|

市场调查报告书

商品编码

1871172

精准发酵生物反应器市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Precision Fermentation Bioreactors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

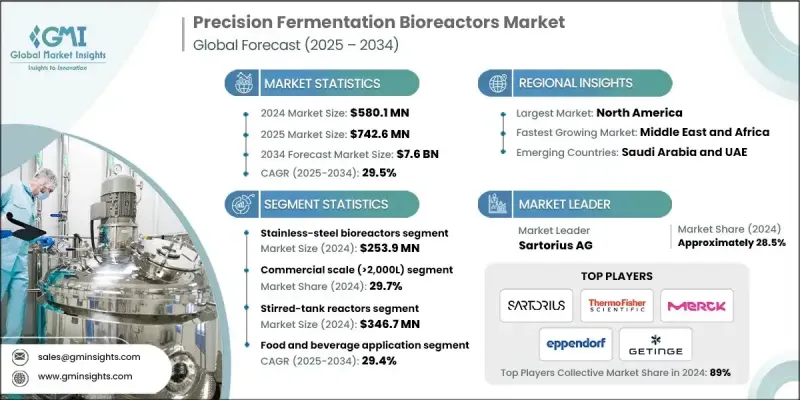

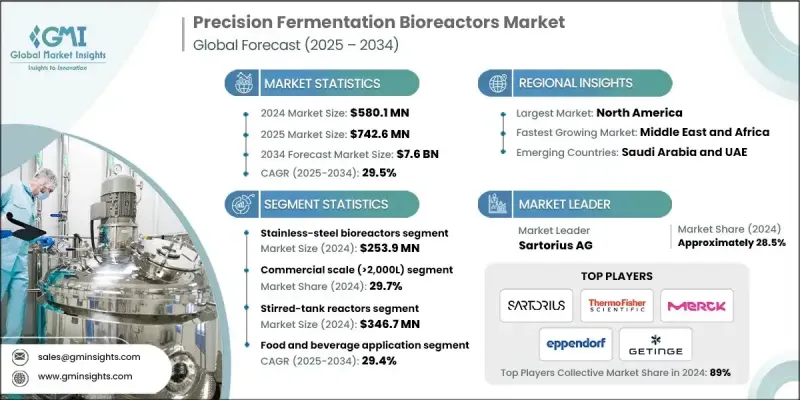

2024 年全球精准发酵生物反应器市值为 5.801 亿美元,预计到 2034 年将以 29.5% 的复合年增长率增长至 76 亿美元。

市场扩张的驱动力在于消费者对可持续且不含动物成分的蛋白质和酵素生产的日益增长的需求。随着消费者越来越多地选择植物基和符合伦理的替代品,精准发酵已成为一种可持续且可扩展的解决方案,用于生产高价值成分,例如乳製品替代品和分离蛋白,而无需依赖动物。对环境责任和符合伦理的采购方式的日益重视,正在加速食品和生物技术领域对精准发酵的采用。此外,该技术能够提供稳定的产品品质并减少传统蛋白质生产的碳足迹,这巩固了其作为未来食品生态系统关键推动因素的地位。微生物菌株工程和即时製程监控的不断进步也提高了发酵系统的精确度、效率和产量,为产业的快速发展创造了有利条件。此外,技术整合、自动化和资料分析正在帮助企业有效地从试点阶段扩展到商业化运营,从而支援发酵衍生成分的大规模生产。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.801亿美元 |

| 预测值 | 76亿美元 |

| 复合年增长率 | 29.5% |

2024年,容量大于2000公升的商业规模生物反应器市场规模达2.356亿美元,预计2025年至2034年间将以29.7%的复合年增长率成长。大容量生物反应器已成为工业规模精准发酵的关键设备,有助于实现稳定、高品质且经济高效的生产流程。商业规模部署的稳定成长表明,该产业正从研发和原型阶段转型为大规模、市场化生产。向工业规模化发展的趋势反映了生产商对实现经济可行性和合规性的信心日益增强,从而推动了该技术在各行业的广泛应用。

食品饮料产业仍然是该技术的主要应用领域之一,这主要得益于市场对透过精准发酵生产的无动物性蛋白质、酵素和调味剂的需求不断增长。消费者对永续发展意识的提高,以及对替代蛋白的需求转变,都促进了发酵技术的广泛应用。随着生产商认识到该方法在生产更清洁、更永续的食品方面的长期潜力,中试规模的实验正在迅速发展成为商业化生产线。

