|

市场调查报告书

商品编码

1858877

宠物咀嚼物及零食市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Pet Chews and Treats Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

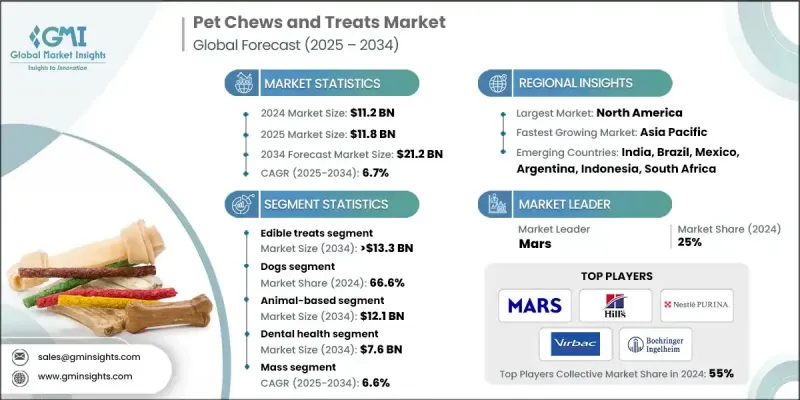

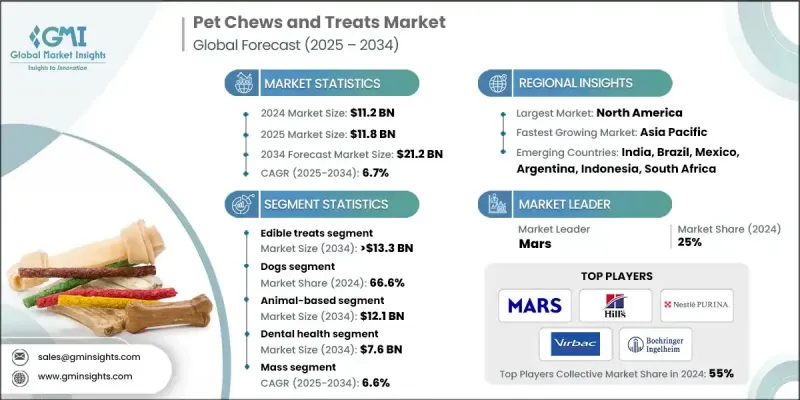

2024 年全球宠物咀嚼零食市场价值 112 亿美元,预计到 2034 年将以 6.7% 的复合年增长率增长至 212 亿美元。

宠物主人对宠物健康(尤其是肠道健康)重要性的认识不断提高,是推动宠物食品市场成长的主要因素。同时,微生物组、免疫力、心理健康和慢性病预防的研究也正在加速市场扩大。此外,年轻一代,尤其是千禧世代和Z世代,越来越倾向于为宠物选择益生元和益生菌等功能性食品。个人化营养和诊断技术的兴起也发挥了重要作用,使得客製化的健康解决方案成为可能,进一步促进了宠物咀嚼片和点心的普及。随着功能性成分的创新不断涌现,市场上出现了针对性产品,例如用于肠道健康的益生菌、用于关节支持的胶原蛋白以及植物性舒缓产品。这种向整体健康解决方案的转变与宠物拟人化的趋势相符,从而推动了对功能性零食的更大需求。因此,包括洁齿咀嚼片、舒缓产品以及富含维生素和益生菌的零食在内的专业宠物咀嚼片市场预计将显着成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 112亿美元 |

| 预测值 | 212亿美元 |

| 复合年增长率 | 6.7% |

受消费者偏好转变和宠物拟人化趋势的推动,宠物零食市场预计在2024年将创造72亿美元的收入。如今,宠物主人不仅希望找到奖励宠物的零食,更希望找到兼具营养和健康益处的产品。这些零食种类繁多,从富含蛋白质到支持关节健康的,应有尽有,适合日常食用。由于添加了清洁标籤成分、天然配方以及针对特定犬种定制的产品,这些零食越来越受欢迎。此外,随着电子商务的兴起,宠物主人更容易购买这些零食,从而提高了购买频率,推动了市场成长。

