|

市场调查报告书

商品编码

1871079

工业气体用低温阀市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Cryogenic Valve for Industrial Gas Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

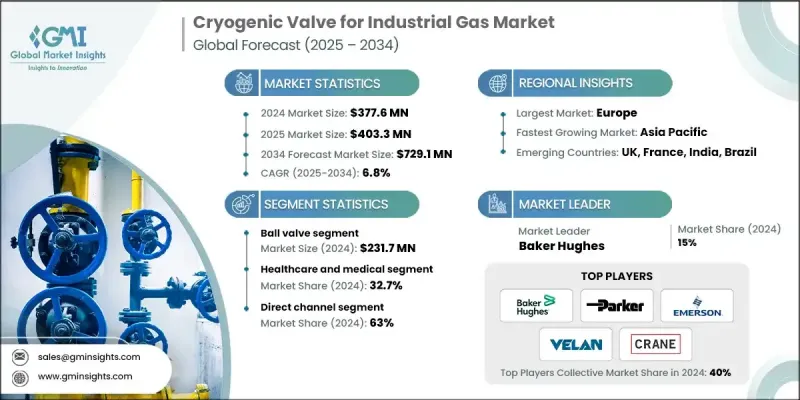

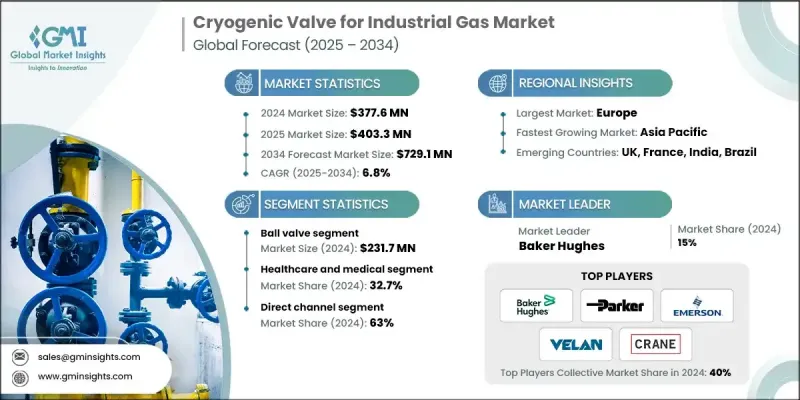

2024 年全球工业气体低温阀门市场价值为 3.776 亿美元,预计到 2034 年将以 6.8% 的复合年增长率增长至 7.291 亿美元。

受氧气、氮气和氩气等特种气体需求不断增长的推动,市场正稳步增长。这些特种气体广泛应用于黑色金属和有色金属冶金製程。这些气体需要先进的低温阀门,能够在极低温度下保持高性能和安全性。工业气体在医疗保健、能源和製造业等多个行业的日益普及,持续推动对高效耐用低温阀门系统的需求。阀门设计的创新,例如引入加长阀盖、金属波纹管密封和改进的顶部入口结构,正在帮助製造商提高效率、减少热洩漏并延长产品寿命。此外,3D列印等积层製造技术正在透过提供更高的精度、更少的浪费和更快的原型製作週期,改变阀门的生产方式。这些进步使生产商能够开发适用于关键应用的客製化高性能组件。随着各行业向自动化和先进的气体分配网路发展,低温阀门在确保安全性、可靠性和符合严格的品质标准方面发挥越来越重要的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.776亿美元 |

| 预测值 | 7.291亿美元 |

| 复合年增长率 | 6.8% |

2024年,蝶阀市占率达到25.3%,这主要得益于其结构紧凑、成本效益高,以及能够适应不同的压力和温度条件。蝶阀在工业领域的广泛应用巩固了其在全球阀门行业的地位。随着基础设施投资的增加以及水和废水处理需求的成长,对蝶阀的需求持续扩大。蝶阀在低温和常温条件下均能提供可靠的性能,使其成为大型工业气体系统的首选。

到2024年,直接配销通路的市占率将达到63%。直接采购透过减少中间环节、确保更快的交付速度和维持产品的高质量,提高了供应链效率。半导体、能源和医疗保健等依赖精度和可靠性的行业,将从这些精简的采购模式中获益匪浅。直接供应不仅保证了品质控制的一致性,还缩短了交货週期并降低了成本,使製造商能够迅速回应客户需求。这种方式有助于企业建立长期的客户关係,提升营运绩效,并增强市场竞争力。

