|

市场调查报告书

商品编码

1804837

全球大型天然冷媒热泵市场(按技术、最终用途、冷媒、容量和地区划分)- 预测至 2030 年Large scale Natural Refrigerant Heat Pump Market by Refrigerant (Ammonia, Carbon Dioxide, Hydrocarbons), by Capacity, by End Use, and by Region - Global Forecast to 2030 |

||||||

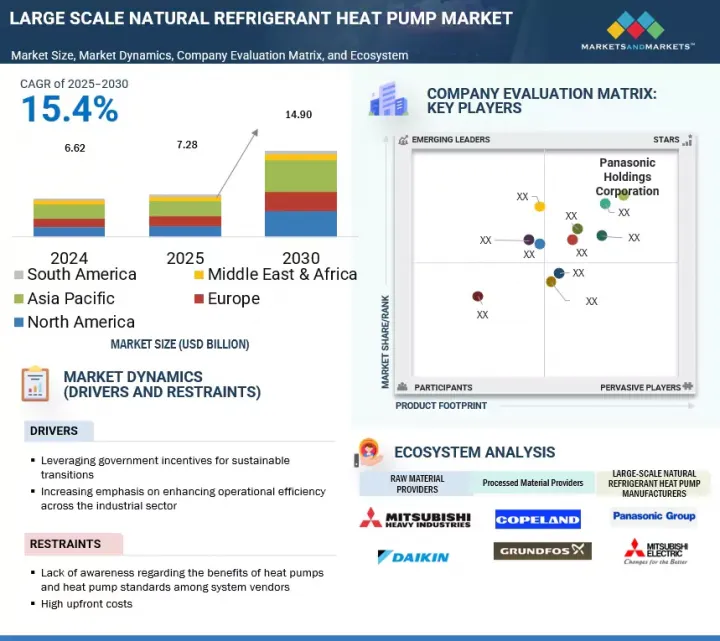

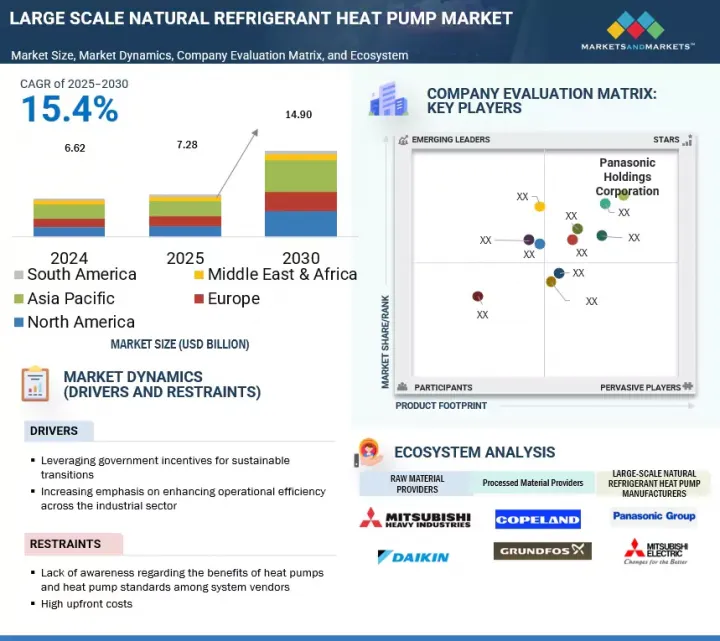

全球大型天然冷媒热泵市场预计将从 2025 年的 72.8 亿美元成长到 2030 年的 149 亿美元,复合年增长率为 15.4%。

| 调查范围 | |

|---|---|

| 调查年份 | 2020-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元/十亿美元) |

| 部分 | 按技术、最终用途、冷媒、容量和地区 |

| 目标区域 | 北美、欧洲、亚太地区、南美、中东和非洲 |

在相关人员和监管机构日益增长的压力下,大型企业越来越多地在工业和商业设施中采用天然冷媒热泵,将其作为环境、社会和管治(ESG) 策略的一部分。这些系统透过减少温室气体排放并提高 ESG 报告的透明度,与永续性和气候行动目标相契合。透过整合低 GWP 技术,企业可以展现积极的气候领导力,提升品牌声誉,并确保其营运符合不断变化的环境法规和投资者期望,从而确保未来营运的可持续性。

工业部门面临越来越大的监管和社会压力,要求减少能源密集型热过程中产生的二氧化碳排放。传统的依赖石化燃料的系统,例如锅炉和蒸汽产生器,是工业二氧化碳排放的重要贡献者。使用氨(R717)和二氧化碳(R744)等天然冷媒的大型热泵,为提供高温热量提供了清洁、节能的解决方案。这些系统使工业部门能够实现加热业务电气化,显着减少碳排放,并符合国家和企业的脱碳目标。大型热泵系统为许多需要不同温度的工业製程提供了潜在的解决方案,在化学品、食品和饮料、纸浆和造纸以及冶金等工业应用中以卓越的效率提供高温输出。大型天然冷媒热泵是工业部门从基于燃烧的系统转向电热能的可行解决方案。电热能使工业部门能够制定长期的温室排放减排策略,并实现环境、社会和治理报告、国家气候目标和全球脱碳承诺。随着产业继续优先考虑业务永续营运连续性和永续性策略,大型天然冷媒热泵有可能提供性能、合规性和环境效益。

