|

市场调查报告书

商品编码

1844375

汽车驾驶监控系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Driver Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

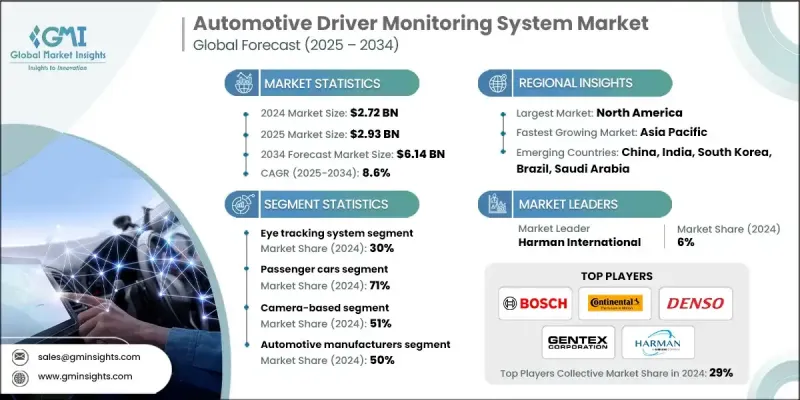

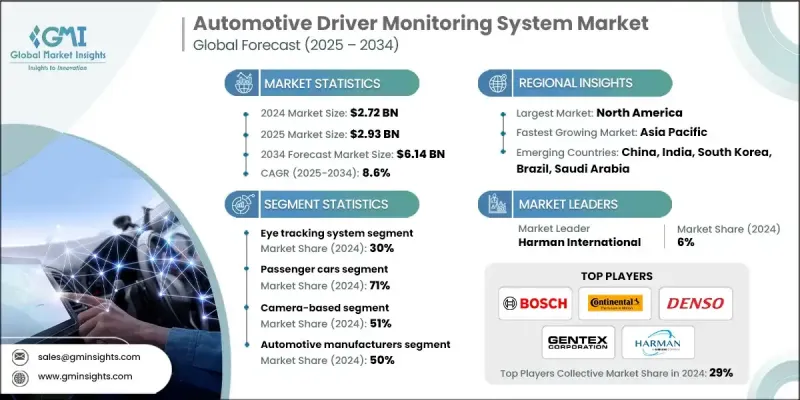

2024 年全球汽车驾驶监控系统市场价值为 27.2 亿美元,预计到 2034 年将以 8.6% 的复合年增长率成长至 61.4 亿美元。

随着道路安全的日益重要以及半自动驾驶技术的快速发展,驾驶员监控系统 (DMS) 在现代车辆中的应用正在加速。这些系统透过分析头部方向、眼球运动、眨眼速度和脸部表情等因素来评估驾驶者的行为和注意力。随着全球安全标准的日益严格,DMS 正逐渐成为乘用车的关键功能,它不仅是一种可选的豪华配置,也是下一代车辆安全架构的核心要素。即时眼动追踪、边缘 AI 处理和红外线夜视技术的进步正在增强系统功能,使其在不同的光照条件和使用者场景下都能获得更佳的效能。开发人员也正在使用大型附註释的资料集来改进 AI 模型,以提高检测疲劳、分心或註意力不集中的准确性。除了私家车之外,DMS 技术也正在大力进军商业车队,在这些领域,管理驾驶员的警觉性在减少事故和提高对新兴安全法规的合规性方面发挥着关键作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 27.2亿美元 |

| 预测值 | 61.4亿美元 |

| 复合年增长率 | 8.6% |

眼动追踪技术在2024年占据了30%的市场份额,预计到2034年将以7.6%的复合年增长率成长。这些系统旨在监测眨眼时长、注视方向和瞳孔扩张等视觉线索,以评估驾驶员疲劳或註意力不集中的迹象。眼动追踪仍然是识别注意力分散早期指标的最有效的生物辨识技术之一。研究模拟表明,该系统能够捕捉眼球运动的细微变化,在低光源环境下或驾驶员佩戴眼镜或遮光眼镜时也能提供高精度检测。

