|

市场调查报告书

商品编码

1858840

ADAS半导体市场机会、成长驱动因素、产业趋势分析及2025-2034年预测ADAS Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

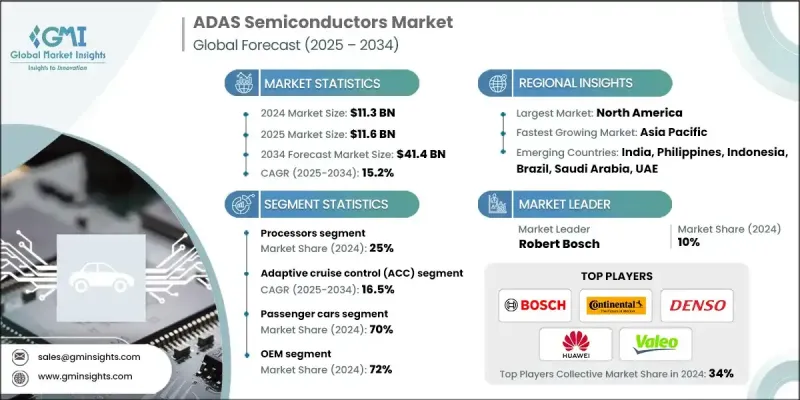

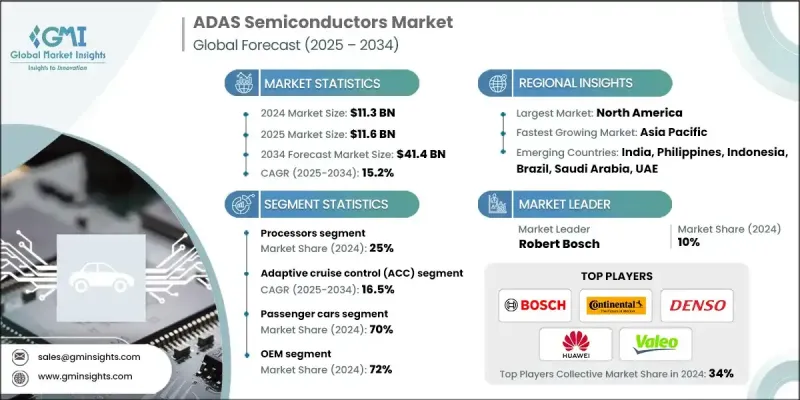

2024 年全球 ADAS 半导体市场价值为 113 亿美元,预计到 2034 年将以 15.2% 的复合年增长率增长至 414 亿美元。

由于更严格的安全标准、对自动驾驶功能日益增长的需求以及ADAS技术在车辆中日益普及,市场正经历快速成长。汽车製造商正在整合各种半导体组件,包括高性能微控制器、雷达晶片、雷射雷达介面IC、影像讯号处理器和人工智慧加速器,以提升决策能力、即时感知能力、能源效率和可靠性。一级供应商和汽车製造商也在推动感测器融合、预测分析和人工智慧驱动系统等技术,以满足严格的安全法规要求。开发封装更优、导热性更高、功耗更低的半导体对于处理大量资料和遵守Euro NCAP、NHTSA和UNECE等法规至关重要。此外,新冠疫情暴露了半导体供应链的脆弱性,促使企业进行多角化经营与外包。随着汽车产业向电气化和自动驾驶汽车转型,对汽车晶片的投资不断增加,订阅服务和晶片组整合合作等新型商业模式提供了可扩展且灵活的解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 113亿美元 |

| 预测值 | 414亿美元 |

| 复合年增长率 | 15.2% |

到2024年,处理器细分市场将占据25%的市场份额,并有望以17%的复合年增长率实现最快增长,这主要得益于对高性能计算日益增长的需求,以支持高级驾驶辅助系统(ADAS)功能并提升车辆的自主性。汽车产业正逐步采用配备集中式域控制系统和人工智慧驱动的系统级晶片(SoC)的车辆,这些晶片能够处理复杂的感测器资料、执行即时决策,并实现深度学习和电脑视觉等复杂演算法。

