|

市场调查报告书

商品编码

1858969

医疗保健3D列印市场机会、成长驱动因素、产业趋势分析及2025-2034年预测Healthcare 3D Printing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

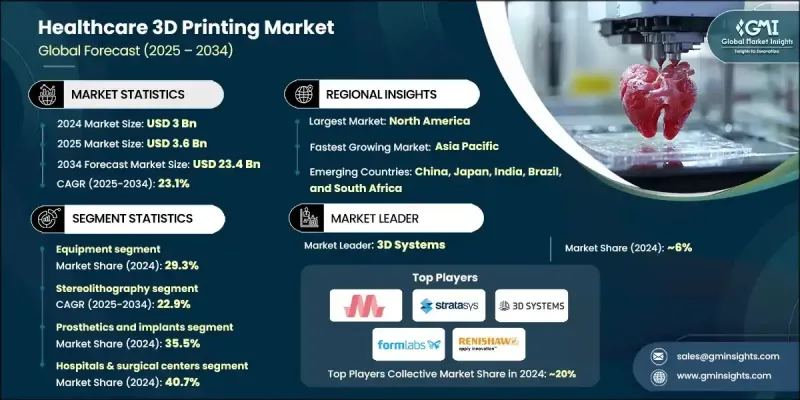

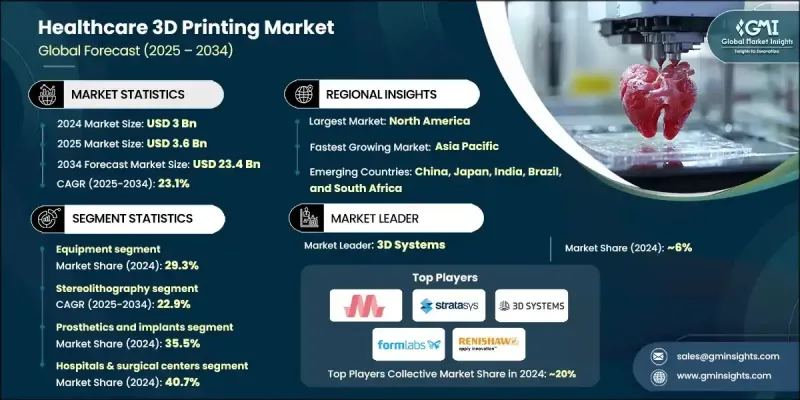

2024 年全球医疗保健 3D 列印市场价值为 30 亿美元,预计到 2034 年将以 23.1% 的复合年增长率增长至 234 亿美元。

3D列印技术的快速成长得益于对个人化医疗解决方案日益增长的需求、研发投入的增加以及临床应用范围的不断扩大。随着医疗保健系统向更加以患者为中心、精准化的方向发展,3D列印在外科手术规划、义肢製造和再生医学等领域持续发挥着至关重要的作用。人口老化加剧,加上生物列印和植入物客製化技术的进步,加速了对高效、精准且经济实惠的技术的需求。医疗机构和学术中心纷纷建立内部3D列印实验室,以缩短回应时间并提升病患照护水准。这些倡议反映了整个行业正在朝着整合数位设计和增材製造技术以改善诊断和治疗效果的方向发展。随着人们对3D列印解决方案在医疗保健领域价值的认识不断提高,医院、实验室和专科护理机构的采用率也在不断上升,进一步巩固了3D列印市场的上升趋势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 30亿美元 |

| 预测值 | 234亿美元 |

| 复合年增长率 | 23.1% |

典型的医疗3D列印设备包括一台3D列印机或生物列印机、专用设计软体以及医用安全材料,例如金属、聚合物或水凝胶。这些系统可以将CT或MRI扫描的影像资料转化为精确的实体模型或病患客製化的医疗器械,从而实现高度个人化的医疗干预。

2024年,设备领域占据了29.3%的市场份额,这主要得益于医疗机构中先进3D列印机的日益普及。医院和实验室正越来越多地采用这项技术,在院内生产个人化工具、解剖模型和植入物,从而显着缩短等待时间并改善手术计划。即时製造的趋势正在加速发展,设备已成为医疗保健3D列印领域的核心支柱。随着人们越来越关注个人化护理和营运效率,对可靠、高性能设备的需求预计将持续成长。

