|

市场调查报告书

商品编码

1871197

智慧逆变器市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Smart Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

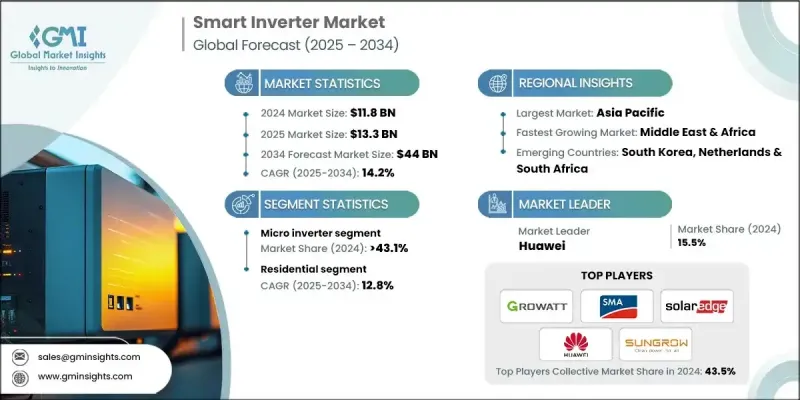

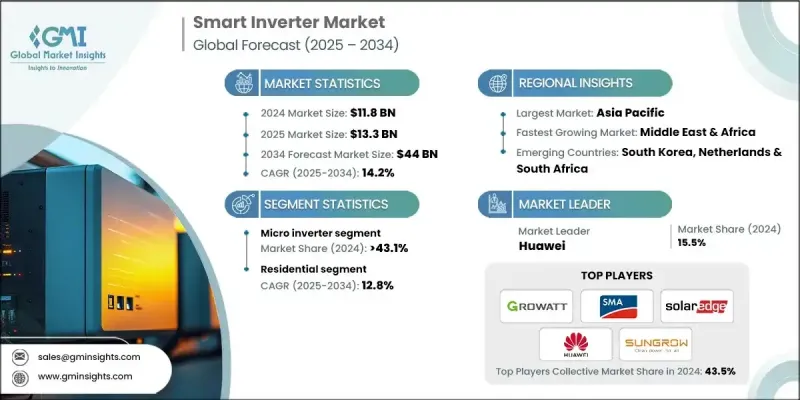

2024年全球智慧逆变器市场规模为118亿美元,预计到2034年将以14.2%的复合年增长率成长至440亿美元。

电网现代化投资的不断增加推动了智慧逆变器的广泛应用,因为它们透过电压控制、无功功率管理和频率调节等先进功能增强了电网稳定性。太阳能快速併入现有电网进一步刺激了产品需求,因为传统逆变器缺乏有效稳定电网所需的动态通讯能力。智慧逆变器能够与电网系统互动并适应电网波动,在最大限度减少电压波动和增强电网在高峰需求或中断期间的可靠性方面发挥着至关重要的作用。这些先进的功率转换设备不仅可以将直流电转换为交流电,还可以与电网进行智慧交互,从而提高能源系统的效率、合规性和性能。对电网韧性的日益重视,以及太阳能係统装机量的不断增长,持续塑造全球市场格局。新兴企业正专注于储能功能的创新和集成,使用户能够储存多余的太阳能电力以供后续使用,从而促进能源独立并提高系统可靠性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 118亿美元 |

| 预测值 | 440亿美元 |

| 复合年增长率 | 14.2% |

微型逆变器在2024年占据了43.1%的市场份额,预计到2034年将以13%的复合年增长率成长。对能够提供更高发电效率和更稳定性能的系统日益增长的需求,显着推动了微型逆变器的普及。这些设备能够实现模组级功率最佳化,即使在部分遮阴或环境变化的情况下也能确保最大能量输出。它们能够在面板上直接进行直流到交流的转换,无需高压直流布线,从而降低了电气风险,并提高了安装安全性。这一特性对于安全性和空间利用率至关重要的小型和机构应用尤为有利。