2024 年,自适应巡航控制 (ACC) 市占率为 22%。虽然 ACC 不是最广泛使用的功能,但由于其能够根据交通状况自动调整车速,从而提高舒适性和安全性,预计 2025 年至 2034 年间,其需求将以 16.5% 的复合年增长率增长。

美国ADAS半导体市场占据主导地位,市占率高达85%,预计到2024年将达到29.1亿美元。美国强大的汽车研发实力、对安全技术的早期应用以及政府强制执行的安全标准,巩固了其在该行业的领先地位。领先的汽车製造商正积极将先进的雷达、摄影机和人工智慧晶片整合到车辆中,以满足消费者对安全性和驾驶辅助功能日益增长的需求。

ADAS半导体市场的主要参与者包括NVIDIA、Mobileye(英特尔旗下)、大陆集团、电装、博世、高通、特斯拉、采埃孚、华为和法雷奥。为了巩固市场地位,ADAS半导体市场的企业正专注于几个关键策略。他们大力投资研发,以开发满足ADAS日益复杂需求的尖端晶片,例如即时处理和增强型感测器融合。他们也积极寻求与汽车製造商的合作与伙伴关係,将人工智慧和机器学习整合到产品中,从而提供更有效率、可扩展的解决方案。此外,各公司也不断改进产品,推出能够处理大量资料集的低功耗、高性能半导体,以满足先进安全系统和自动驾驶功能的需求。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对先进安全功能的需求不断增长以及监管要求的提高。

- 自动驾驶和半自动驾驶汽车普及率激增。

- 人工智慧和机器学习在进阶驾驶辅助系统中的应用日益广泛。

- 电动车的普及需要高性能的ADAS解决方案。

- 感测器融合和多感测器ADAS架构的增加。

- 产业陷阱与挑战

- ADAS半导体解决方案成本高昂,限制了其大规模应用。

- 跨不同车辆平台整合的复杂性。

- 市场机会

- 开发低功耗、人工智慧优化的汽车半导体。

- 原始设备製造商 (OEM) 与半导体公司之间日益密切的合作关係。

- 对77GHz雷达和光达整合晶片的需求不断增长。

- ADAS在新兴市场的扩展。

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 网路安全与功能安全集成

- 汽车网路安全框架实施

- 硬体安全模组 (HSM) 集成

- 安全启动和信任链

- ISO 21434 网路安全合规性

- 威胁建模与风险评估

- 透过设计实现安全的方法

- 事件响应与復原系统

- 隐私保护计算技术

- 颠覆性技术的整合与应用

- 神经形态计算在ADAS应用的应用

- Chiplet架构和解耦式设计

- 记忆体处理(PIM)技术

- 光子运算整合潜力

- 量子运算的未来应用

- RISC-V 开放式架构的采用

- 边缘人工智慧加速器集成

- 模拟人工智慧运算解决方案

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 处理器

- 感应器

- 记忆

- 电源管理积体电路

- 连接性和介面

- 其他的

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 自适应巡航控制(ACC)

- 盲点侦测系统(BSD)

- 停车协助

- 车道偏离预警系统(LDWS)

- 轮胎压力监测系统(TPMS)

- 自动紧急煞车(AEB)

- 自适应头灯(AFL)

- 其他的

第七章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 多用途乘用车

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车辆(HCV)

- 搭乘用车

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:依自主程度划分,2021-2034年

- 主要趋势

- 一级(驾驶辅助)

- 二级(部分自动化)

- 3级(条件自动化)

- 4级(高度自动化)

- 5级(全自动)

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 全球参与者

- Continental

- Denso

- Huawei

- Mobileye (Intel)

- NVIDIA

- Qualcomm

- Robert Bosch

- Tesla

- VALEO

- ZF Friedrichshafen

- 区域玩家

- Analog Devices

- Apvit

- Baidu Apollo

- Infineon

- Innoviz Technologies

- Luminar Technologies

- Magna International

- Microchip Technology

- NXP semiconductors

- ON Semiconductor

- Rohm Semiconductor

- Toshiba Electronic Devices

- Velodyne Lidar

- 新兴参与者

- Ambarella

- Black Sesame

- Hailo Technologies

- Horizon Robotics

- Lattice Semiconductor

- SiTime

- Xilinx

The Global ADAS Semiconductors Market was valued at USD 11.3 billion in 2024 and is estimated to grow at a CAGR of 15.2% to reach USD 41.4 billion by 2034.

