|

市场调查报告书

商品编码

1871119

驾驶员监控系统(DMS)硬体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Driver Monitoring System (DMS) Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

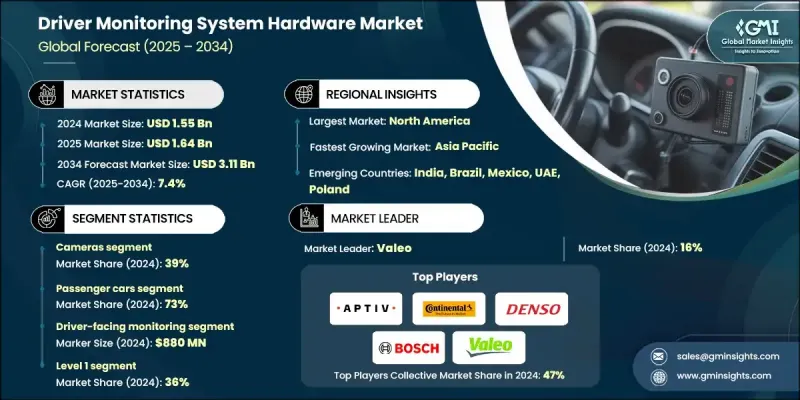

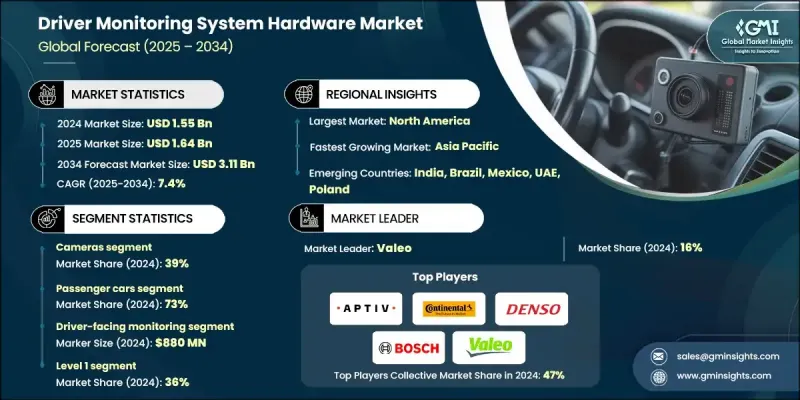

2024 年全球驾驶员监控系统硬体市场价值为 15.5 亿美元,预计到 2034 年将以 7.4% 的复合年增长率增长至 31.1 亿美元。

世界各国政府正加强车辆安全法规的执行力度,强制要求新车安装驾驶监控系统(DMS)。诸如欧洲新车安全评估协会(Euro NCAP)、美国国家公路交通安全管理局(NHTSA)指南以及中国GB法规等标准均要求车内监控系统能够侦测驾驶的疲劳、分心和注意力不集中等情况。为了满足法规要求、降低责任风险并提升整体安全性,汽车製造商正积极回应,为车队配备先进的DMS硬体。日益增长的监管压力以及消费者对更安全车辆的需求,已成为推动DMS硬体普及的主要因素。此外,全球范围内向先进驾驶辅助系统(ADAS)和半自动驾驶汽车的转型,也要求持续监控驾驶员的注意力,以确保安全驾驶。 DMS组件,包括摄影机、红外线感测器和电子控制单元(ECU),对于这些系统的功能至关重要,因此,随着汽车製造商(OEM)在乘用车和商用车领域扩展ADAS功能,DMS组件的普及应用也变得尤为重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15.5亿美元 |

| 预测值 | 31.1亿美元 |

| 复合年增长率 | 7.4% |

2024年,摄影机市占率达到39%,预计到2034年将以8%的复合年增长率成长。其紧凑的设计、精准的定位和经济的价格使其在监测驾驶员视线和脸部表情方面非常有效。与人工智慧分析和ADAS系统集成,可以即时检测疲劳和注意力分散情况。电动车和半自动驾驶汽车产量的不断增长,以及法规的不断完善,正促使全球汽车製造商(OEM)采用基于摄影机的驾驶员监控系统(DMS)解决方案。

乘用车市场占73%的市场份额,预计2025年至2034年将以8%的复合年增长率成长。该细分市场占据主导地位,主要得益于连网、电动和半自动驾驶汽车日益复杂化,这些汽车需要先进的摄影机和红外线驾驶管理系统(DMS)技术。汽车製造商正在这些系统上投入巨资,以确保驾驶员安全、符合监管标准并提升车厢智慧化和舒适性。

预计到2024年,美国驾驶员监控系统(DMS)硬体市场规模将达到4.802亿美元,占据全球91%的市场。美国之所以领先,得益于其强大的汽车製造业基础、较高的汽车保有量以及电动车和半自动驾驶汽车的日益普及。汽车製造商和车队营运商正越来越多地安装基于摄影机的DMS模组,并结合电子控制单元(ECU)和红外线感测器,以监控驾驶员的疲劳和注意力分散情况,从而符合联邦安全法规的要求。

