|

市场调查报告书

商品编码

1871106

汽车照明半导体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Lighting Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

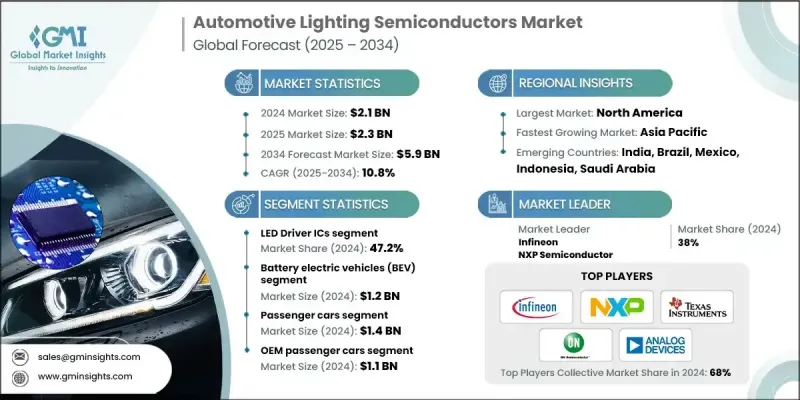

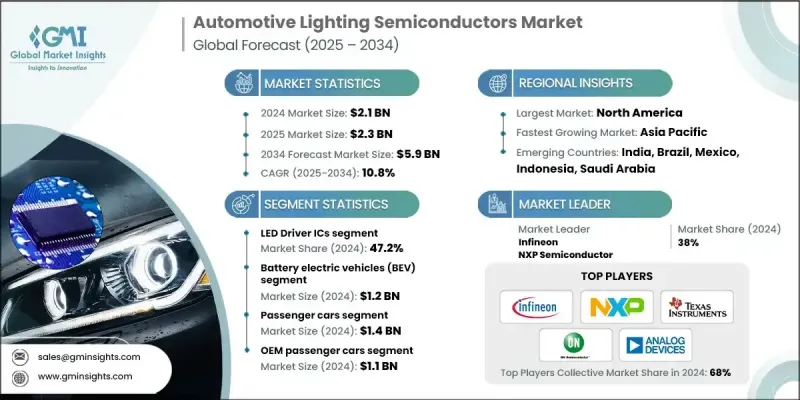

2024 年全球汽车照明半导体市场价值为 21 亿美元,预计到 2034 年将以 10.8% 的复合年增长率成长至 59 亿美元。

市场成长的驱动力在于传统卤素灯和氙气灯向LED和OLED照明技术的转变,这些新技术具有更高的亮度、更长的使用寿命和更低的能耗。汽车製造商正日益整合这些先进的照明系统,以提高效率、永续性和优化车辆设计。自适应和智慧照明技术能够根据驾驶条件调节光束强度和方向,其应用正在加速对可进行精确即时控制的半导体的需求。这些创新对于提高能源效率、安全性和车辆整体性能至关重要,使汽车照明半导体成为现代汽车技术的关键推动因素。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21亿美元 |

| 预测值 | 59亿美元 |

| 复合年增长率 | 10.8% |

2024年,由于节能照明系统的日益普及,纯电动车(BEV)产业创造了12亿美元的收入。纯电动车产量的不断增长,以及对先进LED和自适应照明日益增长的需求,正在推动半导体技术的应用,以提升车辆的性能和安全性。製造商正致力于提升照明半导体的性能、可靠性和整合能力。开发集LED驱动、感测和通讯功能于一体的多功能晶片,是汽车製造商提升产品价值的关键策略。

2024年,乘用车市场规模预计将达14亿美元。这一领先地位主要得益于LED和OLED照明技术的广泛应用,这些技术具有节能、亮度更高、设计更灵活等优势。高级驾驶辅助系统(ADAS)与自适应头灯和自动转向灯等功能的日益整合,进一步推动了市场需求。消费者对时尚、安全和现代照明解决方案的偏好,促使製造商加强对高性能照明半导体的投资。欧洲、北美和亚洲乘用车产量的成长,也为市场的持续扩张和技术进步提供了支撑。