2024年,乘用车市场占了71%的市场份额,预计2025年至2034年期间的复合年增长率将达到9%。这种主导地位的驱动力源自于不断发展的安全协议和更严格的合规要求。全球市场(尤其是亚洲和欧洲)的监管变化正促使製造商将DMS纳入其标准安全功能。这些框架强调疲劳检测和行为监控,促使原始设备製造商将DMS嵌入其最新的乘用车车型中,以满足最新的安全评分基准。

北美汽车驾驶监控系统市场占33%的市场份额,2024年市场规模达8.939亿美元。该地区的领先地位源于地方政府、原始设备製造商和运输车队对整合智慧驾驶辅助系统的大力推动。虽然DMS集成尚未强制要求所有车型都集成,但美国和加拿大的国家级项目和试点项目已积极推动其应用。这些努力旨在提高驾驶员意识,减少分心事故,并支持向更安全、更聪明的出行解决方案过渡。

全球汽车驾驶监控系统市场的主要参与者包括大陆集团、麦格纳、电装、哈曼、镜泰、安波福、Tobii、博世和法雷奥。在汽车驾驶员监控系统市场中运作的公司正在利用策略合作伙伴关係,大力投资人工智慧和感测器技术,并将产品创新与监管框架相结合。许多公司正在与汽车製造商合作,共同开发将驾驶员监控系统 (DMS) 与高级驾驶辅助系统结合的整合安全平台。其他公司则透过即时眼动追踪、边缘运算和红外线感测器功能增强其硬体产品,以提高各种驾驶条件下的可靠性。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预报

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 严格的政府安全法规

- 对 ADAS 和半自动驾驶汽车的需求不断增长

- 分心驾驶和疲劳驾驶事件增多

- 消费者对车内安全功能的认知不断提高

- 人工智慧和电脑视觉在汽车系统中的集成

- 商业车队驾驶员监控规定

- 产业陷阱与挑战

- DMS软硬体整合成本高

- 用户对隐私和生物特征资料问题的担忧

- 市场机会

- Euro NCAP 2026 和 GSR 第二阶段强制使用 DMS

- 专为车内监控设计的人工智慧晶片组的出现

- 与居住者监测和健康分析集成

- 商业和共享出行车队对 DMS 的需求不断增长

- 成长动力

- 成长潜力分析

- 专利分析

- 波特的分析

- PESTEL分析

- 成本分解分析

- 技术和创新格局

- 当前的技术趋势

- 电脑视觉演算法的演变

- 眼动追踪技术进步

- 人工智慧和机器学习集成

- 多模态感测器融合

- 即时处理能力

- 新兴技术

- 当前的技术趋势

- 监管格局

- NHTSA 驾驶员监控要求

- Euro NCAP 安全评估协议

- 欧盟通用安全法规的影响

- ISO 26262 功能安全合规性

- GDPR 生物特征资料保护

- 价格趋势

- 按地区

- 按系统

- 永续性和 ESG 影响分析

- 生命週期环境评估

- 製造业永续性

- 临终管理

- 减少碳足迹

- 投资与融资趋势分析

- 安全和性能标准

- 汽车安全完整性等级(ASIL)

- 检测精度要求

- 反应时间标准

- 环境测试协议

- 电磁相容性(EMC)

- 自动驾驶汽车集成

- SAE 特定等级要求

- 切换场景管理

- 驾驶员准备状况评估

- 数位转型的影响

- 连网汽车集成

- 无线更新功能

- 基于云端的分析平台

- 巨量资料与人工智慧融合

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按系统,2021 - 2034

- 主要趋势

- 眼动追踪系统

- 脸部辨识系统

- 转向行为监测系统

- 心率监测系统

- 其他的

第六章:市场估计与预测:依车型,2021 - 2034

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车(LCV)

- 重型商用车(HCV)

- 中型商用车(MCV)

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 基于摄影机

- 基于感测器

- 杂交种

第 8 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 汽车製造商

- OEM(原始设备製造商)