预计到2034年,商业和工业领域的复合年增长率将达到15.2%,这主要得益于市场对高性价比能源管理解决方案和营运成本节约日益增长的需求。政府为太阳能部署提供大量财政激励措施,从而加速了市场成长,缩短了专案投资回收期。全球企业永续发展目标和不断变化的环境法规正促使各组织向再生能源併网转型,而智慧逆变器在实现能源效率和碳减排目标方面发挥关键作用。持续推动清洁能源生产和优化电网连接,也推动了智慧逆变器在各种应用领域的普及。

2024年,美国智慧逆变器市占率高达91.5%,预计到2034年将达到24亿美元。美国市场扩张的驱动力主要来自那些面临频繁停电和高电价的地区,这些地区正大力推广太阳能+储能係统。智慧逆变器对于管理太阳能板、蓄电池和电网之间的能量流动至关重要,能够确保无缝同步和运作可靠性。随着极端天气事件的增加和电力基础设施的老化,人们对能源安全和韧性的日益重视促使人们更多地部署先进的混合逆变器系统,这些系统能够实现高效的能源管理,并在停电期间提供不间断的电力供应。

全球智慧逆变器市场的主要参与者包括华为、SMA Solar Technology、Growatt、Solis、SolarEdge、Luminous、Eastman Auto & Power Ltd、阳光电源、Vsole Solar Private Limited、EnerTech UPS、Unique Sun Power PVT.、Ushva Clean Technology Pvt. Ltd、MaxVolt Energy 和 Sertech System Limited System System。智慧逆变器市场的关键企业正在采取各种策略来巩固其市场地位并扩大全球业务范围。各公司正大力投资产品创新,专注于先进的能源管理功能和增强的连接性,以满足不断变化的电网需求。策略联盟和合作伙伴关係使製造商能够提升其技术专长并拓展产品线。各公司也正在增加研发投入,以开发整合智慧监控和基于人工智慧的诊断工具的紧凑、高效且经济的逆变器型号。

目录

第一章:方法论与范围

第二章:行业洞察

- 产业概况,2021-2034年

- 商业趋势

- 产品趋势

- 应用趋势

- 沟通趋势

- 区域趋势

第三章:行业洞察

- 产业生态系分析

- 原物料供应及采购分析

- 製造能力评估

- 供应链韧性与风险因素

- 配电网路分析

- 成本结构分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪錶板

- 策略倡议

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:依产品划分,2021-2034年

- 主要趋势

- 细绳

- 微

- 中央

- 杂交种

第六章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 住宅

- 商业和工业

- 公用事业

第七章:市场规模及预测:依通讯方式划分,2021-2034年

- 主要趋势

- 有线

- 无线的

- 云端/物联网赋能

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 荷兰

- 英国

- 法国

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

第九章:公司简介

- Eastman Auto & Power Ltd

- Enertechups

- Growatt

- Huawei

- Luminous

- MaxVolt Energy

- Servotech Renewable Power System Limited

- SMA Solar Technology

- Solar Edge

- Solis

- Sungrow

- Unique Sun Power PVT.

- Ushva Clean Technology Pvt. Ltd

- Vsole Solar Private Limited

The Global Smart Inverter Market was USD 11.8 Billion in 2024 and is estimated to grow at a CAGR of 14.2% to reach USD 44 Billion by 2034.

Increasing investments in grid modernization are driving the widespread adoption of smart inverters as they enhance grid stability through advanced functions such as voltage control, reactive power management, and frequency regulation. The rapid integration of solar energy into existing power networks is further boosting product demand, as conventional inverters lack the dynamic communication capabilities required to stabilize grids efficiently. Smart inverters, with their ability to interact with utility systems and adjust to fluctuating grid conditions, play a vital role in minimizing voltage fluctuations and strengthening grid reliability during high demand or disruptions. These advanced power conversion devices not only convert DC to AC but also offer intelligent interaction with the grid, improving energy system efficiency, compliance, and performance. Rising focus on grid resilience, coupled with increasing installations of solar energy systems, continues to shape the global market landscape. Emerging players are emphasizing innovation and integration of storage capabilities, allowing users to store surplus solar power for later use, thereby promoting energy independence and improving system reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.8 Billion |

