|

市场调查报告书

商品编码

1858977

气体交换肺功能检测市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Gas Exchange Pulmonary Function Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

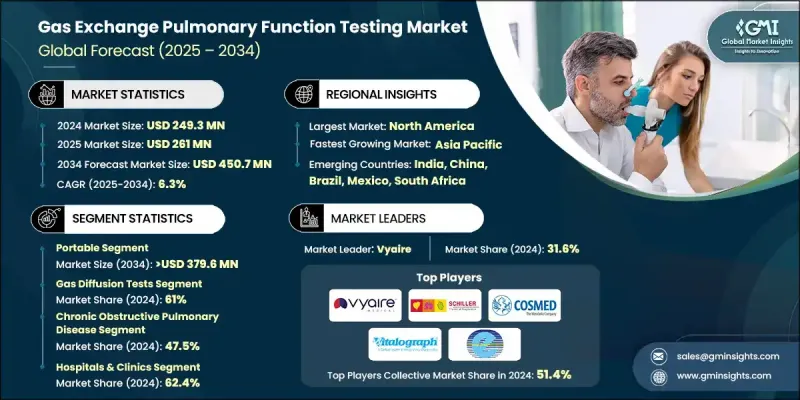

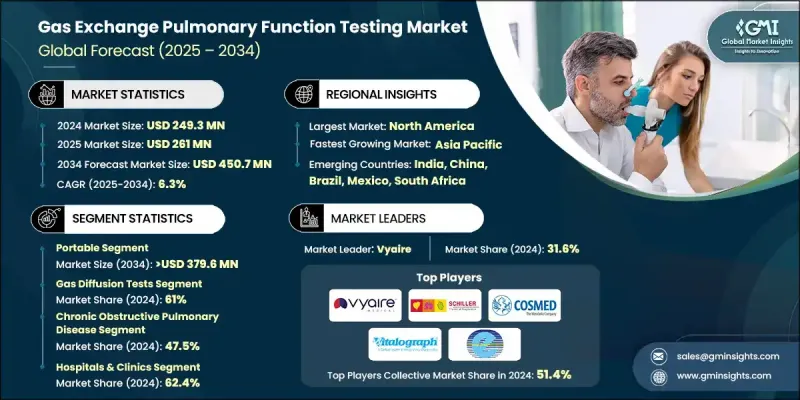

2024 年全球气体交换肺功能测试市值为 2.493 亿美元,预计到 2034 年将以 6.3% 的复合年增长率增长至 4.507 亿美元。

慢性呼吸系统疾病病例的增加、DLCO和CPET等诊断工具的日益普及以及医院诊断设施的扩张,共同推动了该市场的成长。该市场为医疗服务提供者、技术公司、支付方和生命科学公司提供先进的诊断技术,旨在改善临床工作流程、确保合规性并提升患者护理水准。产品包括气体扩散分析仪、CPET系统、肺功能仪以及整合人工智慧和远距医疗功能的数位平台。这些创新正在重塑诊断路径,实现更快、更准确、更远端的检测。随着医疗基础设施的快速发展,尤其是在发展中地区,以及便携式和用户友好型检测工具的日益普及,肺功能检测的覆盖范围达到了前所未有的高度。持续的研发投入、策略联盟和地理扩张正在推动市场竞争和产品创新。在已开发市场,有利的报销机制和对预防性呼吸系统护理日益增长的重视,正在加速先进肺功能检测系统的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.493亿美元 |

| 预测值 | 4.507亿美元 |

| 复合年增长率 | 6.3% |

2024年,便携式设备市占率达到82.8%,这主要得益于人们对居家和床边呼吸监测的日益青睐。患者和医护人员正积极采用便携式肺功能检测工具,以便在临床环境之外管理气喘、慢性阻塞性肺病和间质性肺病等疾病。这些设备得益于数位连接技术的进步、紧凑的设计和直觉的介面,已被证明是居家监测的理想之选,能够在不影响准确性和性能的前提下,实现频繁的检测和远端疾病管理。

