|

市场调查报告书

商品编码

1858975

工业热泵市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Industrial Heat Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

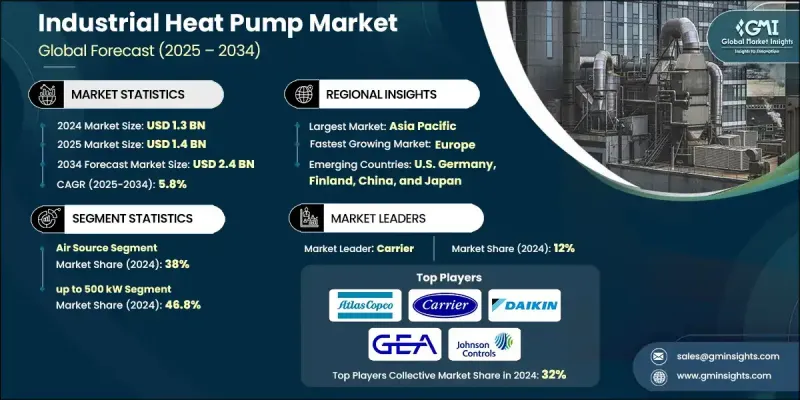

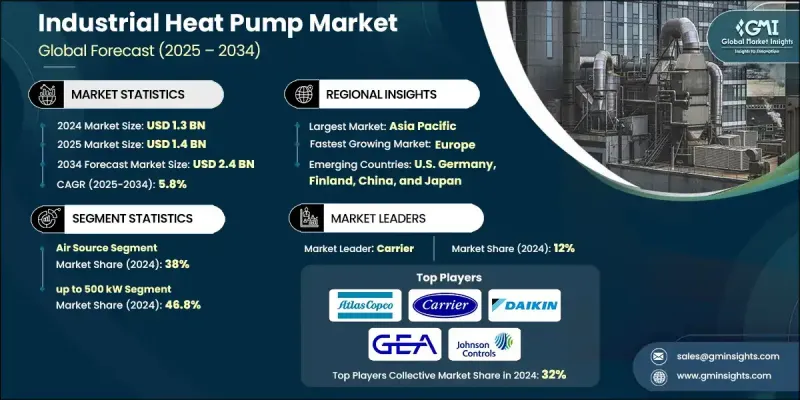

2024 年全球工业热泵市场价值为 13 亿美元,预计到 2034 年将以 5.8% 的复合年增长率增长至 24 亿美元。

日益增长的环境问题以及工业运作中减少碳排放的努力,正在推动对节能技术的需求。工业热泵已成为捕获和再利用低温废热的关键解决方案,从而提高效率和永续性。随着越来越多的产业优先考虑减少对化石燃料的依赖,这些系统的应用正在加速。支持性的监管政策,加上不断上涨的能源成本和日益增长的实现永续发展目标的压力,正在重塑各行业的热能管理方式。工业工厂对高效供暖和製冷的需求,以及逐步淘汰老旧系统的兴趣日益浓厚,持续推动着市场的发展势头。工业企业认识到热泵在提高能源效率和降低营运成本方面的潜力。加之对清洁技术和智慧基础设施(尤其是在新兴经济体)的投资不断增加,未来几年该市场可望迎来强劲成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 24亿美元 |

| 复合年增长率 | 5.8% |

到2034年,水源能源市场规模将达到1.5亿美元,这得益于其高效性和利用稳定水温的能力,该领域正日益受到关注。这些系统尤其适用于位于稳定水源附近的大型工业环境。各能源密集产业对废热回收、提高能源利用率、遵守减量法规的日益重视,正提升对水源能源系统的需求。

2024年,容量高达500千瓦的热泵市占率达到46.8%,预计到2034年将以6.5%的复合年增长率成长。各行业正稳步转向客製化的高效热力系统,以优化能源利用并减少对环境的影响。由于其在化学生产、食品加工和造纸等行业的广泛应用,该细分市场正经历快速发展,这些行业对可扩展的、针对特定应用的技术有着很高的需求。

2024年,美国工业热泵市场占85.3%的市场份额,市场规模达2.621亿美元。这一强劲的市场地位得益于製造业对可靠热力系统的日益普及,以及旨在减少碳排放的法规的不断完善。随着产业领导者致力于摆脱对化石燃料的依赖,转向更永续的热力解决方案,符合脱碳目标的高容量热泵的应用也在持续成长。