亚太地区工业气体低温阀门市场预计在2025年至2034年间以7.2%的复合年增长率成长。印度和中国等国的快速工业化和城市扩张正在推动工业气体应用领域对低温阀门的市场需求。该地区对能源基础设施、医疗保健和製造业的日益重视进一步扩大了成长机会。政府对工业和能源项目的大量投资也为市场扩张提供了支持。亚太市场份额的不断增长凸显了其作为全球低温阀门製造商关键成长中心的地位。

全球工业气体低温阀门市场的主要参与者包括Microfinish、Flowserve、Parker Hannifin、Kitz、Emerson、Bray International、Herose、PK Valve and Engineering、Baker Hughes、Rego、Swagelok、Crane Company、Powell Valves、Trimteck和Velan。为了巩固市场地位,工业气体低温阀门市场的主要企业正优先考虑产品创新、先进製造流程以及拓展新兴经济体市场。领先的製造商正在整合智慧监控技术和增强型密封解决方案,以提高阀门在低温环境下的可靠性和性能。对积层製造和自动化技术的投资正在优化生产效率并降低成本。企业正积极寻求策略合作和併购,以扩大产品组合和区域覆盖范围。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 特种工业气体需求不断成长

- 扩建空气分离装置(ASU)

- 注重营运安全和效率

- 产业陷阱与挑战

- 合规和认证成本高昂

- 维护所需的熟练劳动力有限

- 机会

- 医疗和实验室气体应用领域的成长

- 自动化和智慧阀门技术

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按阀门类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码-8481)

- 主要进口国

- 主要出口国

- 差距分析

- 风险评估与缓解

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依阀门类型划分,2021-2034年

- 主要趋势

- 球阀

- 浮动球阀

- 耳轴式球阀

- 专用氧气服务球阀

- 控制阀

- 球形控制阀

- 特性控制阀

- 减压阀

- 闸阀

- 柔性楔闸阀

- 波纹管密封闸阀

- 其他的

- 止回阀

- 弹簧式止回阀

- 旋启式止回阀

- 升降止回阀

- 其他的

- 蝶阀

- 其他的

第六章:市场估算与预测:依阀门尺寸划分,2021-2034年

- 主要趋势

- 小于1英寸

- 介于 1.5 到 4 英吋之间

- 介于 5 到 6 英吋之间

- 超过6英寸

第七章:市场估算与预测:依天然气类型划分,2021-2034年

- 主要趋势

- 液态氮

- 液态氧

- 液氩

- 氢

- 二氧化碳

- 其他气体(氦气等)

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 隔离阀

- 流量控制阀

- 单向阀/止回阀

- 压力释放功能

- 其他的

第九章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 医疗保健

- 电子和半导体

- 化学

- 其他(金属加工等)

第十章:市场估价与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直接的

- 间接

第十一章:市场估计与预测:按地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Baker Hughes

- Bray International

- Crane Company

- Emerson

- Flowserve

- Herose

- Kitz

- Microfinish

- Parker Hannifin

- PK Valve and Engineering

- Powell Valves

- Rego

- Swagelok

- Trimteck

- Velan

The Global Cryogenic Valve for Industrial Gas Market was valued at USD 377.6 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 729.1 million by 2034.

The market is witnessing steady growth driven by rising demand for specialty gases such as oxygen, nitrogen, and argon used extensively in ferrous and non-ferrous metallurgical processes. These gases require advanced cryogenic valves capable of handling extremely low temperatures while maintaining high performance and safety. The growing adoption of industrial gases across multiple sectors, including healthcare, energy, and manufacturing, continues to create demand for efficient and durable cryogenic valve systems. Innovation in valve design, such as the introduction of extended bonnets, metal bellows seals, and enhanced top-entry configurations, is helping manufacturers improve efficiency, limit heat leakage, and extend product lifespan. Additionally, additive manufacturing technologies like 3D printing are transforming valve production by offering higher precision, reduced waste, and faster prototyping cycles. These advancements allow producers to develop customized, high-performance components suited for critical applications. As industries move toward automation and advanced gas distribution networks, the role of cryogenic valves becomes increasingly vital in ensuring safety, reliability, and compliance with stringent quality standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $377.6 million |

| Forecast Value | $729.1 million |

| CAGR | 6.8% |

The butterfly valve segment held a 25.3% share in 2024, owing to its compact structure, cost-effectiveness, and adaptability in managing varying pressure and temperature conditions. Its versatile application across industrial operations has strengthened its presence in the global valve industry. With rising infrastructure investments and growing requirements in water and wastewater treatment, the demand for these valves continues to expand. Their ability to deliver reliable performance in both cryogenic and ambient conditions makes them a preferred choice for large-scale industrial gas systems.

