|

市场调查报告书

商品编码

1858974

罐装酒精饮料市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Canned Alcoholic Beverages Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

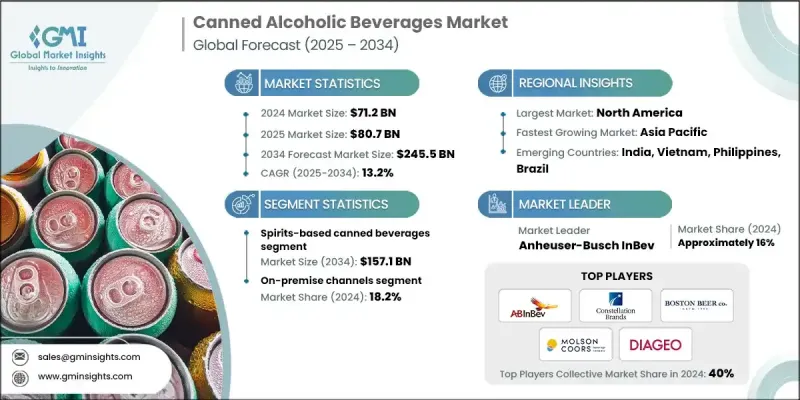

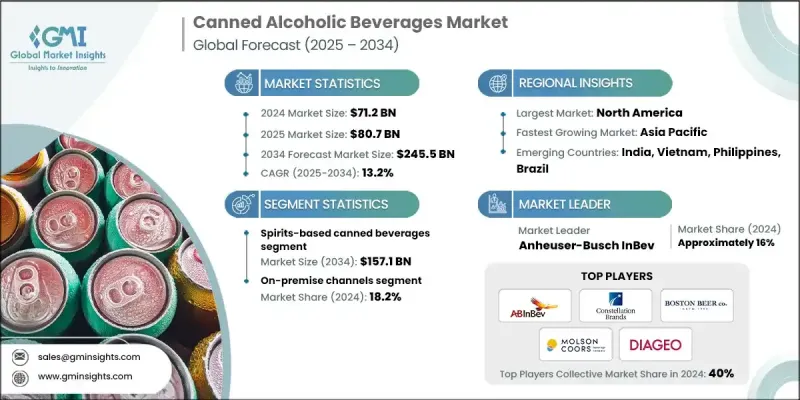

2024 年全球罐装酒精饮料市场价值 712 亿美元,预计到 2034 年将以 13.2% 的复合年增长率增长至 2,455 亿美元。

罐装酒精饮料市场成长的驱动力在于其便利性、易携带性以及在现代消费者中日益增长的吸引力。这些产品适用于各种场合,包括社交聚会、节日庆典、户外活动和日常饮酒。罐装酒精饮料,例如鸡尾酒、葡萄酒、啤酒和硬苏打水,能够满足不同消费者的偏好,尤其在玻璃包装不便或受限的场所,例如海滩、公园和音乐会,更受青睐。电子商务和数位行销平台的兴起也促进了市场成长,使这些产品更容易取得和推广。随着口味、品牌和包装方面的不断创新,罐装酒精饮料行业预计将在未来几年继续扩张和多元化发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 712亿美元 |

| 预测值 | 2455亿美元 |

| 复合年增长率 | 13.2% |

2024年,罐装烈酒饮料市场规模达到467亿美元,预计到2034年将达到1,571亿美元,复合年增长率(CAGR)为12.9%。此品类已快速崛起,成为全球即饮(RTD)酒精饮料市场中最具活力且高收入的细分市场之一。其成长得益于持续的创新和产品高端化。诸如Tanqueray & Tonic RTD、Cutwater Spirits和On the Rocks等知名品牌,透过便利的罐装形式,提供复杂而媲美酒吧品质的鸡尾酒,提升了消费者的期望值。与麦芽或葡萄酒基饮料不同,即饮烈酒饮料的优点在于能够完美还原龙舌兰、伏特加或兰姆酒等烈酒的真实风味,并以专业调配鸡尾酒的真实比例进行混合。

到2024年,非现场销售管道将占据50%的市场。这一主导地位源自于该通路的便利性和易得性,尤其是在疫情后消费者行为转向居家消费和社交活动更加放鬆的情况下。酒类专卖店、连锁超市和便利商店等零售商透过大包装折扣和新口味的推出来提升性价比,从而鼓励消费者尝试购买和发现新品牌。季节性新品和地区性产品也促进了忠实消费者的重复购买行为。

2024年,美国罐装酒精饮料市场规模达259亿美元,预估年复合成长率(CAGR)为9.9%。美国市场对罐装酒精饮料的需求居高不下,这主要得益于消费者对即饮型(RTD)饮料的偏好以及美国蓬勃发展的精酿饮料产业。罐装饮料的便携性和易饮性使其越来越受欢迎,尤其是在户外环境中,这进一步推动了市场成长。