随着全球转向碳排放责任制,依赖石化燃料暖气系统的产业日益承受碳排放税、排放权交易计画和监管处罚的负担。这些经济压力推动了对更清洁、更永续技术的需求。基于二氧化碳的热泵透过显着减少直接温室气体排放提供了一种引人注目的替代方案。它们的采用使产业能够最大限度地减少碳排放,利用排放奖励,并提高长期成本的可预测性。它们回收和升级低品位废热的能力使它们在行业脱碳方面非常有效。此外,基于二氧化碳的系统越来越有资格获得政府补贴、碳信用计划和税收优惠,从而提高了它们对于维修和待开发区计划的财务可行性。随着越来越多的原始设备製造商扩大生产规模并提高 R-744 系统的性能,预计到 2025 年,这一领域将引领天然冷媒市场,并成为全球向净零供热技术转变的基石。

作为更广泛的脱碳行动的一部分,北美工业正在加速向製程加热电气化转型。这项转型的驱动力在于减少对石化燃料的依赖,遵守不断变化的气候法规,并实现企业永续性目标。使用氨或二氧化碳等天然冷媒的大型热泵正在成为取代传统燃气锅炉的策略解决方案。这些系统节能高效,温室气体排放低,并可与再生能源无缝集成,使其成为工业电气化的关键工具。

大型天然冷媒热泵市场的主要参与者有西门子能源(德国)、江森自控(爱尔兰)、谷轮股份公司(美国)、基伊埃集团股份公司(德国)、三菱电机株式会社(日本)、广东芬尼克兹生态能源解决方案有限公司(中国)、ARANER(英国)、谷轮股份公司(美国)、美国股份公司(美国),英国股份公司(中国)、英国股份公司(英国)(中国集团)公司(英国)(中国集团)。 Ltd(英国)、AGO GmbH Energie+Anlagen(德国)、Lync(美国)、SKADEC GmbH(德国)、Akegawa Seisakusho(日本)、Fenagy A/ 主要企业 .(美国)、Pure Thermal(美国)、Enerblue srl(义大利)、ALFA LAVAL(瑞典)、The33(瑞典)、The3S)、ALFA LAVAL(瑞典)、ALFA LA(瑞典)。本研究对大型天然冷媒热泵市场的主要企业进行了详细的竞争分析,包括公司简介、最新发展和主要市场策略。

本报告对大型天然冷媒热泵市场进行了定义、描述和预测,涵盖冷媒(氨 (R-717)、二氧化碳 (R-744)、碳氢化合物和其他冷媒)、容量(20-200kW、200-500kW、500-1000kW 和 1000kW以上)、终端用途(商业、工业)、技术(空气-空气热泵、空气-水热泵、水源热泵、地源(地热)热泵和混合热泵)和说明(北美、欧洲、亚太地区、中东和非洲以及南美)。本报告提供了影响大型天然冷媒热泵市场成长的关键因素(包括市场驱动因素和挑战)的详细资讯。对主要产业参与企业的深入分析,深入了解他们的业务概况、解决方案、服务、关键策略(例如伙伴关係、合作伙伴关係、协议、併购),以及大型天然冷媒热泵市场的最新发展。本报告也对大型天然冷媒热泵市场生态系统中新兴企业的竞争力进行了分析。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

- 影响客户业务的趋势/中断

- 定价分析

- 合成和天然冷媒

- 供应链分析

- 生态系分析

- 技术分析

- 贸易分析

- 2025-2026年主要会议和活动

- 监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 专利分析

- 案例研究分析

- 投资金筹措场景

- 人工智慧/生成式人工智慧对大型天然冷媒热泵市场的影响

- 世界宏观经济展望

- 2025年美国关税对大型天然冷媒热泵市场的影响

第六章 大型天然冷媒热泵市场(依技术)

- 介绍

- 空气对空气热泵

- 空气-水热泵

- 水源热泵

- 地热热泵

- 混合热泵

第七章 大型天然冷媒热泵市场(依最终用途)

- 介绍

- 商业的

- 工业

第八章 大型天然冷媒热泵市场(按冷媒)

- 介绍

- 氨(R-717)

- 二氧化碳(R-744)

- 碳氢化合物

- 其他的

第九章 大型天然冷媒热泵市场(按容量)

- 介绍

- 20~200kW

- 201~500kW

- 501~1,000KW

- 超过1000千瓦

第十章 大型天然冷媒热泵市场(按区域)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 亚太地区

- 中国

- 日本

- 韩国

- 其他的

- 欧洲

- 德国

- 英国

- 法国

- 其他的

- 南美洲

- 阿根廷

- 巴西

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

第十一章竞争格局

- 概述

- 主要参与企业的策略/优势,2020-2025

- 2024年市场占有率分析

- 市场估值框架

- 2020-2024年收益分析

- 产品比较

- 估值和财务指标

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十二章:公司简介

- 主要参与企业

- SIEMENS ENERGY

- MITSUBISHI ELECTRIC CORPORATION

- JOHNSON CONTROLS

- PANASONIC HOLDINGS CORPORATION

- GEA GROUP AKTIENGESELLSCHAFT

- ALFA LAVAL

- THERMAX LIMITED

- EVERLLENCE

- AGO GMBH ENERGIE+ANLAGEN

- COPELAND LP

- GUANGDONG PHNIX ECO-ENERGY SOLUTION LTD.

- STAR REFRIGERATION

- CLADE ENGINEERING SYSTEMS LTD

- LYNC

- SKADEC GMBH

- 其他公司

- NH3 SOLUTIONS

- ARANER

- EMICON AC SPA

- COMPACT KALTETECHNIK GMBH

- ECOTECH SOLUTIONS

- MAYEKAWA MFG. CO., LTD.

