|

市场调查报告书

商品编码

1858982

数位疗法市场机会、成长驱动因素、产业趋势分析及预测(2024-2032年)Digital Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

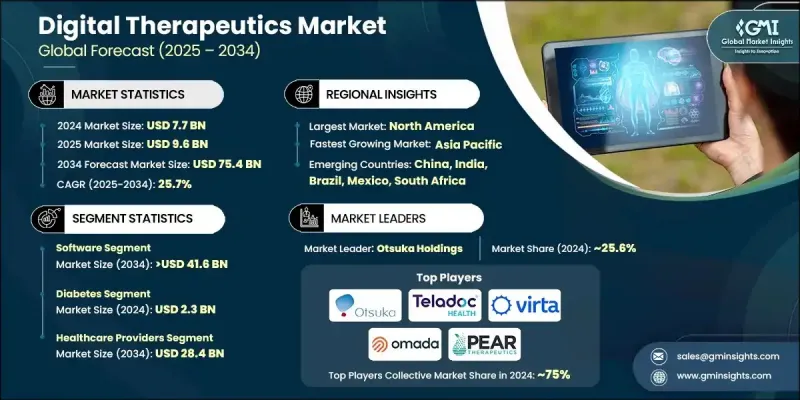

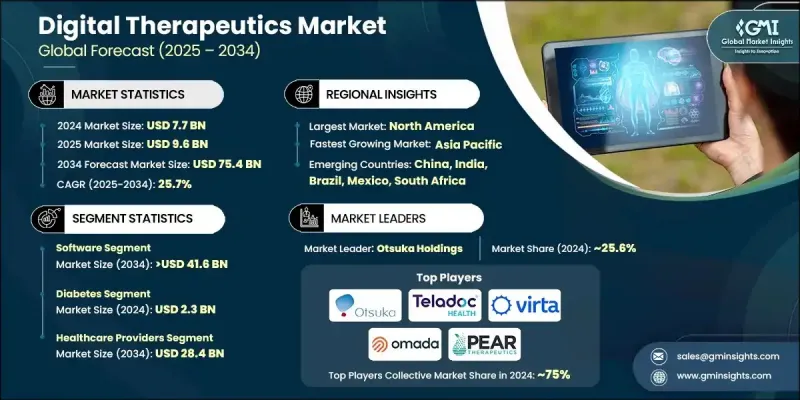

2024 年全球数位疗法市场价值为 77 亿美元,预计到 2034 年将以 25.7% 的复合年增长率增长至 754 亿美元。

全球慢性疾病(例如心血管疾病、糖尿病和精神健康问题)盛行率的不断上升推动了数位疗法的发展。这些持续存在的医疗保健挑战正在推动对数位疗法的需求,数位疗法能够提供经济高效、可扩展且个人化的治疗方案。这些软体驱动的医疗干预措施正日益与人工智慧、穿戴式装置、游戏化和行为健康工具相结合,从而提高患者的依从性、治疗效果和参与度。这些工具既可独立使用,也可与传统疗法合併使用,正逐渐成为现代医疗保健的基石。随着医疗服务提供者和患者越来越寻求灵活且非侵入性的解决方案,数位疗法的吸引力持续增长。它们能够在降低整体医疗成本的同时,提供经临床验证的疗效,这使得它们对雇主、保险公司和公共卫生系统尤其具有吸引力。支付方的支持力度不断加大,以及主要市场监管机构的认可度不断提高,正在进一步加速从代谢疾病到精神健康等各个治疗领域的数位疗法的开发和应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 77亿美元 |

| 预测值 | 754亿美元 |

| 复合年增长率 | 25.7% |

2024年,软体领域占据54.3%的市场份额,预计到2034年将达到416亿美元,复合年增长率达25.9%。该领域涵盖本地部署和云端平台,能够基于用户资料、行为趋势和人工智慧驱动的演算法,提供量身定制的治疗干预措施。这些解决方案不仅有助于养成良好习惯和管理慢性疾病,而且由于其可扩展性和在智慧型手机、电脑和平板电脑等数位设备上的可访问性,也得到了广泛应用。日益便捷的存取方式和远端持续照护能力,使得基于软体的数位疗法成为预防和持续治疗框架中的首选模式。