2024年,美国精准发酵生物反应器市场占据了显着份额,这得益于其先进的研发能力、强大的产业合作以及良好的创新生态系统。美国的生物技术和食品科技产业正积极推进实验室培养蛋白、乳製品替代品和酵素的商业化,大学和私人企业携手合作,不断改进发酵技术。自动化和数位化製程控制的融合正在提升发酵系统的可靠性、生产效率和稳定性。

全球精准发酵生物反应器市场的主要参与者包括默克集团(MilliporeSigma)、赛默飞世尔科技、赛多利斯、Getinge AB 和 Eppendorf AG。精准发酵生物反应器市场中各公司采取的关键策略着重于创新、可扩展性和策略合作。主要製造商正大力投资研发,以提升製程控制、能源效率和发酵产量。与食品科技和生物科技公司的策略合作有助于拓展应用领域并加速市场商业化。各公司也强调模组化生物反应器设计,以实现从实验室到工业生产的灵活扩展。自动化、人工智慧驱动的监控和数位孪生技术的整合正在提高系统精度并降低营运成本。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 供应链的复杂性

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 副产品

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(註:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 免洗生物反应器

- 不銹钢生物反应器

- 玻璃生物反应器

- 混合生物反应器

- 搅拌槽式生物反应器

- 其他的

第六章:市场规模估算与预测(2021-2034年)

- 主要趋势

- 实验室规模(<50公升)

- 中试规模(50公升 - 2,000公升)

- 商业规模(>2,000公升)

- 小型商用(2,000公升 - 10,000公升)

- 大型商用(>10,000公升)

第七章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 搅拌釜式反应器

- 波浪/摇摆式生物反应器

- 鼓泡柱反应器

- 其他技术

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 餐饮

- 替代蛋白

- 乳蛋白

- 肉类蛋白质

- 鸡蛋蛋白

- 食品原料

- 酵素

- 维生素

- 香料和防腐剂

- 功能性食品

- 益生菌和益生元

- 营养补充品

- 替代蛋白

- 製药

- 治疗性蛋白质

- 疫苗和生物製剂

- 药用酶

- 工业和化学

- 工业酵素

- 特种化学品

- 生物燃料和能源

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Eppendorf AG

- Getinge AB

- Pall Corporation (Danaher)

- ABEC Inc.

- Applikon Biotechnology

- Solaris Biotechnology

- Pierre Guerin Technologies

- Perfect Day Inc.

- Impossible Foods Inc.

- TurtleTree Labs

- The EVERY Company

- Motif FoodWorks

- Geltor Inc.

- Clara Foods (The EVERY Company)

- Novonesis (formerly Novozymes)

- Ginkgo Bioworks

- Zymergen (Ginkgo Bioworks)

- Synthetic Biologics Inc.

- Amyris Inc.

- Formo (formerly LegenDairy Foods)

- Change Foods

- New Culture Inc.

- Remilk Ltd.

- Imagindairy Ltd.

- Shiru Inc.

- Tetra Pak

- Culture Biosciences

The Global Precision Fermentation Bioreactors Market was valued at USD 580.1 million in 2024 and is estimated to grow at a CAGR of 29.5% to reach USD 7.6 Billion by 2034.

Market expansion is propelled by the increasing preference for sustainable and animal-free production of proteins and enzymes. As consumers increasingly choose plant-based and ethical alternatives, precision fermentation has emerged as a sustainable and scalable solution for producing high-value ingredients such as dairy analogs and protein isolates without relying on animals. The growing emphasis on environmental responsibility and ethical sourcing is accelerating adoption in both food and biotechnology sectors. Furthermore, the technology's ability to deliver consistent product quality and reduce the carbon footprint of traditional protein production strengthens its position as a key enabler of the future food ecosystem. Continuous progress in microbial strain engineering and real-time process monitoring is also improving the precision, efficiency, and yield of fermentation systems, creating favorable conditions for rapid industry growth. Additionally, technological integration, automation, and data analytics are helping companies scale from pilot to commercial operations efficiently, supporting the shift toward mass production of fermentation-derived ingredients.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $580.1 million |

| Forecast Value | $7.6 Billion |

| CAGR | 29.5% |

The commercial-scale segment > 2,000L was valued at USD 235.6 million in 2024 and is expected to register a CAGR of 29.7% during 2025-2034. Large-volume bioreactors have become essential for industrial-scale precision fermentation, facilitating consistent, high-quality, and cost-effective manufacturing processes. The steady rise in commercial-scale deployment demonstrates the industry's transition from research and prototype phases toward large-scale, market-ready production. The move toward industrial scalability reflects the growing confidence of producers in achieving economic feasibility and regulatory compliance, supporting widespread adoption across various industries.

