|

市场调查报告书

商品编码

1871097

天然有机化妆品市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Natural and Organic Cosmetics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

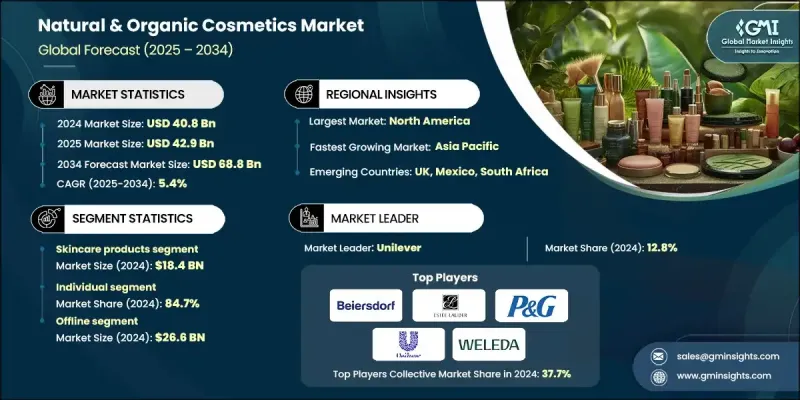

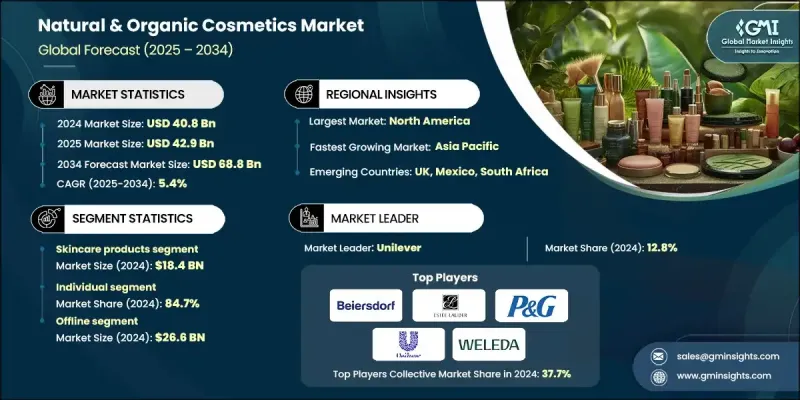

2024年全球天然和有机化妆品市场价值为408亿美元,预计到2034年将以5.4%的复合年增长率增长至688亿美元。

消费者对健康和环保产品的日益重视,推动了对清洁标籤美妆产品的需求。消费者越来越倾向选择不含合成化学物质、符合道德和环境价值的化妆品。透明度、成分可追溯性和清晰的产品标籤已成为重中之重。如今,很大一部分消费者积极寻找可持续的产品,并愿意为此支付更高的价格。数位平台和社群媒体在影响消费者的购买习惯方面发挥着重要作用,并促使品牌承担更多责任。消费者心态的这种转变也促使企业采取更诚实的行销方式,并将道德采购放在首位。除了不断提高的消费者期望外,监管支援和标籤标准的完善也推动了市场扩张。然而,缺乏统一的全球认证体系给寻求国际扩张的品牌带来了挑战。儘管不同地区的信任度存在差异,但对真实可靠、负责任生产的产品的需求仍在持续增长,为护肤、彩妆和个人护理领域创造了新的机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 408亿美元 |

| 预测值 | 688亿美元 |

| 复合年增长率 | 5.4% |

2024年,保养品市场规模预计将达184亿美元。随着越来越多的消费者在日常护肤中更加重视成分天然、植物萃取,市场正稳步成长。天然保湿霜、洗面乳、精华液和护肤品等产品因其多功能性和温和配方而备受青睐。消费者寻求不含刺激性化学物质、兼具护理和滋养功效的替代品,因此对环保护肤色的需求持续攀升。植物萃取、精油和草本混合物如今已成为产品研发的核心要素。

就终端用户而言,个人用户群在2024年占据了84.7%的市场。如今,消费者比以往任何时候都更了解产品讯息,也更积极地参与购买决策。他们会主动查看成分錶,寻求无动物实验认证,并要求产品来源和生产过程透明化。这种意识的转变改变了品牌设计和标註产品的方式,使其更加重视清洁配方,以体现消费者对健康和永续性的价值。如今,道德消费主义和个人健康问题已成为品牌忠诚度和市场定位的核心。

2024年,美国天然和有机化妆品市场占据81.8%的市场份额,市场规模达118亿美元。该地区市场受益于消费者意识的增强、成熟的零售基础设施以及积极的产品创新。美国消费者始终追求成分纯净、采用经认证的有机成分且供应链可追溯的美容产品。随着人们对绿色化学和永续包装的日益关注,该地区已成为新兴天然美容品牌的聚集地。认证和监管框架也有助于建立信任并提升产品信誉。

