|

市场调查报告书

商品编码

1858861

美国真实世界证据解决方案市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)U.S. Real World Evidence Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

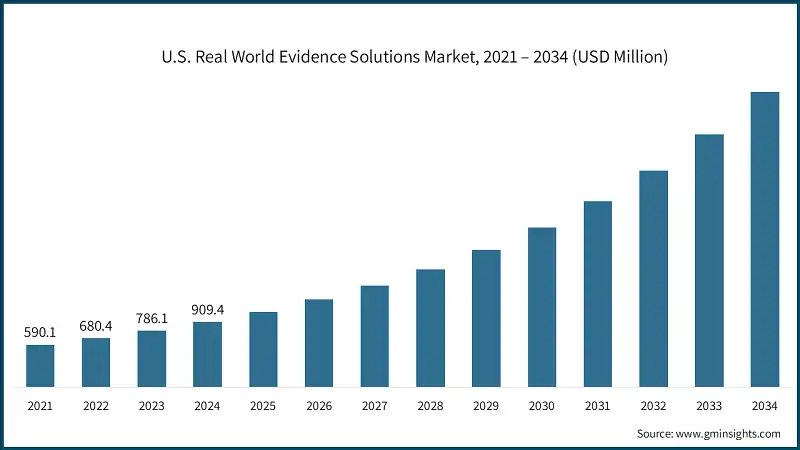

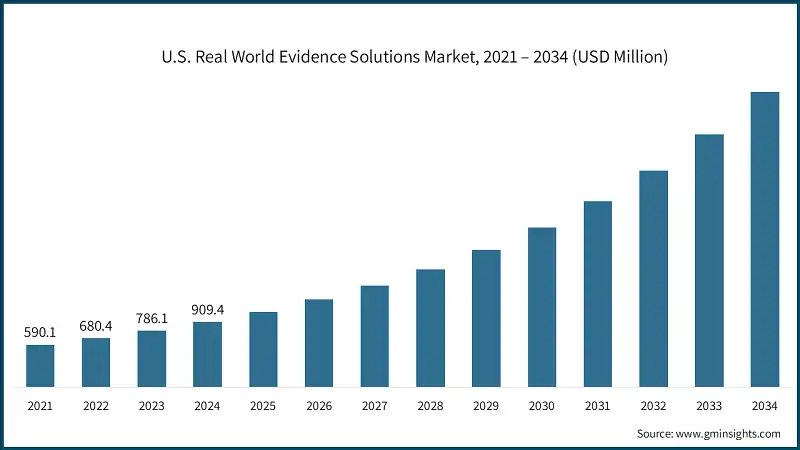

2024 年美国真实世界证据解决方案市值为 9.094 亿美元,预计到 2034 年将以 16.3% 的复合年增长率增长至 41 亿美元。

强劲成长的动力源自于对加速药物研发、降低成本以及加强上市后安全性和有效性评估的日益重视。利害关係人越来越依赖真实世界证据来指导报销策略和临床决策。真实世界证据解决方案能够收集、分析和解读来自日常医疗保健环境(例如电子健康记录、理赔资料库、註册登记系统和穿戴式装置)的资料,从而获得超越传统试验环境的临床见解。随着支付方、监管机构和临床医生对即时证据的需求不断增长,真实世界证据在医疗产品的整个生命週期中发挥着至关重要的作用。这种向实证策略的动态转变,以及对分析领域不断增长的投资,正在重塑美国市场药物和医疗器材的研发、审批和监测方式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.094亿美元 |

| 预测值 | 41亿美元 |

| 复合年增长率 | 16.3% |

2024年,服务板块占据58.4%的市占率。其领先地位得益于订阅模式和高级分析平台的广泛应用,以及生命科学公司对真实世界研究(RWE)服务日益增长的需求。这些服务涵盖研究规划、资料整合、品质控制和法规支援。它们整合从健康记录到穿戴式装置输出等各种资料流,从而支援符合合规标准和决策需求的可靠真实世界研究。

预计到2034年,药物研发和核准领域市场规模将达16亿美元。这一增长主要得益于临床试验活动的增加、优化试验设计的需求以及利用真实世界证据(RWE)支持监管申报和加速审批。该领域涵盖方案製定、患者招募、试验优化、安全性和有效性监测以及为监管机构提供证据等工作。

预计到2024年,製药和医疗器材公司将占据60.4%的市场。这些公司是真实世界证据(RWE)工具和平台的主要采用者,并在产品生命週期的各个阶段进行部署。 RWE帮助他们精准定位患者群体,完善试验方案,并产生符合监管和市场准入要求的真实世界资料,从而补充或在某些情况下替代传统的随机对照试验。

