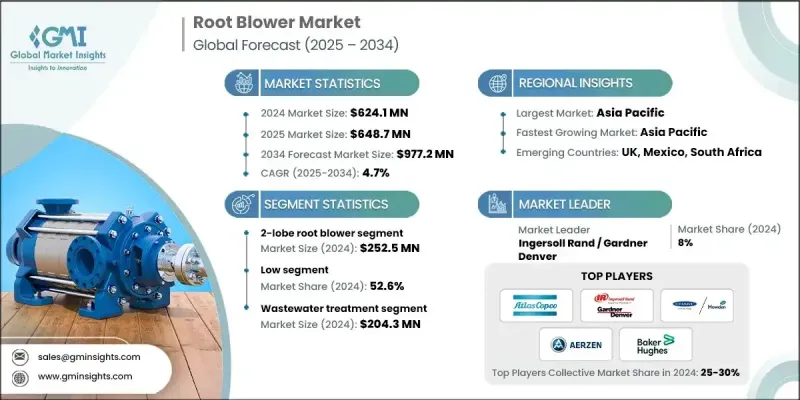

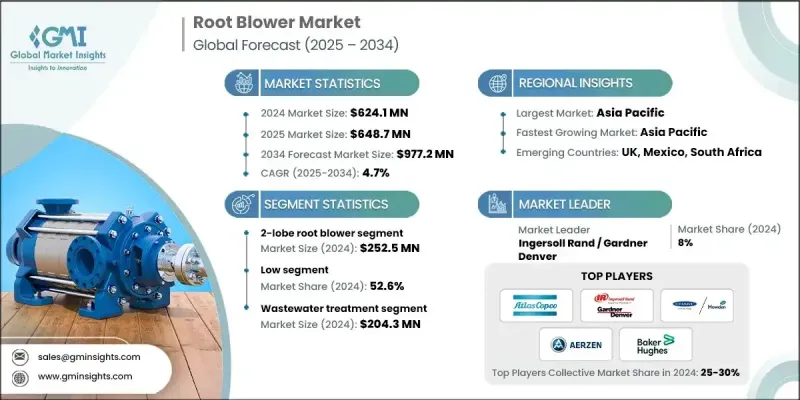

2024 年全球罗特鼓风机市场价值为 6.241 亿美元,预计到 2034 年将以 4.7% 的复合年增长率增长至 9.772 亿美元。

罗茨鼓风机的稳定成长主要得益于其在工业和市政领域的广泛应用。罗茨鼓风机性能卓越,能够在恆定压力下输送高风量,因此被广泛采用,是食品生产、水处理等各种工艺的理想选择。水泥、化工、发电和钢铁生产等产业的持续成长需求不断推动市场发展。这些鼓风机在曝气、气力输送和燃烧空气供应方面发挥着至关重要的作用。已开发地区不断增加的基础设施投资和环保倡议,催生了对经济高效且专业的空气输送系统的强劲需求。市政设施的升级改造,尤其是污水和水处理,是推动这一成长的关键因素。技术进步也在重塑产业格局,製造商致力于研发符合不断变化的产业法规的紧凑型、低噪音、高能源效率设计。物联网监控和预测性维护等智慧功能的集成,进一步提升了系统效能,并帮助操作人员最大限度地减少停机时间和营运成本。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.241亿美元 |

| 预测值 | 9.772亿美元 |

| 复合年增长率 | 4.7% |

2024年,双叶罗茨鼓风机市场规模达2.525亿美元。其运作可靠、结构简单,且能持续稳定地输送气流,使其成为众多工业领域的热门选择。这款鼓风机采用两个反向旋转的叶片设计,确保气流稳定,且无需内部压缩。凭藉其在各种工况下的耐用性和高效性,双叶罗茨鼓风机非常适合水泥製造、废水处理和化学等行业的应用,可用于曝气、燃烧空气供应和物料输送等作业。

