|

市场调查报告书

商品编码

1641830

软机器人-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Soft Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

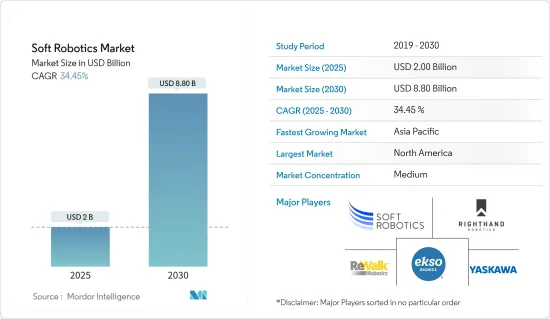

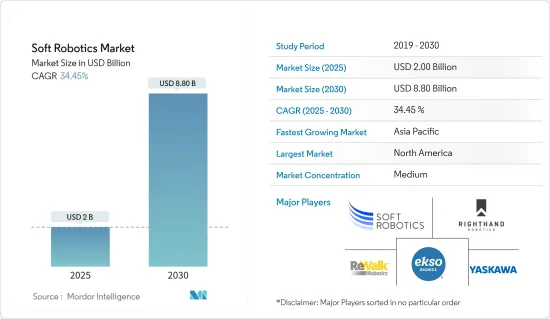

预计 2025 年软机器人市场规模为 20 亿美元,到 2030 年将达到 88 亿美元,预测期内(2025-2030 年)的复合年增长率为 34.45%。

关键亮点

- 儘管软机器人技术仍处于起步阶段,但由于软机器人技术比传统机器人技术具有多种优势,预计在预测期内其应用将呈指数级增长。

- 推动软机器人市场发展的因素包括各终端用户产业的安全需求不断提高,以及食品加工、电子商务等领域对自动化的需求日益增长。多个国家不断增加的研发投资/资金筹措正在推动软机器人市场的成长。

- 外骨骼是一项新技术,可保护仓库和製造工人免受肩痛、背痛、颈部疼痛以及因举重和重复性劳损引起的伤害。许多研究人员正在开发模仿肌肉运动的软性、穿戴式机器人。 2021年5月,加拿大皇后大学的研究团队开发了一种可降低行走代谢成本的外骨骼。这项研究是透过设计一种外骨骼来取代步行过程中的一些煞车功能,从而降低步行的总代谢成本。

- 医疗和非医疗外骨骼均需遵守 ISO/IEC 发布的国际安全监管要求。为了这些产品能够成功商业化,製造商必须遵守这些法规。此外,核准的机会也是主观的。此外,获得批准的可能性具有主观性,并且只有在有合理保证该设备适合其预期用途的情况下才能获得批准。由于这些原因,以及缺乏集中的监管机构,商业化被推迟,限制了市场的潜在成长。

- 各公司正致力于开发柔软的气动夹持器,这种夹持器非常适合处理易碎食品,否则刚性机器人可能会损坏这些食品。由于劳动力短缺和对疾病传播的担忧,疫情期间,食品成为人们对自动化兴趣增加的主要目标。 2021 年 6 月,这家软机器人公司以疫情相关需求为由,筹集 1000 万美元,用于突破性软体抓取、3D 感知和人工智慧技术的研究和开发。

软体机器人市场趋势

医疗和外科应用有望实现最高成长

- 软体机器人装置可帮助治疗和模拟心血管疾病、主动脉瓣狭窄以及 ALS 等疾病引起的肢体损伤。它还可以改善缺血性心臟疾病心臟再生的标靶治疗。根据联合国人口基金预测,到2050年,印度患有心臟病的老年人数量预计将达到1,910万人左右。这样的案例可能会增加研究市场的需求。

- 软机器人本身俱有与人体和生物体的天然组织相容的优势。微创手术(MIS)是采用软机器人技术具有巨大潜力的研究领域之一。这是因为它克服了传统 MIS 方法的局限性,例如自由度低。

