|

市场调查报告书

商品编码

1858814

汽车锂离子电池回收市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Lithium-Ion Battery Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

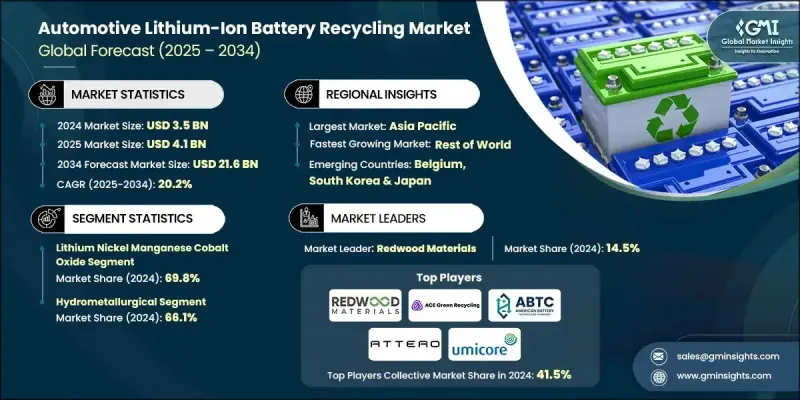

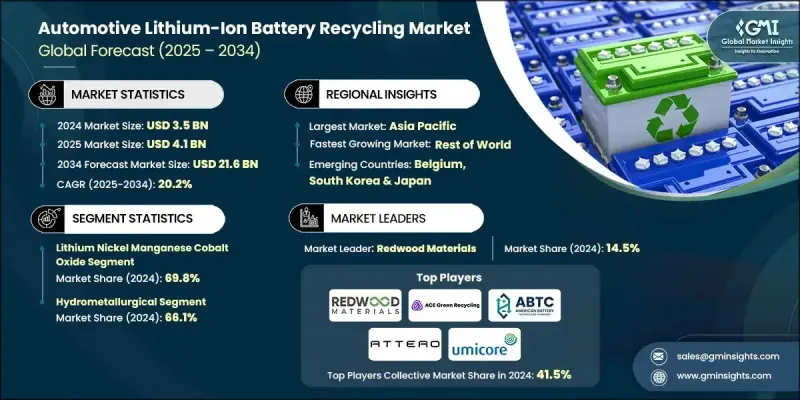

2024 年全球汽车锂离子电池回收市场价值为 35 亿美元,预计到 2034 年将以 20.2% 的复合年增长率成长至 216 亿美元。

推动这一成长的主要因素是汽车产业面临的日益增长的减少环境足迹的压力。电动车常用的锂离子电池含有锂、钴和镍等有害物质,如果处理不当,会造成土壤和水污染。这促使人们更积极地采用回收技术,以回收有价值的金属,减少采矿活动,并最大限度地减少对环境的破坏。随着电动车需求的成长,对有效回收的需求也随之增加,这有助于保护自然资源,并支持汽车产业的循环经济。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35亿美元 |

| 预测值 | 216亿美元 |

| 复合年增长率 | 20.2% |

各国政府和环保组织也发挥关键作用,他们鼓励循环经济倡议,并将回收定位为永续发展的核心策略。汽车製造商正日益将电池回收纳入其长期环境规划,以提升品牌形象并满足严格的监管标准。回收过程不仅有助于安全处置,还能促进关键材料的回收利用,进而强化永续製造实务。汽车锂离子电池回收利用日益重要的作用,是支持电动车转型和减少交通运输产业环境足迹的关键一步。

预计到2034年,磷酸铁锂(LFP)电池市场将以20.6%的复合年增长率成长,这主要得益于LFP电池在首次使用寿命结束后仍能维持较高的容量。这使得LFP电池成为性能要求不高的应用领域的理想再利用选择,不仅减少了废弃物,也提升了回收过程的整体经济价值。 LFP电池的再利用潜力与回收活动密切相关,这将促进业务成长并推动更永续实践的发展。

