|

市场调查报告书

商品编码

1871178

穿戴式血压监测仪市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Wearable Blood Pressure Monitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

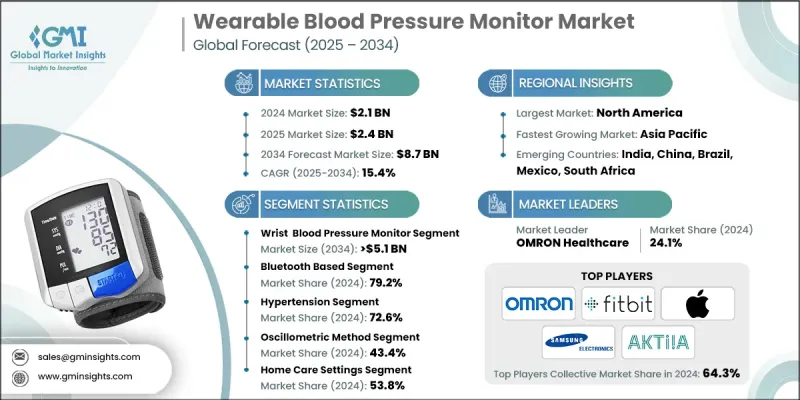

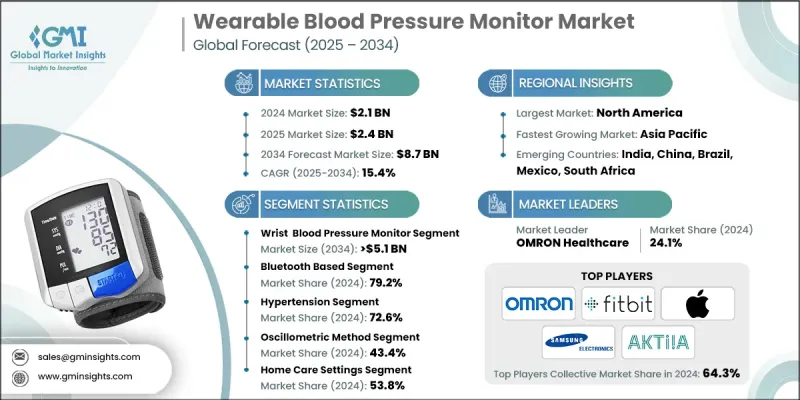

2024 年全球穿戴式血压监测仪市场价值为 21 亿美元,预计到 2034 年将以 15.4% 的复合年增长率成长至 87 亿美元。

高血压盛行率的不断上升以及对持续、非侵入性健康监测解决方案日益增长的需求推动了市场成长。穿戴式血压设备透过提供即时数据、支援预防性护理和辅助临床决策,正在改变消费者、医疗服务提供者和支付方管理心血管健康的方式。这些设备包括腕戴式、无袖带式和智慧手錶整合式血压计,它们配备了人工智慧驱动的分析功能和无线连接功能,使用户能够便捷、准确地追踪血压。智慧型手机整合、基于人工智慧的资料分析和蓝牙连接等技术创新提高了设备的易用性、准确性和患者参与度。这些设备小巧便捷,可提供持续的心血管监测、异常情况的早期检测和便捷的血压管理,使个人能够积极主动地管理自身健康。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21亿美元 |

| 预测值 | 87亿美元 |

| 复合年增长率 | 15.4% |

2024年,腕式血压计市占率达58.1%。其受欢迎的原因在于便携性、用户友好型设计和即时追踪功能,这些特点吸引了精通科技的消费者和老年用户。这些设备非常适合持续的家庭和床边监测,无需专业人员监督。近年来,微型感测器、行动应用程式整合和蓝牙连接等技术的进步,使得即时资料追踪、个人化分析和长期趋势分析成为可能,进一步推动了腕式血压计的普及。

2024年,基于蓝牙技术的市场占据了79.2%的份额,预计到2034年将达到72亿美元。蓝牙技术的广泛应用实现了与智慧型手机、平板电脑和其他连网装置的无缝通信,从而可以将血压读数即时传输到行动应用程式或医疗保健提供者。这种便利性,加上健康和健身应用程式的日益普及,鼓励人们定期监测血压、积极管理疾病,并积极参与预防保健活动。