2024年,气体扩散测试市场占据61%的市场份额,预计2034年将达到2.637亿美元。这些测试,尤其是一氧化碳扩散量(DLCO)测试,对于评估肺部输送氧气和二氧化碳等气体的效率仍然至关重要。随着全球间质性肺病、肺纤维化和慢性阻塞性肺病病例的不断增加,对精准扩散测试的需求持续攀升。医院、诊断实验室和专科诊所越来越依赖这一领域来早期发现和管理复杂的肺部疾病。

2024年,北美气体交换肺功能测试市场份额将达到40.2%,这主要得益于先进的诊断基础设施、慢性呼吸系统疾病的高发生率以及尖端技术的快速普及。此外,老年人口的增长及其患有肺纤维化和慢性阻塞性肺病等疾病的风险增加,也进一步推动了该地区对精准气体交换评估和心肺运动试验(CPET)系统的需求。

全球气体交换肺功能检测市场的主要参与者包括Geratherm Respiratory、MGC Diagnostics Holdings、Sibelmed、Schiller、COSMED、ndd Medical Technologies、Vitalograph、Vyaire、Morgan Scientific、ECO MEDICS、CORTEX和CHEST MI。为了巩固其在全球气体交换肺功能检测市场的地位,这些主要公司正大力投资于产品创新,重点关注数位化整合、基于人工智慧的分析和远端监测功能。与医院、诊断实验室和远距医疗服务提供者建立策略合作伙伴关係有助于扩大分销管道和临床应用。许多企业也透过区域生产、改善物流和为医疗专业人员提供培训计划,加大对新兴市场的关注。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 呼吸系统疾病发生率上升

- 技术进步

- 对居家照护解决方案的需求日益增长

- 政府的支持性措施和报销政策

- 产业陷阱与挑战

- 设备成本高昂

- 市场机会

- 与数位健康平台集成

- 便携式和手持设备的开发

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 报销方案

- 技术格局

- 当前技术趋势

- 配备数位介面的先进肺功能仪平台

- 心肺运动试验(CPET)系统

- 气体扩散分析仪(DLCO)

- 新兴技术

- 人工智慧驱动的呼吸系统诊断预测分析

- 远端监控和远端肺功能测试解决方案

- 穿戴式肺功能监测设备

- 当前技术趋势

- 差距分析

- 波特的分析

- PESTEL 分析

- 价值链分析

- 未来市场趋势

- 居家肺功能测试的成长

- 便携式和以患者为中心的设备的扩展

- 将肺功能测试系统与数位健康平台集成

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 伙伴关係与合作

- 新服务类型推出

- 扩张计划

第五章:市场估算与预测:依系统类型划分,2021-2034年

- 主要趋势

- 便携的

- 文具

第六章:市场估算与预测:依测试方法划分,2021-2034年

- 主要趋势

- 气体扩散试验

- 心肺运动试验(CPET)

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 慢性阻塞性肺臟疾病

- 气喘

- 慢性呼吸困难

- 肺纤维化

- 其他应用

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院和诊所

- 诊断中心

- 其他最终用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- CHEST MI

- CORTEX

- COSMED

- ECO MEDICS

- Geratherm Respiratory

- Morgan Scientific

- MGC Diagnostics Holdings

- ndd Medical Technologies

- Schiller

- Sibelmed

- Vitalograph

- Vyaire

The Global Gas Exchange Pulmonary Function Testing Market was valued at USD 249.3 million in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 450.7 million by 2034.

Growth in this market is being propelled by rising cases of chronic respiratory conditions, increasing adoption of diagnostic tools such as DLCO and CPET, and the expansion of hospital-based diagnostic facilities. This market supports healthcare providers, technology firms, payers, and life sciences companies with advanced diagnostic technologies designed to improve clinical workflows, ensure regulatory compliance, and enhance patient care. Product offerings include gas diffusion analyzers, CPET systems, spirometry devices, and digital platforms integrated with AI and telehealth capabilities. These innovations are reshaping diagnostic pathways by enabling quicker, more accurate, and remote testing capabilities. With rapid growth in healthcare infrastructure, particularly in developing regions, combined with a broader range of portable and user-friendly testing tools, access to pulmonary testing has never been more widespread. Continuous investment in R&D, along with strategic alliances and geographic expansion, is driving competition and product innovation. In developed markets, favorable reimbursement frameworks and a growing shift toward preventive respiratory care are accelerating the adoption of advanced pulmonary function testing systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $249.3 Million |