2024年,糖尿病领域市场规模预计将达23亿美元。包括第1型糖尿病、第2型糖尿病和怀孕期糖尿病在内的所有类型糖尿病发病率的不断上升,促使人们对能够实现即时监测和可持续生活方式改变的工具的需求日益增长。数位疗法提供个人化干预措施,包括行为指导、血糖追踪、用药提醒和基于分析的洞察,使其成为长期糖尿病护理计划的关键组成部分。随着患者对数位疗法在代谢健康管理中作用的认识不断提高,以及临床对数位疗法的认可度不断提升,该领域将继续受益。

预计到2024年,北美数位疗法市场将占据58.1%的份额。该地区强大的医疗保健基础设施、慢性病患病率的不断上升以及有利的监管环境正在推动数位疗法的普及。在美国和加拿大,越来越多的雇主将数位疗法平台纳入员工健康管理策略,以改善员工健康并降低保险支出。此外,广泛的报销机制和强大的技术应用也促进了数位疗法融入主流临床和健康管理系统。

全球数位疗法市场的主要参与者包括Teladoc Health、Virta Health、LifeScan、Hyfe、Omada Health、Akili Interactive、Pear Therapeutics、Orexo、Otsuka Holdings、Click Therapeutics、Propeller Health(ResMed)和AmerisourceBergen。为了巩固市场地位,数位疗法公司正致力于与支付方、製药公司和医疗保健系统建立策略合作伙伴关係,以扩大覆盖范围并确保医疗保险报销。许多公司正在拓展全球分销网络,以渗透新兴市场,同时大力投资研发,利用人工智慧、机器学习和即时病患监测等技术增强平台功能。监管审批仍是重中之重,各公司正与监管机构密切合作,以加快审批速度。与电子健康记录和远距医疗平台的整合是另一个核心关注点,旨在提高互通性和患者参与度。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 慢性病盛行率不断上升

- 对成本控制的需求日益增长

- 扩大医疗服务品质

- 数位疗法的日益普及

- 产业陷阱与挑战

- 资料安全和隐私问题

- 缺乏熟练的IT专业人员

- 市场机会

- 预防性和价值导向医疗的趋势日益增强

- 联合疗法模式的扩展

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

- 技术格局

- 当前技术趋势

- 新兴技术

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 软体

- 现场

- 基于云端的

- 硬体

- 穿戴式装置

- 感测器和监控设备

- 其他设备

- 服务

- 咨询与整合

- 培训和教育

- 其他服务

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 糖尿病

- 肥胖

- 心血管

- 心理健康和行为健康

- 高血压

- 失眠

- 其他应用

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医疗保健提供者

- 医院

- 诊所

- 远距医疗平台

- 付款人

- 患者

- 其他最终用途

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- AmerisourceBergen

- Akili Interactive

- Click Therapeutics

- Hyfe

- LifeScan

- Omada Health

- Orexo

- Otsuka Holdings

- Pear Therapeutics

- Propeller Health (ResMed)

- Teladoc Health

- Virta Health

The Global Digital Therapeutics Market was valued at USD 7.7 billion in 2024 and is estimated to grow at a CAGR of 25.7% to reach USD 75.4 billion by 2034.

The growth is fueled by the rising global prevalence of chronic illnesses such as cardiovascular diseases, diabetes, and mental health conditions. These ongoing healthcare challenges are driving demand for digital therapeutics, which deliver cost-efficient, scalable, and personalized treatment alternatives. These software-driven medical interventions are increasingly integrated with artificial intelligence, wearables, gamification, and behavioral health tools that improve adherence, patient outcomes, and engagement. Designed to work either independently or in conjunction with traditional treatments, these tools are becoming a cornerstone of modern healthcare. As providers and patients increasingly seek flexible and non-invasive solutions, the appeal of digital therapeutics continues to grow. Their ability to deliver clinically proven outcomes while reducing overall care costs makes them particularly attractive to employers, insurers, and public health systems. Growing support from payers and expanded regulatory acceptance across major markets are further accelerating development and deployment across therapeutic areas, from metabolic conditions to mental wellness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $75.4 Billion |

