|

市场调查报告书

商品编码

1689937

电流感测器-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Current Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

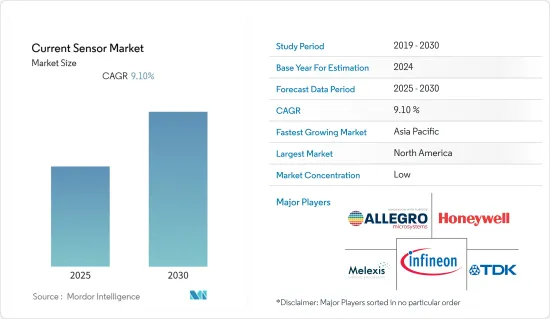

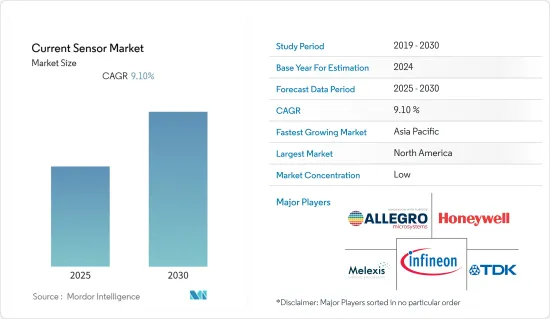

预计目前感测器市场在预测期内的复合年增长率将达到 9.1%。

主要亮点

- 近年来,工业、汽车、商业和通讯系统对低成本、高精度、微型电流感测器解决方案的需求不断增加。透过有系统地使用新的设计理念和先进技术,IC性能可望进一步提高。它还透过将电源保护等附加功能整合到同一电流感测器 IC 中,为新产品方法铺平了道路。

- 例如,2022年5月,大陆集团宣布推出高压电流感测器模组(CSM)和电池撞击侦测(BID)系统,以提高电动车电池的安全性。为了满足严格的功能安全要求,CSM 可用作双通道感测器,透过在单一紧凑单元中整合分流和霍尔技术来独立测量电流。

- 预计智慧型手机的日益普及将在预测期内推动对电流感测器的需求。例如,爱立信预计,到 2026 年,智慧型手机用户数量将超过 12 亿。 5G 预计将成为一个关键驱动力,到 2026 年将占行动用户的 26%。

- 此外,工业 4.0 革命使机器变得更加智慧和直观,这推动了工业应用中对感测器的需求。新设备的设计更有效率、安全、灵活,能够自主监控其效能、使用情况和故障。因此,这些应用正在推动对电流感测器的需求。根据 IFR 预测,国际采用率将大幅成长,到 2024 年,全球工厂预计将运作518,000 台工业机器人。工业机器人的需求呈现良好的成长轨迹,预计这将在同一时期推动感测器市场的发展。

- 此外,人们对世界能源需求的日益关注以及整体环保意识的提高不断推动电力电子应用设计人员提高效率。智慧电网、併网光伏(PV)和其他併网可再生能源系统的出现正在推动高效电源逆变器的发展。根据国际能源总署的《2050年净零排放情境》,到2030年将有3亿辆电动车上路,占新车销量的60%以上。由于电流感测器在电动车和混合动力汽车中的广泛使用,预计汽车终端用户将继续成为电流感测器市场的成长要素之一。

- 物联网和工业物联网的大规模商业化正在加强市场。根据爱立信预测,2023年蜂巢式物联网链路数量将达35亿个。在传统製造业数位转型的背景下,物联网正在催生新一轮智慧互联的工业革命。这正在改变公司处理日益复杂的系统和机械的方式,以提高效率并减少停机时间,为当前感测器市场的成长创造有利可图的局面。

- 然而,与电流感测器的产品开发和整合相关的高成本和技术限制,以及在高电压尖峰、高温和电流条件下对电流感测器的规定,是阻碍研究市场成长的一些主要挑战。

- 但俄罗斯和乌克兰之间的战争正在影响半导体供应链,俄罗斯是生产半导体的天然气和原料的主要供应商。此外,半导体短缺对当前感测器市场产生了多种影响。半导体供不应求可能导致感测器组件生产延迟,对于当前的感测器製造商而言,由于他们必须为有限的半导体供应支付更高的价格,因此成本会增加。

- 此外,2023 年 4 月,玛鲁蒂铃木印度公司表示,电子元件供应的不确定性可能会影响 24 财年的生产。电子元件供不应求对公司23财年的生产造成了一定影响。此类案例可能会继续阻碍市场成长。