- 一级供应商

- 2/3级零件供应商

- 售后市场製造商

- 政府

- 交通运输及安全机构

- 政府车队

- 个人

- 车队营运商

- 运输与物流

- 行程服务

- 行业专用车队

- 商业运输

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 印尼

- 菲律宾

- 泰国

- 韩国

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- 全球参与者

- Aptiv

- Bosch

- Continental

- Denso

- Gentex

- Harman

- Magna

- Tobii

- Valeo

- 区域参与者

- Aisin

- Eyesight Technologies

- Ficosa

- Hyundai Mobis

- Panasonic

- Veoneer

- Visteon

- ZF Friedrichshafen

- 新兴参与者/颠覆者

- Affectiva

- Cipia

- Eyeris Technologies

- Guardian Optical Technologies

- Jungo Connectivity

- Nauto

- StradVision

- Xperi Corporation

The Global Automotive Driver Monitoring System Market was valued at USD 2.72 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 6.14 billion by 2034.

The growing emphasis on road safety and the rapid advancement of semi-autonomous driving technologies are accelerating the adoption of driver monitoring systems (DMS) in modern vehicles. These systems evaluate driver behavior and attentiveness by analyzing factors such as head orientation, eye movement, blinking speed, and facial expressions. As safety standards tighten worldwide, DMS is emerging as a critical feature in passenger vehicles, not just as an optional luxury but as a core element of next-generation vehicle safety architecture. Advancements in real-time eye tracking, edge AI processing, and infrared-based night vision are enhancing system capabilities, allowing better performance across different lighting conditions and user scenarios. Developers are also refining AI models using large annotated datasets to increase the accuracy of detecting fatigue, distraction, or inattention. Beyond private vehicles, DMS technology is making significant inroads into commercial fleets, where managing driver alertness plays a pivotal role in reducing accidents and improving compliance with emerging safety regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.72 Billion |

| Forecast Value | $6.14 Billion |

| CAGR | 8.6% |

The eye tracking technology segment held a 30% share in 2024 and is projected to grow at a CAGR of 7.6% through 2034. These systems are designed to monitor visual cues like blink duration, gaze direction, and pupil dilation to assess signs of driver fatigue or loss of focus. Eye tracking remains one of the most effective biometric techniques for identifying early indicators of distraction. Research simulations have demonstrated the system's ability to capture even subtle variations in eye movement, delivering high detection accuracy in low-light environments or when drivers wear glasses or obstructive eyewear.

The passenger cars segment held a 71% share in 2024 and is expected to grow at a 9% CAGR from 2025 to 2034. This dominance is driven by evolving safety protocols and tighter compliance requirements. Regulatory changes across global markets, especially in Asia and Europe, are pushing manufacturers to incorporate DMS as part of their standard safety features. These frameworks emphasize fatigue detection and behavioral monitoring, prompting OEMs to embed DMS into their latest passenger models to meet updated safety scoring benchmarks.

North America Automotive Driver Monitoring System Market held a 33% share and generated USD 893.9 million in 2024. The region's leadership stems from a strong push by regional authorities, OEMs, and transportation fleets seeking to integrate intelligent driver-assist systems. While DMS integration is not yet mandatory across all vehicle categories, national programs and pilot initiatives in both the US and Canada have actively promoted its adoption. These efforts focus on enhancing driver awareness, reducing distraction-related accidents, and supporting the transition to safer, smarter mobility solutions.

Key players in the Global Automotive Driver Monitoring System Market include Continental, Magna, Denso, Harman, Gentex, Aptiv, Tobii, Bosch, and Valeo. Companies operating in the automotive driver monitoring system market are leveraging strategic partnerships, investing heavily in AI and sensor technology, and aligning product innovation with regulatory frameworks. Many are forming collaborations with automakers to co-develop integrated safety platforms that combine DMS with advanced driver-assistance systems. Others are enhancing their hardware offerings with real-time eye tracking, edge-based computing, and infrared sensor capabilities to improve reliability across driving conditions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 End Use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent government safety regulations

- 3.2.1.2 Rising demand for ADAS and semi-autonomous vehicles

- 3.2.1.3 Increasing incidents of distracted and drowsy driving

- 3.2.1.4 Growing consumer awareness of in-cabin safety features

- 3.2.1.5 Integration of AI and computer vision in automotive systems

- 3.2.1.6 Mandates for commercial fleet driver monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of DMS hardware and software integration