| CAGR | 25.7% |

The software segment held a 54.3% share in 2024 and is anticipated to reach USD 41.6 billion by 2034, growing at a CAGR of 25.9%. This segment includes both on-premise and cloud-based platforms that enable tailored therapeutic interventions based on user data, behavioral trends, and AI-driven algorithms. These solutions not only promote habit formation and chronic disease management but are also widely adopted due to their scalability and accessibility across digital devices such as smartphones, computers, and tablets. The growing ease of access and ability to deliver continuous care remotely make software-based digital therapeutics a preferred model in preventive and ongoing treatment frameworks.

The diabetes segment generated USD 2.3 billion in 2024. Increasing rates of all forms of diabetes, Type 1, Type 2, and gestational, are contributing to rising demand for tools that enable real-time monitoring and sustainable lifestyle changes. Digital therapeutics provide tailored interventions, including behavioral coaching, glucose tracking, medication reminders, and analytics-based insights, positioning them as key components in long-term diabetes care plans. This segment continues to benefit from growing patient awareness and clinical recognition of DTx in metabolic health management.

North America Digital Therapeutics Market held 58.1% share in 2024. The region's strong healthcare infrastructure, rising prevalence of chronic conditions, and favorable regulatory landscape are boosting adoption. In the U.S. and Canada, employers are increasingly including DTx platforms in workplace wellness strategies to enhance employee health outcomes and reduce insurance expenditures. Additionally, widespread reimbursement availability and robust technology adoption are supporting the integration of DTx into mainstream clinical and wellness environments.

Key players in the Global Digital Therapeutics Market are Teladoc Health, Virta Health, LifeScan, Hyfe, Omada Health, Akili Interactive, Pear Therapeutics, Orexo, Otsuka Holdings, Click Therapeutics, Propeller Health (ResMed), and AmerisourceBergen. To strengthen their presence, digital therapeutics companies are focusing on strategic partnerships with payers, pharmaceutical firms, and healthcare systems to broaden reach and ensure reimbursement coverage. Many are expanding their global distribution networks to penetrate emerging markets while investing heavily in R&D to enhance platform functionality using AI, machine learning, and real-time patient monitoring. Regulatory approvals remain a priority, with companies working closely with agencies to gain faster clearances. Integration with electronic health records and telehealth platforms is another core focus, aimed at improving interoperability and patient engagement.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic disease

- 3.2.1.2 Rising demand for cost containment

- 3.2.1.3 Expansion of quality-of-care delivery

- 3.2.1.4 Growing popularity of digital therapeutics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data security and privacy concerns

- 3.2.2.2 Lack of skilled IT professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing shift toward preventive and value-based care

- 3.2.3.2 Expansion of combination therapy models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 On-premises

- 5.2.2 Cloud-based

- 5.3 Hardware

- 5.3.1 Wearable devices

- 5.3.2 Sensors and monitoring devices

- 5.3.3 Other devices

- 5.4 Services

- 5.4.1 Consulting and integration

- 5.4.2 Training and education

- 5.4.3 Other services

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diabetes

- 6.3 Obesity

- 6.4 Cardiovascular

- 6.5 Mental & behavior health

- 6.6 Hypertension

- 6.7 Insomnia

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Healthcare providers

- 7.2.1 Hospitals

- 7.2.2 Clinics

- 7.2.3 Telehealth platforms

- 7.3 Payers

- 7.4 Patients

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AmerisourceBergen

- 9.2 Akili Interactive

- 9.3 Click Therapeutics

- 9.4 Hyfe

- 9.5 LifeScan

- 9.6 Omada Health

- 9.7 Orexo

- 9.8 Otsuka Holdings

- 9.9 Pear Therapeutics

- 9.10 Propeller Health (ResMed)

- 9.11 Teladoc Health

- 9.12 Virta Health