预计到2034年,立体光刻(SLA)领域将以22.9%的复合年增长率成长。 SLA以其高解析度输出和卓越的精确度而备受青睐,使其成为製造复杂医疗结构的理想选择。其应用范围涵盖牙科修復体、患者客製化导板和解剖模型等多个领域,使其成为精准、精细医疗列印的首选技术。

预计到2024年,北美医疗保健3D列印市场占有率将达到42%。该地区的成长得益于先进的医疗基础设施、对创新技术的早期应用以及对医学研究的持续投入。製造商、医疗服务提供者和监管机构之间紧密协作的生态系统,使北美成为医疗保健领域3D列印技术发展的热点地区。美国和加拿大的医院正在积极采用这项技术,用于客製化病患植入物、手术建模和义肢设计。

塑造全球医疗保健3D列印市场格局的关键企业包括:formLabs、OPM、nanoscribe、PROTOLABS、3D Systems、stratasys、Axial3D、ExOne、EOS、RENISHAW、materialise、ETEC 和 KONICA MINOLTA。这些企业正致力于策略性研发投资,以提高材料的生物相容性、列印速度和解析度。许多企业正在拓展产品组合,涵盖软体、服务解决方案和生物列印功能。与医院、研究中心和大学的合作有助于加速创新并扩展临床应用。一些企业也正在建立区域性合作伙伴关係,以加强分销管道并改善即时3D列印服务的可及性。客製化是重点关注领域,企业提供针对植入物、手术规划和牙科应用的客製化解决方案。监管合规和认证仍然是重中之重,确保产品能够安全地应用于医疗环境。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 对客製化植入物的需求不断增长

- 製造商和机构增加研发投入

- 拓展临床应用

- 技术进步

- 产业陷阱与挑战

- 缺乏熟练的专业人员

- 3D列印的高成本

- 市场机会

- 新兴市场采用率不断上升

- 人工智慧与仿真集成

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 目前技术

- 新兴技术

- 未来市场趋势

- 消费者行为分析

- 管道分析

- 投资环境

- 创业场景

- 2024年定价分析

- 波特的分析

- PESTEL 分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 装置

- 3D印表机

- 3D生物列印机

- 材料

- 塑胶

- 热塑性塑料

- 光敏聚合物

- 金属和金属合金

- 生物材料

- 陶瓷

- 纸

- 蜡

- 其他材料

- 塑胶

- 服务和软体

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 立体光刻技术

- 熔融沈积成型(FDM)

- 选择性雷射烧结(SLS)

- 金属印刷

- 其他技术

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 义肢和植体

- 牙科

- 生物列印

- 组织和器官的生成

- 其他应用

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院和外科中心

- 牙医诊所

- 医疗器材製造商

- 其他最终用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 3D Systems

- Axial3D

- eos

- ETEC

- ExOne

- formlabs

- KONICA MINOLTA

- materialise

- nanoscribe

- OPM

- PROTOLABS

- RENISHAW

- stratasys

The Global Healthcare 3D Printing Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 23.1% to reach USD 23.4 billion by 2034.

The rapid growth is fueled by increasing demand for personalized medical solutions, rising investments in research and development, and the growing range of clinical uses. As healthcare systems shift toward more patient-specific and precision-driven approaches, 3D printing continues to play a critical role across surgical planning, prosthetics, and regenerative medicine. The growing elderly population, coupled with advancements in bioprinting and implant customization, is accelerating the need for efficient, accurate, and cost-effective technologies. Healthcare institutions and academic centers are setting up in-house 3D printing labs, improving response times, and enhancing patient care. These efforts reflect a larger industry movement toward integrating digital design and additive manufacturing for improved diagnostics and treatment outcomes. As awareness increases around the value of 3D printed solutions in the healthcare setting, adoption is rising across hospitals, labs, and specialized care facilities, further solidifying the market's upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 23.1% |

A typical healthcare 3D printing setup includes a 3D printer or bioprinter, dedicated software for design, and medically safe materials such as metals, polymers, or hydrogels. These systems transform imaging data from CT or MRI scans into precise physical models or patient-specific medical devices, allowing for highly tailored healthcare interventions.

