|

市场调查报告书

商品编码

1871136

直通式马达启动器市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Direct on Line Motor Starter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

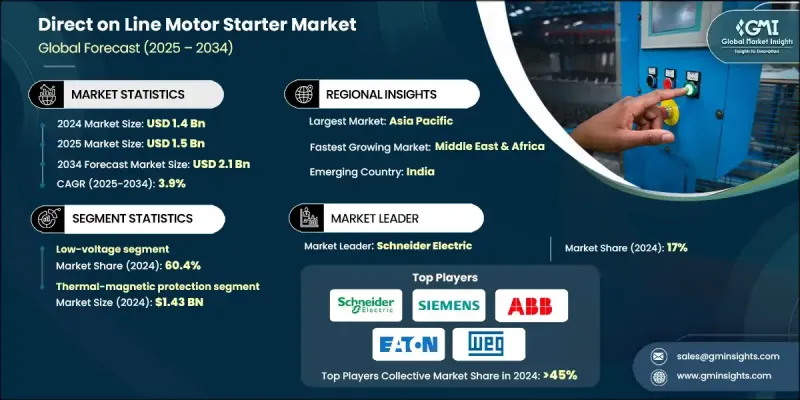

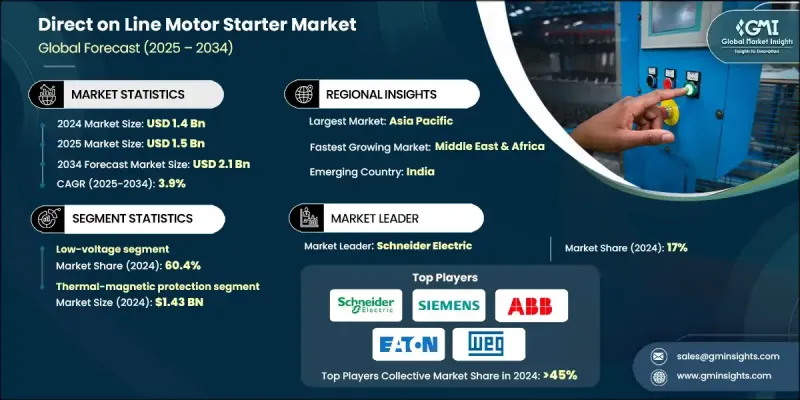

2024 年全球直接启动马达市场价值为 14 亿美元,预计到 2034 年将以 3.9% 的复合年增长率增长至 21 亿美元。

全球电力需求不断增长,工业电气化进程加速,推动了直接启动马达(DOL)技术的应用,尤其是在中小型马达领域。这些启动器因其成本效益高、操作简便而备受青睐。水利基础设施现代化和污水处理设施的投资,也支撑了水泵、风扇和辅助马达负载对直接启动马达的稳定需求。亚洲製造业的成长,得益于资本支出的復苏和高科技工厂升级的大力推进,进一步促进了输送机和公用设施设备等关键系统的部署。在撒哈拉以南非洲和亚洲部分地区,电力供应的增加为基础马达控制系统创造了新的应用情境。国际能源总署(IEA)的最新数据显示,电力供应显着成长,转化为对压缩机、风扇和水泵(直接启动系统的关键应用领域)需求的增加。新兴市场正在采用这些解决方案,因为它们具有生命週期成本低、易于维护等优点,能够满足不断扩展的基础设施需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 21亿美元 |

| 复合年增长率 | 3.9% |

由于其经济实惠、可靠性高且功能高效,热磁保护装置在直接启动器中仍广泛应用。这些组合机制可有效防止过载和短路,使其适用于暖通空调、製造业和水管理等行业。随着各行业在预算限制下不断优先考虑安全性和简易性,热磁装置在性能和实用性之间实现了理想的平衡。

由于低压直接启动器在中小型马达中的广泛应用,其市占率在2024年达到了60.4%。该类别产品凭藉其易于安装、与标准马达配置相容以及在大批量应用中的成本效益等优势,持续保持领先地位。全球市场基础设施建设的扩张和公用事业投资的增加,也推动了低压直接启动器需求的成长,尤其是在水处理和工业设施领域。

2024年,美国直接启动式马达市场规模预计将达到1.627亿美元。由于美国在水务和污水处理基础设施现代化方面的投资,市场需求持续强劲。联邦政府为提高水泵效率和马达控制技术提供的资金,正在推动传统系统的更新换代。美国能源部(DOE)推广的能源效率标准也促进了公共和工业领域向新型低压启动器技术的过渡。