全球天然有机化妆品市场的主要企业包括宝洁、联合利华、雅诗兰黛、维蕾德、欧莱雅、强生、拜尔斯道夫、德国世家、True Botanicals、科蒂、Josie Maran Cosmetics、Haus Labs、Herbivore Botanicals、Wala Heilmittel 和 Burt's Bees。这些领先品牌正大力投资于清洁创新和符合道德规范的采购,以巩固其市场地位。许多公司正在重新配製产品,去除合成添加剂,并优先使用天然成分。与认证供应商建立合作关係有助于确保整个供应链的透明度。品牌也寻求环保包装解决方案,并利用数位化平台加强与消费者的直接互动。通过公认标准的认证有助于确保产品的真实性,并提升消费者信任度。企业正透过收购、进入新的地域市场以及推出针对注重健康的消费者的利基产品线来扩张业务。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 对清洁标籤和透明成分的需求日益增长

- 电子商务和网红行销的成长

- 天然配方监理支持

- 产业陷阱与挑战

- 天然原料和生产成本高

- 保存期限有限和保存问题

- 机会

- 拓展新兴市场

- 永续包装和循环美容领域的创新

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 保养品

- 乳霜和保湿霜

- 洁面产品及卸妆产品

- 精华液和抗衰老

- 防晒霜和紫外线防护

- 爽肤水和精华液

- 其他(去角质产品和磨砂膏等)

- 护髮产品

- 洗髮精和护髮素

- 护髮油

- 造型产品

- 染髮剂和染料

- 其他(头皮护理产品等)

- 彩妆及化妆品

- 唇膏及唇部护理

- 粉底和遮瑕膏

- 眼妆和睫毛膏

- 指甲油

- 其他(腮红、修容粉等)

- 口腔护理产品

- 牙膏和牙粉

- 漱口水和口腔冲洗液

- 其他(牙齿美白产品等)

- 其他(香水等)

第六章:市场估算与预测:依成分划分,2021-2034年

- 主要趋势

- 植物基和植物性

- 精油

- 植物萃取物和草药

- 水果和蔬菜衍生物

- 其他(花卉及花瓣萃取物等)

- 矿物基

- 粘土和土壤矿物

- 海盐和矿物盐

- 矿物颜料和着色剂

- 海洋来源成分

- 海藻和藻类萃取物

- 其他(海洋胶原蛋白和蛋白质等)

- 生物技术衍生的天然成分

- 其他(经认证的有机农产品等)

第七章:市场估计与预测:依消费族群划分,2021-2034年

- 主要趋势

- 男人

- 女性

- 男女通用的

第八章:市场估算与预测:依价格划分,2021-2034年

- 主要趋势

- 低的

- 中等的

- 高的

- 优质的

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 个人

- 专业的

- 美容院

- 水疗和康体中心

- 医疗专业人员

- 饭店及度假村

- 其他(美容院等)

第十章:市场估价与预测:依配销通路划分,2021-2034年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 专卖店

- 药局

- 其他(百货公司等)

第十一章:市场估计与预测:按地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Beiersdorf

- Burt's Bees

- Coty

- Dr. Hauschka

- Estee Lauder

- Haus Labs

- Herbivore Botanicals

- Johnson & Johnson

- Josie Maran Cosmetics

- L'Oreal

- Procter & Gamble

- True Botanicals

- Unilever

- Wala Heilmittel

- Weleda

The Global Natural and Organic Cosmetics Market was valued at USD 40.8 Billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 68.8 Billion by 2034.

Growing consumer preference for health-conscious and eco-friendly choices is driving demand for clean-label beauty products. Buyers are increasingly favoring cosmetics free from synthetic chemicals and aligned with ethical and environmental values. Transparency, ingredient traceability, and clear product labeling have become top priorities. A large portion of consumers now actively seek sustainable options and are willing to pay premium prices for them. Digital platforms and social media are playing a major role in influencing purchasing habits and pushing brands to be more accountable. This shift in consumer mindset is also prompting companies to adopt more honest marketing practices and prioritize ethical sourcing. Alongside rising consumer expectations, regulatory support, and labeling standards are contributing to market expansion. However, the lack of a unified global certification system presents challenges for brands seeking to scale internationally. Even with varying trust levels across regions, the demand for authentic and responsibly made products continues to accelerate, creating new opportunities across skincare, makeup, and personal care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $40.8 billion |

| Forecast Value | $68.8 billion |

| CAGR | 5.4% |

The skincare segment generated USD 18.4 Billion in 2024. This segment is growing steadily as more consumers prioritize clean, plant-based ingredients in their everyday beauty routines. Products like natural moisturizers, face washes, serums, and skin treatments are favored for their multipurpose functions and gentle formulations. With consumers seeking alternatives that both treat and nourish without harsh chemicals, the demand for eco-conscious skincare is climbing steadily. Botanical extracts, essential oils, and herbal blends are now core elements in product development.