The market is experiencing rapid growth due to stricter safety standards, greater demand for automated driving features, and the increasing integration of ADAS technologies in vehicles. Automakers are incorporating a wide range of semiconductor components, including high-performance microcontrollers, radar chips, lidar interface ICs, image signal processors, and AI accelerators, to improve decision-making, real-time perception, energy efficiency, and reliability. Tier-1 suppliers and vehicle manufacturers are also advancing technologies like sensor fusion, predictive analytics, and AI-driven systems to comply with tough safety regulations. The development of semiconductors with better packaging, improved thermal conductivity, and lower power consumption is crucial for handling large data volumes and adhering to regulations such as Euro NCAP, NHTSA, and UNECE. Additionally, the COVID-19 pandemic exposed vulnerabilities in the semiconductor supply chain, prompting companies to diversify and outsource. As the automotive industry moves toward electrification and autonomous vehicles, investments in automotive chips have increased, with new business models such as subscription-based services and chipset integration partnerships offering scalable and flexible solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.3 Billion |

| Forecast Value | $41.4 Billion |

| CAGR | 15.2% |

In 2024, the processors segment held a 25% share and is expected to grow at the highest rate, with a CAGR of 17%, driven by the increasing demand for high-performance computing to support advanced ADAS features and enhance vehicle autonomy. The automotive sector is progressively adopting vehicles with centralized domain controls and AI-powered system-on-chips (SoCs) that can process complex sensor data, perform real-time decision-making, and implement sophisticated algorithms like deep learning and computer vision.

The adaptive cruise control (ACC) segment held a 22% share in 2024. Although ACC is not the most widely used feature, its demand is expected to grow at a CAGR of 16.5% between 2025 and 2034, driven by its ability to automatically adjust vehicle speed based on traffic conditions, improving both comfort and safety.

U.S. ADAS Semiconductors Market held a dominant share of 85% generating USD 2.91 billion in 2024. The strong presence of automotive research and development, along with early adoption of safety technologies and government-imposed safety standards, has solidified the U.S. as a leader in this industry. Leading car manufacturers are actively integrating advanced radar, camera, and AI-powered chips into their vehicles, catering to the growing consumer demand for safety and driver-assistance features.

Key players in the ADAS Semiconductors Market include NVIDIA, Mobileye (Intel), Continental, Denso, Robert Bosch, Qualcomm, Tesla, ZF Friedrichshafen, Huawei, and VALEO. To strengthen their market position, companies in the ADAS Semiconductors Market are focusing on several key strategies. They are heavily investing in research and development (R&D) to develop cutting-edge chips that meet the increasingly sophisticated needs of ADAS, such as real-time processing and enhanced sensor fusion. Collaborations and partnerships with automakers are also being pursued to integrate AI and machine learning into their products, thus offering more efficient and scalable solutions. Furthermore, companies are enhancing their product offerings with low-power, high-performance semiconductors that can handle large data sets, meeting the demands of advanced safety systems and autonomous driving capabilities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Application

- 2.2.4 Vehicle

- 2.2.5 End Use

- 2.2.6 Level of autonomy

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in demand for advanced safety features and regulatory mandates.

- 3.2.1.2 Surge in autonomous and semi-autonomous vehicle adoption.

- 3.2.1.3 Growing integration of AI and machine learning in ADAS.

- 3.2.1.4 Expansion of EVs requiring high-performance ADAS solutions.