全球驾驶监控系统 (DMS) 硬体市场的主要参与者包括 Aptiv、Continental、Denso、Panasonic、Robert Bosch、Seeing Machines、Smart Eye、Valeo、ZF Friedrichshafen 和 Magna International。为了巩固自身地位,DMS 硬体产业的领导者正致力于开发能够与高级驾驶辅助系统 (ADAS) 和自动驾驶系统无缝整合的下一代摄影机和感测器技术。各公司正与汽车製造商建立策略伙伴关係,以扩大OEM的应用范围,并加速在车队中的部署。对研发的大量投入正在推动基于人工智慧的驾驶员行为分析领域的创新,而併购则有助于整合技术能力和地理覆盖范围。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 严格的安全法规

- ADAS和半自动驾驶汽车的普及率不断上升

- 人们越来越意识到驾驶者疲劳和注意力分散的问题

- 相机和红外线感测器的技术进步

- 产业陷阱与挑战

- 先进DMS组件成本高昂

- 与多个ADAS模组的整合复杂性

- 市场机会

- 拓展至商用车和卡车领域

- 与人员监控系统 (OMS) 集成

- 新兴市场采用

- 与人工智慧/软体供应商建立合作关係

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 技术采纳曲线与成熟度评估

- 价格趋势

- 按地区

- 副产品

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 宏观经济影响评估

- 利率对资本投资决策的影响

- 通货膨胀对关键零件和製造成本的影响

- 地缘政治紧张局势所带来的供应链风险

- 使用案例和实施案例研究

- 高阶OEM实施案例

- 商业车队部署案例

- 成功的售后市场改造计划

- 技术采纳和整合方面的区域差异

- 验证与测试方法

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 研发投资分析

- 市场集中度分析

- 供应商选择标准

- 竞争性因应策略

第五章:市场估算与预测:依硬体划分,2021-2034年

- 主要趋势

- 相机

- 红外线感测器

- 电子控制单元(ECUS)

- 处理器

- 其他配套硬件

第六章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 轿车

- SUV

- 掀背车

- 商用车辆

- 轻型商用车(LCV)

- 重型商用车(HCV)

- 中型商用车(MCV)

第七章:市场估计与预测:按监测数据,2021-2034年

- 主要趋势

- 面向驾驶员的监控

- 人员监控

- 驾驶员+乘客联合监测

第八章:市场估算与预测:依车辆自动驾驶等级划分,2021-2034年

- 主要趋势

- 一级

- 二级

- 3级

- 4级

- 5级

第九章:市场估算与预测:依销售管道划分,2021-2034年

- 主要趋势

- OEM

- 售后市场

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 俄罗斯

- 波兰

- 罗马尼亚

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- Global companies

- Aptiv

- Continental

- Denso

- Magna International

- Robert Bosch

- Valeo

- Visteon

- ZF Friedrichshafen

- Semiconductors and component providers

- Infineon Technologies

- Intel (Mobileye)

- NVIDIA

- NXP Semiconductors

- Qualcomm Technologies

- Renesas Electronics

- STMicroelectronics

- Texas Instruments

- DMS Technology providers

- Hyundai Mobis

- Panasonic

- Seeing Machines

- SiTime

- Smart Eye

- Tobii

- Ultravision

- Veoneer (Qualcomm)

- VVDN Technologies

The Global Driver Monitoring System Hardware Market was valued at USD 1.55 Billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 3.11 Billion by 2034.

Governments worldwide are enforcing stricter vehicle safety regulations, mandating the installation of DMS in new vehicles. Standards such as Euro NCAP, U.S. NHTSA guidelines, and China's GB regulations require in-cabin monitoring to detect driver fatigue, distraction, and inattentiveness. Vehicle manufacturers are responding by equipping fleets with advanced DMS hardware to meet compliance, minimize liability risks, and enhance overall safety. Rising regulatory pressure, coupled with growing consumer demand for safer vehicles, has become a primary factor driving the adoption of DMS hardware. Additionally, the global shift toward advanced driver assistance systems (ADAS) and semi-autonomous vehicles necessitates continuous monitoring of driver attention to ensure safe operation. DMS components, including cameras, infrared sensors, and electronic control units (ECUs), are essential for the functionality of these systems, making their adoption critical as OEMs expand ADAS capabilities across passenger and commercial vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.55 Billion |

| Forecast Value | $3.11 Billion |

| CAGR | 7.4% |

The cameras segment held a 39% share in 2024 and is expected to grow at a CAGR of 8% through 2034. Their compact design, accuracy, and affordability make them highly effective for monitoring driver gaze and facial expressions. Integration with AI-powered analytics and ADAS systems allows real-time detection of fatigue and distraction. The increasing production of electric and semi-autonomous vehicles, along with evolving regulations, is prompting OEMs worldwide to adopt camera-based DMS solutions.