- 3.2.2.2 Privacy and biometric data concerns among users

- 3.2.3 Market opportunities

- 3.2.3.1 Mandatory DMS for Euro NCAP 2026 and GSR Phase II

- 3.2.3.2 Emergence of AI chipsets tailored for in-cabin monitoring

- 3.2.3.3 Integration with occupant monitoring and health analytics

- 3.2.3.4 Growing demand for DMS in commercial and shared mobility fleets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Cost breakdown analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.1.1 Computer vision algorithm evolution

- 3.8.1.2 Eye tracking technology advances

- 3.8.1.3 AI and machine learning integration

- 3.8.1.4 Multi-modal sensor fusion

- 3.8.1.5 Real-time processing capabilities

- 3.8.2 Emerging technologies

- 3.8.1 Current technological trends

- 3.9 Regulatory landscape

- 3.9.1 NHTSA driver monitoring requirements

- 3.9.2 Euro NCAP safety assessment protocols

- 3.9.3 EU general safety regulation impact

- 3.9.4 ISO 26262 functional safety compliance

- 3.9.5 GDPR biometric data protection

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By system

- 3.11 Sustainability & ESG impact analysis

- 3.11.1 Lifecycle environmental assessment

- 3.11.2 Manufacturing sustainability

- 3.11.3 End-of-life management

- 3.11.4 Carbon footprint reduction

- 3.12 Investment & funding trends analysis

- 3.13 Safety and performance standards

- 3.13.1 Automotive safety integrity levels (ASIL)

- 3.13.2 Detection accuracy requirements

- 3.13.3 Response time standards

- 3.13.4 Environmental testing protocols

- 3.13.5 Electromagnetic compatibility (EMC)

- 3.14 Autonomous vehicle integration

- 3.14.1 SAE level-specific requirements

- 3.14.2 Handover scenario management

- 3.14.3 Driver readiness assessment

- 3.15 Digital transformation impact

- 3.15.1 Connected vehicle integration

- 3.15.2 Over-the-air update capabilities

- 3.15.3 Cloud-based analytics platforms

- 3.15.4 Big data and AI integration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 (USD Bn)

- 5.1 Key trends

- 5.2 Eye tracking system

- 5.3 Facial recognition system

- 5.4 Steering behavior monitoring system

- 5.5 Heart rate monitoring system

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Heavy commercial vehicles (HCV)

- 6.3.3 Medium commercial vehicles (MCV)

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Bn)

- 7.1 Key trends

- 7.2 Camera-based

- 7.3 Sensor-based

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Automotive manufacturers

- 8.2.1 OEMs (Original Equipment Manufacturers)

- 8.2.2 Tier 1 suppliers

- 8.2.3 Tier 2/3 component suppliers

- 8.2.4 Aftermarket manufacturers

- 8.3 Government

- 8.3.1 Transportation & safety agencies

- 8.3.2 Government vehicle fleets

- 8.4 Individuals

- 8.5 Fleet operators

- 8.5.1 Transportation & logistics

- 8.5.2 Mobility services

- 8.5.3 Industry-specific fleets

- 8.5.4 Commercial transportation

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Aptiv

- 10.1.2 Bosch

- 10.1.3 Continental

- 10.1.4 Denso

- 10.1.5 Gentex

- 10.1.6 Harman

- 10.1.7 Magna

- 10.1.8 Tobii

- 10.1.9 Valeo

- 10.2 Regional Players

- 10.2.1 Aisin

- 10.2.2 Eyesight Technologies

- 10.2.3 Ficosa

- 10.2.4 Hyundai Mobis

- 10.2.5 Panasonic

- 10.2.6 Veoneer

- 10.2.7 Visteon

- 10.2.8 ZF Friedrichshafen

- 10.3 Emerging Players / Disruptors

- 10.3.1 Affectiva

- 10.3.2 Cipia

- 10.3.3 Eyeris Technologies

- 10.3.4 Guardian Optical Technologies

- 10.3.5 Jungo Connectivity

- 10.3.6 Nauto

- 10.3.7 StradVision

- 10.3.8 Xperi Corporation