全球罐装酒精饮料市场的主要参与者包括Cutwater Spirits、Boston Beer Company、喜力(Heineken NV)、嘉士伯集团(Carlsberg Group)、星座集团(Constellation Brands)、摩森康胜饮料公司(Molson Coors Beverage Company)、帝亚吉欧(Diage Brand plc. Holdings)和百威英博(Anheuser-Busch InBev)。罐装酒精饮料市场的企业正致力于创新、高端化和市场扩张,以增强其竞争优势。帝亚吉欧、Boston Beer Company和星座集团等领先企业正在推出多样化的口味和以烈酒为主的配方,以满足不断变化的消费者口味偏好。与酒吧、餐厅和电商平台建立策略合作伙伴关係有助于扩大分销管道。此外,对永续包装、区域产品在地化和数位行销活动的投资也提升了品牌知名度。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 按酒精含量

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计

- 主要进口国

- 主要出口国

(註:贸易统计仅针对重点国家提供)

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 麦芽罐装饮料

- 传统啤酒(拉格啤酒、艾尔啤酒、黑啤酒)

- 风味麦芽饮料(FMBS)

- 麦芽硬苏打水

- 葡萄酒罐装饮料

- 罐装静止葡萄酒

- 葡萄酒苏打水和冰镇饮料

- 水果口味硬苏打水

- 罐装烈酒饮料

- 现调鸡尾酒

- 罐装长饮

- 高级罐装鸡尾酒

- 特色罐装酒精饮料

- 硬茶

- 硬咖啡

- 硬康普茶

第六章:市场估计与预测:依酒精含量划分,2021-2034年

- 主要趋势

- 无酒精产品(酒精浓度0.05% - 0.5%)

- 低酒精产品(酒精浓度:0.5% - 3.0%)

- 标准酒精饮料(酒精浓度 3.0% - 8.0%)

- 高酒精含量产品(>8.0% ABV)

第七章:市场估计与预测:依配销通路划分,2021-2034年

- 主要趋势

- 本地通路

- 酒吧和酒馆

- 餐厅及餐饮服务

- 娱乐场所

- 饭店及餐饮业

- 非现场管道

- 杂货店

- 便利商店

- 酒类商店和专卖店

- 啤酒经销商

- 控制状态通道

- 直接面向消费者(DTC)

- 电子商务与数位管道

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Anheuser-Busch InBev

- Arbor Brewing Company India

- Asahi Group Holdings

- Barnstormer Brewing & Distilling Co.

- Boston Beer Company

- Carlsberg Group

- Cervejaria Cathedral

- Cervejaria Tarantino

- Cloudburst Brewing

- Constellation Brands

- Cutwater Spirits

- Diageo plc

- Fat Bottom Brewing

- Founders Brewing Co.

- Four Mile Brewing

- Goose Island Beer Company

- Heineken NV

- Lagunitas Brewing Company

- Molson Coors Beverage Company

- Parrotdog

- Purity Brewing Co

- Stone Brewing

- Thorn Brewing Co.

- Truly Hard Seltzer (Boston Beer)

- White Claw (Mark Anthony Brands)

- Others

The Global Canned Alcoholic Beverages Market was worth USD 71.2 billion in 2024 and is estimated to grow at a CAGR of 13.2% to reach USD 245.5 billion by 2034.

The market growth is fueled by the convenience, transportability, and rising appeal of canned alcoholic beverages among modern consumers. These products are popular for a wide range of occasions, including social gatherings, festivals, outdoor events, and casual drinking. Canned alcoholic beverages, such as cocktails, wine, beer, and hard seltzers, cater to diverse consumer preferences and are especially favored in places where glass packaging is impractical or restricted, like beaches, parks, and concerts. The rise of e-commerce and digital marketing platforms has also contributed to the market's growth by making these products more accessible and easier to promote. With ongoing innovations in flavors, branding, and packaging, the canned alcoholic beverages industry is poised for continued expansion and diversification in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $71.2 Billion |

| Forecast Value | $245.5 Billion |

| CAGR | 13.2% |

The spirits-based canned beverages segment generated USD 46.7 billion in 2024 and is estimated to reach USD 157.1 billion by 2034, at a CAGR of 12.9%. This category has rapidly emerged as one of the most dynamic and high-revenue segments in the global ready-to-drink (RTD) alcoholic beverages landscape. Its growth is fueled by continued innovation and the premiumization of products. Major brands such as Tanqueray & Tonic RTD, Cutwater Spirits, and On the Rocks have elevated consumer expectations by delivering complex, bar-quality cocktails in convenient canned formats. Unlike malt- or wine-based alternatives, spirit-based RTD beverages stand out for their ability to replicate true spirit flavor profiles, such as tequila, vodka, or rum, mixed in authentic proportions that mirror professionally crafted cocktails.

