|

市场调查报告书

商品编码

1871075

钙钛矿太阳能电池市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Perovskite Solar Cells Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

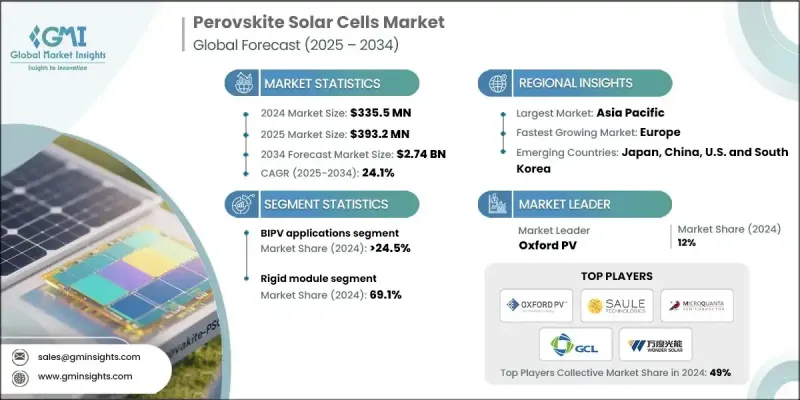

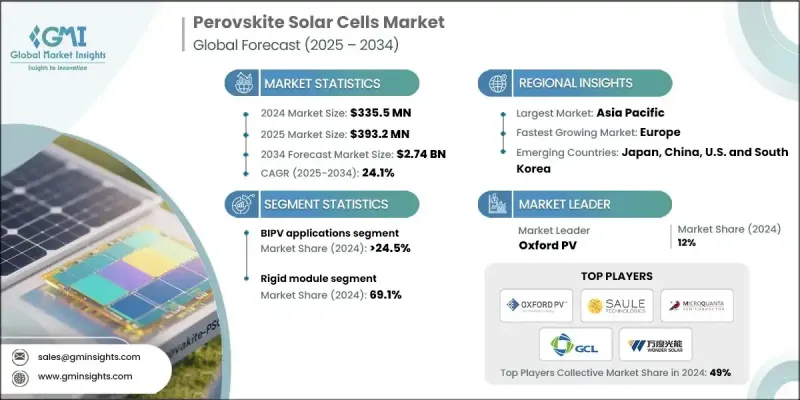

2024 年全球钙钛矿太阳能电池市值为 3.355 亿美元,预计到 2034 年将以 24.1% 的复合年增长率增长至 27.4 亿美元。

钙钛矿太阳能电池正迅速崛起为一种前沿的光伏(PV)技术,它具有高效率、低生产成本和卓越的设计灵活性等优势。这类电池采用钙钛矿结构化合物作为活性光吸收材料,能够有效率地将太阳能转换为电能。与传统的硅基太阳能技术相比,钙钛矿太阳能电池可采用低温溶液法製备,例如旋涂、刮涂和喷墨印刷,从而显着降低製造成本。由于功率转换效率和可扩展性的不断提升,以及钙钛矿材料即使在杂质的情况下也能保持性能,市场正呈现强劲成长动能。此外,钙钛矿太阳能电池与大规模生产製程(包括卷对卷生产)的兼容性也进一步提升了其商业可行性。人们对将太阳能技术整合到建筑、车辆和便携式设备中的兴趣日益浓厚,也推动了市场需求。凭藉其更高的能量输出、更低的生产复杂性和对各种应用的适应性,钙钛矿太阳能电池预计将在未来十年重塑再生能源模式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.355亿美元 |

| 预测值 | 27.4亿美元 |

| 复合年增长率 | 24.1% |

2024年,建筑一体化光伏(BIPV)市占率达到35.8%,预计到2034年将以24.5%的复合年增长率成长。这一增长得益于人们对兼具功能性和设计灵活性的节能建筑材料的日益青睐。这些光伏组件为建筑师和开发商提供了许多美学优势,例如丰富的色彩选择、透明度选项和轻量化结构,使其能够与建筑立面和屋顶完美融合。其多功能特性促使BIPV在商业和住宅建设项目中得到更广泛的应用,尤其是在註重节能的地区,从而提升了其在再生能源转型中的作用。