工业热泵市场竞争格局的主要参与者包括:Turboden SpA、Ecop、MAN Energy Solutions、Carrier、Qvantum Energi AB、Oilon Group Oy、Dalrada Climate Technology、Armstrong International Inc.、Johnson Controls、Atlas Copco AB、GEA Group Aktienges Euroschaft、Hien New Equix、p. Limited、Swegon Ltd、Enerin AS、OCHSNER、Emerson Electric Co.、Baker Hughes Company 和 Piller Blowers & Compressors GmbH。为了巩固自身地位,工业热泵领域的企业正优先考虑对产品创新和研发进行策略性投资,以提供更有效率、更符合现代工业需求的系统。多家企业正在拓展全球製造能力,并建立本地合作伙伴关係,以满足特定区域的需求。此外,各公司也正在调整产品组合,以适应低碳和再生能源的发展趋势,推出能够与废热回收和混合系统整合的系统。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 原物料供应及采购分析

- 影响价值链的关键因素

- 中断

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 工业热泵成本结构分析

- 新兴机会与趋势

- 利用物联网技术实现数位转型

- 新兴市场渗透

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 重要伙伴关係与合作

- 主要併购活动

- 产品创新与发布

- 市场扩张策略

- 竞争性标竿分析

- 战略仪錶板

- 创新与永续发展格局

第五章:市场规模及预测:依产品划分,2021-2034年

- 主要趋势

- 空气源

- 地面源

- 水源

- 闭式循环机械热泵

- 开式循环机械蒸汽压缩热泵

- 开式循环机械热压缩热泵

- 闭式循环吸收式热泵

第六章:市场规模及预测:依产能划分,2021-2034年

- 主要趋势

- 最高可达 500 千瓦

- 500千瓦至2兆瓦

- 2兆瓦 - 5兆瓦

- 大于 5 兆瓦

第七章:市场规模及预测:依温度划分,2021-2034年

- 主要趋势

- 80 - 100 °C

- 100 - 150 °C

- 150 - 200 °C

- > 200 °C

第八章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 工业的

- 纸

- 食品和饮料

- 化学

- 钢铁

- 机械

- 非金属矿物

- 其他行业

- 区域供热

第九章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 挪威

- 丹麦

- 芬兰

- 瑞典

- 德国

- 西班牙

- 奥地利

- 波兰

- 亚太地区

- 中国

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 土耳其

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

第十章:公司简介

- Armstrong International Inc.

- Atlas Copco AB

- Baker Hughes Company

- Carrier

- 大金应用欧洲有限公司

- Dalrada Climate Technology

- Ecop

- Emerson Electric Co.

- Enerin AS

- GEA Group Aktiengesellschaft

- Hien New Energy Equipment Co., Ltd.

- Johnson Controls

- MAN Energy Solutions

- OCHSNER

- Oilon Group Oy

- Piller Blowers & Compressors GmbH

- Qvantum Energi AB

- Swegon Ltd

- Trane Technologies International Limited

- Turboden SpA

The Global Industrial Heat Pump Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 2.4 billion by 2034.

Rising environmental concerns and increased efforts to cut carbon emissions in industrial operations are pushing the demand for energy-efficient technologies. Industrial heat pumps have emerged as a key solution for capturing and repurposing low-temperature waste heat, enhancing both efficiency and sustainability. As more industries prioritize reducing reliance on fossil fuels, the adoption of these systems is accelerating. Supportive regulatory policies, combined with increasing energy costs and growing pressure to align with sustainability targets, are reshaping how industries manage thermal energy. The need for efficient heating and cooling across industrial plants, along with growing interest in phasing out outdated systems, continues to boost market momentum. Industrial players are recognizing the potential of heat pumps to improve energy performance while cutting operational expenditures. Coupled with rising investments in clean technologies and smart infrastructure, especially across emerging economies, the market is set to witness robust expansion in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 5.8% |

The water-source segment will reach USD 150 million by 2034, as it gains traction for its high efficiency and ability to draw from stable water temperatures. These systems are particularly suited for large-scale industrial environments located near consistent water sources. Increased focus on recovering waste heat, improving energy utilization, and complying with emission-reduction regulations is elevating demand for water-based systems across energy-intensive sectors.