当前感测器市场趋势

汽车业占有较大市场占有率

- 随着汽车技术的进步,各国正大力鼓励电动车的生产。电动车的复杂架构通常包括多个电流感测器。除此之外,控制无刷(BLDC)马达也需要电流感测器。 BMW、福斯等公司的EV(电动车)均采用此马达控制电流装置。

- 电流感测器通常用于电池电流监测、太阳能光伏逆变器以及驱动中混合动力和全混合动力电动车牵引牵引马达的电源逆变器。基于 CMOS 霍尔效应的磁性感测器整合了先进的功能并提供高水准输出讯号能力。先进的磁传感器具有可编程内存,并透过微控制器逻辑实现完全自订的输出。此外,还可以实现标准接口,简化与电动车中其他电路的通讯。

- 此外,混合动力电动车(HEV)正迅速成为最受欢迎的绿色汽车,它采用复杂的电子电路来控制车内的电能流动。在单马达混合动力汽车中,马达与内燃机并联,作为牵引马达或发电机在再生煞车期间为电池充电。典型的 HEV 包含多个系统,包括AC马达和 DC-DC 转换器应用,这些系统需要电流检测器以最高效率运作。根据欧洲替代燃料观察站(EAFO)的数据,2022 年德国乘用车领域新註册插电式电动车 823,900 辆,其中电池电动车(BEV)销量约占 56.36%。

- Allegro MicroSystems 等开发商已经开发出一系列适用于混合动力电动车 (HEV) 应用的电流感测器积体电路 (IC)。其特点包括讯号处理和封装设计的创新,可实现 120kHz 输出频宽、高电流解析度、低杂讯频谱密度、降低功率损耗的通孔顺应性以及低电阻导体整合封装。 TLE4971 适用于车用充电器、高压辅助驱动器和充电应用。此外,此感测器也适用于电动车直流充电器、工业驱动器、伺服驱动器和光伏逆变器等工业应用。

- 有利的政府法规也在电动车产业的发展中发挥至关重要的作用,电动车产业正在成为电流感测器的主要消费者。例如,欧盟于 2022 年初宣布了 7,500 亿欧元(7,705 亿美元)的奖励策略,其中包括 200 亿欧元(205 亿美元)用于促进清洁汽车销售,并在 2025 年前安装约 100 万个电动和氢动力汽车充电站。

- 为了刺激中国汽车工业的发展,政府也采取了多项倡议。例如,2022年9月,国家税务总局、财政部、工业和资讯化部联合宣布继续对新能源汽车实施购置税免税政策。因此,由于电动车的销量预计也将保持类似的成长模式,预计在预测期内,整个国内汽车产业对电流感测器的需求也将进一步扩大。

- 此外,2022年10月,BMW集团决定在美国投资17亿美元兴建工厂,生产电动车和电池。该计划包括投资 7 亿美元在邻近的伍德拉夫建立一个高压电池组装厂,以及投资 10 亿美元为现有的南卡罗来纳州斯帕坦堡工厂配备电动车生产设备。这家德国汽车製造商计划在 2030 年之前在美国生产至少 6 辆电动车。

亚太地区可望大幅成长

- 预计亚太地区将经历强劲成长。印度、中国和日本等新兴经济体的人口成长和快速都市化引发了该地区的快速扩张,增加了能源、汽车、电信和网路、工业和医疗保健等领域的终端用户对电流感测器的需求。根据国际能源总署预计,到2040年,印度城镇人口将增加2.7亿人。随着都市化导致家用电器拥有量的增加,预计电力将占能源需求的更大份额。

- 据印度家用电器製造商协会称,到 2024-25 年,印度家用电器和家用电子电器行业规模预计将翻一番,达到 1.48 兆印度卢比(179 亿美元)。越来越多的公司开始基于BiCMOS和CMOS技术来製造完全整合且可编程的电流感测器,随着家用电器产量的增加,预计这些电流感测器的需求将有效增加。

- 日本政府也大力投资兴建可再生产业的基础设施。为了在2050年实现净零计划,政府已启动多项价值数十亿美元的倡议。因此,在预测期内,可再生能源基础设施投资的不断增长可能会推动该国对电流感测器的需求。

- 此外,占全球汽车消费大部分的中国已承诺在2030年减少二氧化碳排放。为了实现排放目标,中国正在减少石化燃料汽车的生产并精简销售。预计这将增加对电动车的需求并推动市场成长。根据国际清洁交通理事会 (ICCT) 的数据,截至 2022 年上半年,电动车占中国乘用车註册量的近四分之一,其中纯电动车占 19%,插电式混合动力车占 5%。