In terms of end users, the individual segment held 84.7% share in 2024. Consumers are more informed and engaged in their purchase decisions than ever before. They actively evaluate ingredient lists, seek cruelty-free certifications, and demand transparency in sourcing and production. This awareness has shifted how brands design and label their products, focusing on clean formulations that reflect consumer values around wellness and sustainability. Ethical consumerism and personal health concerns are now central to brand loyalty and market positioning.

U.S. Natural and Organic Cosmetics Market held 81.8% share and generated USD 11.8 Billion in 2024. The regional market benefits from strong consumer awareness, mature retail infrastructure, and active product innovation. Consumers in the U.S. consistently demand clean beauty products with certified organic ingredients and traceable supply chains. With increasing interest in green chemistry and sustainable packaging, the region has become a hub for emerging natural beauty brands. Certifications and regulatory frameworks are also helping to build trust and enhance product credibility.

Major companies operating in the Global Natural and Organic Cosmetics Market include Procter & Gamble, Unilever, Estee Lauder, Weleda, L'Oreal, Johnson & Johnson, Beiersdorf, Dr. Hauschka, True Botanicals, Coty, Josie Maran Cosmetics, Haus Labs, Herbivore Botanicals, Wala Heilmittel, and Burt's Bees. Leading brands in the Global Natural and Organic Cosmetics Market are investing heavily in clean innovation and ethical sourcing to strengthen their market position. Many companies are reformulating products to eliminate synthetic additives and prioritize naturally derived ingredients. Partnerships with certified suppliers help ensure transparency across the supply chain. Brands are also pursuing eco-friendly packaging solutions and leveraging digital platforms to enhance direct-to-consumer engagement. Certification through recognized standards supports product authenticity and boosts consumer trust. Firms are expanding through acquisitions, entering new geographic markets, and launching niche product lines tailored to wellness-conscious consumers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Ingredients

- 2.2.4 Consumer Group

- 2.2.5 Price

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for clean-label and transparent ingredients

- 3.2.1.2 Growth of e-commerce and influencer marketing

- 3.2.1.3 Regulatory support for natural formulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of natural ingredients and production

- 3.2.2.2 Limited shelf life and preservation issues

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Innovation in sustainable packaging and circular beauty

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Skincare products

- 5.2.1 Face creams & moisturizers

- 5.2.2 Cleansers & makeup removers

- 5.2.3 Serums & anti-aging

- 5.2.4 Sunscreens & UV protection

- 5.2.5 Toners & essences

- 5.2.6 Others (exfoliators & scrubs etc.)

- 5.3 Haircare products

- 5.3.1 Shampoos & conditioners

- 5.3.2 Hair oils

- 5.3.3 Styling products

- 5.3.4 Hair coloring & dyes

- 5.3.5 Others (scalp care products etc.)

- 5.4 Color cosmetics & makeup

- 5.4.1 Lipsticks & lip care

- 5.4.2 Foundations & concealers

- 5.4.3 Eye makeup & mascara

- 5.4.4 Nail polish

- 5.4.5 Others (blushes & bronzers etc.)

- 5.5 Oral care products

- 5.5.1 Toothpaste & tooth powders

- 5.5.2 Mouthwash & oral rinses

- 5.5.3 Others (teeth whitening products etc.)

- 5.6 Others (fragrances etc.)

Chapter 6 Market Estimates and Forecast, By Ingredients, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Plant-based & botanical

- 6.2.1 Essential oils

- 6.2.2 Plant extracts & herbal

- 6.2.3 Fruit & vegetable derivatives

- 6.2.4 Others (flower & petal extracts etc.)

- 6.3 Mineral-based

- 6.3.1 Clays & earth minerals

- 6.3.2 Sea salts & mineral salts

- 6.3.3 Mineral pigments & colorants

- 6.3.4 Marine-derived ingredients

- 6.3.5 Seaweed & algae extracts

- 6.3.6 Others (marine collagen & proteins etc.)

- 6.4 Biotechnology-derived natural ingredients

- 6.5 Others (certified organic agricultural etc.)

Chapter 7 Market Estimates and Forecast, By Consumer Group, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Men

- 7.3 Women

- 7.4 Unisex

Chapter 8 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

- 8.5 Premium

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Individual

- 9.3 Professional

- 9.3.1 Beauty salons

- 9.3.2 Spa & wellness centers

- 9.3.3 Medical professionals

- 9.3.4 Hotel & resort

- 9.3.5 Others (beauty institutes etc.)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Specialty Stores

- 10.3.2 Pharmacies

- 10.3.3 Others (departmental stores, etc.)

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Beiersdorf

- 12.2 Burt's Bees

- 12.3 Coty

- 12.4 Dr. Hauschka

- 12.5 Estee Lauder

- 12.6 Haus Labs

- 12.7 Herbivore Botanicals

- 12.8 Johnson & Johnson

- 12.9 Josie Maran Cosmetics

- 12.10 L'Oreal

- 12.11 Procter & Gamble

- 12.12 True Botanicals

- 12.13 Unilever

- 12.14 Wala Heilmittel

- 12.15 Weleda