2024年,犬类产品市占率预计将达到66.6%,主要归功于较高的养犬率和人们对犬类健康日益增长的关注。犬隻越来越被视为家庭成员,促使主人优先选择能够满足各种健康需求的优质功能性产品,例如关节护理、消化和口腔卫生。犬主与爱犬之间深厚的情感纽带也持续推动着人们对具有特定健康益处的高品质专业零食的需求。

2024年,北美宠物咀嚼零食市占率将达45%。该地区是宠物产品最大的消费市场,这主要得益于较高的宠物拥有率和不断增长的宠物保健支出。美国约有6800万户家庭养狗,4900万户家庭养猫,这为宠物食品和健康零食提供了庞大的消费群体。

全球宠物咀嚼零食市场的主要参与者包括玛氏、普瑞纳宠物护理(雀巢旗下)、维托奎诺、维克、勃林格殷格翰、Ceva Sante Animale、希尔思宠物营养(高露洁棕榄旗下)、PetDine 和 HeroDogTreats 等公司。这些公司不断创新,以在快速成长的市场中保持竞争力。为了巩固自身地位,宠物咀嚼零食产业的公司正致力于采取多种策略措施。其中一个主要策略是持续创新功能性成分,以提供特定的健康益处,例如益生菌促进肠道健康、关节护理产品和舒缓配方。此外,许多公司正在投资研发清洁标籤产品,以满足消费者对成分来源透明度的日益增长的需求。拓展产品线,以满足特定宠物品种、体型和健康需求也是一项关键策略。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 宠物拥有率上升

- 宠物护理支出不断增加

- 人们越来越关注宠物健康和福祉

- 宠物牙齿问题病例日益增多

- 扩展电子商务平台

- 产业陷阱与挑战

- 成分过敏和敏感性

- 监管挑战

- 市场机会

- 日益关注功能性成分创新

- 技术整合

- 天然和有机产品需求不断成长

- 成长驱动因素

- 成长潜力分析

- 技术格局

- 当前技术趋势

- 新兴技术

- 监管环境

- 2024年宠物数量统计数据

- 定价分析

- 动物保健产业的投资与融资环境

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 可食用零食

- 可食用咀嚼物

第六章:市场估算与预测:依宠物类型划分,2021-2034年

- 主要趋势

- 狗

- 猫

- 其他宠物类型

第七章:市场估算与预测:依成分类型划分,2021-2034年

- 主要趋势

- 植物性

- 动物性

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 牙齿健康

- 活动能力和关节健康

- 消化系统健康

- 皮肤和毛髮健康

- 镇静和行为

- 其他应用

第九章:市场估算与预测:依价格区间划分,2021-2034年

- 主要趋势

- 大量的

- 优质的

第十章:市场估价与预测:依销售管道划分,2021-2034年

- 主要趋势

- 线上管道

- 离线频道

- 宠物专卖店

- 大型超市/超市

- 便利商店

- 其他线下通路

第十一章:市场估计与预测:按地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- BarkBox

- Boehringer Ingelheim

- Ceva Sante Animale

- DC Enterprises

- Dechra Pharmaceuticals

- Dogseechew

- Foshan Phoenix Pet Products

- H. von Gimborn

- HeroDogTreats

- Hills Pet Nutrition (Colgate-Palmolive)

- Mars

- Packnpride

- PetDine

- Petmex

- Petsona

- Purina PetCare (Nestle)

- Vetoquinol

- Virbac

The Global Pet Chews and Treats Market was valued at USD 11.2 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 21.2 billion by 2034.

The growth is driven by rising pet owners' awareness of the importance of pet health, particularly gut health. Along with this, research into microbiomes, immunity, mental well-being, and chronic disease prevention is also accelerating the market's expansion. Additionally, younger generations, particularly Millennials and Gen Z, are increasingly seeking functional foods, such as prebiotics and probiotics, for their pets. The rise of personalized nutrition and diagnostics technologies has also played a major role, allowing for custom health solutions that further boost the adoption of pet chews and treats. As innovation in functional ingredients increases, the market is witnessing the launch of targeted products like probiotics for gut health, collagen for joint support, and plant-based calming options. This shift toward holistic wellness solutions is in line with the growing trend of pet humanization, which is driving greater demand for functional treats. As a result, the market for specialized pet chews, including dental chews, calming products, and vitamin- and probiotic-enriched treats, is set to expand significantly.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.2 Billion |

| Forecast Value | $21.2 Billion |

| CAGR | 6.7% |

The edible treats segment generated USD 7.2 billion in 2024, driven by changing consumer preferences and an increase in pet humanization. Pet owners are now looking for treats that not only serve as rewards but also offer health benefits. These treats come in various forms, from protein-rich options to joint health support, making them suitable for daily use. Their appeal has grown due to the inclusion of clean-label ingredients, natural formulations, and products tailored for specific breeds. Additionally, with the rise of e-commerce, these treats are more accessible to pet owners, boosting purchase frequency and driving market growth.