The food & beverage sector remains one of the leading application areas, driven by increasing demand for animal-free proteins, enzymes, and flavoring agents produced through precision fermentation. Rising consumer awareness regarding sustainability, combined with a shift toward alternative proteins, has encouraged broader adoption of fermentation-based technologies. Pilot-scale experiments are rapidly evolving into commercial production lines as producers recognize the long-term potential of this method for creating cleaner, more sustainable food products.

United States Precision Fermentation Bioreactors Market held a significant share in 2024, supported by advanced R&D capabilities, strong industrial collaboration, and a favorable innovation ecosystem. The country's biotechnology and food-tech industries are actively advancing the commercialization of lab-cultured proteins, dairy substitutes, and enzymes, with universities and private firms collaborating to refine fermentation technologies. The integration of automation and digital process control is improving the reliability, productivity, and consistency of fermentation systems.

Leading players operating in the Global Precision Fermentation Bioreactors Market include Merck KGaA (MilliporeSigma), Thermo Fisher Scientific, Sartorius AG, Getinge AB, and Eppendorf AG. Key strategies adopted by companies in the Precision Fermentation Bioreactors Market focus on innovation, scalability, and strategic collaboration. Major manufacturers are investing heavily in R&D to enhance process control, energy efficiency, and fermentation yield. Strategic partnerships with food-tech and biotech firms are helping expand application areas and accelerate market commercialization. Companies are also emphasizing modular bioreactor designs that allow flexible scaling from laboratory to industrial production. Integration of automation, AI-driven monitoring, and digital twin technologies is improving system precision and reducing operational costs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Scale

- 2.2.4 Technology

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain complexity

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021- 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Single-use bioreactors

- 5.3 Stainless steel bioreactors

- 5.4 Glass bioreactors

- 5.5 Hybrid bioreactors

- 5.6 Stirred-tank bioreactors

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Scale, 2021- 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Laboratory scale (<50L)

- 6.3 Pilot scale (50L - 2,000L)

- 6.4 Commercial scale (>2,000L)

- 6.4.1 Small commercial (2,000L - 10,000L)

- 6.4.2 Large commercial (>10,000L)

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million, , Units)

- 7.1 Key trends

- 7.2 Stirred-tank reactors

- 7.3 Wave/rocking bioreactors

- 7.4 Bubble column reactors

- 7.5 Other technologies

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million, , Units)

- 8.1 Key trends

- 8.2 Food and beverage

- 8.2.1 Alternative proteins

- 8.2.1.1 Dairy proteins

- 8.2.1.2 Meat proteins

- 8.2.1.3 Egg proteins

- 8.2.2 Food ingredients

- 8.2.2.1 Enzymes

- 8.2.2.2 Vitamins

- 8.2.2.3 Flavors and preservatives

- 8.2.3 Functional foods

- 8.2.3.1 Probiotics and prebiotics

- 8.2.3.2 Nutritional supplements

- 8.2.1 Alternative proteins

- 8.3 Pharmaceutical

- 8.3.1 Therapeutic proteins

- 8.3.2 Vaccines and biologics

- 8.3.3 Pharmaceutical enzymes

- 8.4 Industrial and chemical

- 8.4.1 Industrial enzymes

- 8.4.2 Specialty chemicals

- 8.4.3 Biofuels and energy

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Sartorius AG

- 10.2 Thermo Fisher Scientific Inc.

- 10.3 Merck KGaA

- 10.4 Eppendorf AG

- 10.5 Getinge AB

- 10.6 Pall Corporation (Danaher)

- 10.7 ABEC Inc.

- 10.8 Applikon Biotechnology

- 10.9 Solaris Biotechnology

- 10.10 Pierre Guerin Technologies

- 10.11 Perfect Day Inc.

- 10.12 Impossible Foods Inc.

- 10.13 TurtleTree Labs

- 10.14 The EVERY Company

- 10.15 Motif FoodWorks

- 10.16 Geltor Inc.

- 10.17 Clara Foods (The EVERY Company)

- 10.18 Novonesis (formerly Novozymes)

- 10.19 Ginkgo Bioworks

- 10.20 Zymergen (Ginkgo Bioworks)

- 10.21 Synthetic Biologics Inc.

- 10.22 Amyris Inc.

- 10.23 Formo (formerly LegenDairy Foods)

- 10.24 Change Foods

- 10.25 New Culture Inc.

- 10.26 Remilk Ltd.

- 10.27 Imagindairy Ltd.

- 10.28 Shiru Inc.

- 10.29 Tetra Pak

- 10.30 Culture Biosciences