|

市场调查报告书

商品编码

1858876

汽车边缘人工智慧加速器市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Edge AI Accelerators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

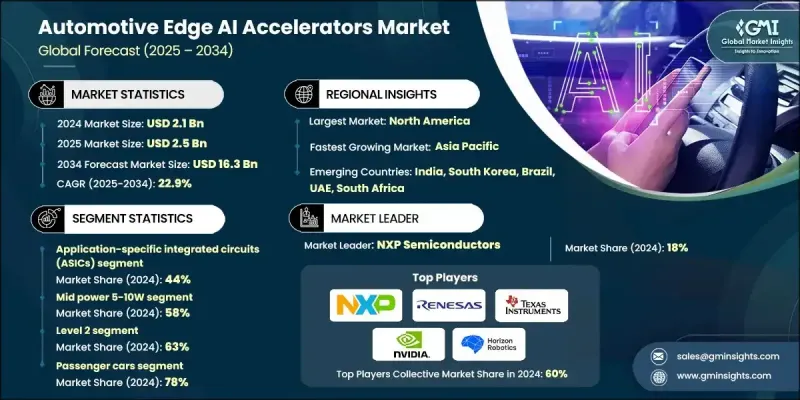

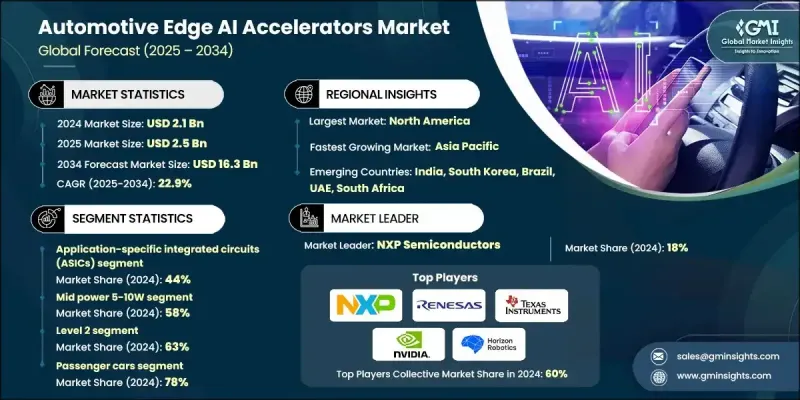

2024 年全球汽车边缘 AI 加速器市场价值为 21 亿美元,预计到 2034 年将以 22.9% 的复合年增长率增长至 163 亿美元。

市场扩张与现代车辆中即时处理能力的日益普及密切相关。从GPU和FPGA到ASIC和NPU等边缘AI加速器,在实现诸如ADAS、驾驶员感知监控、智慧资讯娱乐和语音互动等复杂车载系统方面正变得不可或缺。随着车辆向软体定义互联平台转型,对快速、高效、本地化的AI运算的需求急剧增长。向电动、半自动驾驶和自动驾驶汽车的转变进一步强化了对边缘AI加速的需求。以超低延迟处理来自光达、雷达和摄影机等感测器的海量资料流对于车辆安全和性能至关重要。此外,与网路安全、功能安全和即时空中软体更新相关的法规要求也强化了对边缘高效能AI硬体的需求。电动车对电池优化处理器的需求不断增长,进一步推动了该领域的创新。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21亿美元 |

| 预测值 | 163亿美元 |

| 复合年增长率 | 22.9% |

2024年,专用积体电路(ASIC)市占率达到44%,预计到2034年将以24.1%的复合年增长率成长。这些晶片经过精心设计,能够以最高的能源效率和最小的延迟提供特定任务的人工智慧处理。其客製化架构支援无缝处理感知建模、决策和即时感测器资料处理等任务,使其非常适合先进的汽车应用。

中等功率(5-10W)晶片在2024年占据58%的市场份额,预计在预测期内将以23.8%的复合年增长率成长。此功率范围在性能、效率和散热平衡之间取得了最佳平衡。它既能为进阶驾驶辅助功能(例如多摄影机输入处理和即时物体侦测)提供足够的功率,又能将发热量和功耗控制在车辆设计限制范围内。此晶片市场定位精准,能够满足现代车辆架构日益增长的需求,这些架构既注重性能又注重节能。

北美汽车边缘人工智慧加速器市场占据34%的市场份额,预计到2024年将创造7.034亿美元的市场规模。这一领先地位源于不断完善的监管框架、对人工智慧研发的大量投资以及高度成熟的汽车技术生态系统。该地区强大的机构支援以及科技和汽车企业积极的创新倡议,加速了边缘人工智慧硬体在商用车和乘用车领域的部署。

