|

市场调查报告书

商品编码

1858864

软体机器人用液晶弹性体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Liquid Crystal Elastomers for Soft Robotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

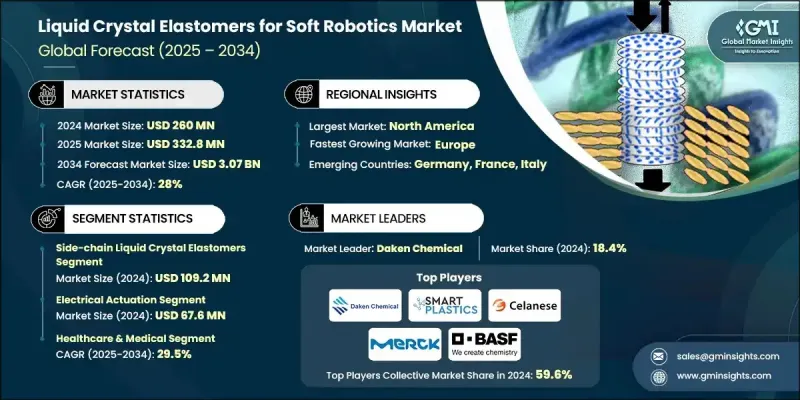

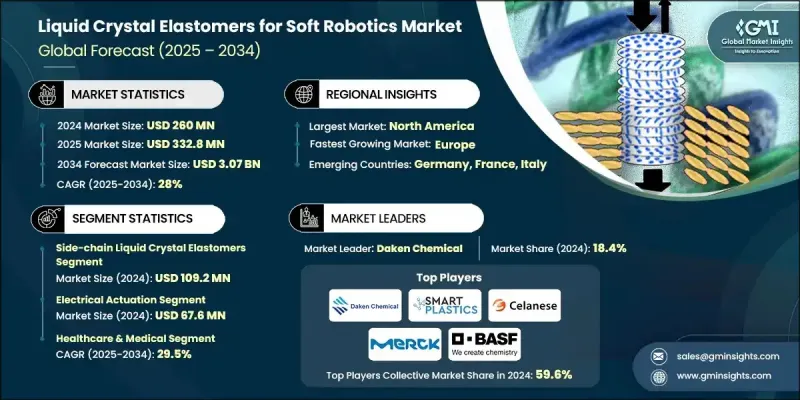

2024 年全球软体机器人用液晶弹性体市场价值为 2.6 亿美元,预计到 2034 年将以 28% 的复合年增长率成长至 30.7 亿美元。

在医疗保健、消费科技和自动化等领域,对液晶弹性体的需求正日益增长,性能和整合度的提升发挥着至关重要的作用。其应用趋势与其他颠覆性致动器技术的发展趋势相符,尤其是在液晶弹性体纤维的功率密度达到 293 W/kg、做功能力高达 650 J/kg 时,其性能已超越天然肌肉。随着纤维基和编织系统在实际负载条件下持续实现多功能运动,人们对其可扩展性和工业可靠性的信心也在不断增强。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.6亿美元 |

| 预测值 | 30.7亿美元 |

| 复合年增长率 | 28% |

由于需要客製化液晶基元、取向层和交联剂,材料成本约占总成本的35-40%;而製造成本则占25-30%,这主要是由于精确交联、分子取向和高保真加工等技术要求。然而,随着直接墨水书写和先进纤维挤出等积层製造技术的普及,这种成本结构正在发生变化,这些技术降低了资本投入,并扩大了设计自由度。现在无需客製化模具即可实现复杂的几何形状和特定位置的材料取向,从而加快原型製作速度并实现多样化的终端产品线。

到2024年,製造服务板块将占据25%的市场份额,这反映了高端製造技术在交付成品液晶元件方面的重要作用。以性能为导向的采购方式正日益取代以材料为中心的采购方式,整合系统和可程式驱动技术正日益受到重视。

2024年,侧链液晶弹性体(LCE)市场规模达到1.092亿美元,凭藉其适应性强、成本效益高且易于加工等优势,占据了市场主导地位。侧链型液晶弹性体在纺织品和柔性穿戴设备领域表现出色,而主链型和混合型液晶弹性体则因其强度和热稳定性,在航太、机器人和精密应用领域日益普及。随着4D列印技术的进步,能够实现具有高方向控制的多层、多材料构建,预计这些不同结构之间的竞争优势将进一步缩小,市场细分将更多地基于功能而非结构。