2024年,柔性组件技术市占率达到30.9%,预计2034年将以24.5%的复合年增长率成长。这些组件采用由塑胶或金属箔製成的轻薄基板,使其成为曲面、移动和对重量敏感的应用的理想选择。透过卷对卷生产,在可扩展的柔性材料上实现超过20%的功率转换效率,正引起製造商和终端用户的极大兴趣。其适应性和易于部署的特点,使其成为下一代太阳能係统,特别是便携式能源设备和交通运输应用领域的理想解决方案。

到2034年,欧洲钙钛矿太阳能电池市场规模将达到8亿美元,这得归功于强而有力的政府措施、先进的研究项目和雄心勃勃的再生能源政策。该地区凭藉其开创性的研究机构和产业合作,持续引领全球钙钛矿太阳能技术的商业化进程。欧洲各大学、国家实验室和私人企业的共同努力,确保了技术的快速发展,并巩固了欧洲在钙钛矿创新领域的领先地位。欧洲高度重视将钙钛矿电池整合到各种再生能源应用中,使其成为产品开发和市场拓展的中心枢纽。

全球钙钛矿太阳能电池市场的主要参与者包括牛津光电(Oxford Photovoltaics)、Saule Technologies、Swift Solar、Microquanta Semiconductor、Frontier Energy Solutions、Energy Materials Corp.、Heiking PV Technology、Dyenamo AB、Caelux、Fraunhofer ISE、富士官能株和光纯药厂(LiKxenux)科技株式新创公司(Li09494p)公司(Li位能源株式科技株(Li0)科技株式科技株和光源)。 Yuan New Energy Technology)、Alfa Aesar、G24 Power Ltd.、Hunt Perovskite Technologies、协鑫苏州奈米科技(GCLzhou Nanotechnology)、CubicPV、FrontMaterials Co. Ltd.、湖北万德太阳能(Hubei Wonder Solar)和积水化学(Sekisui Chemical)。为了巩固市场地位,钙钛矿太阳能电池产业的关键企业正致力于创新、扩大生产规模,并透过材料优化提升产品效率。各公司正大力投资研发,以提高产品在实际应用条件下的稳定性、使用寿命和性能。研究机构和製造商之间正在建立策略合作伙伴关係,以加速商业化部署。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系统

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

- 战略仪錶板

- 策略倡议

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:依类型划分,2021-2034年

- 主要趋势

- 死板的

- 灵活的

第六章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 双腔气门体

- 发电

- 国防与航太

- 运输

- 消费性电子产品

第七章:市场规模及预测:依最终用途划分,2021-2034年

- 主要趋势

- 住宅

- 商业和工业

- 公用事业

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 义大利

- 英国

- 波兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 世界其他地区

第九章:公司简介

- Alfa Aesar

- Caelux

- CubicPV

- Dyenamo AB

- Energy Materials Corp.

- Fraunhofer ISE

- Frontier Energy Solutions

- FrontMaterials Co. Ltd.

- FUJIFILM Wako Pure Chemical Corporation

- G24 Power Ltd.

- GCL Suzhou Nanotechnology

- Heiking PV Technology

- Hubei Wonder Solar

- Hunt Perovskite Technologies

- Li Yuan New Energy Technology

- Microquanta Semiconductor

- Oxfords Photovoltaics

- Saule Technologies

- Sekisui Chemical

- Swift Solar

The Global Perovskite Solar Cells Market was valued at USD 335.5 million in 2024 and is estimated to grow at a CAGR of 24.1% to reach USD 2.74 Billion by 2034.