- 澳洲政府已采取多项倡议扩大该国的可再生能源生产。政府的目标是到2050年实现零碳排放,预计将为研究市场供应商创造巨大的商机。例如,2022年10月,澳洲政府拨款250亿澳元(167亿美元)用于清洁能源支出和可再生能源计划。此外,政府还启动了一项耗资 200 亿澳元(134 亿美元)的重新布线计划,以实现该国电网的现代化。

- 此外,近年来台湾已成为半导体晶片的主要製造国,甚至在某些领域超越了中国大陆。在半导体产业成长的带动下,台湾消费电子产业也开始受到关注,华硕、HTC等公司在全球消费性电子领域站稳了脚步。

电流感测器产业概况

目前的感测器市场比较分散,有多家公司在该领域开展业务。面对竞争对手的激烈竞争,主要企业现在都专注于为客户提供具有成本竞争力的产品。主要公司包括 Allegro MicroSystems, LLC、TDK Corporation 和 Infineon Technologies AG。

2023年8月,德克萨斯宣布推出新的电流感测解决方案,包括提供高精度、高整合度同时简化设计的霍尔效应电流感测器,以及整合分流电阻的新型电流分流监视器。

2023 年 7 月,Littelfuse 宣布推出全新电流感测电阻 (CSR) 系列。该系列提供了一种经济高效的解决方案,用于测量电路中的电流,实现电池充电和马达速度等功能的电压监控、控制和电源管理,并提供过电流保护。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 增加电池供电和可再生能源应用的使用

- 物联网和工业物联网的大规模商业化

- 市场限制

- 感测器组件平均售价下降对新进者的影响

第六章市场区隔

- 按类型

- 霍尔效应感测器

- 开放回路

- 闭合迴路

- 其他类型(分芯霍尔效应电流感测器)

- 光纤电流感测器

- 电感式电流感测器

- 霍尔效应感测器

- 按最终用户

- 车

- 家用电子电器

- 电信和网路

- 医疗保健

- 能源与电力

- 产业

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- Allegro MicroSystems LLC

- TDK Corporation(TDK-Micronas GmbH)

- Infineon Technologies AG

- Melexis NV

- Honeywell International Inc.

- Asahi Kasei Microdevices Corporation

- ABB Group

- NK Technologies

- Tamura Corporation

- Vacuumschmelze GmbH & Co KG

第八章投资分析

第九章:市场的未来

The Current Sensor Market is expected to register a CAGR of 9.1% during the forecast period.

Key Highlights

- In recent years, the demand for low-cost, accurate, and small-size current sensor solutions has increased across the industrial, automotive, commercial, and communications systems. New design concepts and the systematic utilization of advanced technology have entitled further improvements in IC performance. It has also opened the path to new product approaches by supporting integrating additional functions, such as power protection, in the same current sensor IC.

- For instance, in May 2022, Continental AG launched its high-voltage Current Sensor Module (CSM) and the Battery Impact Detection (BID) system to make EV batteries safe. To support strict functional safety requirements, the CSM is available as a two-channel sensor, measuring current independently by integrating shunt technology and hall technology in a compact, single unit.

- The increasing smartphone penetration is expected to drive the demand for current sensors over the forecast period. For instance, according to Ericsson, smartphone subscriptions are expected to surpass 1.2 billion by 2026. 5G is expected to become a key driving factor, with 26 percent of mobile subscriptions by 2026.

- Further, the Industry 4.0 revolution, in which machines are becoming more intelligent and intuitive, is increasing the need for the industrial applications of sensors. The new devices are designed to be more efficient, safe, and flexible, with the ability to monitor their performance, usage, and failure autonomously. Therefore, these applications spur the demand for current sensors. According to the IFR forecasts, international adoption is anticipated to increase significantly to 518,000 industrial robots operating across plants all around the globe by 2024. The favorable growth trajectory of the industrial robots demand is expected to drive the market for sensors during the same period.

- Furthermore, with the growing concerns about the global demand for energy and the overall augmentation of environmental awareness, designers for power electronics applications are under constant pressure to improve efficiency. The advent of the smart grid, grid-tied photovoltaic (PV), and some other grid-tied renewable energy systems require the growth of high-efficiency power inverters. According to the International Energy Agency's Net Zero Emissions by 2050 Scenario, 300 million electric automobiles will be on the road by 2030, accounting for more than 60 percent of new automobile sales. Because of the widespread usage of current sensors in EVs and HEVs, the automotive end-user is projected to continue to be one of the significator factors for the growth of the current sensor market.

