|

市场调查报告书

商品编码

1858995

血压计市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Sphygmomanometer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

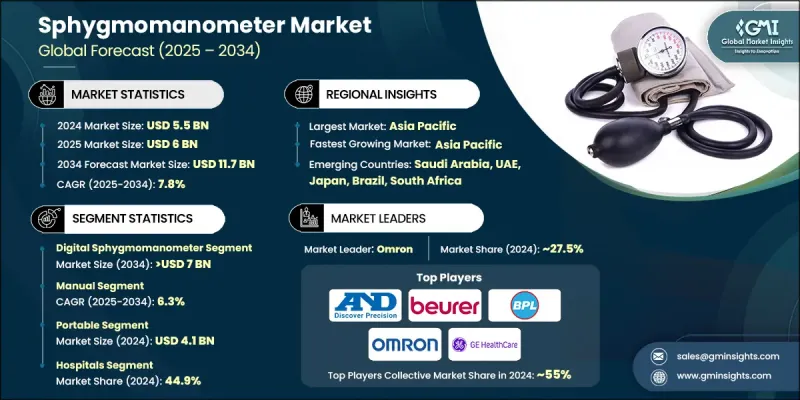

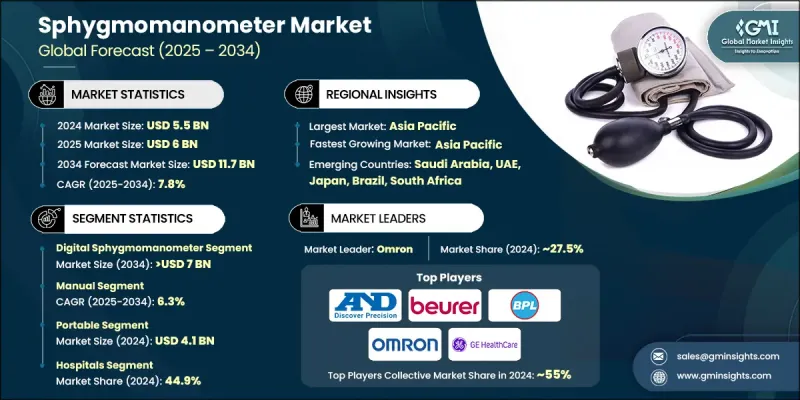

2024 年全球血压计市场价值为 55 亿美元,预计到 2034 年将以 7.8% 的复合年增长率增长至 117 亿美元。

全球高血压和心血管疾病发病率不断上升、人口老化、健康意识增强以及各国政府大力推广预防保健和早期诊断,共同推动了血压监测市场的成长。其中一个主要因素是家庭医疗保健和远端监测解决方案需求的激增。不良的营养、缺乏运动和高压力等生活方式的改变加剧了高血压的流行。随着越来越多的人寻求可靠且便捷的健康追踪方案,对易于使用的血压监测仪的需求持续成长。血压计是一种用于测量血压的医疗设备,通常由袖带、压力表和充气装置组成,充气装置可以是手动的,也可以是自动的。人们越来越重视自我监测和早期检测,这使得血压计成为现代医疗保健趋势的核心,既可用于临床应用,也可用于个人健康追踪。市场上的一个显着变化是向数位化技术的转变。自动血压计凭藉其内建记忆体、进度追踪和无线资料传输等先进功能,获得了广泛的认可。这些数位工具能够与健康应用程式和云端系统无缝集成,使用户更容易管理自己的健康状况并与医疗专业人员交流数据。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 55亿美元 |

| 预测值 | 117亿美元 |

| 复合年增长率 | 7.8% |

由于其用户友善性、读数精准以及在个人和临床环境中的快速普及,预计到2024年,数位血压计市场份额将达到56.7%。这些设备采用示波法测量,无需人工听诊,从而最大限度地减少人为误差,并获得更一致的读数。此外,蓝牙和应用程式的整合也使其在远距医疗和虚拟医疗保健模式中得到更广泛的应用。