- 开放性手术和腹腔镜手术的局限性以及机器人手术系统日益增强的优势预计将推动全球机器人辅助手术的采用率。人体软体机器人手术的灵感来自软体动物,其应用专为微创手术 (MIS) 设计,使外科医生能够使用当前的锁孔手术技术进入以前无法进入的区域。一些研究实验室和医疗技术公司正在进行类似的研究,新的软机器人创新将重塑医生进行手术的方式。

- 根据 IEEE 于 2022 年 5 月开展的一项关于软机器人辅助微创手术 (RAMIS) 和干预措施的研究,腹腔镜手术的出现使外科医生能够透过小切口进行手术,这导致手术迅速从传统的开放性手术在外科界中占有重要地位。下一步合乎逻辑的是从手持式仪器转换为 RAMIS。借助机器人和直觉的使用者介面,外科医生可以轻鬆执行复杂的手术程序,部分复製开放性手术的便利条件。

- 此外,3D 列印软质塑胶,如生物相容性软材料、超弹性材料和硅橡胶,可以提高手术期间的安全性。这些可以根据触摸改变机器人的形态和机械性能,使其本质上更安全。这些发展可能会扩大软机器人的范围,并与腹腔镜检查和单切口腹腔镜检查等微创手术程序相关。

- 2022 年 1 月,Benchmark 宣布已与 Titan Medical 签订製造供应协议,为 Titan 的 Enos Robotics 工作站和单端口手术系统製造病人推车。该公司之所以被选中,是因为它在设计、製造和组装复杂医疗设备方面拥有丰富的经验,并且拥有垂直整合能力以及按需扩大生产的能力。该公司正在将其製造解决方案与 Titan 的相机和铰接式仪器相结合,以帮助实现其生产用于人体测试的手术工作站和病人推车的目标,该目标定于 2023 年开始。

- 机器人手术市场预计将受益于全球泌尿系统、妇科和整形外科等慢性疾病的日益普及。根据世界卫生组织(WHO)的最新报告,心血管疾病、癌症、糖尿病和慢性呼吸系统疾病等非传染性疾病(NCD)占全球死亡人数的近71%。每年有 4,100 万人死于这些非传染性疾病。

预计亚太地区将在预测期内实现最快成长

- 软机器人是用具有与生物组织相当的机械性能的材料建构的系统。这些机器人本质上应该比传统机器人更具创新性。亚太地区研究市场出现了一些领先的创新。

- 例如,2023年1月,中国科学院宁波材料技术工程实验室陈涛教授领衔的智慧高分子材料主题小组与浙江大学郑银飞教授合作,研发出了基于水凝胶的自适应变形软体机器人。上的多维越野驾驶。这款手套有望帮助手指或手部受伤的人的手指肌肉运动,并支持手部的抓握感。

- 亚太地区是软体机器人成长最快的市场之一。该地区的供应商也在软机器人领域的技术创新和发展中发挥关键作用。 2023 年 5 月,麻省理工学院 (MIT) 的一组研究人员朝着开发 SoftZoo 迈出了一步,这是一个受生物启发的平台,可让工程师研究软机器人的协作设计。该框架优化了由决定机器人外观的设计和实现机器人运动的控制系统组成的演算法,增强了用户自动生成潜在机器轮廓的能力。

- 2022 年 9 月,一组中国研究人员开发了微型机器人,这是一种由磁力驱动的强大变形装置,可在人体内移动并解决各种健康状况。这款精密的软机器人长度仅为一毫米,据称能够在血管内跳跃和蠕动,以治疗心血管疾病。

- 食品组装是亚太地区一个潜在的庞大市场。新加坡科技大学的研究人员看到了利用软机器人来提高这些经常重复的製造和组装任务的效率的机会。 2023 年 3 月,在 A*STAR 国家机器人计画的资助下,研究人员开发了可重构工作空间软 (RWS) 机器人夹持器。机械手优化的机器视觉可以适应系统中配置的“工作区”,使 RWS 机器人夹持器能够拾取和抓取各种物品。

