|

市场调查报告书

商品编码

1844382

电流感测器市场机会、成长动力、产业趋势分析及2025-2034年预测Current Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

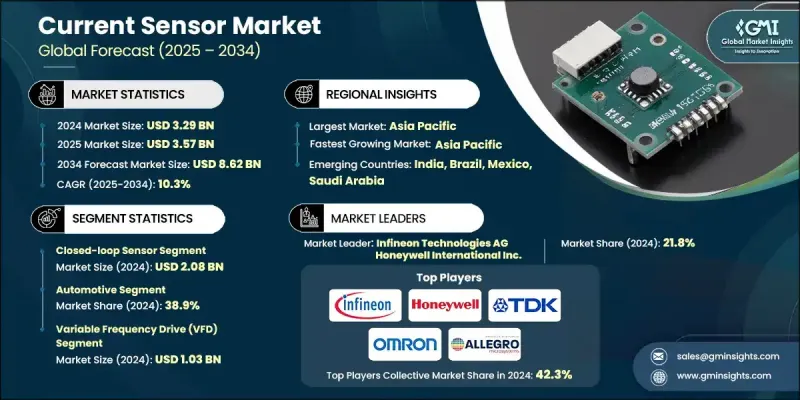

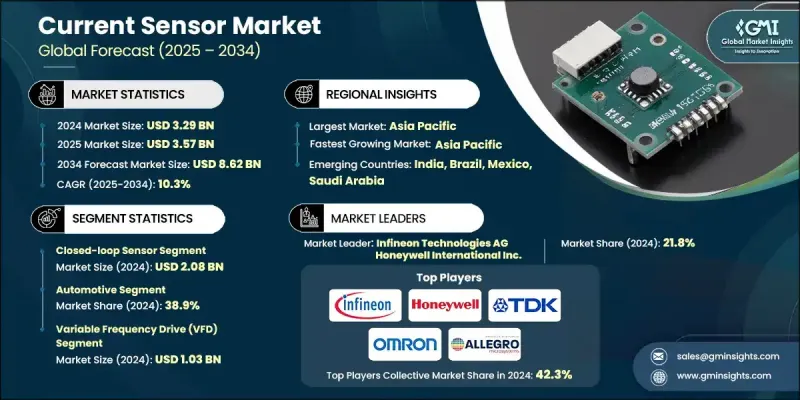

2024 年全球电流感测器市场价值为 32.9 亿美元,预计到 2034 年将以 10.3% 的复合年增长率增长至 86.2 亿美元。

工业自动化、电动车、再生能源和消费性电子等领域对高精度、节能电流感测的需求不断增长,推动了该领域的成长。随着电子产品变得越来越紧凑和功率密度越来越高,对可靠、紧凑和隔离式电流感测器的需求也日益增长。闭环和开环霍尔效应感测器等技术实现了高容量集成,而数位和磁通门感测器在需要更高精度和电压处理能力的应用中也越来越受欢迎。随着电流感测器成为超越基本马达控製或电源监控的系统的核心,它们在电动车牵引逆变器、电池监控系统、太阳能发电级和智慧机器人的应用日益广泛。这些感测器对于预测性诊断、安全保障和性能最佳化至关重要。新兴用例以及即时资料采集在智慧电子产品中日益增长的重要性预计将在未来十年显着影响产品创新和市场发展势头。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 32.9亿美元 |

| 预测值 | 86.2亿美元 |

| 复合年增长率 | 10.3% |

2024年,闭环感测器市场规模达20.8亿美元,反映自动化、机器人和下一代智慧系统的强劲需求。闭环感测器因其能够在操作环境中提供精确的即时回馈和更严格的控製而备受青睐。工业和消费领域对自动化的依赖日益加深,这提升了闭环设计的作用。增强的耐用性、微型化以及与人工智慧驱动系统的整合已成为关键卖点。随着市场动态的演变,感测器製造商不断改进即时分析、预测能力和无缝连接,使闭环配置比以往任何时候都更加智慧、更快回应。

2024年,汽车领域占了38.9%的市场。其主导地位得益于电流感测器在电动和混合动力汽车架构以及先进安全平台中的广泛整合。这些组件是电池管理、车载充电、辅助电子设备和牵引逆变器等系统不可或缺的一部分。高隔离度和高精度标准使其成为电动车安全和性能的关键。全球汽车电气化和基础设施的成长将继续巩固该领域的领先地位,而不断发展的电池化学和平台创新也对客製化感测解决方案提出了越来越高的要求。