- FENAGY A/S

- PURE THERMAL

- TEKO GMBH

- ENERBLUE SRL

第十三章 附录

The global large scale natural refrigerant heat pump market is projected to reach USD 14.90 billion by 2030 from USD 7.28 billion in 2025, registering a CAGR of 15.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Refrigerant, Capacity, End Use, Technology |

| Regions covered | North America, Europe, Asia Pacific, South America, Middle East, and Africa |

In response to growing pressure from stakeholders and regulatory bodies, large corporations are increasingly adopting natural refrigerant heat pumps across industrial and commercial facilities as part of their Environmental, Social, and Governance (ESG) strategies. These systems align with sustainability and climate action goals by reducing greenhouse gas emissions and enhancing transparency in ESG reporting. By integrating low-GWP technologies, companies demonstrate proactive climate leadership, improve brand reputation, and future-proof operations against evolving environmental regulations and investor expectations.

"By end use, the industrial segment is expected to be the fastest-growing market during the forecast period."

Industrial sectors are facing growing regulatory and societal pressure to reduce carbon emissions from energy-intensive thermal processes. Traditional systems reliant on fossil fuels, such as boilers and steam generators, contribute significantly to industrial CO2 emissions. Large scale heat pumps utilizing natural refrigerants like ammonia (R717) and CO2 (R744) present a clean, energy-efficient solution for delivering high-temperature heat. These systems enable industries to electrify their heating operations, significantly lower their carbon footprint, and align with national and corporate decarbonization goals-without compromising on performance or reliability. Large scale heat pump systems are providing high-temperature output with remarkable efficiency, creating a potential solution to the many industrial processes to deliver a range of temperatures encountered within industrial applications, in the chemical, food & beverage, pulp & paper, and metallurgy sectors. Large scale natural refrigerant heat pumps are viable solutions for industries to pivot from combustion-based systems to an electrified thermal energy. By electrifying thermal energy, industries can define long-term GHG emissions reduction strategies and meet ESG reporting, national climate targets, and global decarbonization commitments. As industries not only position for sustainability strategies, they are likely to prioritize operational continuity, and it is highly likely that large scale natural refrigerant heat pumps may deliver performance, compliance, and environmental benefits together.

"By refrigerant, the Carbon dioxide (R-744) segment is anticipated to dominate the market in 2025."

With the global shift toward carbon accountability, industries reliant on fossil-fuel-based heating systems are increasingly burdened by carbon taxes, emissions trading schemes, and regulatory penalties. These financial pressures are driving demand for cleaner, more sustainable technologies. CO2-based heat pumps offer a compelling alternative by significantly lowering direct greenhouse gas emissions. Their adoption enables industries to minimize carbon liabilities, access emissions reduction incentives, and improve long-term cost predictability-while aligning with climate commitments and sustainability targets. Its capability to recover and upgrade low-grade waste heat makes it highly effective for industrial decarbonization. Moreover, CO2-based systems are increasingly eligible for government subsidies, carbon credit schemes, and tax incentives, which improve their financial viability for both retrofits and greenfield projects. With a growing number of OEMs scaling up production and enhancing R-744 system performance, the segment is set to lead the natural refrigerant market by 2025-serving as a cornerstone in the global shift toward net-zero heating technologies.

"By region, North America is expected to account for the second-largest market share during the forecast period."

As part of broader efforts to decarbonize operations, North American industries are accelerating the shift toward electrified process heating. This transition is driven by the need to reduce dependence on fossil fuels, comply with evolving climate regulations, and meet corporate sustainability targets. Large scale heat pumps using natural refrigerants like ammonia and CO2 are emerging as strategic solutions for replacing conventional gas-fired boilers. These systems offer high energy efficiency, lower greenhouse gas emissions, and seamless integration with renewable electricity sources-making them vital tools in the industrial electrification landscape.

In-depth interviews were conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 60%, Tier 2 - 30%, and Tier 3 - 10%

By Designation: Managers - 45%, CEO's and Directors - 30%, and Executives - 25%

By Region: North America - 40%, Europe - 25%, Asia Pacific - 20%, Middle East & Africa - 5% and South America - 10%

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: < USD 500 million. Others include sales managers, engineers, and regional managers.

Siemens Energy (Germany), Johnson Controls (Ireland), Copeland LP (US), GEA Group Aktiengesellschaft. (Germany), Mitsubishi Electric Corporation (Tokyo), Guangdong PHNIX Eco-energy Solution Ltd. (China), ARANER (United Kingdom), Star Refrigeration (United Kingdom), Clade Engineering Systems Ltd (United Kingdom), AGO GmbH Energie + Anlagen (Germany), Lync (US), SKADEC GmbH. (Germany), MAYEKAWA MFG. CO., LTD. (Japan), Fenagy A/S. (Denmark), Pure Thermal (US), Enerblue srl (Italy), ALFA LAVAL (Sweden), NH3 Solutions (Denmark), Thermax Limited (India) are the key players in the large scale natural refrigerant heat pump market. The study includes an in-depth competitive analysis of these key players in the large scale natural refrigerant heat pump market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report defines, describes, and forecasts the large scale natural refrigerant heat pump market by Refrigerant (Ammonia (R-717), Carbon dioxide (R-744), Hydrocarbons, Other Refrigerants), Capacity (20-200 kW, 200-500kW, 500-1000kW, Above 1000 kW), End Use (commercial, Industrial), Technology (Air-to-Air Heat Pumps, Air-to-Water Heat Pumps, Water Source Heat Pumps, Ground-Source (Geothermal) Heat Pumps, Hybrid Heat Pumps), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of large scale natural refrigerant heat pump market. A thorough analysis of the key industry players has provided insights into their business overview, solutions, and services; key strategies such as contracts, partnerships, agreements, mergers, and acquisitions; and recent developments associated with the large scale natural refrigerant heat pump market. This report covers the competitive analysis of upcoming startups in the large scale natural refrigerant heat pump market ecosystem.

