|

市场调查报告书

商品编码

1871118

门用隐形铰链市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Door Invisible Hinges Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

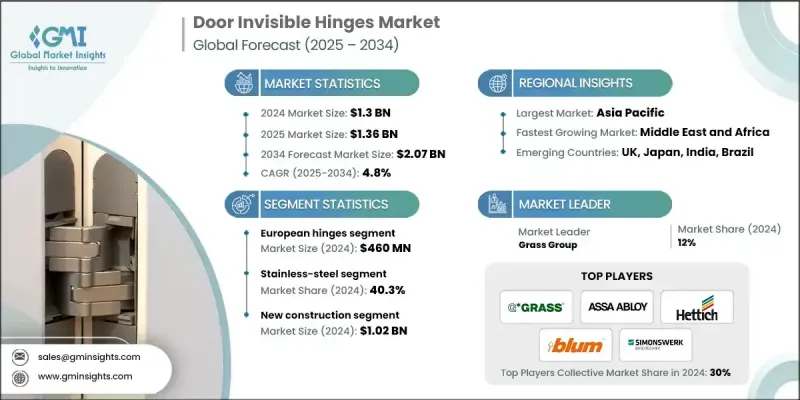

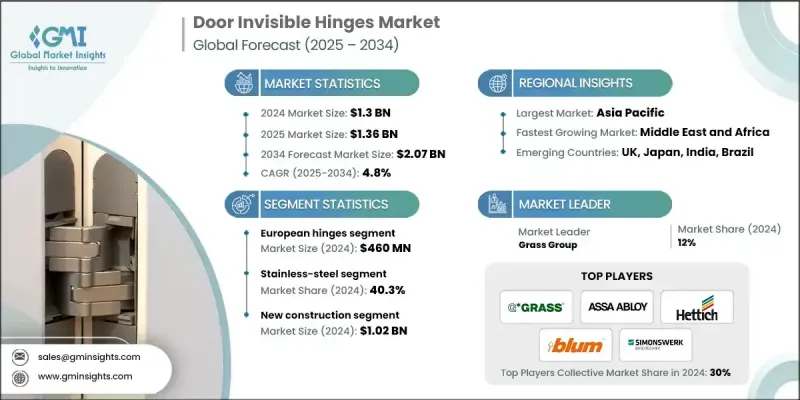

2024 年全球门隐形铰链市场价值为 13 亿美元,预计到 2034 年将以 4.8% 的复合年增长率增长至 20.7 亿美元。

快速的城市化进程和不断演变的建筑趋势,尤其是对简洁、极简和无缝设计的追求,促使建筑商和设计师采用隐藏式五金解决方案,既能保持美观,又能确保功能性。翻新项目,尤其是在高檔住宅、酒店和办公空间中,越来越多地采用隐形铰链来实现齐平的门设计、简洁的线条和现代化的室内氛围。模组化建筑和智慧建筑技术的兴起,进一步拓展了铰链系统的应用前景,使其能够轻鬆整合到自动门和门禁控制系统中,凸显了其在各种应用领域日益增长的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 20.7亿美元 |

| 复合年增长率 | 4.8% |

为了打造齐平的门体安装效果、简洁的线条和现代美感,建筑师和室内设计师越来越频繁地选择隐形铰链。这种日益增长的需求推动了对兼具功能性和美观性的五金配件的强劲需求。尤其是在欧洲和北美,旧建筑的翻新改造为室内升级提供了契机,隐形铰链正是无需改变建筑结构即可实现室内升级的理想选择。永续设计概念和智慧建筑整合也在蓬勃发展,而隐形铰链不仅能提供节能密封,还能与自动化系统完美相容。

2024年,欧洲铰链市场规模达4.6亿美元。欧洲製造商正致力于将美观与性能完美融合,提供可与现代橱柜和家具无缝衔接的隐藏式缓闭铰链。这些特性不仅提升了室内美感,还透过降低噪音和磨损,改善了使用者体验。包括运动感测器、阻尼机构和物联网系统在内的创新技术正逐渐成为标准配置,与日益普及的智慧家庭趋势相契合。

2024年,不锈钢铰链占据了40.3%的市场。其强度高、经久耐用且耐腐蚀,使其非常适合高湿度和高强度使用环境。这些特性确保了其在住宅和商业应用中的持久性能,也促成了其在全球范围内的广泛应用。

