|

市场调查报告书

商品编码

1844385

直接面向消费者的基因检测市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Direct-to-Consumer Genetic Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

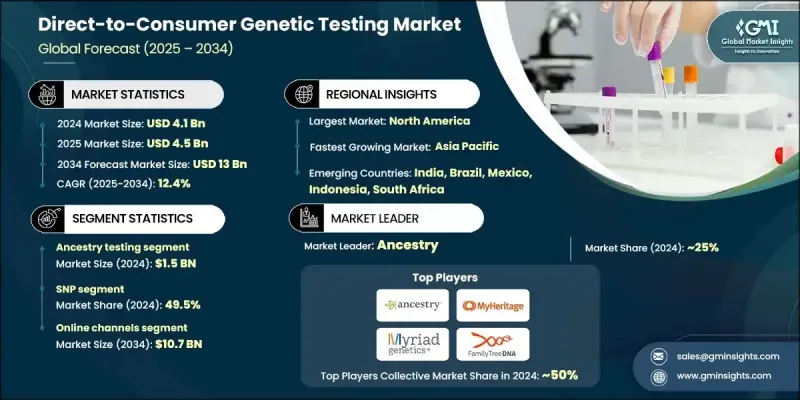

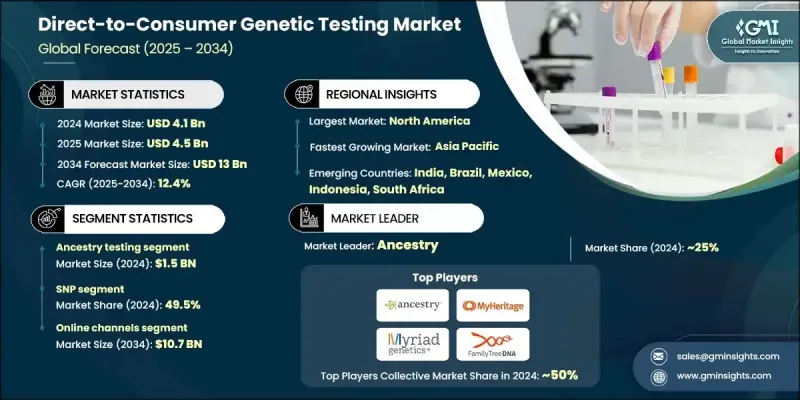

2024 年全球直接面向消费者的基因检测市场价值为 41 亿美元,预计到 2034 年将以 12.4% 的复合年增长率成长,达到 130 亿美元。

消费者对个人化健康和保健解决方案日益增长的需求推动了这个市场的快速扩张。随着越来越多的人,尤其是年轻人,寻求更深入地了解自身的健康状况、血统和生活方式,对家用基因检测的需求也日益增长。这些检测无需医疗中介,只需唾液或颊拭子即可获得便捷的结果。直接面向消费者的基因检测涵盖了广泛的应用领域,包括预测性和携带者检测、药物基因组学、护肤、营养、血统和性状分析。这些基因洞察日益融入数位健康工具和行动应用程序,也是市场的关键驱动力。穿戴式装置和健康追踪平台越来越多地与基因资料同步,以提供个人化的健身、营养和健康建议。基因检测与日常健康技术的结合正在改善用户体验,并扩大消费者的吸引力。向主动健康管理的转变,以及消费者对即时和客製化洞察不断变化的期望,继续支持市场在更广泛人群中的渗透。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 130亿美元 |

| 复合年增长率 | 12.4% |

2024年,血统检测细分市场产值达15亿美元。消费者越来越被血统检测价格实惠、易于理解以及满足个人好奇心的特质所吸引。这些检测提供了一种追溯血统、发现全球族裔背景和探索家庭联繫的方式。推动这一细分市场的公司正在利用大规模DNA资料库、用户友善平台和积极的行销策略来扩大覆盖范围。他们能够以简单易懂的方式提供全面且引人入胜的血统洞察,这大大提升了这个细分市场的受欢迎程度。

2024年,单核苷酸多态性 (SNP) 技术占了49.5%的市场。其可扩展性以及在海量资料集中识别数千种基因变异的高效性使其成为面向消费者应用的理想选择。 SNP晶片广泛用于分析遗传特征、健康倾向和血统。该技术处理速度快、检测成本低且可靠性高,这对于在大批量直接面向消费者的检测中保持经济实惠和快速响应至关重要。这种可扩展性使SNP技术成为当今众多领先基因检测产品的支柱。