2024年,北美软体机器人用液晶弹性体市占率达45%。该地区的领先地位得益于强大的研究生态系统、国防主导的计划以及医疗创新。政府支持的研发活动推动了金属化液晶弹性体薄膜和可编程热性能的突破,这些技术目前正应用于穿戴式压缩系统和临床级义肢。美国市场正随着国防和医疗保健需求的增长而扩张,而加拿大的贡献则主要来自大学机器人项目,这些项目正在试点用于人机互动的软驱动技术。目前的临床试验表明,该技术可在20-60 mmHg范围内调节驱动,并可重复使用,这增强了人们对医疗级应用的信心。

活跃于软体机器人液晶弹性体市场的主要企业包括默克集团(Merck KGaA)、巴斯夫公司(BASF SE)、塞拉尼斯公司(Celanese Corporation)、Beam公司、达肯化学公司(Daken Chemical)、Smart-Plastics Ltd、Synthon Chemicals、Wilshire Technologies和TCI America。这些企业正利用创新、策略合作和材料工程技术来确保长期成长。研发重点在于改进液晶弹性体的分子设计、耐久性和温度稳定性,同时拓展其合成能力,以实现可扩展的生产规模。企业正投资于精密製造技术,例如4D列印和先进挤出技术,以支援客製化几何形状和精确的对准控制。与学术机构和医疗器材开发商的合作,正帮助企业根据医疗保健、航太和穿戴式科技等领域的需求来定製材料。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 刺激反应驱动能力

- 积层製造技术的进步

- 对自主和自持机器人的需求

- 整合到智慧纺织品和可穿戴设备中

- 产业陷阱与挑战

- 执行速度慢

- 复杂的製造技术

- 功率密度有限

- 市场机会

- 有助于开发具有更高灵活性和精确性的下一代生物医学设备

- 促进智慧穿戴装置和响应式纺织品的创新

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 副产品

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依材料类型划分,2021-2034年

- 主要趋势

- 主链液晶弹性体

- 聚硅氧烷基液晶弹性体

- 基于聚丙烯酸酯的液晶弹性体

- 聚酯基液晶弹性体

- 聚氨酯基液晶弹性体

- 侧链液晶弹性体

- 端基侧链LCE

- 侧链液晶弹性体

- 侧向连接的液晶弹性体

- 离子液晶弹性体(iLCEs)

- 阳离子型液晶弹性体

- 阴离子型液晶弹性体

- 两性离子液晶弹性体

- 复合型和混合型液晶弹性体

- 碳基复合材料(碳奈米管、石墨烯、氧化石墨烯)

- 金属奈米颗粒复合材料(Au、Ag、Fe3O4)

- 液态金属嵌入式液晶弹性体

- 陶瓷填充液晶弹性体

第六章:市场估算与预测:以驱动方式划分,2021-2034年

- 主要趋势

- 热驱动

- 直接热加热

- 焦耳热(电热)

- 感应加热

- 光学驱动

- 光化学(偶氮苯基)

- 光热(碳奈米管、金奈米粒子)