全球直接启动式马达市场的主要竞争企业包括施耐德电气、WEG、Kalp Controls、LOVATO ELECTRIC、BCH Electric Limited、Jaydeep Controls、罗克韦尔自动化、ABB、正泰集团、Lauritz Knudsen Electrical & Automation、C&S Electric、西门子、LS ELECTRIC、CMItroalar, Electrical Electric、ccontrolal, Electric、ccontroal、ELECTRIC、CMINOar、S Electric.和伊顿。为了巩固其在直接启动式马达市场的地位,各企业优先采取的策略包括:扩展产品组合,推出专为新兴基础设施项目量身定制的紧凑型模组化设计;增强与节能电机和智慧工业系统的兼容性;以及利用与政府主导的公用事业和水务项目的战略合作来提高公共部门的市场渗透率。同时,全球企业正透过在高成长地区设立本地製造工厂和服务中心,瞄准市场,旨在缩短交货週期并加强支援。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 直接启动式(DoL)马达起动器的成本结构分析

- 价格趋势分析(美元/单位)

- 按地区

- 新兴机会与趋势

- DoL马达起动器投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 战略仪錶板

- 竞争性标竿分析

- 创新与技术格局

第五章:市场规模及预测:依防护系统划分,2021-2034年

- 主要趋势

- 电子过载继电器

- 固态过载保护

- 热磁性保护

第六章:市场规模及预测:依控制系统划分,2021-2034年

- 主要趋势

- PLC

- 现场总线

第七章:市场规模及预测:依电压等级划分,2021-2034年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场规模及预测:依当前状况、2021年-2034年

- 主要趋势

- > 9A - 27A

- > 27 安培 - 90 安培

- 90 安培 - 270 安培

- 270 安培 - 810 安培

- 810 A

第九章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 分散式架构

- 控制柜

- 混合配置

第十章:市场规模及预测:依最终用途划分,2021-2034年

- 主要趋势

- 住宅

- 商业的

- 工业的

第十一章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 俄罗斯

- 英国

- 义大利

- 西班牙

- 荷兰

- 奥地利

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 埃及

- 南非

- 奈及利亚

- 拉丁美洲

- 巴西

- 阿根廷

第十二章:公司简介

- ABB

- BCH Electric Limited

- C&S Electric

- CG Power & Industrial Solutions

- CHINT Group

- CMI Switchgear

- c3controls

- Danfoss

- Eaton

- Jaydeep Controls

- Kalp Controls

- Lauritz Knudsen Electrical & Automation

- LOVATO ELECTRIC

- LS ELECTRIC

- NOARK Electric

- Omron Corporation

- Rockwell Automation

- Schneider Electric

- Siemens

- WEG

The Global Direct on Line Motor Starter Market was valued at USD 1.4 Billion in 2024 and is estimated to grow at a CAGR of 3.9% to reach USD 2.1 Billion by 2034.

Increasing global electricity demand and the accelerated pace of industrial electrification are fueling the adoption of DOL motor starters, especially in small to medium motor segments. These starters continue to be favored for their cost efficiency and operational simplicity. Investments in water infrastructure modernization and wastewater facilities are supporting steady demand for DOL starters across pumps, blowers, and auxiliary motor loads. Manufacturing growth in Asia, driven by revived capital expenditure and a strong push toward high-tech plant upgrades, is further boosting deployment in essential systems like conveyors and utility equipment. In regions across sub-Saharan Africa and parts of Asia, increasing access is creating new use cases for basic motor control systems. The IEA's latest updates highlight substantial growth in power availability, which is translating into heightened demand for compressors, fans, and pumps, key applications for DOL starter systems. Emerging markets are adopting these solutions for their low life-cycle cost and easy maintenance, aligning with the needs of expanding infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 3.9% |

Thermal-magnetic protection remains widely adopted in DOL starters due to its affordability, reliability, and functional efficiency. These combined mechanisms ensure effective protection against overload and short-circuit events, making them suitable for sectors such as HVAC, manufacturing, and water management. As industries continue prioritizing safety and simplicity under budget constraints, thermal-magnetic units offer an ideal balance between performance and practicality.

The low-voltage DOL starters segment held 60.4% share in 2024, owing to their prevalent use in small and medium-sized electric motors. This category continues to lead due to ease of installation, compatibility with standard motor configurations, and cost-effectiveness in high-volume applications. Expansion in infrastructure development and rising utility investments across global markets are also contributing to the increasing preference for low-voltage DOL starters, especially in water treatment and industrial facilities.