2024年,北美直接面向消费者的基因检测市场占据了48.6%的市场。该地区受益于消费者认知度、先进的数位健康基础设施以及早期采用的心态。个人化健康工具的广泛使用、支持性的监管框架以及公众对健康优化的浓厚兴趣,进一步推动了美国和加拿大DTC检测生态系统的发展。此外,关键产业参与者的积极参与以及基因检测与数位健康平台之间日益增强的协同作用,正在加速市场成长并巩固其区域领导地位。

影响全球直接面向消费者基因检测市场的一些主要参与者包括 DNA Genotek、Dante Lab、The SkinDNA Company、Family Tree DNA (Gene By Gene)、Easy DNA、Tempus AI、MedGenome、Helix、MyHeritage、Nutrigenomix、HomeDNA、Veritas Intercontinental、Mapmygenome、BlueGenetics、Fulnostics、Fullatics) Complete、Myriad Genetics, Inc.、Living DNA、Ancestry、Quest Diagnostics、Genesis Healthcare 和 Identigene。 DTC 基因检测市场的公司正致力于透过多语言平台和本地合作伙伴关係扩大其全球影响力。主要参与者正在投资用户友好的行动应用程序,将即时健康资料与基因洞察相结合,以增强客户参与度。定期更新检测小组并推出皮肤护理和健康遗传学等利基检测类别,正在帮助公司触及新的人群。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 基于基因洞察的个人化解决方案需求不断增长

- 基因组定序技术不断进步

- 提高对遗传疾病的认识

- 透过线上管道扩大DTC的可近性

- 产业陷阱与挑战

- 隐私和资料安全

- 严格的监管挑战

- 市场机会

- 扩大网上分销通路

- 策略联盟和伙伴关係

- 新兴市场的渗透率不断提高

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 多边环境协定

- 基因检测产业的投资与融资格局

- 技术格局

- 新兴技术

- 现有技术

- 资料隐私问题

- 价值链分析

- 报销场景

- 定价分析

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按测试类型,2021 - 2034 年

- 主要趋势

- 携带者筛检

- 预测测试

- 血统测试

- 营养基因组学测试

- 药物基因组学检测

- 保养品测试

- 其他测试类型

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 基于微阵列的侦测

- 单核苷酸多态性(SNP)晶片

- 全基因组定序(WGS)

- 其他技术

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 线上通路

- 场外交易(OTC)

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Ancestry

- Blueprint Genetics

- Counsyl

- Dante Lab

- DNA Complete

- DNA Genotek

- Easy DNA

- Family Tree DNA (Gene By Gene)

- Fulgent Genetics

- Genesis Healthcare

- Genova Diagnostics (GDX)

- Helix

- HomeDNA

- Identigene

- Living DNA

- Mapmygenome

- MedGenome

- MyHeritage

- Myriad Genetics, Inc.

- Nutrigenomix

- Pathway genomics

- Quest Diagnostics

- Tempus AI

- The SkinDNA Company

- Veritas Intercontinental

The Global Direct-to-Consumer Genetic Testing Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 12.4% to reach USD 13 billion by 2034.

The rapid expansion is fueled by the rising consumer demand for personalized health and wellness solutions. As more individuals, especially younger demographics, seek deeper insights into their health, ancestry, and lifestyle, the demand for at-home genetic tests is accelerating. These tests eliminate the need for a healthcare intermediary, offering accessible results via simple saliva or cheek swabs. Direct-to-Consumer Genetic Testing covers a wide range of applications, including predictive and carrier testing, pharmacogenomics, skincare, nutrition, ancestry, and trait analysis. The growing integration of these genetic insights into digital health tools and mobile apps is also a key market driver. Wearables and health tracking platforms are increasingly syncing with genetic data to deliver personalized fitness, nutrition, and wellness recommendations. This alignment of genetic testing with everyday health technology is improving user experience and widening consumer appeal. The shift toward proactive health management, along with evolving consumer expectations for real-time and tailored insights, continues to support market penetration across a broader population base.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $13 Billion |

| CAGR | 12.4% |

The ancestry testing segment generated USD 1.5 billion in 2024. Consumers are increasingly drawn to the affordability, ease of understanding, and personal curiosity that ancestry testing satisfies. These tests offer a way to trace heritage, discover global ethnic backgrounds, and explore family connections. Companies driving this segment are leveraging large-scale DNA databases, consumer-friendly platforms, and aggressive marketing strategies to expand reach. Their ability to deliver comprehensive and engaging ancestry insights in an accessible format has significantly strengthened the popularity of this segment.