- 日本政府正在与大学和公司合作开发机器人手术系统,该系统可以帮助医生更精确地进行手术,同时监测 MRI 读数和其他设备的资料。此外,2022 年 10 月,日本筑波大学的研究小组开发了软体机器人,患者可以与之互动,以减轻在接受痛苦或不舒服的医疗程序时的压力和恐惧。

软体机器人产业概览

软体机器人市场正在投入大量资金进行技术投资,预计会有新参与企业出现。目前,软体机器人製造商拥有非常专业的解决方案,市场竞争适中。然而,随着机器人市场主要参与者的出现,软机器人领域的竞争预计将变得更加激烈。

- 2024 年 2 月 - RightHand Robotics 是订单履行自主 AI 机器人拣选解决方案的领导者之一,宣布与美国工作空间产品和解决方案领导者之一 Staples Inc. 达成多年期协议。该交易将使史泰博公司能够安装 RightPick 物品处理系统并实现自动化操作,从而实现更高的服务水平和次日送达美国98% 以上地区的目的。

- 2023 年 12 月 - ReWalk Robotics, Ltd. 是领先的创新技术提供者之一,该技术可帮助神经系统疾病患者的康復和日常生活中实现移动性和健康,该公司宣布演示了概念验证的下一代外骨骼。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 需要更安全的自动化解决方案

- 製造业中个人安全的需求

- 各国加大研发力道

- 市场限制

- 缺乏意识和集中监管机构

第六章 技术简介

第七章 市场区隔

- 按应用

- 人机介面与互动

- 运动与探索

- 操纵

- 医疗外科应用

- 復健与穿戴机器人

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第八章 竞争格局

- 公司简介

- Soft Robotics Inc

- RightHand Robotics Inc

- Ekso Bionics Holdings Inc

- Rewalk Robotics Ltd

- Yaskawa Electric Corporation

- Bioservo Technologies AB

- Festo AG

- Roam Robotics

- ABB Ltd.

- Pneubotics Inc

第九章投资分析

第十章 市场机会与未来趋势

The Soft Robotics Market size is estimated at USD 2.00 billion in 2025, and is expected to reach USD 8.80 billion by 2030, at a CAGR of 34.45% during the forecast period (2025-2030).

Key Highlights

- Though soft robotics is still in its early stages, with the variety of benefits offered by soft robots compared to traditional robots, the penetration of soft robots is expected to grow dramatically over the forecast period.

- Factors driving the development of the soft robotics market include the increasing demand for safety across the various end-user industries and the growing need for automation in food processing, e-commerce, etc. The ever-increasing investments/funding in research and development across multiple nations is fueling the growth of the soft robotics market.

- Exoskeletons are an emerging developing technology that has the potential to protect and save warehouse and manufacturing workers from shoulders, back pain, neck pain, and injuries related to heavy and repetitive lifting. Various researchers are developing soft, wearable robots that mimic muscle movements. In May 2021, a team of researchers at Queen's University in Canada developed an exoskeleton that reduces the metabolic cost of walking. The research is based on designing an exoskeleton that obtains over some of the brakings that occur during walking, thereby reducing the total metabolic cost of walking.

- Medical and non-medical exoskeletons are subjected to international safety regulatory requirements published by ISO (International Organization for Standardization)/IEC. For successful commercialization of these products, manufacturers must comply with these regulations. Also, the chances for approval are subjective. They can be achieved only if there is a reasonable assurance that the device is appropriate for its application. Because of these reasons and the lack of a single centralized regulatory body, the commercialization aspect is delayed, thus restraining the potential growth of the market.