Key Benefits of Buying the Report

- The report includes the analysis of key drivers (Mounting demand for low-emission energy amid rapid industrialization, shifting preference from coal to cleaner alternative fuels, and increasing adoption of large scale natural refrigerant heat pumps.

- in power generation, heating, and other industrial applications), restraints (requirement for substantial financial resources and long payback period, issues related to compliance with safety, environmental, and land use regulations), opportunities (increasing reliance on natural gas to curb carbon footprint, growing focus on diversifying energy sources and enhancing energy security, and rising emphasis on supporting regions with under-developed gas infrastructure) and challenges (climate risks and high operational costs of Floating storage regasification unit (FSRU), and geopolitical instability impacting supply security) influencing the growth of the large scale natural refrigerant heat pump market.

- Product Development/Innovation: EPC companies are effectively using next-level project management, pre-fabrication, and combined design capabilities to increase efficiency and decrease complexity at the site. Innovations in the large scale natural refrigerant heat pump sector include AI for scheduling, remote construction monitoring, and 3D modeling digital twins to enhance precision and reduce delays. The industry increasingly adopts low-carbon designs with carbon capture, renewable energy, and waste heat recovery. These trends help EPC contractors provide flexible, scalable, and energy-compliant large scale natural refrigerant heat pump infrastructure while supporting global demand growth and decarbonization efforts.

- Market Development: In October 2023, Siemens Energy received a contract from MVV GmbH to supply and integrate a 20 MWth river-source heat pump into Mannheim's district heating network. The system uses Rhine River water and renewable electricity to deliver heat up to 99 °C, serving around 3,500 households and reducing ~10,000 tons of CO2 annually.

- Market Diversification: The report offers a comprehensive analysis of the strategies employed by EPC players to facilitate market diversification. It outlines innovative service and operating models, as well as new partnership frameworks across various regions, underpinned by technology-driven business lines. The findings emphasize opportunities for expansion beyond traditional operations, identifying geographical areas and customer segments that are currently served but remain underserved and are suitable for strategic entry.

- Competitive Assessment: The report provides an in-depth assessment of market shares, growth strategies, and service offerings of leading players such as Siemens Energy (Germany), Johnson Controls (Ireland), Copeland LP (US), GEA Group Aktiengesellschaft. (Germany), Mitsubishi Electric Corporation (Tokyo), Guangdong PHNIX Eco-energy Solution Ltd. (China), ARANER (United Kingdom), Star Refrigeration (United Kingdom), Clade Engineering Systems Ltd (United Kingdom), AGO GmbH Energie + Anlagen (Germany), among others, in the large scale natural refrigerant heat pump market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 PRIMARY AND SECONDARY DATA

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of key secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primaries

- 2.2.1 SECONDARY DATA

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Demand-side assumptions

- 2.4.3.2 Demand-side calculations

- 2.4.4 SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Supply-side assumptions

- 2.4.4.2 Supply-side calculations

- 2.5 GROWTH PROJECTION

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET

- 4.2 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT

- 4.3 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY

- 4.4 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE

- 4.5 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY TECHNOLOGY

- 4.6 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Government incentives for sustainable transition

- 5.2.1.2 Increasing emphasis on enhancing operational efficiency across industrial sector

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness about heat pump standards and benefits among system vendors

- 5.2.2.2 High upfront costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Cold climate optimization

- 5.2.3.2 Industrial decarbonization initiatives

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of low-cost fossil energy-based alternative technologies

- 5.2.4.2 Energy source dependency in heat pump efficiency

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING RANGE OF LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS, BY TECHNOLOGY, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS, BY REGION, 2022-2024

- 5.5 SYNTHETIC REFRIGERANT VS. NATURAL REFRIGERANT

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Air-to-air heat pumps

- 5.8.1.2 Air-to-water heat pumps

- 5.8.1.3 Water-source heat pumps

- 5.8.1.4 Hybrid heat pumps

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Smart-grid and energy management systems

- 5.8.2.2 Smart controls and automation technologies

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Heat recovery ventilation systems

- 5.8.3.2 Internet of Things devices

- 5.8.1 KEY TECHNOLOGIES

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO (841861)

- 5.9.2 IMPORT SCENARIO (841861)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATIONS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 THREAT OF NEW ENTRANTS

- 5.12.6 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 PATENT ANALYSIS

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 ELIMINATION OF FOSSIL-FUEL BOILERS WITH HIGH-EFFICIENCY HEAT PUMP INTEGRATION

- 5.15.2 CARRIER'S AQUAEDGE 19DV CHILLER WITH HEAT RECOVERY INSTALLED TO DRIVE PROCESS INNOVATION AT INDUSTRIAL SITE

- 5.15.3 CUTTING EMISSIONS IN BEER PRODUCTION WITH HIGH-TEMPERATURE HEAT PUMPS

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 IMPACT OF AI/GEN AI ON LARGE-SCALE NATURAL REFRIGERANT HEAT PUMP MARKET

- 5.17.1 ADOPTION OF AI/GEN AI IN LARGE-SCALE NATURAL REFRIGERANT HEAT PUMP APPLICATIONS

- 5.17.2 IMPACT OF AI/GEN AI ON LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS SUPPLY CHAIN, BY REGION

- 5.18 GLOBAL MACROECONOMIC OUTLOOK

- 5.18.1 INTRODUCTION

- 5.18.2 FOCUS ON LONG-TERM ENERGY SECURITY

- 5.18.3 TECHNOLOGICAL ADVANCEMENTS

- 5.18.4 FINANCING AND GOVERNMENT POLICY SUPPORT

- 5.18.5 HIGH CAPEX AMID INFLATION

- 5.19 IMPACT OF 2025 US TARIFF ON LARGE-SCALE NATURAL REFRIGERANT HEAT PUMP MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRIES/REGIONS