预计到2034年,手动血压计市场将以6.3%的复合年增长率成长。儘管数位血压计广受欢迎,手动血压计因其无可比拟的精准度,在医疗领域仍备受推崇。它们在临床评估中仍然发挥着重要作用,尤其是在需要透过听诊进行精确评估的情况下,例如高风险患者群体或临床研究。此外,在那些优先考虑诊断可靠性而非便利性的医疗环境中,手动血压计也备受青睐。

北美血压计市场预计到2034年将以5.3%的复合年增长率增长,这主要得益于完善的医疗保健体系、人们对心血管健康的高度重视以及消费者对远端患者监测技术的日益普及。此外,该地区还受益于有利的医疗报销政策,提高了家用监测设备的可近性。美国食品药物管理局(FDA)等监管机构确保产品的安全性和性能,增强了市场信心并推动了需求。包括联邦医疗保险(Medicare)和私人保险在内的广泛保险覆盖进一步促进了家庭血压计的增长。

全球血压计市场的主要参与者包括GE医疗、博雅(Beurer)、欧姆龙(OMRON)、BPL、ADC、ACCOSON、Bosch(BOSCH + SOHN)、PRESTIGE MEDICAL、SUNTECH、Riester、microlife、Little Doctor、Rossmax、Spengler和AND。为了巩固其在全球血压计市场的地位,领先企业正致力于采取多项策略措施。这些倡议包括持续的产品创新、整合先进的数位功能(例如应用程式连接和基于人工智慧的分析)以及拓展其全球分销网路。许多公司正在加大研发投入,以提高血压计的准确性、舒适性和易用性,从而满足专业医疗保健人员和家庭用户的需求。与远距医疗平台和医疗机构建立策略伙伴关係也对提高血压计的普及率起着关键作用。此外,各公司正在根据不同的用户需求客製化产品线,从便于携带的便携式设备到诊所使用的专业级血压计,从而确保在多个客户群中占据稳固的地位。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 高血压和心血管疾病盛行率不断上升

- 政府推行促进预防性医疗保健和早期诊断的倡议

- 技术进步

- 对家庭医疗保健和远距病人监护的需求不断增长。

- 产业陷阱与挑战

- 严格的监管审批和合规性

- 市场机会

- 新兴经济体医疗保健基础设施的扩建

- 采用电子血压计

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 目前技术

- 新兴技术

- 未来市场趋势

- 消费者行为分析

- 2021-2024年各地区高血压病例数

- 报销方案

- 管道分析

- 投资环境

- 2024年定价分析

- 波特的分析

- PESTEL 分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 电子血压计

- 臂式电子血压计

- 腕式电子血压计

- 无液体血压计

- 水银血压计

第六章:市场估算与预测:依营运方式划分,2021-2034年

- 主要趋势

- 手动的

- 自动的

- 半自动

第七章:市场估算与预测:依配置划分,2021-2034年

- 主要趋势

- 便携的

- 桌面安装

- 落地式

- 壁挂式

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院

- 居家照护

- 门诊手术中心

- 其他最终用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- ACCOSON

- ADC

- AND

- beurer

- BOSCH + SOHN

- BPL

- GE Healthcare

- Little Doctor

- microlife

- Omron

- PRESTIGE MEDICAL

- Riester

- rossmax

- Spengler

- SUNTECH

The Global Sphygmomanometer Market was valued at USD 5.5 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 11.7 billion by 2034.

This growth is fueled by the increasing global incidence of hypertension and cardiovascular conditions, the aging population, growing health awareness, and strong initiatives by governments promoting preventive care and early diagnosis. A major contributing factor is the surge in demand for home healthcare and remote monitoring solutions. Lifestyle shifts characterized by poor nutrition, physical inactivity, and elevated stress levels have intensified the prevalence of high blood pressure. As more individuals seek reliable and simple solutions to track their health, demand for user-friendly blood pressure monitors continues to rise. A sphygmomanometer is a medical device used to measure blood pressure and typically consists of a cuff, a pressure gauge, and an inflation mechanism, which may be manual or automated. The growing focus on self-monitoring and early detection has placed these devices at the center of modern healthcare trends, supporting both clinical applications and personal wellness tracking. A notable transformation in the market is the shift toward digital technology. Automated sphygmomanometers have gained significant traction due to advanced features such as internal memory, progress tracking, and wireless data transmission. These digital tools enable seamless integration with health apps and cloud-based systems, making it easier for users to manage their health and communicate readings with medical professionals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.5 Billion |