美国真实世界证据解决方案市场的主要参与者包括ICON plc、Oracle Corporation、Aetion, Inc.、TriNetX、Cytel Inc.、Merative、Flatiron Health Inc.、Tempus、Syneos Health Inc.、Medidata Solutions, Inc.、Thermo Fisher Scientific, Inc.、UnitedHealth Group Incorpor Holdings、ParVIA Holdings.S.这些公司正积极推行多项策略措施以巩固其市场地位。许多公司正大力投资人工智慧和机器学习,以提升预测建模、因果推论和资料分析能力。与医疗系统、支付者和研究机构建立合作关係和联盟,有助于获得更丰富、更多样化的真实世界资料集。此外,公司还透过收购和合併来拓展服务范围、引入新技术或扩大地域覆盖范围。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 日益重视加速药物研发和降低成本

- 药品和医疗器材即时安全性和有效性监测的需求日益增长

- 提高真实世界证据解决方案在知情报销决策中的应用

- 临床决策中资料分析服务的应用日益广泛

- 产业陷阱与挑战:

- 现实世界资料的整合和互通性缺乏标准化

- 熟练专业人员短缺

- 市场机会:

- 新兴治疗领域正扩展到肿瘤学以外的领域

- 重点关注患者产生的健康资料整合

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 技术进步

- 当前技术趋势

- 人工智慧和机器学习的融合

- 云端运算和资料基础设施

- 用于临床资料撷取的自然语言处理(NLP)

- 新兴技术

- 区块链和分散式帐本技术

- 量子计算应用

- 联邦学习与隐私权保护分析

- 当前技术趋势

- 未来市场趋势

- 将真实世界证据纳入药物研发与市场进入的监管体系

- 人工智慧驱动的真实世界资料分析助力精准医疗

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 服务

- 资料收集与整合

- 研究设计与实施

- 前瞻性观察研究

- 回顾性资料库研究

- 以地点为中心的研究

- 基于註册登记的研究

- 混合研究

- 监管和市场准入支持

- 证据网络

- 其他服务

- 数据集

- 不同的资料集

- 临床环境资料

- 索赔资料集

- 药房资料集

- 患者驱动资料集

- 基于註册表的资料集

- 综合资料集

- 不同的资料集

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 药物研发及审批

- 肿瘤学

- 心血管疾病

- 神经病学

- 免疫学

- 其他治疗领域

- 医疗器材开发与审批

- 上市后监测

- 市场准入和报销/承保决策

- 临床和监管决策

第七章:市场估计与预测:依所得模式划分,2021-2034年

- 主要趋势

- 按使用量付费(基于价值的定价)

- 订阅

第八章:市场估算与预测:依部署模式划分,2021-2034年

- 主要趋势

- 本地部署

- 基于云端的

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 製药和医疗器材公司

- 医疗保健支付方

- 医疗保健提供者

- 其他最终用途

第十章:公司简介

- Aetion, Inc.

- Cytel Inc

- Flatiron Health Inc

- Fortrea Holdings Inc

- IBM Corporation

- ICON plc

- IQVIA Holdings Inc

- Medidata Solutions, Inc.

- Merative

- Oracle Corporation

- Parexel International Corporation

- Syneos Health Inc

- Tempus

- TriNetX

- Thermo Fisher Scientific, Inc.

- UnitedHealth Group Incorporated

U.S. Real World Evidence Solutions Market was valued at USD 909.4 million in 2024 and is estimated to grow at a CAGR of 16.3% to reach USD 4.1 billion by 2034.

The robust growth is fueled by increased emphasis on expediting drug development, lowering costs, and enhancing post-market safety and efficacy evaluation. Stakeholders are placing greater reliance on real-world evidence to guide reimbursement strategies and clinical decision-making. RWE solutions gather, analyze, and interpret data from everyday healthcare environments such as electronic health records, claims databases, registries, and wearable devices to derive clinical insights beyond conventional trial settings. As payers, regulators, and clinicians demand more real-time evidence, the role of RWE is becoming critical throughout the lifecycle of medical products. This dynamic shift toward evidence-driven strategies, plus growing investments in analytics, is reshaping how drugs and devices are developed, approved, and monitored in the U.S. market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $909.4 Million |

| Forecast Value | $4.1 Billion |

| CAGR | 16.3% |

In 2024, the services segment held a 58.4% share. Its leading position is supported by the widespread offering of subscription models and advanced analytics platforms, and by growing uptake of RWE services among life sciences firms. These services encompass study planning, data integration, quality control, and regulatory support. They harmonize diverse data streams from health records to wearable outputs to enable robust real-world studies that meet compliance standards and decision-making needs.

The drug development and approvals segment is expected to reach USD 1.6 billion by 2034. This growth is driven by increased clinical trial activity, the need to optimize trial designs, and the use of RWE to support regulatory submissions and accelerate approvals. The segment includes protocol formulation, patient recruitment, trial optimization, safety and efficacy monitoring, and evidence generation for regulatory bodies.