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END USE

6 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 AIR-TO-AIR HEAT PUMPS

- 6.2.1 LOWER GWP IMPACT AND ENVIRONMENT-FRIENDLY HEATING AND COOLING SOLUTIONS TO DRIVE DEMAND

- 6.3 AIR-TO-WATER HEAT PUMPS

- 6.3.1 GROWING ADOPTION OF AIR-BASED HEATING SOLUTIONS TO DRIVE DEMAND

- 6.4 WATER-SOURCE HEAT PUMPS

- 6.4.1 HIGH OPERATIONAL EFFICIENCY TO BOOST ADOPTION

- 6.5 GROUND-SOURCE (GEOTHERMAL) HEAT PUMPS

- 6.5.1 POLICY MEASURES FOR DEPLOYMENT OF GEOTHERMAL HEAT PUMPS TO DRIVE MARKET

- 6.6 HYBRID HEAT PUMPS

- 6.6.1 SEAMLESS INTEGRATION WITH EXISTING INFRASTRUCTURE TO DRIVE DEMAND

7 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE

- 7.1 INTRODUCTION

- 7.2 COMMERCIAL

- 7.2.1 INVESTMENT IN ENERGY-EFFICIENT HEAT PUMPS FOR LONG-TERM SAVINGS TO DRIVE SEGMENT GROWTH

- 7.2.2 EDUCATIONAL INSTITUTES

- 7.2.2.1 Sustainable learning environments empowered by heat pumps to fuel market growth

- 7.2.3 HOSPITALITY SPACES

- 7.2.3.1 Modern infrastructure in hospitality spaces to drive market growth

- 7.2.4 OTHER COMMERCIAL BUILDINGS

- 7.3 INDUSTRIAL

- 7.3.1 BOOST IN INDUSTRIAL PROCESS EFFICIENCY TO SPUR DEMAND

- 7.3.2 FOOD & BEVERAGES

- 7.3.2.1 Reduction in greenhouse gas emission to fuel market growth

- 7.3.3 PULP & PAPER

- 7.3.3.1 Sustainable heating for growing packaging industry to boost market growth

- 7.3.4 CHEMICALS & PETROCHEMICALS

- 7.3.4.1 Revolutionized high-heat industrial applications to drive market growth

- 7.3.5 OTHER INDUSTRIES

8 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMP MARKET, BY REFRIGERANT

- 8.1 INTRODUCTION

- 8.2 AMMONIA (R-717)

- 8.2.1 HIGH EFFICIENCY OF LOW-CHARGE AMMONIA HEAT PUMPS TO DRIVE MARKET

- 8.3 CARBON DIOXIDE (R-744)

- 8.3.1 REVOLUTIONIZED LOW-TEMPERATURE APPLICATIONS WITH CO2 REFRIGERATION TO SPUR DEMAND

- 8.4 HYDROCARBONS

- 8.4.1 ADVANCED COOLING SYSTEMS WITH HIGH LATENT HEAT HYDROCARBONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 8.5 OTHER REFRIGERANTS

9 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY

- 9.1 INTRODUCTION

- 9.2 20-200 KW

- 9.2.1 SMALL-SCALE COMMERCIAL AND LIGHT INDUSTRIAL DECARBONIZATION TO DRIVE SEGMENT

- 9.3 201-500 KW

- 9.3.1 MID-SCALE COMMERCIAL INTEGRATION TO DRIVE USE

- 9.4 501-1,000 KW

- 9.4.1 WIDELY USED IN LARGE-SCALE COMMERCIAL & INDUSTRIAL PROCESS APPLICATIONS

- 9.5 ABOVE 1,000 KW

- 9.5.1 FOCUS ON UTILITY-SCALE & DISTRICT ENERGY DECARBONIZATION TO DRIVE DEMAND

10 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Government focus on cold-climate heat pumps to bolster market growth

- 10.2.2 CANADA

- 10.2.2.1 Focus on reduction of greenhouse gas (GHG) emissions to fuel demand

- 10.2.3 MEXICO

- 10.2.3.1 Increasing focus on regulatory standards and energy-saving initiatives to drive market

- 10.2.1 US

- 10.3 ASIA PACIFIC

- 10.3.1 CHINA

- 10.3.1.1 Action plan to advance heat pump industry to fuel demand

- 10.3.2 JAPAN

- 10.3.2.1 EcoCute program under Kyoto protocol framework to augment market growth

- 10.3.3 SOUTH KOREA

- 10.3.3.1 Increasing demand for energy-efficient heating technology to propel market growth

- 10.3.4 REST OF ASIA PACIFIC

- 10.3.1 CHINA

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Federal incentive and subsidies on use of natural refrigerant products to drive market

- 10.4.2 UK

- 10.4.2.1 Climate-friendly natural refrigerant systems and renewable energy transition to propel demand

- 10.4.3 FRANCE

- 10.4.3.1 Domestic manufacturing and rising utilization of energy-efficient heating systems to boost market growth

- 10.4.4 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 SOUTH AMERICA

- 10.5.1 ARGENTINA

- 10.5.1.1 Significant focus on sustainability to drive market growth

- 10.5.2 BRAZIL

- 10.5.2.1 Adoption of renewable energy to fuel market growth

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 ARGENTINA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

- 10.6.1.1 Saudi Arabia

- 10.6.1.1.1 Energy efficiency program in industrial & commercial sector to boost market growth

- 10.6.1.2 Other GCC countries

- 10.6.1.2.1 Kigali Amendment and green building frameworks encouraging low-GWP systems lead to market growth