2024年,美国电流感测器市场规模达8.4038亿美元。市场扩张主要得益于电动车的普及、先进电池技术的进步以及智慧电网和再生能源计划的部署。自动化、云端资料中心和高性能电子设备对高精度电流感测的需求日益增长,进一步加速了市场需求。为了保持竞争力,製造商正在设计适用于下一代电动车动力系统、太阳能係统和工业机械的先进电流感测解决方案。

推动全球电流感测器市场的关键公司包括 Littelfuse, Inc.、Infineon Technologies AG、Vishay Intertechnology, Inc.、Melexis、TE Connectivity、Honeywell International Inc.、VACUUMSCHMELZE GmbH & Co. KG、Allegro MicroSystems, Inc.、LEUMSCHMELZE GmbH & Co. KG、Allegro MicroSystems, Inc.、LEMc. Kasei Microdevices Corporation、NVE Corporation、STMicroelectronics NV、Silicon Laboratories、TDK Corporation、KOHSHIN ELECTRIC CORPORATION、Texas Instruments Incorporated 和 Aceinna。电流感测器市场的公司正在透过扩大生产能力和开发针对汽车、工业和再生能源系统的特定应用解决方案来增强其全球影响力。主要重点是小型化、提高精度以及数位介面和自我诊断等智慧功能的整合。与电动车製造商、太阳能整合商和自动化公司的策略合作伙伴关係有助于加速新兴领域的采用。许多参与者也投资研发,以创造与高压系统和恶劣环境相容的下一代感测器。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 衝击力

- 成长动力

- 资料中心和云端基础设施的需求不断增长

- 采用先进的电流感测技术

- 电流感测器在消费性和高性能电子产品中的集成

- 电流感测器在工业和自动化系统中的使用

- 在汽车和电动车应用中部署电流感测器

- 产业陷阱与挑战

- 实施和升级成本高

- 来自替代感测技术的竞争

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 市场集中度分析

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 数位转型计划

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 闭环

- 开环

第六章:市场估计与预测:依技术,2021-2034

- 主要趋势

- 霍尔效应

- 分流器

- 磁通门

- 磁阻

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 电池管理系统(BMS)

- 电源分配单元 (PDU)

- 开关电源(SMPS)

- UPS

- 校准台

- 牵引马达逆变器

- 车用充电器(OBC)

- 变频驱动器(VFD)

第 8 章:市场估计与预测:按最终用途,2021-2034 年

- 主要趋势

- 汽车

- 工业的

- 资料中心

- 卫生保健

- 再生能源

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者:

- Allegro MicroSystems, Inc.

- Asahi Kasei Microdevices Corporation

- Honeywell International Inc.

- Infineon Technologies AG

- LEM International SA

- Melexis

- STMicroelectronics NV

- TDK Corporation

- TE Connectivity

- Texas Instruments Incorporated

- Vishay Intertechnology, Inc.

- 区域参与者:

- KOHSHIN ELECTRIC CORPORATION

- Omron Corporation

- ROHM Co., Ltd.

- Sensitec GmbH

- TAMURA Corporation

- VACUUMSCHMELZE GmbH & Co. KG

- 新兴参与者:

- Aceinna

- Littelfuse, Inc.

- NVE Corporation

- Silicon Laboratories

The Global Current Sensor Market was valued at USD 3.29 billion in 2024 and is estimated to grow at a CAGR of 10.3% to reach USD 8.62 billion by 2034.

Growth is fueled by rising demand for high-precision, energy-efficient current sensing across segments like industrial automation, electric mobility, renewable energy, and consumer electronics. As electronics become more compact and power-dense, the push for reliable, compact, and isolated current sensors has intensified. Technologies such as closed-loop and open-loop Hall effect sensors lead to high-volume integration, while digital and fluxgate sensors gain popularity in applications requiring greater accuracy and voltage handling. As current sensors become central to systems beyond basic motor control or power supply oversight, their presence is growing in electric vehicle traction inverters, battery monitoring systems, solar power stages, and intelligent robotics. These sensors are vital for predictive diagnostics, safety assurance, and performance optimization. Emerging use cases and the growing importance of real-time data acquisition in smart electronics are expected to significantly influence product innovation and market momentum over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.29 billion |

| Forecast Value | $8.62 billion |

| CAGR | 10.3% |

The closed-loop sensor segment was valued at USD 2.08 billion in 2024, reflecting strong demand in automation, robotics, and next-gen smart systems. Closed-loop sensors are favored for their ability to deliver precise real-time feedback and tighter control in operational environments. Increasing reliance on automation, both in industrial and consumer spaces, is elevating the role of closed-loop designs. Enhanced durability, miniaturization, and integration with AI-driven systems have become key selling points. As market dynamics evolve, sensor manufacturers continue advancing real-time analytics, predictive capabilities, and seamless connectivity, making closed-loop configurations more intelligent and responsive than ever.