In 2024, the equipment segment held a 29.3% share, driven by the growing installation of sophisticated 3D printers across healthcare settings. Hospitals and labs are increasingly adopting this technology to produce personalized tools, anatomical models, and implants in-house, significantly reducing wait times and improving surgical planning. The trend of point-of-care manufacturing is gaining momentum, positioning equipment as a central pillar in the healthcare 3D printing landscape. As the focus continues to shift toward personalized care and operational efficiency, demand for reliable and high-performance equipment is expected to grow consistently.

The stereolithography (SLA) segment is expected to grow at a CAGR of 22.9% through 2034. SLA is favored for its high-resolution output and exceptional accuracy, making it ideal for creating complex medical structures. Its use spans across multiple applications such as dental prosthetics, patient-specific guides, and anatomical models, making it the go-to technology for precise, detailed medical printing.

North America Healthcare 3D Printing Market held a 42% share in 2024. The region's growth is supported by advanced healthcare infrastructure, early adoption of innovative technologies, and consistent funding for medical research. A well-integrated ecosystem involving manufacturers, healthcare providers, and regulatory agencies makes North America a hotspot for 3D printing advancements in healthcare. Hospitals across the U.S. and Canada are embracing this technology for patient-specific implants, surgical modeling, and prosthetic design.

Key players shaping the Global Healthcare 3D Printing Market include: formLabs, OPM, nanoscribe, PROTOLABS, 3D Systems, stratasys, Axial3D, ExOne, EOS, RENISHAW, materialise, ETEC, and KONICA MINOLTA. Companies operating in the Healthcare 3D Printing Market are focusing on strategic R&D investments to improve material biocompatibility, print speed, and resolution. Many are expanding their product portfolios to include software, service solutions, and bioprinting capabilities. Collaborations with hospitals, research centers, and universities help to accelerate innovation and broaden clinical applications. Several players are also building region-specific partnerships to strengthen their distribution channels and improve access to point-of-care 3D printing. Customization is a major focus, with firms offering tailored solutions for implants, surgical planning, and dental applications. Regulatory compliance and certifications remain a priority, ensuring safe integration into medical settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for custom implants

- 3.2.1.2 Increasing R&D investments from manufacturers and institutions

- 3.2.1.3 Extending clinical applications

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Lack of skilled professionals

- 3.2.2.2 High price associated with 3D printing

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption in emerging markets

- 3.2.3.2 AI & simulation integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Consumer behavior analysis

- 3.8 Pipeline analysis

- 3.9 Investment landscape

- 3.10 Start-up scenario

- 3.11 Pricing analysis, 2024

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Equipment

- 5.2.1 3D printers

- 5.2.2 3D bioprinters

- 5.3 Materials

- 5.3.1 Plastics

- 5.3.1.1 Thermoplastics

- 5.3.1.2 Photopolymers

- 5.3.2 Metals and metal alloys

- 5.3.3 Biomaterials

- 5.3.4 Ceramics

- 5.3.5 Paper

- 5.3.6 Wax

- 5.3.7 Other materials

- 5.3.1 Plastics

- 5.4 Services & software

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Stereolithography

- 6.3 Fused deposition modelling (FDM)

- 6.4 Selective laser sintering (SLS)

- 6.5 Metal printing

- 6.6 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Prosthetics and implants

- 7.3 Dental

- 7.4 Bioprinting

- 7.5 Tissue and organ generation

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals & surgical centers

- 8.3 Dental clinics

- 8.4 Medical device manufacturers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3D Systems

- 10.2 Axial3D

- 10.3 eos

- 10.4 ETEC

- 10.5 ExOne

- 10.6 formlabs

- 10.7 KONICA MINOLTA

- 10.8 materialise

- 10.9 nanoscribe

- 10.10 OPM

- 10.11 PROTOLABS

- 10.12 RENISHAW

- 10.13 stratasys