United States Direct on Line Motor Starter Market generated USD 162.7 million in 2024. U.S. continues to witness strong demand due to investments in modernizing water and wastewater infrastructure. Federal funding aimed at improving pump efficiency and motor control technologies is driving the replacement of legacy systems. Energy efficiency standards promoted by the Department of Energy (DOE) are also supporting the transition toward updated low-voltage starter technologies across both public and industrial sectors.

Key companies competing in the Global Direct on Line Motor Starter Market include Schneider Electric, WEG, Kalp Controls, LOVATO ELECTRIC, BCH Electric Limited, Jaydeep Controls, Rockwell Automation, ABB, CHINT Group, Lauritz Knudsen Electrical & Automation, C&S Electric, Siemens, LS ELECTRIC, CMI Switchgear, CG Power & Industrial Solutions, Omron Corporation, Danfoss, NOARK Electric, c3controls, and Eaton. To strengthen their position in the Direct on Line Motor Starter Market, companies are prioritizing strategies such as expanding product portfolios with compact, modular designs tailored for emerging infrastructure projects. They are also enhancing compatibility with energy-efficient motors and smart industrial systems. Strategic collaborations with government-led utility and water projects are being leveraged to increase public sector penetration. In parallel, global players are targeting high-growth regions by setting up local manufacturing facilities and service centers, aiming to reduce lead times and enhance support.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Protection system trends

- 2.1.3 Control system trends

- 2.1.4 Voltage trends

- 2.1.5 Current trends

- 2.1.6 Application trends

- 2.1.7 End use trends

- 2.1.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.7 Cost structure analysis of Direct on Line (DoL) motor starters

- 3.8 Price trend analysis, (USD/Unit)

- 3.8.1 By region

- 3.9 Emerging opportunities & trends

- 3.10 Investment analysis & future outlook for the DoL motor starter

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Strategic dashboard

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Protection System, 2021 - 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Electronic overload relays

- 5.3 Solid-state overload protection

- 5.4 Thermal-magnetic protection

Chapter 6 Market Size and Forecast, By Control System, 2021 - 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 PLC

- 6.3 Fieldbus

Chapter 7 Market Size and Forecast, By Voltage, 2021 - 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Size and Forecast, By Current, 2021 - 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 > 9 A - 27 A

- 8.3 > 27 A - 90 A

- 8.4 > 90 A - 270 A

- 8.5 > 270 A - 810 A

- 8.6 > 810 A

Chapter 9 Market Size and Forecast, By Application, 2021 - 2034 (Units & USD Million)

- 9.1 Key trends

- 9.2 Distributed architecture

- 9.3 Control cabinet

- 9.4 Hybrid configuration

Chapter 10 Market Size and Forecast, By End Use, 2021 - 2034 (Units & USD Million)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

- 10.4 Industrial

Chapter 11 Market Size and Forecast, By Region, 2021 - 2034 (Units & USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 France

- 11.3.3 Russia

- 11.3.4 UK

- 11.3.5 Italy

- 11.3.6 Spain

- 11.3.7 Netherlands

- 11.3.8 Austria

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 South Korea

- 11.4.4 India

- 11.4.5 Australia

- 11.4.6 New Zealand

- 11.4.7 Indonesia

- 11.5 Middle East & Africa

- 11.5.1 Saudi Arabia

- 11.5.2 UAE

- 11.5.3 Qatar

- 11.5.4 Egypt

- 11.5.5 South Africa

- 11.5.6 Nigeria

- 11.6 Latin America

- 11.6.1 Brazil

- 11.6.2 Argentina

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 BCH Electric Limited

- 12.3 C&S Electric

- 12.4 CG Power & Industrial Solutions

- 12.5 CHINT Group

- 12.6 CMI Switchgear

- 12.7 c3controls

- 12.8 Danfoss

- 12.9 Eaton

- 12.10 Jaydeep Controls

- 12.11 Kalp Controls

- 12.12 Lauritz Knudsen Electrical & Automation

- 12.13 LOVATO ELECTRIC

- 12.14 LS ELECTRIC

- 12.15 NOARK Electric

- 12.16 Omron Corporation

- 12.17 Rockwell Automation

- 12.18 Schneider Electric

- 12.19 Siemens

- 12.20 WEG