预计到2034年,物理/机械回收领域将以18.4%的复合年增长率成长。与更复杂的化学或热力回收方法相比,物理/机械回收工艺所需的资本投入较低,因此越来越受欢迎。此外,物理回收方法在常温常压下进行,最大限度地减少了有害排放、用水量和二次废弃物的产生。这对于那些注重遵守环境法规和实现永续发展目标的回收企业来说极具吸引力,从而提振了市场前景。

美国汽车锂离子电池回收市场占86.3%的份额。预计到2034年,美国市场收入将超过30亿美元,主要得益于国内电动车产量的扩张,从而增加了废弃旧材料和报废电池的供应。消费者对更环保技术的需求也促使製造商采用循环经济模式,进一步推动了市场成长。

全球汽车锂离子电池回收市场的主要企业包括ACE Green Recycling、Altilium Metals、American Battery Technology Company、Attero Recycling、Cirba Solutions、Ecobat、Eramet、Fortum、赵锋锂业、嘉能可、Northvolt、Re.Lion.Bat、Redwood Materials、Recyclus、Re.Lion.Bat、Redwood Materials、Recyc、Re. Recycling、SungEel Hitech和优美科。为了巩固其在汽车锂离子电池回收市场的地位,各公司正采取多种策略,例如扩大回收能力、改进技术以提高材料回收效率,以及与汽车製造商建立合作关係以确保废弃电池的稳定供应。这些公司也投资于先进的研发,以开发经济高效且永续的回收技术,在处理更大批量电池的同时,减少对环境的影响。

目录

第一章:方法论与范围

第二章:行业洞察

- 产业概况,2021-2034年

- 商业趋势

- 化学趋势

- 过程趋势

- 区域趋势

第三章:行业洞察

- 产业生态系分析

- 收集和运输基础设施

- 预处理和拆卸作业

- 黑人群众生产与特征

- 物料回收与纯化

- 最终产品製造和分销

- 成本结构分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

- 战略仪錶板

- 策略倡议

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:依化学品类别划分,2021-2034年

- 主要趋势

- 锂镍锰钴氧化物(NMC)

- 磷酸铁锂(LFP)

- 钴酸锂(LCO)

- 其他的

第六章:市场规模及预测:依製程划分,2021-2034年

- 主要趋势

- 火法冶金

- 湿式冶金

- 物理/机械

第七章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 法国

- 比利时

- 瑞士

- 德国

- 亚太地区

- 中国

- 韩国

- 日本

- 世界其他地区

第八章:公司简介

- ACE Green Recycling

- Altilium Metals

- American Battery Technology Company

- Attero Recycling

- Cirba Solution

- Ecobat

- Eramet

- Fortum

- Ganfeng Lithium

- Glencore

- Northvolt

- Re.Lion.Bat

- Redwood Materials

- Recyclus Group

- ReBAT

- RecycleKaro

- SK TES

- Stena Recycling

- SungEel Hitech

- Umicore

The Global Automotive Lithium-Ion Battery Recycling Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 20.2% to reach USD 21.6 billion by 2034.

A primary driver for this surge is the increasing pressure on the automotive sector to reduce its environmental footprint. Lithium-ion batteries, commonly used in electric vehicles (EVs), contain hazardous materials such as lithium, cobalt, and nickel, which pose risks of soil and water contamination if not disposed of properly. This has intensified the adoption of recycling technologies to recover valuable metals, reduce mining activities, and minimize environmental damage. As the demand for electric vehicles rises, so does the need for effective recycling, allowing for the conservation of natural resources and supporting a circular economy in the automotive industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $21.6 Billion |

| CAGR | 20.2% |

Governments and environmental organizations are also playing a pivotal role by encouraging circular economy initiatives, positioning recycling as a core strategy for sustainable development. Automakers are increasingly integrating battery recycling into their long-term environmental plans to enhance their brand image and meet stringent regulatory standards. The recycling process not only aids in safe disposal but also fosters the recovery of critical materials, reinforcing sustainable manufacturing practices. The growing role of automotive lithium-ion battery recycling is an essential step in supporting the EV transition and reducing the environmental footprint of the transportation sector.