- 3.2.1.5 Increase in sensor fusion and multi-sensor ADAS architectures.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of ADAS semiconductor solutions limiting mass adoption.

- 3.2.2.2 Complexity in integration across diverse vehicle platforms.

- 3.2.3 Market opportunities

- 3.2.3.1 Development of low-power, AI-optimized automotive semiconductors.

- 3.2.3.2 Growing partnerships between OEMs and semiconductor companies.

- 3.2.3.3 Rising demand for 77GHz radar and lidar integration chips.

- 3.2.3.4 Expansion of ADAS in emerging markets.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Cybersecurity & Functional Safety Integration

- 3.13.1 Automotive cybersecurity framework implementation

- 3.13.2 Hardware security module (HSM) integration

- 3.13.3 Secure boot & chain of trust

- 3.13.4 ISO 21434 cybersecurity compliance

- 3.13.5 Threat modeling & risk assessment

- 3.13.6 Security by design methodologies

- 3.13.7 Incident response & recovery systems

- 3.13.8 Privacy-preserving computing techniques

- 3.14 Disruptive technology integration & adoption

- 3.14.1 Neuromorphic computing for adas applications

- 3.14.2 Chiplet architecture & disaggregated design

- 3.14.3 Processing-in-memory (PIM) technologies

- 3.14.4 Photonic computing integration potential

- 3.14.5 Quantum computing future applications

- 3.14.6 RISC-V open architecture adoption

- 3.14.7 Edge ai accelerator integration

- 3.14.8 Analog AI computing solutions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Processors

- 5.3 Sensors

- 5.4 Memory

- 5.5 Power Management ICs

- 5.6 Connectivity & Interface

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Adaptive Cruise Control (ACC)

- 6.3 Blind Spot Detection System (BSD)

- 6.4 Park Assistance

- 6.5 Lane Departure Warning System (LDWS)

- 6.6 Tire Pressure Monitoring System (TPMS)

- 6.7 Autonomous Emergency Braking (AEB)

- 6.8 Adaptive Front Lights (AFL)

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.1.1 Passenger cars

- 7.1.1.1 Hatchbacks

- 7.1.1.2 Sedans

- 7.1.1.3 SUVs

- 7.1.1.4 MPVs

- 7.1.2 Commercial vehicles

- 7.1.2.1 Light commercial vehicles (LCVs)

- 7.1.2.2 Medium commercial vehicles (MCVs)

- 7.1.2.3 Heavy commercial vehicles (HCVs)

- 7.1.1 Passenger cars

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Level of Autonomy, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Level 1 (Driver assistance)

- 9.3 Level 2 (Partial automation)

- 9.4 Level 3 (Conditional automation)

- 9.5 Level 4 (High automation)

- 9.6 Level 5 (Full automation)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Continental

- 11.1.2 Denso

- 11.1.3 Huawei

- 11.1.4 Mobileye (Intel)

- 11.1.5 NVIDIA

- 11.1.6 Qualcomm

- 11.1.7 Robert Bosch

- 11.1.8 Tesla

- 11.1.9 VALEO

- 11.1.10 ZF Friedrichshafen

- 11.2 Regional Players

- 11.2.1 Analog Devices

- 11.2.2 Apvit

- 11.2.3 Baidu Apollo

- 11.2.4 Infineon

- 11.2.5 Innoviz Technologies

- 11.2.6 Luminar Technologies

- 11.2.7 Magna International

- 11.2.8 Microchip Technology

- 11.2.9 NXP semiconductors

- 11.2.10 ON Semiconductor

- 11.2.11 Rohm Semiconductor

- 11.2.12 Toshiba Electronic Devices

- 11.2.13 Velodyne Lidar

- 11.3 Emerging Players

- 11.3.1 Ambarella

- 11.3.2 Black Sesame

- 11.3.3 Hailo Technologies

- 11.3.4 Horizon Robotics

- 11.3.5 Lattice Semiconductor

- 11.3.6 SiTime

- 11.3.7 Xilinx