2024年,北美汽车照明半导体市场规模预计将达到7.325亿美元。这一成长主要归功于乘用车和商用车对LED和OLED照明技术的广泛应用,以提高能源效率、增强可视性和优化设计。此外,ADAS系统(包括自适应头灯、自动号誌灯和智慧照明控制系统)的整合进一步推动了半导体需求。同时,汽车产量的成长、消费者对安全时尚照明的需求以及日益严格的安全法规也促进了北美汽车照明半导体市场的发展。

汽车照明半导体市场的主要参与者包括英飞凌、恩智浦半导体、德州仪器、安森美半导体、亚德诺半导体、意法半导体、Monolithic Power Systems、瑞萨电子、欧司朗、日亚化学、Lumileds、首尔半导体和三星。汽车照明半导体市场企业采取的关键策略包括:大力投资研发,以打造节能、高性能和多功能晶片;与汽车製造商建立策略合作伙伴关係,共同开发客製化解决方案;以及扩大生产能力以满足不断增长的市场需求。此外,各公司也致力于提升可靠性和整合能力,开发自适应智慧照明解决方案,并实现在地化生产,以增强供应链的韧性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 衝击力

- 成长驱动因素

- 车辆照明系统中LED和OLED技术的应用日益普及

- 对节能耐用型照明解决方案的需求日益增长

- 电动车和自动驾驶汽车的成长需要先进的照明系统

- 消费者对高端美观的汽车设计越来越感兴趣

- 产业陷阱与挑战

- 高昂的实施和整合成本

- 市场碎片化与互通性

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 新兴商业模式

- 合规要求

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 市场集中度分析

- 对主要参与者进行竞争基准分析

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导人

- 挑战者

- 追踪者

- 小众玩家

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年主要发展动态

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 数位转型计划

- 新兴/新创企业竞争对手格局

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- LED驱动积体电路

- 电源管理积体电路(PMIC)

- 微控制器(MCU)

- 光电元件

- 离散组件

第六章:市场估价与预测:依车辆动力系统划分,2021-2034年

- 主要趋势

- 内燃机(ICE)车辆

- 油电混合动力/插电式油电混合动力车(HEV/PHEV)

- 电池电动车(BEV)

第七章:市场估价与预测:依车辆类别划分,2021-2034年

- 主要趋势

- 搭乘用车

- 轻型商用车(LCV)

- 重型商用车辆(HCV)

第八章:市场估算与预测:依最终用户客户划分,2021-2034年

- 主要趋势

- OEM乘用车

- OEM商用车

- 一级供应商

- 售后市场

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Infineon

- NXP Semiconductors

- Texas Instruments

- ON Semiconductor

- Analog Devices

- STMicroelectronics

- Monolithic Power Systems

- Renesas Electronics

- ams-OSRAM

- Nichia

- Lumileds

- Seoul Semiconductor

- Samsung LED

The Global Automotive Lighting Semiconductors Market was valued at USD 2.1 Billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 5.9 Billion by 2034.

The market growth is driven by the shift from traditional halogen and xenon lamps to LED and OLED lighting technologies, which provide better brightness, longer life, and lower energy consumption. Automotive manufacturers are increasingly integrating these advanced lighting systems to enhance efficiency, sustainability, and vehicle design. The adoption of adaptive and smart lighting, which adjusts beam intensity and direction based on driving conditions, is accelerating demand for semiconductors capable of precise real-time control. These innovations are critical for energy efficiency, safety, and overall vehicle performance, positioning automotive lighting semiconductors as a key enabler of modern automotive technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 10.8% |

In 2024, the battery electric vehicles (BEV) sector generated USD 1.2 Billion owing to the rising use of energy-efficient lighting systems. The increasing production of BEVs, coupled with growing demand for advanced LED and adaptive lighting, is driving semiconductor adoption for improved vehicle performance and safety. Manufacturers are focusing on enhancing the performance, reliability, and integration capabilities of lighting semiconductors. Developing multifunctional chips that combine LED driving, sensing, and communication features is a key strategy to add value for automakers.