- Large-scale commercialization of IoT and IIoT is bolstering the market. According to Ericsson, the number of cellular IoT links is predicted to reach 3.5 billion in 2023. With the traditional manufacturing sector witnessing a digital transformation, IoT is fueling intelligent connectivity's next industrial revolution. This is transforming the way enterprises approach increasingly complicated systems and machines to enhance efficiency and reduce downtime, creating a good scenario for the growth of the current sensor market.

- However, high cost and technical limitations associated with product development and integration of current sensors integration, along with the rules of current sensors in case of high voltage spikes, high temperature, and current conditions, are some of the major factors challenging the growth of the studied market.

- However, the Russia-Ukraine war is impacting the supply chain of semiconductors, being a major supplier of natural gas and raw materials in producing semiconductors. Additionally, the semiconductor shortage had several impacts on the current sensors market. The shortage of semiconductors could result in delayed production of sensor components, leading to increased costs for current sensor manufacturers, as they may need to pay more increased prices for the limited supply of semiconductors available.

- Moreover, in April 2023, Maruti Suzuki India said that the uncertainties in the electronic component supplies might affect production in FY 24. The shortage of electronic components had some impact on the company's production in FY 2023. Such instances will continue to hamper the growth of the market.

Current Sensor Market Trends

Automotive Industry to Hold Considerable Market Share

- With increased automotive technology advancements, the trends toward electric vehicle production are highly recommended in various countries. A complex architectural diagram of an electric car generally incorporates multiple current sensors. Besides this, current sensors are also needed for brushless (BLDC) electric motor control. The EVs (electronic vehicles) of companies like BMW, Volkswagen, etc. use this motor-control-current device.

- Typically, current sensors are found in battery current monitoring, solar power inverters, and power inverters that drive traction motors in mid and full hybrid electric vehicles. CMOS Hall-effect-based magnetic sensors integrate advanced features and provide high-level output signal functionality. Sophisticated magnetic sensors hold programmable memory, and even microcontroller logic allows for a fully custom-calibrated output. Additionally, it is possible to implement standard interfaces that simplify communication with other circuits in EVs.

- Furthermore, the hybrid electric vehicle (HEV) is quickly becoming the most popular green car and employs complex electronic circuitry to control the flow of electric energy through the vehicle. In a single-motor HEV, the motor acts as a drive motor in parallel with the internal combustion engine or as a generator to charge the battery during regenerative braking. A typical HEV includes multiple systems that require electrical current detectors for maximally efficient operation, including AC motor and DC-DC converter applications. According to the European Alternative Fuels Observatory (EAFO), Germany recorded 823,900 new registrations of plug-in electric cars in the passenger car segment in 2022, with battery electric vehicle (BEV) sales accounting for about 56.36 percent.

- Players like Allegro MicroSystems have developed a broad family of current sensor integrated circuits (ICs) that are ideally suited for hybrid electric vehicles (HEV) applications. The features include signal processing and package design innovations enabling 120 kHz output bandwidth, high current resolution, low noise spectral density, reduced power loss through-hole compliance, and low-resistance integrated conductor packages. Further, in November 2022, Infineon launched an automotive current sensor IC (TLE4971), available in four pre-programmed current ranges: 25, 50, 75, or 120 A. The TLE4971 is intended for onboard chargers, high-voltage auxiliary drives, and charging applications. Moreover, the sensor is also suitable for industrial applications like DC chargers for electric vehicles, industrial drives, servo drives, and photovoltaic inverters.

- Favorable government regulations are also playing an integral role in the growth of the EV industry, which has emerged as a leading consumer of current sensors. For instance, in early 2022, the European Union announced a unique EUR 750 billion (USD 770.5 billion) stimulus package, which includes EUR 20 billion (USD 20.5 billion) to boost the sales of clean vehicles and to install about 1 million electric and hydrogen cars charging stations by 2025.

- To stimulate the growth of the Chinese automotive industry, several initiatives are also being taken by the government. For instance, in September 2022, the State Taxation Administration (STA), the Ministry of Finance (MOF), and the Ministry of Industry and Information Technology (MIIT) jointly announced the continuation of tax exemptions on purchases of new energy vehicles. Hence, with the sales of EVs expected to sustain a similar growth pattern, the demand for current sensors across the country's automotive industry is also expected to grow further during the forecast period.

- Additionally, in October 2022, The BMW Group confirmed the investment of USD 1.7 billion in its American facilities to produce electric automobiles and batteries. The project will consist of USD 700 million for a planned high-voltage battery-assembly plant in the neighboring Woodruff and USD 1 billion to equip the automaker's current Spartanburg manufacturing in South Carolina for the manufacturing of EVs. By 2030, the German manufacturer plans to manufacture at least six all-electric vehicles in the United States.