2024年,北美穿戴式血压监测仪市占率达35.5%。该地区的领先地位归功于其先进的医疗基础设施、数位健康解决方案的高普及率以及心血管疾病发病率的上升。预防性医疗保健意识的广泛普及、有利的报销政策以及监管机构对远距患者监测的鼓励进一步推动了市场成长。穿戴式装置和智慧型手机的高普及率使得健康资料追踪更加便捷,让持续血压监测对消费者更具吸引力。

穿戴式血压监测仪市场的主要参与者包括三星、Fitbit(Google旗下)、华为、iHealth Labs、CardiacSense、Caretaker Medical、Biobeat Medical、欧姆龙医疗、Tenovi、Withings、SunTech Medical、Corsano Health、CardieX、Aktiia 和苹果。这些公司正透过创新、策略合作和市场拓展措施来巩固其市场地位。他们大力投资研发,以提高设备的精度、设计以及与行动医疗平台的整合度。与医疗服务提供者和科技公司的合作,有助于开发人工智慧驱动的监测解决方案,并提升与健康应用程式的互通性。各公司正透过进入新地区、建立分销管道和利用远距医疗技术来扩大其全球影响力。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 高血压和心血管疾病盛行率上升

- 转向居家护理和远距病人监护(RPM)

- 医疗穿戴式装置日益普及

- 无袖带感测器技术(PPG/PTT/AI演算法)的进步

- 产业陷阱与挑战

- 临床准确性和验证问题

- 监理障碍和多变的审批途径

- 市场机会

- 感测器技术创新

- 新兴市场的扩张

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 2024年定价分析

- 技术格局

- 当前技术趋势

- 便携式和家用可穿戴式血压监测仪的成长

- 支援远端监测的数位健康平台

- 对病人友善、非侵入性的监测系统

- 新兴技术

- 人工智慧驱动的预测分析

- 穿戴式互联设备

- 具有自适应监控模式的智慧型设备

- 当前技术趋势

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 人工智慧、数位医疗和连网设备的融合

- 扩展家庭和远端监控解决方案

- 采用无袖带和非侵入式技术

- 与健康和预防保健计划相结合

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新服务类型推出

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 腕式血压计

- 指式血压计

- 上臂血压监测仪

第六章:市场估算与预测:基于连网技术的2021-2034年市场展望

- 主要趋势

- 基于蓝牙

- 基于WiFi

第七章:市场估算与预测:依指示剂划分,2021-2034年

- 主要趋势

- 高血压

- 心律不整

- 低血压

第八章:市场估算与预测:依计量类型划分,2021-2034年

- 主要趋势

- 示波法

- 动脉张力测定

- 脉衝传输时间(PPT)

- 光电容积脉搏波描记法(PPG)

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 家庭护理机构

- 医院和诊所

- 门诊手术中心

- 其他最终用途

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- Aktiia

- Apple

- Biobeat Medical

- CardiacSense

- CardieX

- Caretaker Medical

- Corsano Health

- Fitbit (Google)

- HUAWEI

- iHealth Labs

- Microlife

- OMRON Healthcare

- Samsung

- Sotera Wireless

- SunTech Medical

- Tenovi

- Withings

The Global Wearable Blood Pressure Monitor Market was valued at USD 2.1 Billion in 2024 and is estimated to grow at a CAGR of 15.4% to reach USD 8.7 Billion by 2034.

Market growth is fueled by the increasing prevalence of hypertension and the rising demand for continuous, non-invasive health monitoring solutions. Wearable blood pressure devices are transforming the way consumers, healthcare providers, and payers manage cardiovascular health by offering real-time insights, supporting preventive care, and aiding clinical decision-making. These devices include wrist-worn, cuffless, and smartwatch-integrated monitors equipped with AI-driven analytics and wireless connectivity, allowing users to track blood pressure conveniently and accurately. Technological innovations such as smartphone integration, AI-based data analysis, and Bluetooth-enabled connectivity enhance usability, accuracy, and patient engagement. Compact and user-friendly, these monitors provide continuous cardiovascular monitoring, early detection of anomalies, and convenient management of blood pressure, empowering individuals to take a proactive role in their health.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 15.4% |

The wrist blood pressure monitors segment held a 58.1% share in 2024. Their popularity stems from portability, user-friendly design, and real-time tracking capabilities, which appeal to both tech-savvy consumers and elderly users. These devices are ideal for ongoing home and point-of-care monitoring, eliminating the need for professional supervision. Recent technological advances, including miniaturized sensors, mobile app integration, and Bluetooth connectivity, allow for real-time data tracking, personalized insights, and long-term trend analysis, further driving adoption.