美国隐形门铰链市场占据78.6%的市场份额,预计2024年市场规模将达3亿美元。市场成长主要得益于建筑活动的增加、房屋翻新以及对坚固耐用、技术先进的五金配件的需求。自动锁定、远端存取和其他智慧功能越来越受欢迎,这得益于电子商务的普及,使全国各地的消费者都能获得创新的铰链解决方案。

全球隐形门铰链市场的主要参与者包括海福乐集团 (Hafele Group)、百隆 (Blum)、戈德瑞博伊斯製造公司 (Godrej & Boyce Manufacturing)、里舍留五金 (Richelieu Hardware)、哈德温 (Hardwyn)、SOSS製造公司 (SOSS Manufacturing)、西蒙斯合本集团 (SimonAx) Group)、AGB(阿尔班·贾科莫股份公司,Alban Giacomo Spa)、申刚五金 (Shengang Hardware)、格拉斯集团 (Grass Group)、Sugatsune America、多尔马卡巴控股 (Dormakaba Holding)、安塞尔米 (Anselmi) 和海蒂诗集团 (Hettich Group)。隐形门铰链市场的领导者正在采取各种策略来巩固其市场地位并扩大市场份额。这些策略包括投资研发以推出创新、智慧和自动化的铰链解决方案;建立策略合作伙伴关係以拓展分销网络;以及扩展产品组合以满足多样化的设计和功能需求。此外,各公司也注重永续性和节能解决方案,并利用电子商务平台触及更广泛的消费群。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 建筑和翻新活动日益增多

- 铰链技术和智慧解决方案的进步

- 对客製化和美观型硬体的需求不断增长

- 产业陷阱与挑战

- 市场参与者之间的竞争非常激烈

- 原物料价格波动

- 机会

- 模组化建筑与预製

- 智慧建筑集成

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 欧洲铰链

- 暗装式合页

- 枢轴隐藏式铰链

- 圆柱形/圆柱形隐藏式铰链

- 隐藏式铰链

- 隐藏式弹簧门铰链

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 基本型隐藏式铰链

- 自闭式铰链

- 缓缓闭铰链

- 3D可调式铰链

- 重型铰链

- 快拆铰链

- 防火铰链

第七章:市场估计与预测:依年级划分,2021-2034年

- 主要趋势

- 一级(优质)

- 二年级(标准)

- 三年级(基础)

- 工业级

第八章:市场估算与预测:依材料类型划分,2021-2034年

- 主要趋势

- 不銹钢

- 锌合金

- 碳钢

- 黄铜/青铜

- 铝合金

第九章:市场估计与预测:依价格划分,2021-2034年

- 主要趋势

- 低的

- 中等的

- 高的

第十章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 住宅

- 商业的

- 机构

- 工业的

第十一章:市场估计与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 新建工程

- 改造/翻新

第十二章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直销

- 间接销售

第十三章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十四章:公司简介

- AGB (Alban Giacomo Spa)

- Anselmi

- ASSA ABLOY Group

- Blum

- Dormakaba Holding

- Godrej & Boyce Manufacturing

- Grass Group

- Hafele Group

- Hardwyn

- Hettich Group

- Richelieu Hardware

- Shengang Hardware

- Simonswerk

- SOSS Manufacturing

- Sugatsune America

The Global Door Invisible Hinges Market was valued at USD 1.3 Billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 2.07 Billion by 2034.

Rapid urbanization and evolving architectural trends favoring sleek, minimal, and seamless designs are prompting builders and designers to adopt concealed hardware solutions that maintain aesthetic integrity while ensuring functionality. Renovation projects, particularly in upscale homes, hotels, and office spaces, increasingly rely on invisible hinges to achieve flush door designs, clean lines, and modern interiors. The rise of modular construction and smart building technologies further expands opportunities for hinge systems that integrate easily with automated doors and access control solutions, highlighting their growing relevance across diverse applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.07 Billion |

| CAGR | 4.8% |

Architects and interior designers are requesting invisible hinges more frequently to create flush door installations, clean profiles, and contemporary aesthetics. This growing preference is generating strong demand for hardware that balances functionality with visual appeal. Renovation cycles in older buildings, especially across Europe and North America, are creating retrofitting opportunities where invisible hinges are ideal for updating interiors without altering structural frameworks. Sustainable design practices and smart building integrations are also on the rise, with invisible hinges offering energy-efficient sealing and full compatibility with automated systems.