The passenger car segment generated USD 1.4 Billion in 2024. This leadership is fueled by widespread adoption of LED and OLED lighting, offering energy efficiency, improved brightness, and design flexibility. The increasing integration of advanced driver-assistance systems (ADAS) with adaptive headlights and automated signaling further boosts demand. Consumer preference for stylish, safe, and modern lighting solutions is driving manufacturers to invest in high-performance lighting semiconductors. Rising production of passenger vehicles across Europe, North America, and Asia supports sustained market expansion and technological advancement.

North America Automotive Lighting Semiconductors Market reached USD 732.5 million in 2024. This increase is attributed to greater adoption of LED and OLED lighting in both passenger and commercial vehicles for energy efficiency, visibility, and design. Integration of ADAS systems, including adaptive headlights, automated signaling, and intelligent lighting controls, further strengthens semiconductor demand. Additionally, rising vehicle production, consumer demand for safe and stylish lighting, and stricter safety regulations contribute to the growing deployment of automotive lighting semiconductors in North America.

Prominent Automotive Lighting Semiconductors Market participants include Infineon, NXP Semiconductors, Texas Instruments, ON Semiconductor, Analog Devices, STMicroelectronics, Monolithic Power Systems, Renesas Electronics, ams-OSRAM, Nichia, Lumileds, Seoul Semiconductor, and Samsung LED. Key strategies adopted by companies in the automotive lighting semiconductors market include investing heavily in research and development to create energy-efficient, high-performance, and multifunctional chips, forming strategic partnerships with automakers to co-develop tailored solutions, and expanding manufacturing capabilities to meet growing demand. Firms are also focusing on improving reliability and integration capabilities, developing adaptive and smart lighting solutions, and localizing production to strengthen supply chain resilience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product Type

- 2.2.2 Vehicle Powertrain

- 2.2.3 Vehicle Class

- 2.2.4 End Use Analysis

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of LED and OLED technologies in vehicle lighting systems

- 3.2.1.2 Increasing demand for energy-efficient and long-lasting lighting solutions

- 3.2.1.3 Growth in electric and autonomous vehicles requiring advanced lighting systems

- 3.2.1.4 Rising consumer preference for premium and aesthetic vehicle designs

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Implementation and Integration Costs

- 3.2.2.2 Market Fragmentation & Interoperability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Consumer sentiment analysis

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 LED Driver ICs

- 5.3 Power Management ICs (PMICs)

- 5.4 Microcontrollers (MCUs)

- 5.5 Optoelectronic Components

- 5.6 Discrete Components

Chapter 6 Market Estimates & Forecast, By Vehicle Powertrain, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Internal Combustion Engine (ICE) Vehicles

- 6.3 Hybrid Electric / Plug-in Hybrid Electric Vehicles (HEV/PHEV)

- 6.4 Battery Electric Vehicles (BEV)

Chapter 7 Market Estimates & Forecast, By Vehicle Class, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.3 Light Commercial Vehicles (LCVs)

- 7.4 Heavy Commercial Vehicles (HCVs)

Chapter 8 Market Estimates & Forecast, By End Use Customer, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 OEM Passenger Cars

- 8.3 OEM Commercial Vehicles

- 8.4 Tier-1 Suppliers

- 8.5 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Infineon

- 10.2 NXP Semiconductors

- 10.3 Texas Instruments

- 10.4 ON Semiconductor

- 10.5 Analog Devices

- 10.6 STMicroelectronics

- 10.7 Monolithic Power Systems

- 10.8 Renesas Electronics

- 10.9 ams-OSRAM

- 10.10 Nichia

- 10.11 Lumileds

- 10.12 Seoul Semiconductor

- 10.13 Samsung LED