- 10.6.1.1 Saudi Arabia

- 10.6.2 SOUTH AFRICA

- 10.6.2.1 Emissions reduction goals to boost market growth

- 10.6.3 REST OF MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 MARKET EVALUATION FRAMEWORK

- 11.5 REVENUE ANALYSIS, 2020-2024

- 11.6 PRODUCT COMPARISON

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.8.5.1 Company footprint

- 11.8.5.2 Region footprint

- 11.8.5.3 Refrigerant footprint

- 11.8.5.4 Capacity footprint

- 11.8.5.5 End-use footprint

- 11.8.5.6 Technology footprint

- 11.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.9.5.1 Detailed list of key startups/SMEs

- 11.9.5.2 Competitive benchmarking of key startups/SMEs

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

- 11.10.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SIEMENS ENERGY

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 MITSUBISHI ELECTRIC CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 JOHNSON CONTROLS

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Expansions

- 12.1.3.3.2 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 PANASONIC HOLDINGS CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.3.4 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 GEA GROUP AKTIENGESELLSCHAFT

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 ALFA LAVAL

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.7 THERMAX LIMITED

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 EVERLLENCE

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Other developments

- 12.1.9 AGO GMBH ENERGIE + ANLAGEN

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Expansions

- 12.1.10 COPELAND LP

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.10.3.3 Expansions

- 12.1.10.3.4 Other developments

- 12.1.11 GUANGDONG PHNIX ECO-ENERGY SOLUTION LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.12 STAR REFRIGERATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.12.3.2 Other developments

- 12.1.13 CLADE ENGINEERING SYSTEMS LTD

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.13.3.2 Other developments

- 12.1.14 LYNC

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.15 SKADEC GMBH

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.1 SIEMENS ENERGY

- 12.2 OTHER PLAYERS

- 12.2.1 NH3 SOLUTIONS

- 12.2.2 ARANER

- 12.2.3 EMICON AC S.P.A.

- 12.2.4 COMPACT KALTETECHNIK GMBH

- 12.2.5 ECOTECH SOLUTIONS

- 12.2.6 MAYEKAWA MFG. CO., LTD.

- 12.2.7 FENAGY A/S

- 12.2.8 PURE THERMAL

- 12.2.9 TEKO GMBH

- 12.2.10 ENERBLUE SRL

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: RISK ANALYSIS

- TABLE 4 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET SNAPSHOT

- TABLE 5 REFRIGERANTS AND THEIR COMMON APPLICATIONS

- TABLE 6 PRICING RANGE OF LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS, BY TECHNOLOGY, 2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF LARGE SCALE NATURAL REFRIGERANT HEAT PUMP, BY REGION 2022-2024 (USD)

- TABLE 8 COMPARISON BETWEEN SYNTHETIC REFRIGERANT AND NATURAL REFRIGERANT

- TABLE 9 ROLE OF COMPANIES IN LARGE-SCALE NATURAL REFRIGERANT HEAT PUMP ECOSYSTEM

- TABLE 10 EXPORT DATA FOR HS CODE 841861-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 11 IMPORT SCENARIO FOR HS CODE 841861-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 12 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMP MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REGULATIONS

- TABLE 20 PORTER'S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE (%)

- TABLE 22 KEY BUYING CRITERIA, BY END USE

- TABLE 23 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMP MARKET: KEY PATENTS, 2023-2025

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 25 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON APPLICATIONS DUE TO TARIFF IMPACT

- TABLE 26 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 27 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 28 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY TECHNOLOGY, 2020-2024 (THOUSAND UNITS)

- TABLE 29 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 30 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 31 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 32 COMMERCIAL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 COMMERCIAL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 COMMERCIAL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 35 COMMERCIAL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY TYPE (USD MILLION)

- TABLE 36 EDUCATIONAL INSTITUTES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 EDUCATIONAL INSTITUTES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 HOSPITALITY SPACES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 HOSPITALITY SPACES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 OTHER COMMERCIAL BUILDINGS: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 OTHER COMMERCIAL BUILDINGS: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 INDUSTRIAL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 INDUSTRIAL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 INDUSTRIAL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY TYPE (USD MILLION)

- TABLE 45 INDUSTRIAL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY TYPE (USD MILLION)

- TABLE 46 FOOD & BEVERAGES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 FOOD & BEVERAGES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 PULP & PAPER: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 PULP & PAPER: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 CHEMICALS & PETROCHEMICALS: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 CHEMICALS & PETROCHEMICALS: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 OTHER INDUSTRIES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 OTHER INDUSTRIES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 55 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 56 AMMONIA (R-717): LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 AMMONIA (R-717): LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 CARBON DIOXIDE (R-744): LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 CARBON DIOXIDE (R-744): LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 HYDROCARBONS: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 HYDROCARBONS: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 OTHER REFRIGERANTS: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 OTHER REFRIGERANTS: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 65 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 66 20-200 KW: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 20-200 KW: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 201-500 KW: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 201-500 KW: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 501-1,000 KW: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 501-1,000 KW: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 ABOVE 1,000 KW: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 ABOVE 1,000 KW: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2020-2024 (THOUSAND UNITS)

- TABLE 77 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 78 NORTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COMMERCIAL END USE, 2020-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COMMERCIAL END USE, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY INDUSTRIAL END USE, 2020-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY INDUSTRIAL END USE, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: COMMERCIAL LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: INDUSTRIAL LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 US: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 91 US: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 92 US: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 93 US: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 94 CANADA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 95 CANADA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 96 CANADA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 97 CANADA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 98 MEXICO: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 99 MEXICO: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 100 MEXICO: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 101 MEXICO: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 103 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 105 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 107 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COMMERCIAL END USE, 2020-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COMMERCIAL END USE, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY INDUSTRIAL END USE, 2020-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY INDUSTRIAL END USE, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 CHINA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 115 CHINA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 116 CHINA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 117 CHINA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 118 JAPAN: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 119 JAPAN: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 120 JAPAN: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 121 JAPAN: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 122 SOUTH KOREA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 123 SOUTH KOREA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 124 SOUTH KOREA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 125 SOUTH KOREA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 131 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 133 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 135 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COMMERCIAL END USE, 2020-2024 (USD MILLION)