The dog segment held a 66.6% share in 2024, attributed to the high rate of dog ownership and a growing awareness of canine health. Dogs are increasingly viewed as family members, prompting owners to prioritize premium, functional products that address various health needs, such as joint care, digestion, and dental hygiene. The emotional bond between dog owners and their pets continues to fuel demand for specialized, high-quality treats designed for specific health benefits.

North America Pet Chews and Treats Market held a 45% share in 2024. The region is the largest consumer of pet products, driven by a high pet ownership rate and increased spending on pet wellness. Approximately 68 million households in the U.S. own dogs, while 49 million own cats, providing a substantial consumer base for pet foods and health-oriented treats.

Key players in the Global Pet Chews and Treats Market include companies such as Mars, Purina PetCare (Nestle), Vetoquinol, Virbac, Boehringer Ingelheim, Ceva Sante Animale, Hills Pet Nutrition (Colgate-Palmolive), PetDine, and HeroDogTreats, among others. These companies are continually innovating to stay competitive in a rapidly expanding market. To strengthen their position, companies in the pet chews and treats industry are focusing on several strategic approaches. A primary tactic is the continuous innovation of functional ingredients that offer specific health benefits, such as probiotics for gut health, joint care products, and calming solutions. Additionally, many companies are investing in clean-label products to meet the rising consumer demand for transparency in ingredient sourcing. Expanding their product lines to cater to specific pet breeds, sizes, and health needs is also a key strategy.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Pet type

- 2.2.4 Ingredient type

- 2.2.5 Application

- 2.2.6 Price range

- 2.2.7 Sales channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership rate

- 3.2.1.2 Increasing pet care expenditure

- 3.2.1.3 Growing awareness for pet health and wellness

- 3.2.1.4 Increasing cases of pet dental problems

- 3.2.1.5 Expanding e-commerce platform

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Ingredient allergies and sensitivities

- 3.2.2.2 Regulatory challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Growing focus on functional ingredient innovation

- 3.2.3.2 Technology integration

- 3.2.3.3 Growing natural and organic product demand

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.6 Pet population statistics 2024

- 3.7 Pricing analysis

- 3.8 Investment and funding landscape in the animal health industry

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Merger and acquisition

- 4.5.2 Partnership and collaboration

- 4.5.3 New product launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Edible treats

- 5.3 Edible chews

Chapter 6 Market Estimates and Forecast, By Pet Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Other pet types

Chapter 7 Market Estimates and Forecast, By Ingredient Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Plant-based

- 7.3 Animal-based

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Dental health

- 8.3 Mobility and joint health

- 8.4 Digestive health

- 8.5 Skin and coat health

- 8.6 Calming and behavioral

- 8.7 Other applications

Chapter 9 Market Estimates and Forecast, By Price Range, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Mass

- 9.3 Premium

Chapter 10 Market Estimates and Forecast, By Sales Channel, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Online channels

- 10.3 Offline channels

- 10.3.1 Pet specialty stores

- 10.3.2 Hypermarkets/ supermarkets

- 10.3.3 Convenience store

- 10.3.4 Other offline channels

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 BarkBox

- 12.2 Boehringer Ingelheim

- 12.3 Ceva Sante Animale

- 12.4 D.C. Enterprises

- 12.5 Dechra Pharmaceuticals

- 12.6 Dogseechew

- 12.7 Foshan Phoenix Pet Products

- 12.8 H. von Gimborn

- 12.9 HeroDogTreats

- 12.10 Hills Pet Nutrition (Colgate-Palmolive)

- 12.11 Mars

- 12.12 Packnpride

- 12.13 PetDine

- 12.14 Petmex

- 12.15 Petsona

- 12.16 Purina PetCare (Nestle)

- 12.17 Vetoquinol

- 12.18 Virbac