The pharmaceutical and medical device companies segment held a 60.4% share in 2024. These organizations are the primary adopters of RWE tools and platforms, deploying them across product lifecycle stages. RWE helps them pinpoint patient cohorts, refine trial protocols, and produce real-world data aligned with regulatory and market access demands, either supplementing or, in some cases, substituting traditional randomized controlled trials.

Prominent participants in the U.S. Real World Evidence Solutions Market include ICON plc, Oracle Corporation, Aetion, Inc., TriNetX, Cytel Inc., Merative, Flatiron Health Inc., Tempus, Syneos Health Inc., Medidata Solutions, Inc., Thermo Fisher Scientific, Inc., UnitedHealth Group Incorporated, IQVIA Holdings Inc., Parexel International Corporation, and Fortrea Holdings Inc. Firms in the U.S. real world evidence solutions market are pursuing several strategic initiatives to solidify their market position. Many are investing heavily in AI and machine learning to improve predictive modeling, causal inference, and data analytics capabilities. Partnerships and alliances with healthcare systems, payers, and research institutions are helping to access richer, more diverse real-world datasets. Acquisitions and mergers are being used to broaden service offerings, add novel technology, or expand geographic reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Component trends

- 2.2.3 Application trends

- 2.2.4 Revenue model trends

- 2.2.5 Deployment model trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing focus towards accelerating drug development and cost reduction

- 3.2.1.2 Growing demand for real-time safety and efficacy monitoring of drugs and medical devices

- 3.2.1.3 Increasing adoption of RWE Solutions for informed reimbursement decision-making

- 3.2.1.4 Increasing adoption of data analytics services in clinical decision making

- 3.2.2 Industry Pitfalls and challenges:

- 3.2.2.1 Lack of standardization in integration and interoperability of real-world data

- 3.2.2.2 Shortage of skilled professionals

- 3.2.3 Market opportunities:

- 3.2.3.1 Emerging therapeutic areas expansion beyond oncology

- 3.2.3.2 Focus on patient-generated health data integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.1.1 Artificial intelligence and machine learning integration

- 3.5.1.2 Cloud computing and data infrastructure

- 3.5.1.3 Natural language processing (NLP) for clinical data extraction

- 3.5.2 Emerging technologies

- 3.5.2.1 Blockchain and distributed ledger technologies

- 3.5.2.2 Quantum computing applications

- 3.5.2.3 Federated learning and privacy-preserving analytics

- 3.5.1 Current technological trends

- 3.6 Future market trends

- 3.6.1 Regulatory integration of RWE in drug development and market access

- 3.6.2 AI-driven real world data analytics for precision medicine

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Services

- 5.2.1 Data collection and integration

- 5.2.2 Study design and execution

- 5.2.2.1 Prospective observational studies

- 5.2.2.2 Retrospective database studies

- 5.2.2.3 Site-centric studies

- 5.2.2.4 Registry-based studies

- 5.2.2.5 Hybrid studies

- 5.2.3 Regulatory and market access support

- 5.2.4 Evidence network

- 5.2.5 Other services

- 5.3 Data sets

- 5.3.1 Disparate data sets

- 5.3.1.1 Clinical settings data

- 5.3.1.2 Claims data sets

- 5.3.1.3 Pharmacy data sets

- 5.3.1.4 Patient powered data sets

- 5.3.1.5 Registry-based data sets

- 5.3.2 Integrated data sets

- 5.3.1 Disparate data sets

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drug development and approval

- 6.2.1 Oncology

- 6.2.2 Cardiovascular disease

- 6.2.3 Neurology

- 6.2.4 Immunology

- 6.2.5 Other therapeutic areas

- 6.3 Medical device development and approvals

- 6.4 Post-market surveillance

- 6.5 Market access and reimbursement/coverage decision-making

- 6.6 Clinical and regulatory decision-making

Chapter 7 Market Estimates and Forecast, By Revenue Model, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pay-per-use (value-based pricing)

- 7.3 Subscription

Chapter 8 Market Estimates and Forecast, By Deployment Model, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 On-premise

- 8.3 Cloud-based

Chapter 9 Market Estimates and Forecast, By End use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Pharmaceutical and medical device companies

- 9.3 Healthcare payers

- 9.4 Healthcare providers

- 9.5 Other end use

Chapter 10 Company Profiles

- 10.1 Aetion, Inc.

- 10.2 Cytel Inc

- 10.3 Flatiron Health Inc

- 10.4 Fortrea Holdings Inc

- 10.5 IBM Corporation

- 10.6 ICON plc

- 10.7 IQVIA Holdings Inc

- 10.8 Medidata Solutions, Inc.

- 10.9 Merative

- 10.10 Oracle Corporation

- 10.11 Parexel International Corporation

- 10.12 Syneos Health Inc

- 10.13 Tempus

- 10.14 TriNetX

- 10.15 Thermo Fisher Scientific, Inc.

- 10.16 UnitedHealth Group Incorporated