|

市场调查报告书

商品编码

1858844

RNA干扰疗法市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)RNA Interference Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

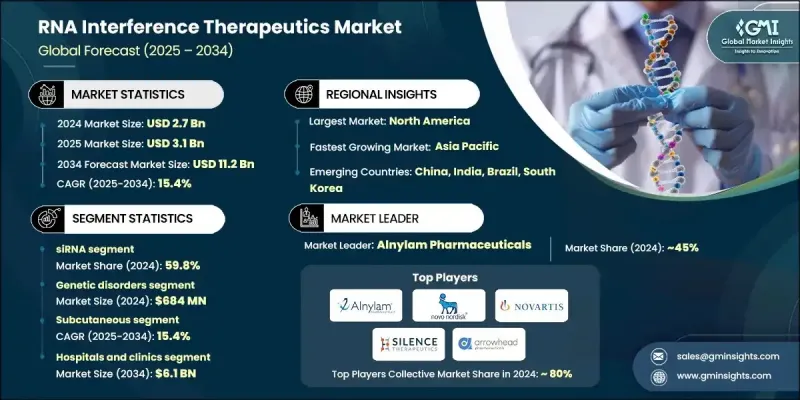

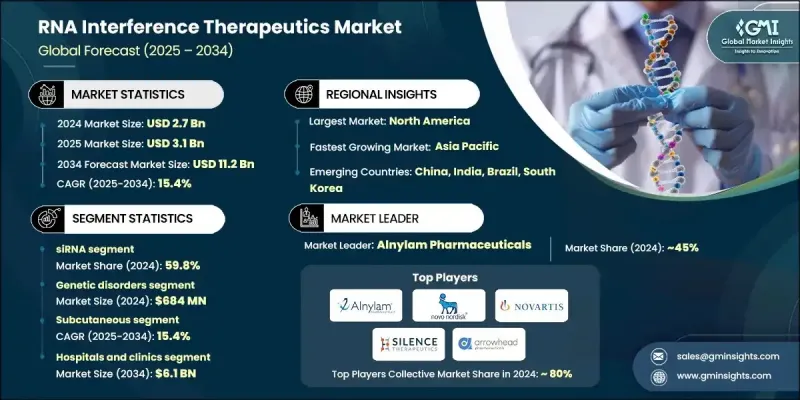

2024 年全球 RNA 干扰疗法市场价值为 27 亿美元,预计到 2034 年将以 15.4% 的复合年增长率增长至 112 亿美元。

基于RNAi的疗法日益重要,这源于基因研究的蓬勃发展、慢性疾病负担的加重以及罕见遗传疾病诊断率的上升。这些疗法透过沉默疾病相关基因发挥作用,提供了一种精准的标靶治疗方法。技术创新,特别是脂质奈米颗粒和偶联繫统等递送方法的进步,显着提高了RNAi疗法的安全性和有效性。这拓宽了其临床应用范围,并促进了生物製药产业的合作。 RNAi疗法拓展至以往难以触及的治疗领域,尤其是在肝臟以外的领域,标誌着其临床应用发生了关键性转变。个人化医疗、基因编辑技术的进步以及基因疗法在国际上日益增长的势头,都是推动市场发展的关键因素。有利的监管环境,特别是针对孤儿药研发的监管政策,提供了加速审批和更长的专利保护期,使RNAi领域对製药投资更具吸引力。在公部门和私部门的大力支持下,市场持续发展,推动RNAi从小众科学走向主流疗法。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 27亿美元 |

| 预测值 | 112亿美元 |

| 复合年增长率 | 15.4% |

2024年,小干扰RNA(siRNA)市占率达到59.8%,预计2034年将达到68亿美元,年复合成长率(CAGR)为15.5%。 siRNA疗法因其基因沉默的精准性和较低的脱靶风险,处于RNAi技术发展的前沿。更先进的递送技术以及对基因表现模式更深入的理解,使得siRNA的应用范围扩展到肝臟以外的新治疗标靶。 siRNA能够调节心血管疾病、代谢性疾病和罕见遗传性疾病中的基因表达,这极大地促进了其快速增长。在更广泛的RNAi市场中,siRNA仍然是临床应用最成熟、科学验证最充分的领域。