The automotive segment held a 38.9% share in 2024. Its dominance is supported by the broad integration of current sensors across electric and hybrid vehicle architectures and advanced safety platforms. These components are integral to systems such as battery management, onboard charging, auxiliary electronics, and traction inverters. High isolation and accuracy standards make them essential for safety and performance in EVs. Global vehicle electrification and infrastructure growth will continue reinforcing this segment's leadership, while evolving battery chemistries and platform innovations require increasingly tailored sensing solutions.

United States Current Sensor Market was valued at USD 840.38 million in 2024. Expansion is largely tied to increased adoption of EVs, advanced battery technologies, and the deployment of smart grid and renewable energy initiatives. The growing need for high-accuracy current sensing in automation, cloud data centers, and performance electronics is further accelerating demand. To remain competitive, manufacturers are designing advanced current sensing solutions suited for next-generation EV powertrains, solar systems, and industrial machinery.

Key companies driving the Global Current Sensor Market include Littelfuse, Inc., Infineon Technologies AG, Vishay Intertechnology, Inc., Melexis, TE Connectivity, Honeywell International Inc., VACUUMSCHMELZE GmbH & Co. KG, Allegro MicroSystems, Inc., LEM International SA, Sensitec GmbH, ROHM Co., Ltd., TAMURA Corporation, Omron Corporation, Asahi Kasei Microdevices Corporation, NVE Corporation, STMicroelectronics N.V., Silicon Laboratories, TDK Corporation, KOHSHIN ELECTRIC CORPORATION, Texas Instruments Incorporated, Aceinna. Companies in the current sensor market are enhancing their global presence by expanding production capabilities and developing application-specific solutions tailored to automotive, industrial, and renewable energy systems. A major focus is placed on miniaturization, increased accuracy, and integration of smart features like digital interfaces and self-diagnostics. Strategic partnerships with electric vehicle manufacturers, solar integrators, and automation firms help accelerate adoption across emerging sectors. Many players are also investing in R&D to create next-generation sensors compatible with high-voltage systems and harsh environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Type trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand from data centers and cloud infrastructure

- 3.2.1.2 Adoption of advanced current sensing technologies

- 3.2.1.3 Integration of current sensors in consumer and high-performance electronics

- 3.2.1.4 Use of current sensors in industrial and automation systems

- 3.2.1.5 Deployment of current sensors in automotive and EV applications

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High implementation and upgrade costs

- 3.2.2.2 Competition from alternative sensing technologies

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Consumer sentiment analysis

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million and Million Units)

- 5.1 Key trends

- 5.2 Closed loop

- 5.3 Open loop

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million and Million Units)

- 6.1 Key trends

- 6.2 Hall-effect

- 6.3 Shunt

- 6.4 Fluxgate

- 6.5 Magneto-resistive

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million and Million Units)

- 7.1 Key trends

- 7.2 Battery Management Systems (BMS)

- 7.3 Power Distribution Units (PDUs)

- 7.4 Switched-mode Power Supply (SMPS)

- 7.5 UPS

- 7.6 Calibration benches

- 7.7 Traction motor inverter

- 7.8 On-board charger (OBC)

- 7.9 Variable Frequency Drives (VFDs)

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million and Million Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Industrial

- 8.4 Data center

- 8.5 Healthcare

- 8.6 Renewable energy

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million and Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players:

- 10.1.1 Allegro MicroSystems, Inc.

- 10.1.2 Asahi Kasei Microdevices Corporation

- 10.1.3 Honeywell International Inc.

- 10.1.4 Infineon Technologies AG

- 10.1.5 LEM International SA

- 10.1.6 Melexis

- 10.1.7 STMicroelectronics N.V.

- 10.1.8 TDK Corporation

- 10.1.9 TE Connectivity

- 10.1.10 Texas Instruments Incorporated

- 10.1.11 Vishay Intertechnology, Inc.

- 10.2 Regional Players:

- 10.2.1 KOHSHIN ELECTRIC CORPORATION

- 10.2.2 Omron Corporation

- 10.2.3 ROHM Co., Ltd.

- 10.2.4 Sensitec GmbH

- 10.2.5 TAMURA Corporation

- 10.2.6 VACUUMSCHMELZE GmbH & Co. KG

- 10.3 Emerging Players:

- 10.3.1 Aceinna

- 10.3.2 Littelfuse, Inc.

- 10.3.3 NVE Corporation

- 10.3.4 Silicon Laboratories