|

市场调查报告书

商品编码

1844386

兽医自体免疫疾病治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Veterinary Autoimmune Disease Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

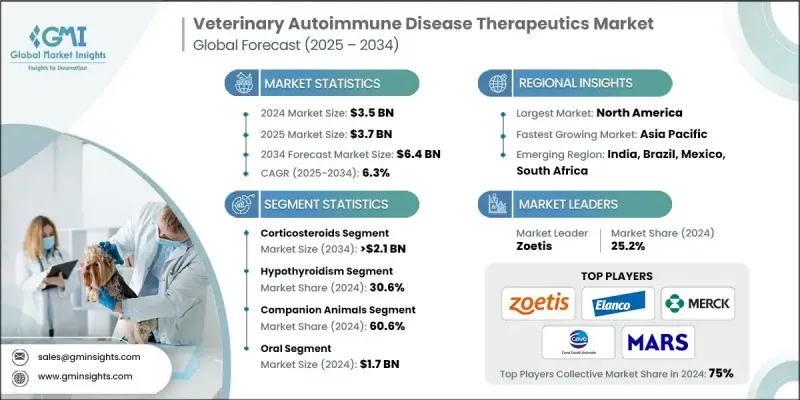

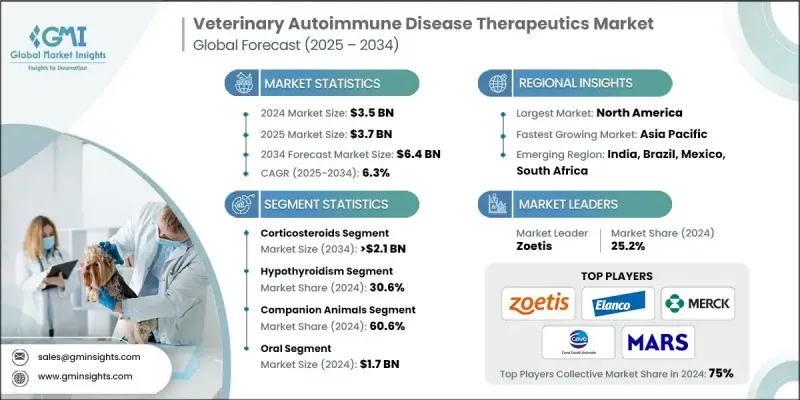

2024 年全球兽医自体免疫疾病治疗市场价值为 35 亿美元,预计到 2034 年将以 6.3% 的复合年增长率增长至 64 亿美元。

动物自体免疫疾病发生率的上升,以及宠物饲养趋势的日益增长,持续推动了对有效兽医治疗的需求。随着人们对动物健康意识的提升、诊断技术的进步以及对宠物长期健康需求的增加,市场正在获得显着增长。治疗方法正在不断发展,以应对动物免疫系统针对自身组织的复杂疾病。这推动了生物製剂、免疫抑制药物和个人化治疗等领域的创新,有助于提高疾病管理的准确性和疗效。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35亿美元 |

| 预测值 | 64亿美元 |

| 复合年增长率 | 6.3% |

目前,针对自体免疫疾病的兽医疗法种类繁多,从皮质类固醇到先进的生物製剂,有助于更有效地控制狼疮、天疱疮和免疫介导性贫血等疾病。市场正在见证药物传输系统的重大技术进步,从而提高依从性和治疗效果。各公司正在优先考虑生态环保的疗法,包括有机和永续的药物配方。兽药製造商与学术研究机构之间的密切合作正在加速获得更新、更有针对性的疗法。长效注射剂和定製药物日益受到关注,这有助于改善多种动物的治疗效果和生活品质。

2024年,皮质类固醇市场规模达12亿美元。这一市场主导地位源自于其快速起效、成本效益高,以及对多种动物自体免疫疾病的疗效已得到证实。这些药物常用于透过调节发炎和免疫反应来控制与免疫相关疾病相关的症状,例如免疫介导性关节炎、甲状腺功能减退症和贫血。皮质类固醇的可及性和已证实的有效性使其成为全球兽医治疗慢性和急性病例的基石。

甲状腺功能减退症在2024年占据30.6%的市场份额,成为领先的疾病适应症。甲状腺功能减退症是犬类最常见的自体免疫疾病之一,由于免疫系统功能障碍导致甲状腺激素分泌减少。甲状腺功能减退症的高发性促使人们开发针对该疾病的药物,以恢復伴侣动物的荷尔蒙平衡并改善其整体健康状况。宠物疲劳、脱髮和肥胖等主要症状正越来越多地透过持续精准的荷尔蒙替代疗法得到控制。