2024年,遗传性疾病领域创造了6.84亿美元的市场规模。这一主导地位归功于siRNA疗法能够精准靶向导致各种遗传疾病的基因。这些疗法在治疗以往缺乏有效治疗手段的疾病方面具有巨大潜力。 siRNA疗法在治疗罕见疾病和遗传性疾病方面已证实有效,这支撑了该应用领域持续的临床拓展和商业发展。

2024年,北美RNA干扰疗法市场占45.7%的比重。这一领先地位主要得益于先进的医疗基础设施、高度发展的研究生态系统以及对创新疗法的早期应用。美国国立卫生研究院等主要机构的大量资金投入,以及主要製药企业和合约研发生产机构(CDMO)的积极参与,加速了该地区的药物研发进程。对精准疗法日益增长的需求以及遗传疾病发病率的上升,进一步巩固了该地区在该领域的领先地位。

全球RNA干扰疗法市场的主要贡献者包括Silence Therapeutics、Sirnaomics、Arrowhead Pharmaceuticals、Alnylam Pharmaceuticals、诺华、Creative Biogene、Arbutus Biopharma、OliX Pharmaceuticals、Benitec Biopharma、赛诺菲、诺和诺德和Atalanta Therapeutics。为了在RNAi疗法市场中占据更有利的地位,领先企业正大力推动策略合作、技术共享和研发投入。生物技术创新者与大型製药公司之间的合作能够加速药物研发,获得先进的给药系统,并扩大市场覆盖范围。各公司也优先考虑产品线多元化,以涵盖常见疾病和罕见疾病的疗法。透过获得孤儿药资格和快速审批通道,企业可以获得竞争优势,例如延长独占期和缩短上市时间。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 遗传性疾病盛行率不断上升

- RNA递送技术的进步

- 以RNAi为基础的研究投入不断增加

- 核准RNAi疗法用于治疗慢性病和罕见疾病

- 产业陷阱与挑战

- 有效递送RNAi分子的挑战

- RNAi疗法研发成本高昂

- 市场机会

- RNAi在神经病学和神经退化性疾病的应用

- 针对遗传疾病的个人化RNAi疗法

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 北美洲

- 技术格局

- 当前技术趋势

- 新兴技术

- 管道分析

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 小干扰RNA(siRNA)

- 微小RNA(miRNA)

- 短髮夹RNA(shRNA)

- 其他产品类型

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 癌症

- 遗传性疾病

- 心血管疾病

- 病毒感染

- 神经退化性疾病

- 眼科疾病

- 呼吸系统疾病

- 其他应用

第七章:市场估计与预测:依给药途径划分,2021-2034年

- 主要趋势

- 静脉注射(IV)

- 皮下(SC)

- 其他给药途径

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院和诊所

- 研究实验室

- 其他最终用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Alnylam Pharmaceuticals

- Arbutus Biopharma

- Arrowhead Pharmaceuticals

- Atalanta Therapeutics

- Benitec Biopharma

- Creative Biogene

- Novartis

- Novo Nordisk

- OliX Pharmaceuticals

- Sanofi

- Silence Therapeutics

- Sirnaomics

The Global RNA Interference Therapeutics Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 15.4% to reach USD 11.2 billion by 2034.

The growing importance of RNAi-based therapies stems from a surge in genetic research, the rising burden of chronic diseases, and increasing diagnoses of rare genetic disorders. These therapies work by silencing disease-related genes, offering a precise and targeted approach to treatment. Technological innovations, particularly in delivery methods like lipid nanoparticles and conjugate systems, have significantly enhanced the safety and effectiveness of RNAi therapies. This has widened the scope for clinical application and encouraged collaborations within the biopharmaceutical industry. The expansion of RNAi into therapeutic areas previously difficult to reach, especially beyond the liver, marks a pivotal shift in its clinical utility. Personalized medicine, advancements in gene editing, and growing international momentum for gene therapies are key contributors to the market's momentum. Favorable regulatory conditions, especially those geared toward orphan drug development, offer accelerated pathways and longer exclusivity, making the RNAi space more attractive for pharmaceutical investments. The market continues to evolve with strong backing from both public and private sectors, supporting the transition of RNAi from niche science to mainstream therapy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $11.2 Billion |