- 近红外线响应

- 对可见光有响应

- 电动驱动

- 介电驱动

- 静电驱动

- 离子驱动

- 磁场驱动

- 磁热

- 直接磁扭矩

- 多模态驱动

- 热光组合

- 电热组合

- 射频控制系统

第七章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 医疗保健

- 医疗器材及植入物

- 义肢和矫形器

- 药物输送系统

- 手术机器人

- 復健设备

- 生物医学研究工具

- 航太与国防

- 变形飞机结构

- 自适应伪装系统

- 可展开式空间结构

- 自主军用机器人

- 监视与侦察

- 导弹和火箭部件

- 製造与工业自动化

- 软体机器人抓手

- 装配线自动化

- 物料搬运系统

- 品质控制与检验

- 包装与加工

- 维护和维修机器人

- 消费性电子产品和穿戴式装置

- 智慧纺织品和服装

- 穿戴式健康监测器

- 触觉回馈设备

- 柔性显示器

- 个人辅助设备

- 游戏与娱乐

- 汽车

- 自适应座椅系统

- 主动空气动力学

- 振动阻尼

- 车内舒适系统

- 安全防护系统

- 研发

- 学术研究机构

- 政府研究实验室

- 材料测试与表征

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Smart-Plastics Ltd

- Celanese Corporation

- Merck KGaA

- Synthon Chemicals

- Beam Co

- Wilshire Technologies

- TCI America

- BASF Corporation

- Daken Chemical

The Global Liquid Crystal Elastomers for Soft Robotics Market was valued at USD 260 million in 2024 and is estimated to grow at a CAGR of 28% to reach USD 3.07 billion by 2034.

The demand is gaining momentum across sectors like healthcare, consumer tech, and automation, with advancements in performance and integration playing a crucial role. The adoption curve mirrors trends observed in other disruptive actuator technologies, particularly as LCE fibers begin outperforming natural muscle with power density reaching 293 W/kg and work capacity up to 650 J/kg. As fiber-based and woven systems consistently deliver multifunctional motion under real load conditions, confidence in scalability and industrial reliability is accelerating.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $260 Million |

| Forecast Value | $3.07 Billion |

| CAGR | 28% |

Material costs account for approximately 35-40% of the total due to the need for tailored mesogens, alignment layers, and crosslinkers, while fabrication represents another 25-30% owing to technical demands like precise crosslinking, molecular alignment, and high-fidelity machining. However, this cost structure is evolving as additive manufacturing methods such as direct ink writing and advanced fiber extrusion gain traction, reducing capital requirements and expanding design freedom. Complex geometries and site-specific material alignment are now possible without custom molds, enabling quicker prototyping and diversified end-product lines.

The manufacturing services segment held 25% share in 2024, reflecting the role of high-end fabrication techniques in delivering finished LCE components. Performance-driven buying is increasingly replacing materials-focused procurement, with integrated systems and programmable actuation gaining priority.

In 2024, sidechain LCEs segment accounted for USD 109.2 million, capturing a dominant share due to their balance of adaptability, cost-efficiency, and ease of processing. While side-chain types excel in textiles and flexible wearables, main-chain and hybrid structures are gaining popularity in aerospace, robotics, and precision applications due to their strength and thermal stability. As 4D printing technologies evolve, allowing for multilayer, multimaterial builds with high directional control, the competitive edge between these formats is expected to tighten, leading to greater market segmentation based on function rather than format.

North America Liquid Crystal Elastomers for Soft Robotics Market held 45% share in 2024. The region's dominance is driven by strong research ecosystems, defense-led initiatives, and medical innovation. Government-backed R&D has led to breakthroughs in metallized LCE films and programmable thermal properties, which are now finding applications in wearable compression systems and clinical-grade prosthetics. The US market is expanding with defense and healthcare demand, while Canada's contribution is shaped by university-based robotics programs piloting soft actuation for human-machine interfaces. Current clinical pilots demonstrate adjustable actuation between 20-60 mmHg and reusable cycling, reinforcing confidence in healthcare-grade applications.

Key players active in the Liquid Crystal Elastomers for Soft Robotics Market include Merck KGaA, BASF SE, Celanese Corporation, Beam Co, Daken Chemical, Smart-Plastics Ltd, Synthon Chemicals, Wilshire Technologies, and TCI America. Companies competing in the Liquid Crystal Elastomers for Soft Robotics Market are leveraging innovation, strategic partnerships, and materials engineering to secure long-term growth. Focused R&D is being used to improve molecular design, durability, and temperature stability of LCEs while also expanding synthesis capabilities for scalable formats. Players are investing in precision manufacturing techniques such as 4D printing and advanced extrusion to support custom geometries and alignment control. Collaborations with academic institutions and medical device developers are helping firms tailor their materials to healthcare, aerospace, and wearable tech.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Admixtures

- 2.2.3 Application Methods

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stimuli-responsive actuation capabilities