| Forecast Value | $44 Billion |

| CAGR | 14.2% |

The micro inverter segment held 43.1% share in 2024 and is projected to grow at a CAGR of 13% through 2034. The growing need for systems that deliver superior power generation efficiency and consistent performance is significantly influencing micro inverter adoption. These devices enable module-level power optimization, ensuring maximum energy output even under partial shading or varying conditions. Their capability to perform DC-to-AC conversion directly at the panel eliminates the requirement for high-voltage DC wiring, reducing electrical hazards and enhancing installation safety. This feature is particularly beneficial for small-scale and institutional installations where safety and space optimization are top priorities.

The commercial and industrial segment is forecasted to grow at a CAGR of 15.2% through 2034, driven by the increasing demand for cost-effective energy management solutions and operational savings. Supportive government initiatives offering substantial financial incentives for solar deployment are accelerating market growth by reducing project payback periods. Global corporate sustainability goals and evolving environmental regulations are compelling organizations to transition toward renewable energy integration, with smart inverters playing a critical role in achieving energy efficiency and carbon reduction targets. The ongoing push toward cleaner power generation and optimized grid connectivity continues to propel smart inverter adoption across diverse applications.

United States Smart Inverter Market held a 91.5% share in 2024 and is expected to reach USD 2.4 Billion by 2034. Market expansion in the country is fueled by a surge in solar-plus-storage installations across regions facing frequent power interruptions and high electricity costs. Smart inverters are essential for managing the flow of energy between solar panels, batteries, and the grid, ensuring seamless synchronization and operational reliability. The growing emphasis on energy security and resilience amid rising instances of extreme weather and an aging power infrastructure has led to increased deployment of advanced hybrid inverter systems that enable efficient energy management and uninterrupted power supply during outages.

Leading participants in the Global Smart Inverter Market include Huawei, SMA Solar Technology, Growatt, Solis, Solar Edge, Luminous, Eastman Auto & Power Ltd, Sungrow, Vsole Solar Private Limited, EnerTech UPS, Unique Sun Power PVT., Ushva Clean Technology Pvt. Ltd, MaxVolt Energy, and Servotech Renewable Power System Limited. Key companies in the Smart Inverter Market are adopting various strategies to strengthen their market position and expand global reach. Firms are heavily investing in product innovation, focusing on advanced energy management capabilities and improved connectivity to support evolving grid requirements. Strategic alliances and partnerships are enabling manufacturers to enhance their technological expertise and broaden product offerings. Companies are also increasing their R&D expenditure to develop compact, efficient, and cost-effective inverter models integrated with smart monitoring and AI-based diagnostic tools.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Industry Insights

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Application trends

- 2.5 Communication trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Cost structure analysis

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 String

- 5.3 Micro

- 5.4 Central

- 5.5 Hybrid

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial & industrial

- 6.4 Utility

Chapter 7 Market Size and Forecast, By Communication, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Wired

- 7.3 Wireless

- 7.4 Cloud/IoT enabled

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Netherlands

- 8.3.3 UK

- 8.3.4 France

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

Chapter 9 Company Profiles

- 9.1 Eastman Auto & Power Ltd

- 9.2 Enertechups

- 9.3 Growatt

- 9.4 Huawei

- 9.5 Luminous

- 9.6 MaxVolt Energy

- 9.7 Servotech Renewable Power System Limited

- 9.8 SMA Solar Technology

- 9.9 Solar Edge

- 9.10 Solis

- 9.11 Sungrow

- 9.12 Unique Sun Power PVT.

- 9.13 Ushva Clean Technology Pvt. Ltd

- 9.14 Vsole Solar Private Limited