| CAGR | 15.4% |

The small interfering RNA (siRNA) segment held a 59.8% share in 2024 and is projected to reach USD 6.8 billion by 2034, driven by a CAGR of 15.5%. siRNA therapies are at the forefront of RNAi advancements due to their gene-silencing precision and lower off-target risks. The development of more sophisticated delivery technologies and a deeper understanding of gene expression patterns has enabled expansion into new therapeutic targets outside the liver. The ability of siRNA to modulate gene expression in cardiovascular, metabolic, and rare inherited disorders is contributing significantly to its rapid growth. This segment remains the most clinically mature and scientifically validated within the broader RNAi market.

The genetic disorders segment generated USD 684 million in 2024. This dominance is attributed to the precision of siRNA therapies in targeting genes responsible for various inherited conditions. These therapies hold strong potential for addressing diseases that previously lacked effective treatment options. The proven efficacy of siRNA-based solutions in treating rare and genetically rooted conditions supports continued clinical expansion and commercial interest in this application area.

North America RNA Interference Therapeutics Market held a 45.7% share in 2024. This leadership is primarily driven by a combination of advanced healthcare infrastructure, a highly developed research ecosystem, and early adoption of innovative treatments. Significant funding from major institutions like the National Institutes of Health, along with active participation from major pharmaceutical players and CDMOs, has accelerated drug development in the region. The growing demand for precision-based therapeutics and rising rates of genetic diseases further support regional dominance in this space.

Key companies contributing to the Global RNA Interference Therapeutics Market include Silence Therapeutics, Sirnaomics, Arrowhead Pharmaceuticals, Alnylam Pharmaceuticals, Novartis, Creative Biogene, Arbutus Biopharma, OliX Pharmaceuticals, Benitec Biopharma, Sanofi, Novo Nordisk, and Atalanta Therapeutics. To establish a stronger presence in the RNAi therapeutics market, leading firms are focusing heavily on strategic partnerships, technology sharing, and R&D investments. Collaborations between biotech innovators and large pharmaceutical firms enable rapid drug development, access to advanced delivery systems, and broader market reach. Companies are also prioritizing pipeline diversification to include therapies targeting both common and rare diseases. By securing orphan drug status and fast-track regulatory designations, firms gain competitive advantages such as extended exclusivity and reduced time-to-market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 Route of administration trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of genetic disorders

- 3.2.1.2 Advancements in RNA delivery technologies

- 3.2.1.3 Rising investment in RNAi-based research

- 3.2.1.4 Approval of RNAi therapeutics for chronic and rare diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Challenges in effective delivery of RNAi molecules

- 3.2.2.2 High cost of RNAi therapeutics development

- 3.2.3 Market opportunities

- 3.2.3.1 RNAi applications in neurology and neurodegenerative diseases

- 3.2.3.2 Personalized RNAi therapies for genetic diseases

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Small interfering RNA (siRNA)

- 5.3 MicroRNA (miRNA)

- 5.4 Short hairpin RNA (shRNA)

- 5.5 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cancer

- 6.3 Genetic disorders

- 6.4 Cardiovascular diseases

- 6.5 Viral infections

- 6.6 Neurodegenerative diseases

- 6.7 Ophthalmic disorders

- 6.8 Respiratory disorders

- 6.9 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Intravenous (IV)

- 7.3 Subcutaneous (SC)

- 7.4 Other route of administration

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Research laboratories

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alnylam Pharmaceuticals

- 10.2 Arbutus Biopharma

- 10.3 Arrowhead Pharmaceuticals

- 10.4 Atalanta Therapeutics

- 10.5 Benitec Biopharma

- 10.6 Creative Biogene

- 10.7 Novartis

- 10.8 Novo Nordisk

- 10.9 OliX Pharmaceuticals

- 10.10 Sanofi

- 10.11 Silence Therapeutics

- 10.12 Sirnaomics