| Forecast Value | $450.7 Million |

| CAGR | 6.3% |

In 2024, the portable device segment held an 82.8% share owing to the increased preference for home-based and point-of-care respiratory monitoring. Patients and healthcare professionals are embracing portable pulmonary function tools to manage conditions such as asthma, COPD, and interstitial lung diseases outside clinical settings. These devices, supported by advancements in digital connectivity, compact designs, and intuitive interfaces, are proving to be ideal for home monitoring, enabling frequent testing and remote disease management without compromising accuracy or performance.

The gas diffusion tests segment held a 61% share in 2024 and is anticipated to reach USD 263.7 million by 2034. These tests, especially DLCO, remain vital in assessing how efficiently the lungs transfer gases like oxygen and carbon dioxide. With rising global cases of interstitial lung diseases, pulmonary fibrosis, and chronic obstructive pulmonary disease, the demand for accurate diffusion testing continues to climb. Hospitals, diagnostic labs, and specialty clinics are increasingly relying on this segment for early detection and management of complex pulmonary disorders.

North America Gas Exchange Pulmonary Function Testing Market held 40.2% share in 2024, driven by advanced diagnostic infrastructure, high prevalence of chronic respiratory conditions, and accelerated uptake of cutting-edge technologies. The growing elderly population and their increased vulnerability to conditions like pulmonary fibrosis and COPD further support the demand for precise gas exchange assessments and CPET systems in the region.

Leading players in the Global Gas Exchange Pulmonary Function Testing Market include Geratherm Respiratory, MGC Diagnostics Holdings, Sibelmed, Schiller, COSMED, ndd Medical Technologies, Vitalograph, Vyaire, Morgan Scientific, ECO MEDICS, CORTEX, and CHEST M.I. To boost their foothold in the Global Gas Exchange Pulmonary Function Testing Market, key companies are heavily investing in product innovation focused on digital integration, AI-based analytics, and remote monitoring capabilities. Strategic partnerships with hospitals, diagnostic labs, and telehealth providers help expand distribution and clinical adoption. Many players are also increasing their focus on emerging markets through regional manufacturing, improved logistics, and training programs for medical professionals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 System type trends

- 2.2.3 Test method trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of respiratory diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Growing demand for home care solutions

- 3.2.1.4 Supportive government initiatives and reimbursement policies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with digital health platforms

- 3.2.3.2 Development of portable and handheld device

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.1.1 Advanced spirometry platforms with digital interfaces

- 3.6.1.2 Cardiopulmonary exercise testing (CPET) systems

- 3.6.1.3 Gas diffusion analyzers (DLCO)

- 3.6.2 Emerging technologies

- 3.6.2.1 AI-driven predictive analytics for respiratory diagnostics

- 3.6.2.2 Remote monitoring and tele-PFT solutions

- 3.6.2.3 Wearable pulmonary function monitoring devices

- 3.6.1 Current technological trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

- 3.11 Future market trends

- 3.11.1 Growth of home-based pulmonary function testing

- 3.11.2 Expansion of portable and patient-centric devices

- 3.11.3 Integration of PFT systems with digital health platforms

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By System Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Portable

- 5.3 Stationary

Chapter 6 Market Estimates and Forecast, By Test Method, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Gas diffusion tests

- 6.3 Cardiopulmonary exercise testing (CPET)

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Chronic obstructive pulmonary disease

- 7.3 Asthma

- 7.4 Chronic shortness of breath

- 7.5 Pulmonary fibrosis

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals & clinics

- 8.3 Diagnostic centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 CHEST M.I.

- 10.2 CORTEX

- 10.3 COSMED

- 10.4 ECO MEDICS

- 10.5 Geratherm Respiratory

- 10.6 Morgan Scientific

- 10.7 MGC Diagnostics Holdings

- 10.8 ndd Medical Technologies

- 10.9 Schiller

- 10.10 Sibelmed

- 10.11 Vitalograph

- 10.12 Vyaire