The direct distribution channel held a 63% share in 2024. Direct procurement enhances supply chain efficiency by reducing intermediaries, ensuring faster delivery, and maintaining high product quality. Industries that rely on precision and reliability, such as semiconductors, energy, and healthcare, benefit significantly from these streamlined procurement models. Direct supply not only guarantees consistent quality control but also reduces lead times and costs, allowing manufacturers to respond promptly to customer needs. This approach helps companies build long-term client relationships, enhance operational performance, and strengthen their market competitiveness.

Asia Pacific Cryogenic Valve for Industrial Gas Market will grow at a CAGR of 7.2% from 2025 to 2034. Rapid industrialization and urban expansion across countries like India and China are driving market demand for cryogenic valves in industrial gas applications. The region's increasing emphasis on energy infrastructure, healthcare, and manufacturing has further amplified growth opportunities. Substantial government investment in industrial and energy projects is also supporting market expansion. The growing share of the Asia Pacific market underscores its importance as a key growth hub for cryogenic valve manufacturers globally.

Key players operating in the Global Cryogenic Valve for Industrial Gas Market include Microfinish, Flowserve, Parker Hannifin, Kitz, Emerson, Bray International, Herose, PK Valve and Engineering, Baker Hughes, Rego, Swagelok, Crane Company, Powell Valves, Trimteck, and Velan. To strengthen their foothold, major companies in the cryogenic valve for industrial gas market are prioritizing product innovation, advanced manufacturing methods, and expansion into emerging economies. Leading manufacturers are integrating smart monitoring technologies and enhanced sealing solutions to improve valve reliability and performance in cryogenic environments. Investment in additive manufacturing and automation is optimizing production efficiency while reducing costs. Strategic partnerships and mergers are being pursued to expand product portfolios and regional reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Valve type

- 2.2.3 Valve size

- 2.2.4 Gas type

- 2.2.5 Application

- 2.2.6 End Use

- 2.2.7 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for specialty industrial gases

- 3.2.1.2 Expansion of air separation units (ASUs)

- 3.2.1.3 Focus on operational safety and efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of compliance and certification

- 3.2.2.2 Limited skilled workforce for maintenance

- 3.2.3 Opportunities

- 3.2.3.1 Growth in medical and laboratory gas applications

- 3.2.3.2 Automation and smart valve technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Valve type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-8481)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Valve type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Ball valves

- 5.2.1 Floating ball valves

- 5.2.2 Trunnion mounted ball valves

- 5.2.3 Specialized oxygen service ball valves

- 5.3 Control valves

- 5.3.1 Globe-style control valves

- 5.3.2 Characterized control valves

- 5.3.3 Pressure reducing valves

- 5.4 Gate valves

- 5.4.1 Flexible wedge gate valves

- 5.4.2 Bellows-sealed gate valves

- 5.4.3 Others

- 5.5 Check valves

- 5.5.1 Spring-loaded check valves

- 5.5.2 Swing check valves

- 5.5.3 Lift check valves

- 5.5.4 Others

- 5.6 Butterfly valves

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Valve size, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Less than 1 inch

- 6.3 Between 1.5 to 4 inches

- 6.4 Between 5 to 6 inches

- 6.5 More than 6 inches

Chapter 7 Market Estimates & Forecast, By Gas Type, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Liquid Nitrogen

- 7.3 Liquid Oxygen

- 7.4 Liquid Argon

- 7.5 Hydrogen

- 7.6 Carbon Dioxide

- 7.7 Others (Helium etc.)

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Isolation valves

- 8.3 Flow control valves

- 8.4 Check/non-return valves

- 8.5 Pressure relief functions

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Healthcare and medical

- 9.3 Electronics and semiconductors

- 9.4 Chemical

- 9.5 Others (metal processing etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Baker Hughes

- 12.2 Bray International

- 12.3 Crane Company

- 12.4 Emerson

- 12.5 Flowserve

- 12.6 Herose

- 12.7 Kitz

- 12.8 Microfinish

- 12.9 Parker Hannifin

- 12.10 PK Valve and Engineering

- 12.11 Powell Valves

- 12.12 Rego

- 12.13 Swagelok

- 12.14 Trimteck

- 12.15 Velan