The Bluetooth-based segment held 79.2% share in 2024 and is estimated to reach USD 7.2 Billion through 2034. The widespread use of Bluetooth technology enables seamless communication with smartphones, tablets, and other connected devices, allowing instant transmission of blood pressure readings to mobile apps or healthcare providers. This convenience, combined with the growing use of health and fitness applications, encourages regular monitoring, active disease management, and patient engagement in preventive care routines.

North America Wearable Blood Pressure Monitor Market held a 35.5% share in 2024. The region's leadership is attributed to advanced healthcare infrastructure, high adoption of digital health solutions, and a rising incidence of cardiovascular disorders. Widespread awareness of preventive healthcare, supportive reimbursement policies, and regulatory encouragement for remote patient monitoring further drive growth. High penetration of wearable devices and smartphones facilitates seamless health data tracking, making continuous blood pressure monitoring accessible and appealing to consumers.

Key players operating in the Wearable Blood Pressure Monitor Market include Samsung, Fitbit (Google), HUAWEI, iHealth Labs, CardiacSense, Caretaker Medical, Biobeat Medical, OMRON Healthcare, Tenovi, Withings, SunTech Medical, Corsano Health, CardieX, Aktiia, and Apple. Companies in the wearable blood pressure monitor market are strengthening their foothold through innovation, strategic partnerships, and market expansion initiatives. They are investing heavily in research and development to enhance device accuracy, design, and integration with mobile health platforms. Collaborations with healthcare providers and technology firms enable the creation of AI-driven monitoring solutions and improve interoperability with health apps. Firms are expanding their global presence by entering new regions, establishing distribution channels, and leveraging telehealth integration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Connecting technology trends

- 2.2.4 Indication trends

- 2.2.5 Measurement type trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of hypertension & CVD

- 3.2.1.2 Shift to home care & remote patient monitoring (RPM)

- 3.2.1.3 Growing adoption of medical wearables

- 3.2.1.4 Advances in cuffless sensor tech (PPG/PTT/AI algorithms)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Clinical accuracy & validation concerns

- 3.2.2.2 Regulatory hurdles & variable approval pathways

- 3.2.3 Market opportunities

- 3.2.3.1 Innovation in sensor technology

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Pricing analysis, 2024

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.1.1 Growth of portable and home-based wearable blood pressure monitors

- 3.6.1.2 Digital health platforms enabling remote monitoring

- 3.6.1.3 Patient-friendly, non-invasive monitoring systems

- 3.6.2 Emerging technologies

- 3.6.2.1 AI-Powered predictive analytics

- 3.6.2.2 Wearable connected devices

- 3.6.2.3 Smart devices with adaptive monitoring modes

- 3.6.1 Current technological trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.10.1 Convergence of AI, digital health, and connected devices

- 3.10.2 Expansion of home-based and remote monitoring solutions

- 3.10.3 Adoption of cuffless and non-invasive technologies

- 3.10.4 Integration with wellness and preventive health programs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wrist blood pressure monitor

- 5.3 Finger blood pressure monitor

- 5.4 Upper arm blood pressure monitor

Chapter 6 Market Estimates and Forecast, By Connecting Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Bluetooth based

- 6.3 WiFi based

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hypertension

- 7.3 Irregular heartbeat

- 7.4 Hypotension

Chapter 8 Market Estimates and Forecast, By Measurement Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oscillometric method

- 8.3 Arterial tonometry

- 8.4 Pulse transit time (PPT)

- 8.5 Photoplethysmography (PPG)

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Home care settings

- 9.3 Hospital & clinics

- 9.4 Ambulatory surgical centers

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aktiia

- 11.2 Apple

- 11.3 Biobeat Medical

- 11.4 CardiacSense

- 11.5 CardieX

- 11.6 Caretaker Medical

- 11.7 Corsano Health

- 11.8 Fitbit (Google)

- 11.9 HUAWEI

- 11.10 iHealth Labs

- 11.11 Microlife

- 11.12 OMRON Healthcare

- 11.13 Samsung

- 11.14 Sotera Wireless

- 11.15 SunTech Medical

- 11.16 Tenovi

- 11.17 Withings