- TABLE 137 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COMMERCIAL END USE, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY INDUSTRIAL END USE, 2020-2024 (USD MILLION)

- TABLE 139 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY INDUSTRIAL END USE, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 141 EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 142 GERMANY: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 143 GERMANY: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 144 GERMANY: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 145 GERMANY: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 146 UK: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 147 UK: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 148 UK: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 149 UK: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 150 FRANCE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 151 FRANCE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 152 FRANCE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 153 FRANCE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 154 REST OF EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 155 REST OF EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 156 REST OF EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 157 REST OF EUROPE: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 158 SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 159 SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 160 SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 161 SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 162 SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 163 SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 164 SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COMMERCIAL END USE, 2020-2024 (USD MILLION)

- TABLE 165 SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COMMERCIAL END USE, 2025-2030 (USD MILLION)

- TABLE 166 SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY INDUSTRIAL END USE, 2020-2024 (USD MILLION)

- TABLE 167 SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY INDUSTRIAL END USE, 2025-2030 (USD MILLION)

- TABLE 168 SOUTH AMERICA: COMMERCIAL LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 169 SOUTH AMERICA: INDUSTRIAL LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 170 ARGENTINA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 171 ARGENTINA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 172 ARGENTINA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 173 ARGENTINA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 174 BRAZIL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 175 BRAZIL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 176 BRAZIL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 177 BRAZIL: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 178 REST OF SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 179 REST OF SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 180 REST OF SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 181 REST OF SOUTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COMMERCIAL END USE, 2020-2024 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COMMERCIAL END USE, 2025-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY INDUSTRIAL END USE, 2020-2024 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY INDUSTRIAL END USE, 2025-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 194 GCC COUNTRIES: COMMERCIAL LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 195 GCC COUNTRIES: INDUSTRIAL LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 196 SAUDI ARABIA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 197 SAUDI ARABIA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 198 SAUDI ARABIA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 199 SAUDI ARABIA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 200 OTHER GCC COUNTRIES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 201 OTHER GCC COUNTRIES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 202 OTHER GCC COUNTRIES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 203 OTHER GCC COUNTRIES: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 204 SOUTH AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 205 SOUTH AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 206 SOUTH AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 207 SOUTH AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2020-2024 (USD MILLION)

- TABLE 211 REST OF MIDDLE EAST & AFRICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 212 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-JUNE 2025

- TABLE 213 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 214 MARKET EVALUATION FRAMEWORK, 2020-2025

- TABLE 215 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: REGION FOOTPRINT

- TABLE 216 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: REFRIGERANT FOOTPRINT

- TABLE 217 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: CAPACITY FOOTPRINT

- TABLE 218 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: END USE FOOTPRINT

- TABLE 219 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: BY TECHNOLOGY FOOTPRINT

- TABLE 220 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: KEY STARTUPS/SMES

- TABLE 221 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 222 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 223 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 224 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 225 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JUNE 2025

- TABLE 226 SIEMENS ENERGY: COMPANY OVERVIEW

- TABLE 227 SIEMENS ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 SIEMENS ENERGY: DEALS

- TABLE 229 SIEMENS ENERGY: OTHER DEVELOPMENTS

- TABLE 230 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 231 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 232 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 233 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 234 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 235 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 JOHNSON CONTROLS: EXPANSIONS

- TABLE 237 JOHNSON CONTROLS: OTHER DEVELOPMENTS

- TABLE 238 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 239 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 240 PANASONIC HOLDINGS CORPORATION: PRODUCT LAUNCHES

- TABLE 241 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 242 PANASONIC HOLDINGS CORPORATION: EXPANSIONS

- TABLE 243 PANASONIC HOLDINGS CORPORATION: OTHER DEVELOPMENTS

- TABLE 244 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 245 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 GEA GROUP AKTIENGESELLSCHAFT: DEALS

- TABLE 247 GEA GROUP AKTIENGESELLSCHAFT: OTHER DEVELOPMENTS

- TABLE 248 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 249 ALFA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 ALFA LAVAL: PRODUCT LAUNCHES

- TABLE 251 ALFA LAVAL: DEALS

- TABLE 252 THERMAX LIMITED: COMPANY OVERVIEW

- TABLE 253 THERMAX LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 EVERLLENCE: COMPANY OVERVIEW

- TABLE 255 EVERLLENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 EVERLLENCE: DEALS

- TABLE 257 EVERLLENCE: OTHER DEVELOPMENTS

- TABLE 258 AGO GMBH ENERGIE + ANLAGEN: COMPANY OVERVIEW

- TABLE 259 AGO GMBH ENERGIE + ANLAGEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 AGO GMBH ENERGIE + ANLAGEN: EXPANSIONS

- TABLE 261 COPELAND LP: COMPANY OVERVIEW

- TABLE 262 COPELAND LP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 COPELAND LP: PRODUCT LAUNCHES

- TABLE 264 COPELAND LP: DEALS

- TABLE 265 COPELAND LP: EXPANSIONS

- TABLE 266 COPELAND LP: OTHER DEVELOPMENTS

- TABLE 267 GUANGDONG PHNIX ECO-ENERGY SOLUTION LTD.: COMPANY OVERVIEW

- TABLE 268 GUANGDONG PHNIX ECO-ENERGY SOLUTION LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 GUANGDONG PHNIX ECO-ENERGY SOLUTION LTD.: PRODUCT LAUNCHES