全球汽车边缘人工智慧加速器市场的主要参与者包括瑞萨电子、高通、英伟达、Arm、Horizon Robotics、德州仪器 (TI)、英飞凌科技、恩智浦半导体、义法半导体和Mobileye。这些领先企业正致力于整合晶片设计、策略合作和效能优化,以获得竞争优势。许多企业正在投资客製化人工智慧晶片的开发,以最大限度地提高运算能力并最大限度地降低能耗,从而满足电动车和自动驾驶平台对边缘处理日益增长的需求。与原始设备製造商 (OEM) 和一级供应商的合作,正在推动针对高级驾驶辅助系统 (ADAS) 和资讯娱乐系统量身定制的平台专用加速器的共同开发。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预报

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 先进驾驶辅助系统(ADAS)的需求日益增长

- 自动驾驶汽车的普及率不断提高

- 更重视车辆安全保障

- 政府法规促进车辆自动化

- 互联汽车技术的扩展

- 人工智慧晶片技术的进步

- 产业陷阱与挑战

- 先进人工智慧硬体成本高昂

- 整合边缘人工智慧系统的复杂性

- 市场机会

- 不断成长的电动车市场

- 智慧车队管理的需求日益增长

- 新兴市场对汽车人工智慧的投资

- 晶片製造商与汽车製造商之间的合作

- 成长驱动因素

- 成长潜力分析

- 专利分析

- 波特的分析

- PESTEL 分析

- 成本細項分析

- 技术格局

- 当前技术趋势

- 新兴技术

- 监管环境

- ISO 26262 功能安全要求

- AUTOSAR自适应平台合规性

- ASPICE软体开发标准

- 网路安全标准(ISO 21434)

- 价格趋势

- 按地区

- 透过处理器

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 投资与融资趋势分析

- 安全与网路安全框架分析

- 硬体安全模组 (HSM) 集成

- 安全启动和可信任执行环境

- 空中下载 (OTA) 更新安全性

- 生态系伙伴关係与联盟分析

- 晶片OEM策略合作伙伴关係

- 软体平台协作

- 总拥有成本 (TCO) 分析

- 硬体购置成本

- 软体开发和整合成本

- 验证和认证费用

- 製造和部署成本

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依处理器划分,2021-2034年

- 主要趋势

- 中央处理器(CPU)

- 图形处理器(GPU)

- 专用积体电路(ASIC)

- 现场可程式闸阵列(FPGA)

第六章:市场估算与预测:依电力产业划分,2021-2034年

- 主要趋势

- 低功耗(<5W)

- 中功率 5-10W

- 高功率 >10W

第七章:市场估计与预测:依自主程度划分,2021-2034年

- 主要趋势

- 一级

- 二级

- 3级

- 4级

- 5级

第八章:市场估算与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 印尼

- 菲律宾

- 泰国

- 韩国

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- 全球参与者

- Arm

- Horizon Robotics

- Infineon Technologies

- MediaTek

- Mobileye

- NVIDIA

- NXP Semiconductors

- Qualcomm

- Renesas Electronics

- Samsung Electronics

- STMicroelectronics

- Texas Instruments (TI)

- 区域玩家

- CEVA

- GlobalFoundries

- HiSilicon

- Nextchip

- SemiDrive

- Socionext

- Tsinghua Unigroup

- Verisilicon

- 新兴参与者/颠覆者

- Ambarella

- Hailo Technologies

- Kneron

- Mythic

- SiMa.ai

The Global Automotive Edge AI Accelerators Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 22.9% to reach USD 16.3 billion by 2034.

The market's expansion is tied to the growing implementation of real-time processing capabilities in modern vehicles. Edge AI accelerators ranging from GPUs and FPGAs to ASICs and NPUs are becoming indispensable in enabling complex in-vehicle systems such as ADAS, driver awareness monitoring, intelligent infotainment, and voice interaction features. As vehicles transition into software-defined, connected platforms, the demand for fast, efficient, localized AI computation has accelerated sharply. The shift toward electric, semi-autonomous, and autonomous vehicles further intensifies the need for edge-based AI acceleration. Handling massive data flows from sensors like LiDAR, radar, and cameras with ultra-low latency is critical to safety and vehicle performance. Additionally, regulatory requirements tied to cybersecurity, functional safety, and real-time over-the-air software updates are reinforcing the need for high-performance AI hardware at the edge. The increasing demand for battery-optimized processors in electric vehicles further drives innovation in this space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $16.3 Billion |

| CAGR | 22.9% |

The application-specific integrated circuits (ASICs) segment held a 44% share in 2024 and is anticipated to grow at a 24.1% CAGR through 2034. These chips are engineered to deliver task-specific AI processing with maximum energy efficiency and minimal delay. Their tailored architecture supports seamless handling of tasks such as perception modeling, decision-making, and real-time sensor data processing, making them highly suitable for advanced automotive applications.

The mid-power (5-10W) segment held 58% share in 2024 and will grow at a CAGR of 23.8% through the forecast period. This power range hits the sweet spot between performance, efficiency, and thermal balance. It offers adequate capacity for advanced driver assistance functions like multi-camera input handling and live object detection while maintaining heat and power consumption levels manageable within vehicle design constraints. The segment is well-positioned to cater to rising demands from modern vehicle architectures that prioritize both performance and energy savings.