2024年,美国兽医自体免疫疾病治疗市场规模达13.5亿美元。宠物和牲畜免疫疾病的发生率不断上升,推动了对免疫抑制剂等治疗药物以及干细胞干预等新型疗法的需求。美国市场受惠于强大的研发实力,并在兽药公司与国家机构的合作支持下,持续提升产品的安全性和有效性。对先进诊断技术的投资不断增加以及获得尖端兽医护理服务的管道不断拓宽,也促进了该地区的成长。

积极影响全球兽医自体免疫疾病治疗市场的主要公司包括硕腾 (Zoetis)、诗华 (Ceva Sante Animale)、Vet-Stem、Aratana Therapeutics、玛氏兽医 (Mars Veterinary Health)、Dechra Pharmaceuticals、诺布鲁克 (Norbrook)、Vequinol、赫斯卡来 (Heskaan) 和梅卡来为了巩固市场地位,兽医自体免疫疾病治疗市场的公司正在推行各种策略性倡议,包括扩大地域覆盖范围,进入宠物拥有量和牲畜护理需求不断增长的尚未普及的地区。许多公司正在大力投资研发,以开发针对伴侣动物的标靶生物製剂、单株抗体和个人化医疗方案。与研究机构和兽医诊所的合作可以加快新疗法的开发和批准速度。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 人畜共通传染病在人与人之间传播的威胁日益增加

- 牲畜自体免疫疾病发生率上升

- 提高对自体免疫疾病的认识与诊断

- 伴侣动物饲养量不断增加

- 增加动物保健支出

- 产业陷阱与挑战

- 兽医自体免疫疗法成本高昂

- 自体免疫药物增加感染风险

- 市场机会

- 对特定品种和个人化治疗的需求不断增长

- 远距医疗和远距兽医诊断的成长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 未来市场趋势

- 技术格局

- 目前技术

- 新兴技术

- 定价分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按治疗类型,2021 - 2034 年

- 主要趋势

- 皮质类固醇

- 硫唑嘌呤

- 环孢菌素

- 霉酚酸酯

- 来氟米特

- 环磷酰胺

- 左甲状腺素

- 其他治疗类型

第六章:市场估计与预测:按疾病,2021 - 2034 年

- 主要趋势

- 甲状腺功能低下症

- 天疱疮疾病

- 犬狼疮

- 自体免疫性溶血性贫血

- 大疱性类天疱疮

- 盘状红斑狼疮(DLE)

- 免疫相关关节炎

- 其他疾病

第七章:市场估计与预测:按动物类型,2021 - 2034 年

- 主要趋势

- 伴侣动物

- 狗

- 猫

- 马匹

- 其他伴侣动物

- 牲畜

- 牛

- 猪

- 家禽

- 羊

- 其他牲畜

- 其他动物

第 8 章:市场估计与预测:按管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 注射剂

- 外用

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 兽医院

- 兽医诊所

- 其他分销管道

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Aratana Therapeutics

- Ceva Sante Animale

- Dechra Pharmaceuticals

- Elanco

- Heska

- Mars Veterinary Health

- Merck

- Norbrook

- Vetoquinol

- Vet-Stem

- Virbac

- Zoetis

The Global Veterinary Autoimmune Disease Therapeutics Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 6.4 billion by 2034.

The rising occurrence of autoimmune disorders in animals, along with the growing trend of pet ownership, continues to fuel the demand for effective veterinary treatments. With increased awareness around animal health, diagnostic advancements, and demand for long-term wellness in pets, the market is gaining significant traction. Treatments are evolving to address complex conditions where an animal's immune system targets its own tissues. This has driven innovation in areas such as biologics, immunosuppressive drugs, and personalized therapeutics, helping boost both accuracy and outcomes in disease management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 6.3% |

Veterinary therapies designed for autoimmune diseases now range from corticosteroids to advanced biologic solutions, helping to manage conditions like lupus, pemphigus, and immune-mediated anemia more effectively. The market is witnessing major technological progress in drug delivery systems, resulting in improved adherence and treatment efficacy. Companies are prioritizing eco-conscious therapies, including organic and sustainable drug formulations. Strong collaboration between veterinary pharmaceutical manufacturers and academic research bodies is accelerating access to newer, more targeted therapeutics. A growing focus on long-acting injectables and tailored medications is helping improve both treatment outcomes and quality of life for affected animals across multiple species.