2024年,低压鼓风机市占率达52.6%。低压罗茨鼓风机设计工作压力最高可达15 PSI,常用于需要稳定低压气流的场合,例如水产养殖、市政污水处理以及多种轻工业流程。其非脉动式送风特性在生物处理应用中特别实用,也适用于气动输送谷物、粉末和其他轻质物料,在这些应用中,虽然不需要更高的压力,但持续的气流至关重要。

2024年,美国罗特鼓风机市场占78.4%的市场份额,市场规模达1.456亿美元。受升级老旧水处理系统和日益严格的环境法规的推动,该市场正经历稳定成长。随着监管机构收紧排放标准,市政部门和企业纷纷转向罗特鼓风机等可靠设备以满足合规要求。这些系统在污泥处理和曝气等製程中至关重要,而污泥处理和曝气又是高效合规废水处理不可或缺的环节。

全球罗茨鼓风机市场的主要企业包括 Robuschi/Gardner Denver、KlimatVentMash、AERZEN、Baker Hughes、Ventinform、Izhvent、Howden/Chart Industries、Roots、VENTPROM、Atlas Copco、Gardner Denver/Inollt Rand、Roots、VENTPROM、Atlas Copco、Gardner Denver/Inollgers Rand、Ukrventsystems、Aztra*、Kirzaler这些企业正致力于创新、提高能源效率和实现数位化集成,以增强其竞争优势。许多企业正在开发结构紧凑、噪音低、节能性能更佳的鼓风机,以满足现代工业需求。采用物联网等智慧技术进行远端监控和预测性维护是延长设备寿命、减少停机时间的关键策略。为了拓展客户群,製造商也正在为水处理、水泥和电力等行业的特定应用客製化产品。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 工业需求扩张

- 技术进步

- 城市基础设施和公用设施升级

- 产业陷阱与挑战

- 高能耗

- 监理合规压力

- 机会

- 智慧製造与工业4.0融合

- 节能环保设计

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 双叶罗茨鼓风机

- 三叶式罗茨鼓风机

- 四叶罗茨鼓风机

- 多层根式鼓风机

第六章:市场估价与预测:依轴承类型划分,2021-2034年

- 主要趋势

- 滚动轴承

- 滑动轴承

- 磁轴承

第七章:市场估算与预测:依密封技术划分,2021-2034年

- 主要趋势

- 机械密封

- 迷宫封印

- 接触密封

第八章:市场估算与预测:依压力输出划分,2021-2034年

- 主要趋势

- 低(最高 15 PSI)

- 中(15 PSI-30 PSI)

- 高(高于 30 PSI)

第九章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 废水处理

- 气动输送系统

- 水泥生产

- 化学加工

- 发电

- 其他的

第十章:市场估价与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直销

- 间接销售

第十一章:市场估计与预测:按地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- AERZEN

- Atlas Copco

- Azvetra

- Baker Hughes

- Gardner Denver/Ingersoll Rand

- Howden/Chart Industries

- Izhvent

- Kaeser

- KlimatVentMash

- Robuschi/Gardner Denver

- Roots

- TMC Fluid Systems

- Ukrventsystemy

- VENTPROM

- Ventinform

The Global Root Blower Market was valued at USD 624.1 million in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 977.2 million by 2034.

The steady growth is driven by its essential use in both industrial and municipal sectors. Root blowers are widely adopted for their robust performance and ability to deliver high air volumes at a constant pressure, making them ideal for various processes such as food production, water treatment, and more. Increasing demand across industries, including cement, chemicals, power generation, and steel production, continues to boost market growth. These blowers play a critical role in aeration, pneumatic conveying, and supplying combustion air. Rising infrastructure investments and environmental initiatives across developed regions are creating strong demand for cost-effective and specialized air movement systems. Municipal upgrades, especially in sewage and water treatment, are key contributors to this momentum. Technological advancements are also reshaping the landscape, with manufacturers focusing on compact, low-noise, and energy-efficient designs that meet evolving industry regulations. The integration of smart features like IoT-based monitoring and predictive maintenance is further improving system performance and helping operators minimize downtime and operational costs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $624.1 Million |

| Forecast Value | $977.2 Million |

| CAGR | 4.7% |

In 2024, the 2-lobe root blower segment generated USD 252.5 million. Its dependable operation, simple mechanics, and ability to maintain uninterrupted air flow make it a popular option across numerous industrial settings. With a design that incorporates two lobes rotating in opposite directions, this blower type ensures a steady airflow without internal compression. These features make it well-suited for operations in sectors such as cement manufacturing, wastewater treatment, and chemicals, where it is employed for tasks like aeration, combustion air supply, and material handling, due to its durability and effectiveness under varying conditions.