North America Automotive Edge AI Accelerators Market held a 34% share and generated USD 703.4 million in 2024. This leadership stems from a combination of evolving regulatory frameworks, substantial investments in AI development, and a highly mature automotive technology ecosystem. Strong institutional support and aggressive innovation by tech and automotive players in the region have accelerated the deployment of edge AI hardware across both commercial and passenger vehicle segments.

Key players operating in the Global Automotive Edge AI Accelerators Market include Renesas Electronics, Qualcomm, NVIDIA, Arm, Horizon Robotics, Texas Instruments (TI), Infineon Technologies, NXP Semiconductors, STMicroelectronics, and Mobileye. Leading companies in the Global Automotive Edge AI Accelerators Market are focusing on integrated chip design, strategic collaborations, and performance optimization to gain a competitive edge. Many players are investing in custom AI chip development to maximize computing power while minimizing energy consumption, addressing the growing demand for edge processing in EVs and autonomous platforms. Partnerships with OEMs and Tier 1 suppliers are enabling co-development of platform-specific accelerators tailored to ADAS and infotainment systems.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Processor

- 2.2.3 Power

- 2.2.4 Level of autonomy

- 2.2.5 Vehicle

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for advanced driver assistance systems (ADAS)

- 3.2.1.2 Rising adoption of autonomous vehicles

- 3.2.1.3 Increased focus on vehicle safety and security

- 3.2.1.4 Government regulations promoting vehicle automation

- 3.2.1.5 Expansion of connected car technologies

- 3.2.1.6 Advancements in AI chip technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced AI hardware

- 3.2.2.2 Complexity in integrating edge AI systems

- 3.2.3 Market opportunities

- 3.2.3.1 Growing electric vehicle (EV) market

- 3.2.3.2 Rising demand for smart fleet management

- 3.2.3.3 Emerging markets investing in automotive AI

- 3.2.3.4 Collaborations between chipmakers and automakers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Cost breakdown analysis

- 3.8 Technology landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Regulatory landscape

- 3.9.1 ISO 26262 functional safety requirements

- 3.9.2 AUTOSAR adaptive platform compliance

- 3.9.3 ASPICE software development standards

- 3.9.4 Cybersecurity standards (ISO 21434)

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By processor

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Investment & funding trends analysis

- 3.13 Security & cybersecurity framework analysis

- 3.13.1 Hardware security module (HSM) integration

- 3.13.2 Secure boot & trusted execution environment

- 3.13.3 Over-the-air (OTA) update security

- 3.14 Ecosystem partnerships & alliance analysis

- 3.14.1 Chip-OEM strategic partnerships

- 3.14.2 Software platform collaborations

- 3.15 Total cost of ownership (TCO) analysis

- 3.15.1 Hardware acquisition costs

- 3.15.2 Software development & integration costs

- 3.15.3 Validation & certification expenses

- 3.15.4 Manufacturing & deployment costs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Processor, 2021 - 2034 (USD Bn, Units)

- 5.1 Key trends

- 5.2 Central processing unit (CPU)

- 5.3 Graphics processing unit (GPU)

- 5.4 Application-specific integrated circuits (ASICs)

- 5.5 Field-programmable gate array (FPGA)

Chapter 6 Market Estimates & Forecast, By Power, 2021 - 2034 (USD Bn, Units)

- 6.1 Key trends

- 6.2 Low power <5W

- 6.3 Mid power 5-10W

- 6.4 High power >10W

Chapter 7 Market Estimates & Forecast, By Level of autonomy, 2021 - 2034 (USD Bn, Units)

- 7.1 Key trends

- 7.2 Level 1

- 7.3 Level 2

- 7.4 Level 3

- 7.5 Level 4

- 7.6 Level 5

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Bn, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCV)

- 8.3.2 Medium commercial vehicles (MCV)

- 8.3.3 Heavy commercial vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Arm

- 10.1.2 Horizon Robotics

- 10.1.3 Infineon Technologies

- 10.1.4 MediaTek

- 10.1.5 Mobileye

- 10.1.6 NVIDIA

- 10.1.7 NXP Semiconductors

- 10.1.8 Qualcomm

- 10.1.9 Renesas Electronics

- 10.1.10 Samsung Electronics

- 10.1.11 STMicroelectronics

- 10.1.12 Texas Instruments (TI)

- 10.2 Regional Players

- 10.2.1 CEVA

- 10.2.2 GlobalFoundries

- 10.2.3 HiSilicon

- 10.2.4 Nextchip

- 10.2.5 SemiDrive

- 10.2.6 Socionext

- 10.2.7 Tsinghua Unigroup

- 10.2.8 Verisilicon

- 10.3 Emerging Players / Disruptors

- 10.3.1 Ambarella

- 10.3.2 Hailo Technologies

- 10.3.3 Kneron

- 10.3.4 Mythic

- 10.3.5 SiMa.ai