The corticosteroids segment reached USD 1.2 billion in 2024. This dominance stems from their quick therapeutic impact, cost-effectiveness, and proven efficacy across a wide range of autoimmune disorders in animals. These drugs are frequently used to manage symptoms linked with immune-related conditions such as immune-mediated arthritis, hypothyroidism, and anemia by modulating inflammation and the immune response. Their accessibility and established effectiveness make corticosteroids a cornerstone treatment option for veterinarians worldwide in managing chronic and acute cases.

The hypothyroidism segment held a 30.6% share in 2024, making it the leading disease indication. This condition is one of the most common autoimmune disorders diagnosed in dogs, leading to reduced production of thyroid hormones due to immune system malfunction. The high occurrence of hypothyroidism has led to the development of disease-specific drugs that restore hormonal balance and improve overall health in companion animals. Key symptoms such as fatigue, hair loss, and obesity in pets are increasingly being managed through consistent and precise hormone replacement therapies.

U.S Veterinary Autoimmune Disease Therapeutics Market reached USD 1.35 billion in 2024. The rising prevalence of immune disorders in both pets and livestock is driving demand for treatments such as immunosuppressants and newer modalities like stem cell-based interventions. The U.S. market benefits from a robust pipeline of research efforts, supported by collaborations between veterinary pharmaceutical companies and national institutions, which continue to enhance product safety and efficacy. Increasing investments in advanced diagnostics and access to cutting-edge veterinary care are also contributing to regional growth.

Major companies actively shaping the Global Veterinary Autoimmune Disease Therapeutics Market include Zoetis, Ceva Sante Animale, Vet-Stem, Aratana Therapeutics, Mars Veterinary Health, Dechra Pharmaceuticals, Norbrook, Vetoquinol, Heska, Elanco, Merck, and Virbac. To strengthen their foothold, companies in the Veterinary Autoimmune Disease Therapeutics Market are pursuing a variety of strategic initiatives. These include expanding their geographical reach to enter underpenetrated regions with rising pet ownership and livestock care needs. Many firms are investing heavily in R&D to develop targeted biologics, monoclonal antibodies, and personalized medicine options for companion animals. Collaborations with research organizations and veterinary clinics enable faster development and approval of novel therapies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Therapy type

- 2.2.3 Disease

- 2.2.4 Animal type

- 2.2.5 Route of administration

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing threat of transfer of zoonotic diseases among humans

- 3.2.1.2 Rising incidence of auto-immune diseases in livestock animals

- 3.2.1.3 Increasing awareness and diagnosis of autoimmune diseases

- 3.2.1.4 Growing companion animal ownership

- 3.2.1.5 Increasing expenditure on animal healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of veterinary autoimmune therapies

- 3.2.2.2 Increased risk of infection due to autoimmune drugs

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for breed-specific and personalized treatments

- 3.2.3.2 Growth in telemedicine and remote veterinary diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.6.1 Current technology

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Therapy Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Corticosteroids

- 5.3 Azathioprine

- 5.4 Cyclosporine

- 5.5 Mycophenolate

- 5.6 Leflunomide

- 5.7 Cyclophosphamide

- 5.8 Levothyroxine

- 5.9 Other therapy types

Chapter 6 Market Estimates and Forecast, By Disease, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hypothyroidism

- 6.3 Pemphigus disease

- 6.4 Canine lupus

- 6.5 Auto-immune haemolytic anaemia

- 6.6 Bullous pemphigoid

- 6.7 Discoid lupus erythematosus (DLE)

- 6.8 Immune-related arthritis

- 6.9 Other diseases

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Companion animals

- 7.2.1 Dogs

- 7.2.2 Cats

- 7.2.3 Horses

- 7.2.4 Other companion animals

- 7.3 Livestock animals

- 7.3.1 Cattle

- 7.3.2 Swine

- 7.3.3 Poultry

- 7.3.4 Sheep

- 7.3.5 Other livestock animals

- 7.4 Other animals

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Injectable

- 8.4 Topical

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals

- 9.3 Veterinary clinics

- 9.4 Other distribution channels

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aratana Therapeutics

- 11.2 Ceva Sante Animale

- 11.3 Dechra Pharmaceuticals

- 11.4 Elanco

- 11.5 Heska

- 11.6 Mars Veterinary Health

- 11.7 Merck

- 11.8 Norbrook

- 11.9 Vetoquinol

- 11.10 Vet-Stem

- 11.11 Virbac

- 11.12 Zoetis