- TABLE 270 STAR REFRIGERATION: COMPANY OVERVIEW

- TABLE 271 STAR REFRIGERATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 STAR REFRIGERATION: DEALS

- TABLE 273 STAR REFRIGERATION: OTHER DEVELOPMENTS

- TABLE 274 CLADE ENGINEERING SYSTEMS LTD: COMPANY OVERVIEW

- TABLE 275 CLADE ENGINEERING SYSTEMS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 CLADE ENGINEERING SYSTEMS LTD: PRODUCT LAUNCHES

- TABLE 277 CLADE ENGINEERING SYSTEMS LTD: OTHER DEVELOPMENTS

- TABLE 278 LYNC: COMPANY OVERVIEW

- TABLE 279 LYNC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 SKADEC GMBH: COMPANY OVERVIEW

- TABLE 281 SKADEC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 NH3 SOLUTIONS: COMPANY OVERVIEW

- TABLE 283 ARANER: COMPANY OVERVIEW

- TABLE 284 EMICON AC S.P.A.: COMPANY OVERVIEW

- TABLE 285 COMPACT KALTETECHNIK GMBH: COMPANY OVERVIEW

- TABLE 286 ECOTECH SOLUTIONS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMP MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 KEY DATA FROM PRIMARY SOURCES

- FIGURE 5 KEY INDUSTRY INSIGHTS

- FIGURE 6 BREAKDOWN OF PRIMARIES

- FIGURE 7 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: DATA TRIANGULATION

- FIGURE 8 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: BOTTOM-UP APPROACH

- FIGURE 9 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: TOP-DOWN APPROACH

- FIGURE 10 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 11 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS

- FIGURE 12 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 13 INDUSTRY CONCENTRATION, 2024

- FIGURE 14 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: RESEARCH LIMITATIONS

- FIGURE 15 CARBON DIOXIDE (R-744) SEGMENT TO HOLD MAJOR MARKET SIZE IN 2030

- FIGURE 16 20-200 KW SEGMENT TO DOMINATE, BY CAPACITY, IN 2025 AND 2030

- FIGURE 17 INDUSTRIAL END USE TO BE LARGEST SEGMENT IN 2030

- FIGURE 18 AIR-TO-AIR HEAT PUMPS TO HOLD MAJOR MARKET SHARE IN 2025

- FIGURE 19 ASIA PACIFIC - LARGEST REGIONAL MARKET FOR LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS IN 2024

- FIGURE 20 RAPID INDUSTRIALIZATION AND URBANIZATION TO CONTRIBUTE TO LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET GROWTH

- FIGURE 21 CARBON DIOXIDE (R-744) SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 22 201-500KW SEGMENT TO DOMINATE LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET IN 2030

- FIGURE 23 INDUSTRIAL SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 24 AIR-TO-AIR HEAT PUMPS SEGMENT TO HOLD DOMINANT MARKET SHARE IN 2030

- FIGURE 25 NORTH AMERICA TO EXHIBIT HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 HEAT PUMP SALES, BY REGION/COUNTRY

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 AVERAGE SELLING PRICE TREND OF LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS, BY REGION, 2022-2024 (USD)

- FIGURE 30 SUPPLY CHAIN ANALYSIS

- FIGURE 31 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMP ECOSYSTEM

- FIGURE 32 EXPORT DATA FOR HS CODE 841861-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024 (USD THOUSAND)

- FIGURE 33 IMPORT DATA FOR HS CODE 841861-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024 (USD THOUSAND)

- FIGURE 34 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USE

- FIGURE 36 KEY BUYING CRITERIA, BY END USE

- FIGURE 37 PATENT APPLIED AND GRANTED, 2015-2024

- FIGURE 38 INVESTMENT AND FUNDING SCENARIO

- FIGURE 39 IMPACT OF AI/GEN AI ON LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS SUPPLY CHAIN, BY REGION

- FIGURE 40 AIR-TO-AIR HEAT PUMP SEGMENT CAPTURED LARGEST SHARE IN 2024

- FIGURE 41 INDUSTRIAL SEGMENT HELD LARGEST SHARE IN 2024

- FIGURE 42 CARBON DIOXIDE HELD DOMINANT SHARE OF MARKET IN 2024

- FIGURE 43 20-200KW SEGMENT CAPTURED MAJOR MARKET SHARE IN 2024

- FIGURE 44 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET, BY REGION, 2024

- FIGURE 45 NORTH AMERICA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET FROM 2025 TO 2030

- FIGURE 46 NORTH AMERICA: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET REGIONAL SNAPSHOT

- FIGURE 47 ASIA PACIFIC: LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET SNAPSHOT

- FIGURE 48 MARKET SHARE ANALYSIS OF COMPANIES OFFERING LARGE-SCALE NATURAL REFRIGERANT HEAT PUMP MARKETS, 2024

- FIGURE 49 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 50 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: PRODUCT COMPARISON

- FIGURE 51 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: COMPANY EVALUATION

- FIGURE 52 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: FINANCIAL METRICS

- FIGURE 53 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: COMPANY FOOTPRINT

- FIGURE 55 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET FOOTPRINT

- FIGURE 56 LARGE-SCALE NATURAL REFRIGERANT HEAT PUMPS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 57 SIEMENS ENERGY: COMPANY SNAPSHOT

- FIGURE 58 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 60 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 62 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 63 THERMAX LIMITED: COMPANY SNAPSHOT