In 2024, the single-nucleotide polymorphism (SNP) technology held a 49.5% share. Its scalability and efficiency in identifying thousands of genetic variants across large datasets make it ideal for consumer-facing applications. SNP chips are extensively used for analyzing genetic traits, health predispositions, and ancestry. The technology offers fast processing, reduced testing costs, and high reliability, which are critical for maintaining affordability and speed in high-volume direct-to-consumer testing. This scalability has positioned SNP technology as the backbone of many leading genetic testing products available today.

North America Direct-to-Consumer Genetic Testing Market held a 48.6% share in 2024. The region benefits from a strong mix of consumer awareness, advanced digital health infrastructure, and an early adoption mindset. High engagement with personalized health tools, supportive regulatory frameworks, and strong public interest in health optimization are further boosting the DTC testing ecosystem in the U.S. and Canada. In addition, the active presence of key industry players and increasing alignment between genetic testing and digital wellness platforms are accelerating market growth and strengthening regional leadership.

Some of the major players shaping the Global Direct-to-Consumer Genetic Testing Market include DNA Genotek, Dante Lab, The SkinDNA Company, Family Tree DNA (Gene By Gene), Easy DNA, Tempus AI, MedGenome, Helix, MyHeritage, Nutrigenomix, HomeDNA, Veritas Intercontinental, Mapmygenome, Blueprint Genetics, Fulgent Genetics, Pathway Genomics, Genova Diagnostics (GDX), DNA Complete, Myriad Genetics, Inc., Living DNA, Ancestry, Quest Diagnostics, Genesis Healthcare, and Identigene. Companies in the DTC genetic testing market are focusing on expanding their global presence through multilingual platforms and local partnerships. Key players are investing in user-friendly mobile apps that integrate real-time health data with genetic insights to enhance customer engagement. Regular updates to testing panels and the introduction of niche test categories, such as skincare and wellness genetics, are helping companies reach new demographics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Test type trends

- 2.2.3 Technology trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for personalized solutions based on genetic insights

- 3.2.1.2 Growing technology advancement in genomic sequencing

- 3.2.1.3 Increased awareness of genetic disorders

- 3.2.1.4 Expanding accessibility of DTC through online channels

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Privacy and data security

- 3.2.2.2 Stringent regulatory challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of online distribution channels

- 3.2.3.2 Strategic alliances and partnerships

- 3.2.3.3 Increasing penetration in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.4.2.1 Germany

- 3.4.2.2 UK

- 3.4.2.3 France

- 3.4.2.4 Spain

- 3.4.2.5 Italy

- 3.4.3 Asia Pacific

- 3.4.3.1 China

- 3.4.3.2 Japan

- 3.4.3.3 India

- 3.4.3.4 Australia

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Investment and funding landscape in the genetic testing industry

- 3.6 Technological landscape

- 3.6.1 Emerging technologies

- 3.6.2 Current technologies

- 3.7 Data privacy concerns

- 3.8 Value chain analysis

- 3.9 Reimbursement scenario

- 3.10 Pricing analysis

- 3.11 Future market trends

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Carrier screening

- 5.3 Predictive testing

- 5.4 Ancestry testing

- 5.5 Nutrigenomic testing

- 5.6 Pharmacogenomic testing

- 5.7 Skincare testing

- 5.8 Other test types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Microarray-based testing

- 6.3 Single-nucleotide polymorphism (SNP) chips

- 6.4 Whole genome sequencing (WGS)

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Online channels

- 7.3 Over-the-counter (OTC)

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ancestry

- 9.2 Blueprint Genetics

- 9.3 Counsyl

- 9.4 Dante Lab

- 9.5 DNA Complete

- 9.6 DNA Genotek

- 9.7 Easy DNA

- 9.8 Family Tree DNA (Gene By Gene)

- 9.9 Fulgent Genetics

- 9.10 Genesis Healthcare

- 9.11 Genova Diagnostics (GDX)

- 9.12 Helix

- 9.13 HomeDNA

- 9.14 Identigene

- 9.15 Living DNA

- 9.16 Mapmygenome

- 9.17 MedGenome

- 9.18 MyHeritage

- 9.19 Myriad Genetics, Inc.

- 9.20 Nutrigenomix

- 9.21 Pathway genomics

- 9.22 Quest Diagnostics

- 9.23 Tempus AI

- 9.24 The SkinDNA Company

- 9.25 Veritas Intercontinental