Perovskite solar cells are emerging as a cutting-edge photovoltaic (PV) technology that offers high efficiency, low production cost, and exceptional flexibility in design. These cells utilize a perovskite-structured compound as the active light-absorbing material, capable of efficiently converting solar energy into electricity. Their ability to be produced using low-temperature, solution-based fabrication techniques such as spin-coating, blade-coating, and inkjet printing significantly reduces manufacturing expenses when compared to traditional silicon-based solar technologies. The market is gaining strong momentum owing to continuous advancements in power conversion efficiency and scalability, alongside the ability of perovskite materials to maintain performance even with material impurities. The compatibility of these cells with large-scale manufacturing approaches, including roll-to-roll production, is further improving commercial viability. Increasing interest in integrating solar technologies into buildings, vehicles, and portable devices is also driving demand. With their capability to achieve higher energy output, reduced production complexity, and adaptability to diverse applications, perovskite solar cells are set to reshape the renewable energy landscape over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $335.5 Million |

| Forecast Value | $2.74 Billion |

| CAGR | 24.1% |

The building-integrated photovoltaic (BIPV) segment held 35.8% in 2024, growing at a CAGR of 24.5% through 2034. This growth is supported by the rising preference for energy-efficient building materials that combine functionality and design flexibility. These cells provide architects and developers with aesthetic benefits such as color versatility, transparency options, and lightweight configurations, enabling smooth integration into building facades and roofs. Their multifunctional features are contributing to increased adoption across commercial and residential construction projects, particularly in energy-conscious regions, enhancing their role within the renewable energy transition.

The flexible module technology segment held 30.9% share in 2024 and is projected to grow at a CAGR of 24.5% through 2034. These modules leverage thin, lightweight substrates made of plastic or metal foils, making them ideal for curved, mobile, and weight-sensitive applications. The ability to achieve power conversion efficiencies surpassing 20% on scalable, flexible materials through roll-to-roll production is driving significant interest among manufacturers and end users. Their adaptability and ease of deployment make them a promising solution for next-generation solar systems, particularly in portable energy devices and transport applications.

Europe Perovskite Solar Cells Market will reach USD 800 million by 2034, supported by robust government initiatives, advanced research programs, and ambitious renewable energy policies. The region continues to lead the global commercialization of perovskite solar technologies, backed by pioneering research institutions and industry collaborations. The combined efforts of European universities, national laboratories, and private companies are ensuring rapid technological progress and maintaining Europe's leadership in perovskite innovation. The strong focus on integrating perovskite cells into various renewable applications is positioning Europe as a central hub for product development and market expansion.

Prominent companies participating in the Global Perovskite Solar Cells Market include Oxford Photovoltaics, Saule Technologies, Swift Solar, Microquanta Semiconductor, Frontier Energy Solutions, Energy Materials Corp., Heiking PV Technology, Dyenamo AB, Caelux, Fraunhofer ISE, FUJIFILM Wako Pure Chemical Corporation, Li Yuan New Energy Technology, Alfa Aesar, G24 Power Ltd., Hunt Perovskite Technologies, GCL Suzhou Nanotechnology, CubicPV, FrontMaterials Co. Ltd., Hubei Wonder Solar, and Sekisui Chemical. To reinforce their presence, key players in the perovskite solar cells industry are focusing on innovation, scaling production, and enhancing product efficiency through material optimization. Companies are investing heavily in research and development to improve stability, lifespan, and performance under real-world conditions. Strategic partnerships between research institutions and manufacturers are being established to accelerate commercial deployment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Type trends

- 2.4 Application trends

- 2.5 End Use trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of world

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Rigid

- 5.3 Flexible

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 BIPV

- 6.3 Power generation

- 6.4 Defense & aerospace

- 6.5 Transportation

- 6.6 Consumer electronics

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Italy

- 8.3.4 UK

- 8.3.5 Poland

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 Alfa Aesar

- 9.2 Caelux

- 9.3 CubicPV

- 9.4 Dyenamo AB

- 9.5 Energy Materials Corp.

- 9.6 Fraunhofer ISE

- 9.7 Frontier Energy Solutions

- 9.8 FrontMaterials Co. Ltd.

- 9.9 FUJIFILM Wako Pure Chemical Corporation

- 9.10 G24 Power Ltd.

- 9.11 GCL Suzhou Nanotechnology

- 9.12 Heiking PV Technology

- 9.13 Hubei Wonder Solar

- 9.14 Hunt Perovskite Technologies

- 9.15 Li Yuan New Energy Technology

- 9.16 Microquanta Semiconductor

- 9.17 Oxfords Photovoltaics

- 9.18 Saule Technologies

- 9.19 Sekisui Chemical

- 9.20 Swift Solar