The passenger cars segment held a 73% share and is projected to grow at a CAGR of 8% from 2025 to 2034. This segment dominates due to the growing complexity of connected, electric, and semi-autonomous vehicles, which require sophisticated camera and infrared-enabled DMS technologies. Automakers are investing significantly in these systems to ensure driver safety, comply with regulatory standards, and enhance cabin intelligence and comfort.

U.S. Driver Monitoring System (DMS) Hardware Market reached USD 480.2 million in 2024, representing 91% share. The U.S. leads due to a strong automotive manufacturing base, high vehicle ownership rates, and increasing adoption of EVs and semi-autonomous vehicles. OEMs and fleet operators are increasingly installing camera-based DMS modules, along with ECUs and infrared sensors, to monitor driver fatigue and distraction and comply with federal safety regulations.

Key players in the Global Driver Monitoring System (DMS) Hardware Market include Aptiv, Continental, Denso, Panasonic, Robert Bosch, Seeing Machines, Smart Eye, Valeo, ZF Friedrichshafen, and Magna International. To strengthen their position, leading companies in the DMS hardware industry are focusing on developing next-generation camera and sensor technologies that integrate seamlessly with ADAS and autonomous driving systems. Firms are forming strategic partnerships with automakers to expand OEM adoption and accelerate deployment across vehicle fleets. Heavy investment in R&D is driving innovation in AI-based driver behavior analytics, while mergers and acquisitions help consolidate technological capabilities and geographic reach.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Hardware

- 2.2.3 Vehicle

- 2.2.4 Monitoring

- 2.2.5 Vehicle autonomy level

- 2.2.6 Sales channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

- 2.6.1 For equipment manufacturers

- 2.6.2 For End use (OEM, suppliers)

- 2.6.3 For testing service providers

- 2.6.4 For investors & financial institutions

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent safety regulations

- 3.2.1.2 Rising ADAS and semi-autonomous vehicle adoption

- 3.2.1.3 Growing awareness of driver fatigue and distraction

- 3.2.1.4 Technological advancements in cameras and IR sensors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced DMS components

- 3.2.2.2 Integration complexity with multiple ADAS modules

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into commercial vehicles and trucks

- 3.2.3.2 Integration with occupant monitoring systems (OMS)

- 3.2.3.3 Emerging markets adoption

- 3.2.3.4 Partnerships with AI/software providers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology adoption curves & maturity assessment

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Macroeconomic impact assessment

- 3.13.1 Impact of interest rates on capital investment decisions

- 3.13.2 Inflation effects on key component and manufacturing costs

- 3.13.3 Supply chain risks from geopolitical tensions

- 3.14 Use cases & implementation case studies

- 3.14.1 Premium OEM implementation examples

- 3.14.2 Commercial fleet deployment cases

- 3.14.3 Successful aftermarket retrofit programs

- 3.14.4 Regional variations in technology adoption and integration

- 3.15 Validation & Testing Methodologies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 R&D investment analysis

- 4.8 Market concentration analysis

- 4.9 Vendor selection criteria

- 4.10 Competitive response strategies

Chapter 5 Market Estimates & Forecast, By Hardware, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Cameras

- 5.3 Infrared sensors

- 5.4 Electronic control units (ECUS)

- 5.5 Processors

- 5.6 Other supporting hardware

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Heavy commercial vehicles (HCV)

- 6.3.3 Medium commercial vehicles (MCV)

Chapter 7 Market Estimates & Forecast, By Monitoring, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Driver-facing monitoring

- 7.3 Occupant monitoring

- 7.4 Combined (driver + occupant) monitoring

Chapter 8 Market Estimates & Forecast, By Vehicle Autonomy Level, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Level 1

- 8.3 Level 2

- 8.4 Level 3

- 8.5 Level 4

- 8.6 Level 5

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Poland

- 10.3.9 Romania

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Vietnam

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 Aptiv

- 11.1.2 Continental

- 11.1.3 Denso

- 11.1.4 Magna International

- 11.1.5 Robert Bosch

- 11.1.6 Valeo

- 11.1.7 Visteon

- 11.1.8 ZF Friedrichshafen

- 11.2 Semiconductors and component providers

- 11.2.1 Infineon Technologies

- 11.2.2 Intel (Mobileye)

- 11.2.3 NVIDIA

- 11.2.4 NXP Semiconductors

- 11.2.5 Qualcomm Technologies

- 11.2.6 Renesas Electronics

- 11.2.7 STMicroelectronics

- 11.2.8 Texas Instruments

- 11.3 DMS Technology providers

- 11.3.1 Hyundai Mobis

- 11.3.2 Panasonic

- 11.3.3 Seeing Machines

- 11.3.4 SiTime

- 11.3.5 Smart Eye

- 11.3.6 Tobii

- 11.3.7 Ultravision

- 11.3.8 Veoneer (Qualcomm)

- 11.3.9 VVDN Technologies