In 2024, the European hinges accounted for USD 460 million. European manufacturers are blending aesthetics and performance, offering concealed and soft-close hinges that seamlessly integrate with modern cabinetry and furniture. These features enhance interior appeal while improving user experience by reducing noise and wear. Innovations, including motion sensors, damping mechanisms, and IoT-enabled systems, are becoming standard, aligning with growing smart home adoption.

The stainless-steel hinges held a 40.3% share in 2024. Their strength, durability, and resistance to corrosion make them highly suitable for high-humidity and heavily used environments. These properties ensure long-lasting performance in both residential and commercial applications, which contributes to their widespread global acceptance.

United States Door Invisible Hinges Market held a 78.6% share, generating USD 300 million in 2024. Growth is driven by increasing construction activity, home renovations, and demand for robust and technologically advanced hardware. Automated locking, remote access, and other smart features are growing in popularity, supported by widespread e-commerce availability that provides customers nationwide with access to innovative hinge solutions.

Key players in the Global Door Invisible Hinges Market include Hafele Group, Blum, Godrej & Boyce Manufacturing, Richelieu Hardware, Hardwyn, SOSS Manufacturing, Simonswerk, ASSA ABLOY Group, AGB (Alban Giacomo Spa), Shengang Hardware, Grass Group, Sugatsune America, Dormakaba Holding, Anselmi, and Hettich Group. Leading companies in the Door Invisible Hinges Market are adopting strategies to strengthen their position and expand their footprint. These include investing in research and development to introduce innovative, smart, and automated hinge solutions, forming strategic partnerships and collaborations to widen distribution networks, and expanding product portfolios to meet diverse design and functional requirements. Companies are also emphasizing sustainability and energy-efficient solutions while leveraging e-commerce platforms to reach broader consumer bases.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Technology

- 2.2.4 Grade level

- 2.2.5 Material type

- 2.2.6 Price

- 2.2.7 Application

- 2.2.8 End use industry

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing construction and renovation activities

- 3.2.1.2 Advancements in hinge technology and smart solutions

- 3.2.1.3 Rising demand for customized and aesthetic hardware

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition among market players

- 3.2.2.2 Fluctuations in raw material prices

- 3.2.3 Opportunities

- 3.2.3.1 Modular construction & prefabrication

- 3.2.3.2 Smart building integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million units)

- 5.1 Key trends

- 5.2 European hinges

- 5.3 Mortise concealed hinges

- 5.4 Pivot concealed hinges

- 5.5 Barrel/Cylindrical concealed Hinges

- 5.6 Concealed hinges

- 5.7 Concealed spring door hinges

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Million units)

- 6.1 Key trends

- 6.2 Basic concealed hinges

- 6.3 Self-closing hinges

- 6.4 Soft-close hinges

- 6.5 3D adjustable hinges

- 6.6 Heavy-duty hinges

- 6.7 Quick-release hinges

- 6.8 Fire-rated hinges

Chapter 7 Market Estimates and Forecast, By Grade Level, 2021 - 2034 (USD Billion) (Million units)

- 7.1 Key trends

- 7.2 Grade 1 (Premium)

- 7.3 Grade 2 (Standard)

- 7.4 Grade 3 (Basic)

- 7.5 Industrial grade

Chapter 8 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Million units)

- 8.1 Key trends

- 8.2 Stainless steel

- 8.3 Zinc alloy

- 8.4 Carbon steel

- 8.5 Brass/bronze

- 8.6 Aluminum alloy

Chapter 9 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Million units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Million units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

- 10.4 Institutional

- 10.5 Industrial

Chapter 11 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Million units)

- 11.1 Key trends

- 11.2 New construction

- 11.3 Retrofit/renovation

Chapter 12 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million units)

- 12.1 Key trends

- 12.2 Direct sales

- 12.3 Indirect sales

Chapter 13 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 Japan

- 13.4.3 India

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 Middle East and Africa

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 AGB (Alban Giacomo Spa)

- 14.2 Anselmi

- 14.3 ASSA ABLOY Group

- 14.4 Blum

- 14.5 Dormakaba Holding

- 14.6 Godrej & Boyce Manufacturing

- 14.7 Grass Group

- 14.8 Hafele Group

- 14.9 Hardwyn

- 14.10 Hettich Group

- 14.11 Richelieu Hardware

- 14.12 Shengang Hardware

- 14.13 Simonswerk

- 14.14 SOSS Manufacturing

- 14.15 Sugatsune America