Asia-Pacific is Expected to Register Significant Growth

- Asia-Pacific is anticipated to account for significant growth. The population growth and rapid urbanization in developing economies, such as India, China, and Japan, have initiated the speedy expansion in the region, which will increase the need for the current sensor from end-users such as energy, automotive, telecom and networking, industrial, and healthcare. According to IEA, an estimated 270 million people will likely be added to India's urban population by 2040. As urbanization leads to a rise in the ownership of consumer appliances, the share of energy demand taken by electricity is expected to grow further.

- According to the Consumer Electronics and Appliances Manufacturers Association, India's appliances and consumer electronics industry is projected to double by INR 1.48 lakh crore (USD 17.9 Billion) by 2024 - 25. As players are manufacturing fully integrated and programmable current sensors based on BiCMOS or CMOS technology, the demand for these current sensors will increase effectively with the increasing production of consumer electronics.

- The Japanese government is also investing significantly in developing renewable industry infrastructure. To achieve its net zero by 2050 plans, the government has launched several initiatives worth multiple billions. Hence, the growing investment in renewable energy infrastructure will drive the demand for current sensors in the country during the forecast period.

- Furthermore, China, responsible for a large portion of global car consumption, pledged to control its carbon emissions by 2030. It has been streamlining the production cuts and sale of cars that run on fossil fuels to meet the emission goals. This is anticipated to increase the demand for electric vehicles, thereby driving market growth. According to the International Council on Clean Transportation (ICCT), throughout the first six months of 2022, electric vehicles in China constituted almost one-fourth of all unique passenger car registrations, with BEVs accounting for 19 percent and PHEVs an additional 5 percent.

- The Australian government has started taking several initiatives to expand the production of renewable power in the country. The government seeks to achieve net zero carbon emissions by 2050, which is expected to create significant opportunities for the studied market vendors. For instance, in October 2022, the Australian government allocated a budget of AUD 25 billion (USD 16.7 billion) for cleaning energy spending and renewable energy projects. Furthermore, the government also launched an AUD 20 billion (USD 13.4 billion), rewiring the Nation's plan to modernize the country's electricity grids.

- Furthermore, in recent years, Taiwan has emerged as the leading semiconductor chip manufacturer and has even outpaced China in some categories. Driven by the semiconductor industry's growth, the consumer electronics industry of the country has also started to gain traction, with companies like Asus and HTC making their place in the global consumer electronics industry.

Current Sensor Industry Overview

The current sensor market is fragmented, with several companies operating in the segment. Significant players are currently focusing on providing customers with cost-competitive products, catering to an intense rivalry in the Market. Key players are Allegro MicroSystems, LLC, TDK Corporation, Infineon Technologies AG, etc.

In August 2023, Texas Instruments introduced new current sensing solutions designed to offer more accuracy and higher integration while simplifying designs, which includes a Hall-effect current sensor that offers the lowest drift in TI's portfolio and new current shunt monitors with a built-in shunt resistor.

In July 2023, Littelfuse Inc. announced the launch of its new Current Sensing Resistor (CSR) family that offers a more cost-effective solution for measuring current within circuits, enabling voltage monitoring, control, and power management of functions such as battery charging and motor speed, while also providing overcurrent protection.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Use of Battery-Powered and Renewable Energy Applications

- 5.1.2 Large Scale Commercialization of IoT and IIoT

- 5.2 Market Restraints

- 5.2.1 Falling Average Selling Prices of Sensor Components Affecting New Market Entrants

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hall Effect Sensors

- 6.1.1.1 Open Loop

- 6.1.1.2 Closed Loop

- 6.1.1.3 Other Types(Split Core Hall Effect Current Sensor)

- 6.1.2 Fiber Optic Current Sensors

- 6.1.3 Inductive Current Sensors

- 6.1.1 Hall Effect Sensors

- 6.2 By End User

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Telecom and Networking,

- 6.2.4 Medical

- 6.2.5 Energy and Power

- 6.2.6 Industrial

- 6.2.7 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of the Asia Pacific

- 6.3.4 Rest of the World

- 6.3.4.1 Latin America

- 6.3.4.2 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Allegro MicroSystems LLC

- 7.1.2 TDK Corporation (TDK-Micronas GmbH)

- 7.1.3 Infineon Technologies AG

- 7.1.4 Melexis NV

- 7.1.5 Honeywell International Inc.

- 7.1.6 Asahi Kasei Microdevices Corporation

- 7.1.7 ABB Group

- 7.1.8 NK Technologies

- 7.1.9 Tamura Corporation

- 7.1.10 Vacuumschmelze GmbH & Co KG