In 2024, the heat pumps with capacities up to 500 kW accounted for a 46.8% share and are expected to register a CAGR of 6.5% through 2034. Industries are steadily shifting toward tailored, high-efficiency thermal systems to optimize energy use and reduce environmental impact. This segment is seeing rapid development due to its versatility in sectors such as chemical production, food processing, and paper manufacturing, where scalable, application-specific technologies are in high demand.

U.S. Industrial Heat Pump Market held 85.3% share in 2024, generating USD 262.1 million. This strong market position is supported by the growing deployment of reliable thermal systems in manufacturing, coupled with evolving regulations focused on reducing carbon footprints. Adoption of high-capacity heat pumps that align with decarbonization goals continues to increase, as industry leaders aim to move away from fossil fuel-dependent technologies and transition to more sustainable thermal solutions.

Key players shaping the competitive landscape of the Industrial Heat Pump Market include Turboden S.p.A., Ecop, MAN Energy Solutions, Carrier, Qvantum Energi AB, Oilon Group Oy, Dalrada Climate Technology, Armstrong International Inc., Johnson Controls, Atlas Copco AB, GEA Group Aktiengesellschaft, Hien New Energy Equipment Co., Ltd., Daikin Applied Europe S.p.A., Trane Technologies International Limited, Swegon Ltd, Enerin AS, OCHSNER, Emerson Electric Co., Baker Hughes Company, and Piller Blowers & Compressors GmbH. To strengthen their positioning, companies in the industrial heat pump space are prioritizing strategic investments in product innovation and R&D to offer higher efficiency systems compatible with modern industrial demands. Several players are expanding global manufacturing capabilities and establishing local partnerships to cater to region-specific requirements. Firms are also aligning their portfolios with low-carbon and renewable energy trends, introducing systems capable of integrating with waste heat recovery and hybrid setups.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Capacity trends

- 2.5 Temperature trends

- 2.6 Application trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of industrial heat pumps

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Air source

- 5.3 Ground source

- 5.4 Water source

- 5.5 Closed cycle mechanical heat pump

- 5.6 Open cycle mechanical vapor compression heat pump

- 5.7 Open cycle mechanical thermocompression heat pump

- 5.8 Closed cycle absorption heat pump

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Up to 500 kW

- 6.3 > 500 kW to 2 MW

- 6.4 2 MW - 5 MW

- 6.5 > 5 MW

Chapter 7 Market Size and Forecast, By Temperature, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 80 - 100 °C

- 7.3 100 - 150 °C

- 7.4 150 - 200 °C

- 7.5 > 200 °C

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Industrial

- 8.2.1 Paper

- 8.2.2 Food & Beverages

- 8.2.3 Chemical

- 8.2.4 Iron & Steel

- 8.2.5 Machinery

- 8.2.6 Non-Metallic minerals

- 8.2.7 Other industries

- 8.3 District heating

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Norway

- 9.3.3 Denmark

- 9.3.4 Finland

- 9.3.5 Sweden

- 9.3.6 Germany

- 9.3.7 Spain

- 9.3.8 Austria

- 9.3.9 Poland

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Turkey

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Mexico

Chapter 10 Company Profiles

- 10.1 Armstrong International Inc.

- 10.2 Atlas Copco AB

- 10.3 Baker Hughes Company

- 10.4 Carrier

- 10.5 Daikin Applied Europe S.p.A.

- 10.6 Dalrada Climate Technology

- 10.7 Ecop

- 10.8 Emerson Electric Co.

- 10.9 Enerin AS

- 10.10 GEA Group Aktiengesellschaft

- 10.11 Hien New Energy Equipment Co., Ltd.

- 10.12 Johnson Controls

- 10.13 MAN Energy Solutions

- 10.14 OCHSNER

- 10.15 Oilon Group Oy

- 10.16 Piller Blowers & Compressors GmbH

- 10.17 Qvantum Energi AB

- 10.18 Swegon Ltd

- 10.19 Trane Technologies International Limited

- 10.20 Turboden S.p.A.