- Various players have been focusing on developing soft, pneumatic-powered grippers ideal for fragile foodstuff that might be damaged by rigid robotics otherwise. Food has been a prime target for interest in automation during the pandemic due to labor shortages and fears of disease transmission. In June 2021, Soft Robotics company cited pandemic-related demand and raised USD 10 million for research and development in its revolutionary soft grasping, 3D perception, and AI technologies.

Soft Robotics Market Trends

Medical and Surgical Applications is Anticipated to Register Highest Growth

- Soft robotic devices can assist in treating or simulating conditions like cardiovascular disease, aortic stenosis, and limb disabilities causes by diseases like ALS. They have the potential to improve targeted therapy for cardiac regeneration in ischemic heart diseases. According to the United Nations Population Fund, the number of cases of heart disease in senior citizens across India in 2050 was forecasted to be about 19.1 million. Such instances are likely to augment the demand for the studied market.

- Soft robots inherently have the advantage of being compliant with the natural tissues of humans and living organisms. Minimally invasive surgery (MIS) is one of the research areas with the big potential of adopting soft robotics. This is because it overcomes the limitation of traditional MIS methods, such as a low degree of freedom.

- The limitations of open and laparoscopic procedures and the increasing advantages of robotic surgery systems are expected to boost the adoption rates of robot-assisted surgeries worldwide. Soft-robotic surgery on a human body has been inspired by soft-bodied animals with applications specifically designed for minimally invasive surgery (MIS), opening up areas previously inaccessible to surgeons using current keyhole surgery techniques. With similar research being active across multiple researcher labs, and medtech companies innovating new soft robots will likely shape how physicians perform surgeries.

- According to a study conducted on Soft Robot-Assisted Minimally Invasive Surgery (RAMIS) and Interventions by IEEE in May 2022, with the arrival of laparoscopic surgery, which is performed through narrow incisions, the surgical community saw a rapid move away from traditional open surgery. Switching from handheld instruments to RAMIS was the next logical step. Surgeons could easily perform complex surgical procedures with the help of robots and an intuitive user interface, partially replicating the easily accessible situation of open surgery.

- Furthermore, biocompatible soft materials, super elastic materials, and 3D-printed soft plastics such as silicone elastomers allow for greater safety during surgeries. These allow changes in robotic shape and mechanical properties in response to touch, thus enhancing their greater intrinsic safety. Such developments are likely to expand the scope of soft robotics and become relevant to procedures in minimally invasive surgery, such as laparoscopy, single port laparoscopy, etc.

- In January 2022, Benchmark announced a manufacturing and supply agreement with Titan Medical to manufacture patient carts for Titan's Enos robotic workstations and single-port surgical systems. The company was selected for its experience and vertical integration in designing, manufacturing, and assembling complex medical devices and its ability to scale production to meet demand. The company has integrated its manufacturing solutions with Titan's cameras and articulated instruments to help achieve its goal of manufacturing surgical workstations and patient carts for use in human studies scheduled to begin in 2023.

- The robotic surgery market is expected to benefit from the growing incidence of chronic diseases such as urology, gynecology, orthopedic, and other chronic disorders worldwide. According to the latest World Health Organization (WHO) report, non-communicable diseases (NCDs), such as cardiovascular disease, cancer, diabetes, and chronic respiratory diseases, are responsible for almost 71% of global deaths. It accounts for 41 million people dying each year of these NCDs.

Asia Pacific is Expected to Register the Fastest Growth During the Forecast Period

- Soft robots are systems constructed from materials that have mechanical properties comparable to those of living tissues. These robots are intrinsically assumed to be more innovative than conventional robots. The Asia Pacific region is witnessing several advanced innovations in the studied market.

- For instance, in January 2023, the Smart Polymer Materials Group led by Prof. CHEN Tao at the Ningbo Institute of Materials Technology and Engineering of the Chinese Academy of Sciences, in cooperation with Prof. ZHENG Yinfei at Zhejiang University, developed a hydrogel-based soft robot with adaptive deformation, realizing multi-dimensional off-road locomotion on natural terrains. Its creators expect that the glove would help people with finger or hand injuries by aiding the movement of finger muscles, helping them feel the grasp of holding with one's hands.