The lithium iron phosphate (LFP) battery segment is expected to grow at a CAGR of 20.6% through 2034, driven by the high retention capacity of LFP batteries at the end of their first life. This makes them an ideal candidate for reuse in less demanding applications, which not only reduces waste but also contributes to the overall economic value of the recycling process. The potential for LFP battery reuse is strongly linked to recycling activities, promoting business growth and the development of more sustainable practices.

The physical/mechanical recycling segment is expected to grow at an 18.4% CAGR through 2034. This process is becoming increasingly popular due to its lower capital requirements when compared to more complex chemical or thermal methods. Additionally, the physical method operates under ambient conditions, minimizing harmful emissions, water usage, and secondary waste. This is appealing to recyclers focused on compliance with environmental regulations and sustainability goals, thereby boosting the market outlook.

United States Automotive Lithium-Ion Battery Recycling Market held an 86.3% share. The U.S. is expected to generate over USD 3 billion in revenue by 2034, driven by the expansion of domestic EV production, which increases the availability of scrap materials and end-of-life batteries. Consumer demand for greener technologies is also pushing manufacturers to adopt circular economy models, further driving market growth.

Key companies operating in the Global Automotive Lithium-Ion Battery Recycling Market include ACE Green Recycling, Altilium Metals, American Battery Technology Company, Attero Recycling, Cirba Solutions, Ecobat, Eramet, Fortum, Ganfeng Lithium, Glencore, Northvolt, Re.Lion.Bat, Redwood Materials, Recyclus Group, ReBAT, RecycleKaro, SK TES, Stena Recycling, SungEel Hitech, and Umicore. To strengthen their position in the Automotive Lithium-Ion Battery Recycling Market, companies are adopting various strategies such as expanding their recycling capacity, improving technology for better efficiency in material recovery, and forging partnerships with automakers to ensure a steady supply of end-of-life batteries. These companies are also investing in advanced research and development to develop cost-effective and sustainable recycling technologies, which can handle a larger volume of batteries while reducing environmental impact.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Industry Insights

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Chemistry trends

- 2.4 Process trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Collection and transportation infrastructure

- 3.1.2 Pre-treatment and dismantling operations

- 3.1.3 Black mass production and characterization

- 3.1.4 Material recovery and purification

- 3.1.5 End product manufacturing and distribution

- 3.2 Cost structure analysis

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Chemistry, 2021 - 2034 (USD Billion & Thousand Tons)

- 5.1 Key trends

- 5.2 Lithium nickel manganese cobalt oxide (NMC)

- 5.3 Lithium iron phosphate (LFP)

- 5.4 Lithium cobalt oxide (LCO)

- 5.5 Others

Chapter 6 Market Size and Forecast, By Process, 2021 - 2034 (USD Billion & Thousand Tons)

- 6.1 Key trends

- 6.2 Pyrometallurgical

- 6.3 Hydrometallurgical

- 6.4 Physical/Mechanical

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & Thousand Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Belgium

- 7.3.4 Switzerland

- 7.3.5 Germany

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 South Korea

- 7.4.3 Japan

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 ACE Green Recycling

- 8.2 Altilium Metals

- 8.3 American Battery Technology Company

- 8.4 Attero Recycling

- 8.5 Cirba Solution

- 8.6 Ecobat

- 8.7 Eramet

- 8.8 Fortum

- 8.9 Ganfeng Lithium

- 8.10 Glencore

- 8.11 Northvolt

- 8.12 Re.Lion.Bat

- 8.13 Redwood Materials

- 8.14 Recyclus Group

- 8.15 ReBAT

- 8.16 RecycleKaro

- 8.17 SK TES

- 8.18 Stena Recycling

- 8.19 SungEel Hitech

- 8.20 Umicore