| Forecast Value | $11.7 Billion |

| CAGR | 7.8% |

The digital segment held a 56.7% share in 2024, owing to its user-friendliness, precise readings, and rapid uptake in personal and clinical environments. These devices use oscillometric measurement methods, which eliminate the need for manual auscultation, minimizing human error and allowing for more consistent readings. Additionally, the integration of Bluetooth and app compatibility has allowed for wider adoption in telemedicine and virtual healthcare models.

The manual sphygmomanometers segment is expected to grow at a CAGR of 6.3% through 2034. Despite the popularity of digital devices, manual monitors remain highly regarded in medical settings for their unmatched accuracy. They continue to be relied upon in clinical assessments, especially where auscultation is preferred for precise evaluation, such as in high-risk patient populations or clinical studies. These devices are also favored in healthcare environments that prioritize diagnostic reliability over convenience.

North America Sphygmomanometer Market is projected to grow at a CAGR of 5.3% through 2034, supported by a well-established healthcare system, high awareness of cardiovascular health, and growing consumer adoption of remote patient monitoring technologies. The region also benefits from favorable healthcare reimbursement policies that improve access to home monitoring devices. Regulatory agencies such as the FDA ensure product safety and performance, which supports market confidence and drives demand. Widespread insurance coverage, including Medicare and private plans, further supports the growth of home-use blood pressure monitors.

Key industry players leading the Global Sphygmomanometer Market include GE Healthcare, beurer, OMRON, BPL, ADC, ACCOSON, BOSCH + SOHN, PRESTIGE MEDICAL, SUNTECH, Riester, microlife, Little Doctor, Rossmax, Spengler, and AND. To strengthen their presence in the Global Sphygmomanometer Market, leading companies are focusing on several strategic moves. These include continuous product innovation, integrating advanced digital features like app connectivity and AI-based analytics, and expanding their global distribution networks. Many firms are investing in R&D to enhance accuracy, comfort, and usability, catering to both professional healthcare providers and home users. Strategic partnerships with telehealth platforms and healthcare institutions also play a key role in increasing adoption. Additionally, companies are tailoring product lines for various user needs from compact devices for travel to professional-grade monitors for clinics ensuring a strong foothold across multiple customer segments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Operation trends

- 2.2.4 Configuration trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of hypertension and cardiovascular diseases

- 3.2.1.2 Government initiatives promoting preventive healthcare and early diagnosis

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing demand for home healthcare and remote patient monitoring.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approvals and compliance

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding healthcare infrastructure in emerging economies

- 3.2.3.2 Adoption of digital sphygmomanometer

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Consumer behavior analysis

- 3.8 Number of cases of hypertension, by region, 2021 - 2024

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 MEA

- 3.9 Reimbursement scenario

- 3.10 Pipeline analysis

- 3.11 Investment landscape

- 3.12 Pricing analysis, 2024

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Digital sphygmomanometer

- 5.2.1 Arm electronic sphygmomanometer

- 5.2.2 Wrist electronic sphygmomanometer

- 5.3 Aneroid sphygmomanometer

- 5.4 Mercury sphygmomanometer

Chapter 6 Market Estimates and Forecast, By Operation, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

- 6.4 Semi-automatic

Chapter 7 Market Estimates and Forecast, By Configuration, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Portable

- 7.3 Desk mounted

- 7.4 Floor standing

- 7.5 Wall mounted

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Homecare

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ACCOSON

- 10.2 ADC

- 10.3 AND

- 10.4 beurer

- 10.5 BOSCH + SOHN

- 10.6 BPL

- 10.7 GE Healthcare

- 10.8 Little Doctor

- 10.9 microlife

- 10.10 Omron

- 10.11 PRESTIGE MEDICAL

- 10.12 Riester

- 10.13 rossmax

- 10.14 Spengler

- 10.15 SUNTECH