The off-premise channel held a 50% share in 2024. This dominance stems from the channel's accessibility and convenience, especially as consumer behaviors shifted post-pandemic toward at-home consumption and relaxed social settings. Retailers like liquor stores, grocery chains, and convenience shops offer value through bulk-pack discounts and new flavor availability, which has encouraged trial purchases and brand discovery. Seasonal releases and region-specific product variations also drive repeat buying behavior among loyal consumers.

U.S. Canned Alcoholic Beverages Market reached USD 25.9 billion in 2024 and is projected to grow at a CAGR of 9.9%. The U.S. market leads in demand for canned alcoholic drinks, driven by consumer preferences for ready-to-drink (RTD) beverages and the country's robust craft beverage scene. The portability and ease of consumption of canned formats make them increasingly popular, particularly in outdoor environments, further fueling the market's growth.

Key players in the Global Canned Alcoholic Beverages Market are Cutwater Spirits, Boston Beer Company, Heineken N.V., Carlsberg Group, Constellation Brands, Molson Coors Beverage Company, Diageo plc, White Claw (Mark Anthony Brands), Asahi Group Holdings, and Anheuser-Busch InBev. Companies in the Canned Alcoholic Beverages Market are focusing on innovation, premiumization, and market expansion to strengthen their competitive edge. Leading players such as Diageo plc, Boston Beer Company, and Constellation Brands are introducing diverse flavor profiles and spirit-forward formulations to cater to evolving taste preferences. Strategic partnerships with bars, restaurants, and e-commerce platforms are helping boost distribution. Additionally, investments in sustainable packaging, regional product localization, and digital marketing campaigns are enhancing brand visibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Alcohol content

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.7.3 By alcohol content

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

( Note: the trade statistics will be provided for key countries only)

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Liters)

- 5.1 Key trends

- 5.2 Malt-based canned beverages

- 5.2.1 Traditional beer (lagers, ales, stouts)

- 5.2.2 Flavored malt beverages (FMBS)

- 5.2.3 Malt-based hard seltzers

- 5.3 Wine-based canned beverages

- 5.3.1 Canned still wine

- 5.3.2 Wine spritzers & coolers

- 5.3.3 Fruit-based hard seltzers

- 5.4 Spirits-based canned beverages

- 5.4.1 Rtd cocktails

- 5.4.2 Canned long drinks

- 5.4.3 Premium canned cocktails

- 5.5 Specialty canned alcoholic beverages

- 5.5.1 Hard tea

- 5.5.2 Hard coffee

- 5.5.3 Hard kombucha

Chapter 6 Market Estimates and Forecast, By Alcohol Content, 2021 - 2034 (USD Billion) (Liters)

- 6.1 Key trends

- 6.2 No-alcohol products (0.05% - 0.5% ABV)

- 6.3 Low-alcohol products (>0.5% - 3.0% ABV)

- 6.4 Standard-alcohol products (3.0% - 8.0% ABV)

- 6.5 High-alcohol products (>8.0% ABV)

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Liters)

- 7.1 Key trends

- 7.2 On-premise channels

- 7.2.1 Bars & taverns

- 7.2.2 Restaurants & food service

- 7.2.3 Entertainment venues

- 7.2.4 Hotels & hospitality

- 7.3 Off-premise channels

- 7.3.1 Grocery stores

- 7.3.2 Convenience stores

- 7.3.3 Liquor stores & specialty retail

- 7.3.4 Beer distributors

- 7.4 Control state channels

- 7.5 Direct-to-consumer (DTC)

- 7.6 E-commerce & digital channels

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Liters)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Anheuser-Busch InBev

- 9.2 Arbor Brewing Company India

- 9.3 Asahi Group Holdings

- 9.4 Barnstormer Brewing & Distilling Co.

- 9.5 Boston Beer Company

- 9.6 Carlsberg Group

- 9.7 Cervejaria Cathedral

- 9.8 Cervejaria Tarantino

- 9.9 Cloudburst Brewing

- 9.10 Constellation Brands

- 9.11 Cutwater Spirits

- 9.12 Diageo plc

- 9.13 Fat Bottom Brewing

- 9.14 Founders Brewing Co.

- 9.15 Four Mile Brewing

- 9.16 Goose Island Beer Company

- 9.17 Heineken N.V.

- 9.18 Lagunitas Brewing Company

- 9.19 Molson Coors Beverage Company

- 9.20 Parrotdog

- 9.21 Purity Brewing Co

- 9.22 Stone Brewing

- 9.23 Thorn Brewing Co.

- 9.24 Truly Hard Seltzer (Boston Beer)

- 9.25 White Claw (Mark Anthony Brands)

- 9.26 Others