- 3.2.1.2 Advancements in additive manufacturing

- 3.2.1.3 Demand for autonomous and self-sustained robotics

- 3.2.1.4 Integration into smart textiles and wearables

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Slow actuation speed

- 3.2.2.2 Complex fabrication techniques

- 3.2.2.3 Limited power density

- 3.2.3 Market opportunities

- 3.2.3.1 Enables development of next-gen biomedical devices with enhanced flexibility and precision

- 3.2.3.2 Facilitates innovation in smart wearables and responsive textiles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Main-chain liquid crystal elastomers

- 5.2.1 Polysiloxane-based LCEs

- 5.2.2 Polyacrylate-based LCEs

- 5.2.3 Polyester-based LCEs

- 5.2.4 Polyurethane-based LCEs

- 5.3 Side-chain liquid crystal elastomers

- 5.3.1 End-on Sidechain LCEs

- 5.3.2 Side-on Sidechain LCEs

- 5.3.3 Laterally Attached LCEs

- 5.4 Ionic liquid crystal elastomers (iLCEs)

- 5.4.1 Cationic iLCEs

- 5.4.2 Anionic iLCEs

- 5.4.3 Zwitterionic iLCEs

- 5.5 Composite & hybrid LCEs

- 5.5.1 Carbon-based Composites (CNT, Graphene, GO)

- 5.5.2 Metal Nanoparticle Composites (Au, Ag, Fe3O4)

- 5.5.3 Liquid Metal Embedded LCEs

- 5.5.4 Ceramic-filled LCEs

Chapter 6 Market Estimates and Forecast, By Actuation Mode, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Thermal actuation

- 6.2.1 Direct thermal heating

- 6.2.2 Joule heating (electrothermal)

- 6.2.3 Induction heating

- 6.3 Optical actuation

- 6.3.1 Photochemical (azobenzene-based)

- 6.3.2 Photothermal (CNT, gold nanoparticles)

- 6.3.3 Near-infrared responsive

- 6.3.4 Visible light responsive

- 6.4 Electrical actuation

- 6.4.1 Dielectric actuation

- 6.4.2 Electrostatic actuation

- 6.4.3 Ionic actuation

- 6.5 Magnetic field actuation

- 6.5.1 Magnetothermal

- 6.5.2 Direct magnetic torque

- 6.6 Multi-modal actuation

- 6.6.1 Thermal-optical combined

- 6.6.2 Electrical-thermal combined

- 6.6.3 Rf-controlled systems

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Healthcare & Medical

- 7.2.1 Medical devices & implants

- 7.2.2 Prosthetics & orthotics

- 7.2.3 Drug delivery systems

- 7.2.4 Surgical robotics

- 7.2.5 Rehabilitation equipment

- 7.2.6 Biomedical research tools

- 7.3 Aerospace & Defense

- 7.3.1 Morphing aircraft structures

- 7.3.2 Adaptive camouflage systems

- 7.3.3 Deployable space structures

- 7.3.4 Autonomous military robots

- 7.3.5 Surveillance & reconnaissance

- 7.3.6 Missile & rocket components

- 7.4 Manufacturing & Industrial Automation

- 7.4.1 Soft robotic grippers

- 7.4.2 Assembly line automation

- 7.4.3 Material handling systems

- 7.4.4 Quality control & inspection

- 7.4.5 Packaging & processing

- 7.4.6 Maintenance & repair robots

- 7.5 Consumer Electronics & Wearables

- 7.5.1 Smart textiles & clothing

- 7.5.2 Wearable health monitors

- 7.5.3 Haptic feedback devices

- 7.5.4 Flexible displays

- 7.5.5 Personal assistive devices

- 7.5.6 Gaming & entertainment

- 7.6 Automotive

- 7.6.1 Adaptive seating systems

- 7.6.2 Active aerodynamics

- 7.6.3 Vibration damping

- 7.6.4 Interior comfort systems

- 7.6.5 Safety & protection systems

- 7.7 Research & Development

- 7.7.1 Academic research institutions

- 7.7.2 Government research labs

- 7.7.3 Material testing & characterization

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Smart-Plastics Ltd

- 9.2 Celanese Corporation

- 9.3 Merck KGaA

- 9.4 Synthon Chemicals

- 9.5 Beam Co

- 9.6 Wilshire Technologies

- 9.7 TCI America

- 9.8 BASF Corporation

- 9.9 Daken Chemical