- Asia-Pacific is one of the fastest-growing markets for soft robotics mainly due to the massive adoption of the technology with increasing domestic production in the market. The regional vendors also play a significant role in the innovation and development in the soft robotics field. In May 2023, a team of MIT researchers took a step towards developing SoftZoo, a bio-inspired platform that allows engineers to study soft robot co-design. The framework optimizes algorithms that consist of design, which determines what the robot would look like, and control, or the system that allows robotic motion, enhancing how users automatically generate outlines for potential machines.

- In September 2022, a Chinese research team created a powerful micro robot, a shape-shifting device driven by a magnetic force that is able to travel within the human body and help address an array of health conditions. The high-performance soft robot, which is just a millimeter long, is claimed to be able to bounce or squirm within blood vessels to treat cardiovascular disease, among other potential applications.

- Food assembly is a potentially big market in the Asia Pacific region. The researchers from the Singapore University of Technology and Design saw an opportunity to use soft robotics to improve the efficiency of manufacturing and assembly operations - where tasks of this nature tend to be repetitive. In March 2023, with funding support from A*STAR's National Robotics Programme, the researchers came up with a reconfigurable workspace soft (RWS) robotic gripper. The robotic hand-optimized machine vision adapts to the 'workspace' configured in the system, so the RWS robotic gripper is equipped with the ability to scoop and grasp a wide range of items.

- Additionally, in Japan, the government is collaborating with universities and companies to develop a robotic surgery system that allows doctors to operate more accurately and simultaneously monitor MRI readings and data from other devices. Further, in October 2022, a team of researchers at the University of Tsukuba in Japan developed a soft robot that patients can interact with to decrease their stress and fear when undergoing painful or uncomfortable medical procedures.

Soft Robotics Industry Overview

The Soft Robotics Market has seen huge investments in the technical front, and new entrants are expected to emerge in the market. Currently, soft robot manufacturers have very specific solutions, and the market is moderately competitive. However, with the advent of big players in the robotics market, venturing into soft robotics is expected to increase the competition.

- February 2024 - RightHand Robotics, one of the leaders in autonomous AI robotic picking solutions for order completion, announces a multi-year agreement with Staples Inc., one of the Americas leaders in workspace products and solutions. The agreement allows Staples to deploy and install the RightPick item-handling system to automate operations for higher service levels and Next-Day Delivery to over 98% of the United States.

- December 2023 - ReWalk Robotics, Ltd., one of the leading providers of innovative technologies that enable mobility and wellness in rehabilitation and daily life for individuals with neurological conditions, announced the successful demonstration of a proof-of-concept next-generation exoskeleton.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Safer Automation Solutions

- 5.1.2 Need for Human Safety in Manufacturing Units

- 5.1.3 Increased R&D From Various Countries

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness and a Single Centralized Regulatory Body

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Application

- 7.1.1 Human-machine Interface and Interaction

- 7.1.2 Locomotion and Exploration

- 7.1.3 Manipulation

- 7.1.4 Medical and Surgical Applications

- 7.1.5 Rehabilitation and Wearable Robots

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia

- 7.2.4 Australia and New Zealand

- 7.2.5 Latin America

- 7.2.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Soft Robotics Inc

- 8.1.2 RightHand Robotics Inc

- 8.1.3 Ekso Bionics Holdings Inc

- 8.1.4 Rewalk Robotics Ltd

- 8.1.5 Yaskawa Electric Corporation

- 8.1.6 Bioservo Technologies AB

- 8.1.7 Festo AG

- 8.1.8 Roam Robotics

- 8.1.9 ABB Ltd.

- 8.1.10 Pneubotics Inc