The low-pressure segment held a 52.6% share in 2024. Designed for operating pressures up to 15 PSI, low-pressure root blowers are commonly utilized in applications where a steady, low-pressure airflow is essential. These include aquaculture, municipal wastewater treatment, and several light industrial processes. Their non-pulsating air delivery is especially useful in biological treatment applications, as well as in the pneumatic conveying of grains, powders, and other lightweight materials where higher pressure is not necessary, but continuous airflow is critical to the process.

United States Root Blower Market held a 78.4% share and generated USD 145.6 million in 2024. The market is experiencing stable expansion driven by the need to upgrade outdated water treatment systems and increasing enforcement of environmental regulations. With regulatory bodies tightening emission and discharge standards, municipalities and industries are turning to reliable equipment like root blowers to meet compliance standards. These systems are vital in processes like sludge handling and aeration, both of which are integral to efficient and compliant wastewater treatment.

Leading companies operating in the Global Root Blower Market include Robuschi/Gardner Denver, KlimatVentMash, AERZEN, Baker Hughes, Ventinform, Izhvent, Howden/Chart Industries, Roots, VENTPROM, Atlas Copco, Gardner Denver/Ingersoll Rand, Ukrventsystems, Azvetra, Kaeser, and TMC Fluid Systems. Companies in the Global Root Blower Market are focusing on innovation, energy efficiency, and digital integration to strengthen their competitive positioning. Many are developing compact, low-noise blowers with enhanced energy-saving features to meet modern industrial requirements. Incorporating smart technologies like IoT for remote monitoring and predictive maintenance is a key strategy to improve equipment lifespan and reduce operational downtime. To expand their customer base, manufacturers are also tailoring products for specific applications in water treatment, cement, and power industries.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Bearing type

- 2.2.4 Sealing technology

- 2.2.5 Pressure output

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrial demand expansion

- 3.2.1.2 Technological advancements

- 3.2.1.3 Urban infrastructure & utility upgrades

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High energy consumption

- 3.2.2.2 Regulatory compliance pressure

- 3.2.3 Opportunities

- 3.2.3.1 Smart manufacturing & industry 4.0 integration

- 3.2.3.2 Energy-efficient and eco-friendly designs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 2-lobe root blowers

- 5.3 3-lobe root blowers

- 5.4 4-lobe root blowers

- 5.5 Multi-stage root blowers

Chapter 6 Market Estimates and Forecast, By Bearing Type, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Rolling element bearing

- 6.3 Sleeve bearing

- 6.4 Magnetic bearing

Chapter 7 Market Estimates and Forecast, By Sealing Technology, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Mechanical seals

- 7.3 Labyrinth seals

- 7.4 Contact seals

Chapter 8 Market Estimates and Forecast, By Pressure Output, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Low (upto 15 PSI)

- 8.3 Medium (15 PSI-30 PSI)

- 8.4 High (above 30 PSI)

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Wastewater treatment

- 9.3 Pneumatic conveying systems

- 9.4 Cement production

- 9.5 Chemical processing

- 9.6 Power generation

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AERZEN

- 12.2 Atlas Copco

- 12.3 Azvetra

- 12.4 Baker Hughes

- 12.5 Gardner Denver/Ingersoll Rand

- 12.6 Howden/Chart Industries

- 12.7 Izhvent

- 12.8 Kaeser

- 12.9 KlimatVentMash

- 12.10 Robuschi/Gardner Denver

- 12.11 Roots

- 12.12 TMC Fluid Systems

- 12.13 Ukrventsystemy

- 12.14 VENTPROM

- 12.15 Ventinform