|

市场调查报告书

商品编码

1871308

后生元补充剂市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Postbiotic Supplements Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

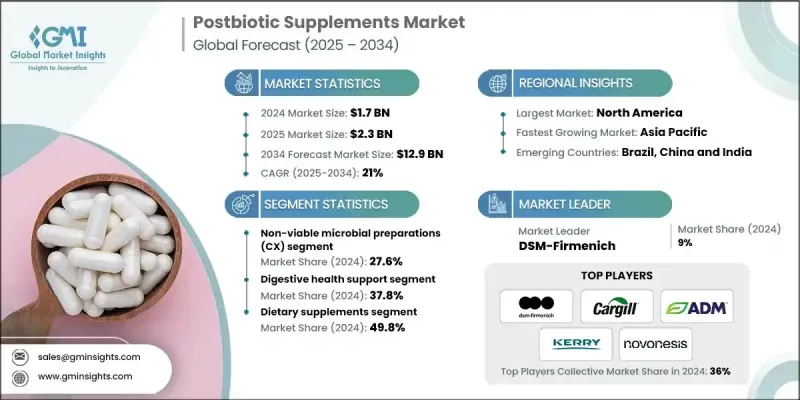

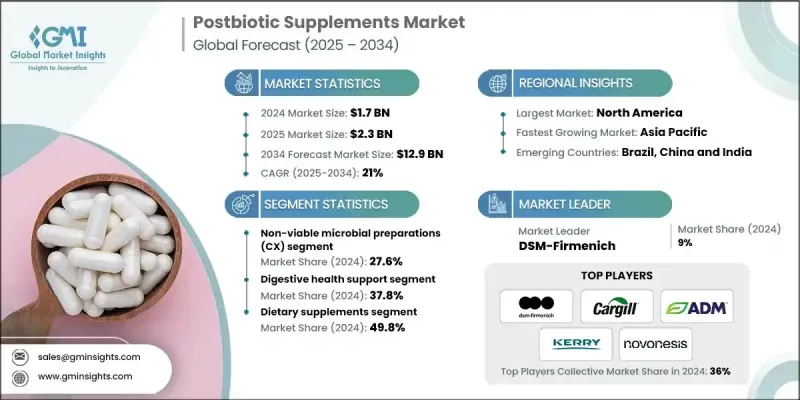

2024 年全球后生元补充剂市场价值为 17 亿美元,预计到 2034 年将以 21% 的复合年增长率增长至 129 亿美元。

根据国际益生菌和益生元科学协会 (ISAPP) 的官方定义,后生元是指非活性微生物和/或其成分的製剂,它们在失去活性后仍能保持生物活性,从而为宿主带来健康益处。越来越多的科学证据表明,后生元对健康人群和弱势群体的消化、免疫和代谢健康都有积极作用。临床验证正在加速推进,研究表明,后生元能够改善粪便品质、肠道屏障功能和呼吸系统健康。这些不断累积的证据增强了市场信心,并推动了产品线的拓展,从传统的胶囊和粉末扩展到功能性饮料、能量棒和即食产品,充分利用后生元的热稳定性,将其融入日常营养补充中。后生元的安全性和稳定性使其特别适用于婴幼儿、免疫功能低下患者和老年人,临床试验进一步证实了其透过短链脂肪酸等代谢产物促进肠道健康和发炎控制,从而有益于儿童生长发育和健康老化。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 129亿美元 |

| 复合年增长率 | 21% |

2024年,复杂的非活性微生物製剂(CX)占据了27.6%的市场份额,预计到2034年将以20.5%的复合年增长率成长。这些完全灭活的製剂保留了细胞结构和代谢产物,使其能够达到甚至超越通常由活性益生菌带来的健康益处。製造商透过采用可控发酵,然后使用经过验证的灭活方法(通常是热灭活)来实现这一点,从而保留了胶囊和食品配方中使用的生物活性成分。

膳食补充剂市场占据49.8%的市场份额,预计到2034年将以20.8%的复合年增长率成长。后生元生物活性化合物因其稳定性、安全性和适应性而备受青睐,使其成为膳食补充剂、功能性食品和饮料的理想成分。食品生产商正越来越多地在零食、饮料和乳製品替代品中添加后生元,以满足消费者对清洁标籤和有益于肠道菌群产品的需求。膳食补充剂以胶囊、粉末和软糖等方便服用的形式提供,有助于增强免疫力和促进新陈代谢。后生元在各种加工条件下的稳定性为创新和更广泛的商业应用铺平了道路。

2024年,北美后生元补充剂市占率达41%。这一领先地位得益于临床医生的高度认可、消费者意识的提升以及美国和加拿大广泛的零售管道。美国市场的成长主要由功能性饮料和能量棒推动,这得益于膳食补充剂标籤和健康声明方面明确的监管指南。在加拿大,消费者对清洁标籤产品的偏好以及对免疫和消化健康的日益关注,支撑了对无需冷藏、剂量简便且稳定的非活性产品的需求。医疗保健从业者通路的持续高端化以及主流产品上市数量的增加,预计将在预测期内推动市场成长。

全球益生元补充品市场的主要参与者包括:Immuse Health(麒麟控股/协和发酵生物)、Biofarma集团、Culturelle(i-Health公司)、帝斯曼-菲美意、Kerry集团、Metagenics、Probi AB、Ritua、SCD Probiotics、Archers Midland (ADMSLs Midland (ADM)、Samine、Scoson、Sakovs Midland (ADM)、Acoceland (ADM)、Scorpus、Acoson、Sakovs Midland (ADM)。这些公司正积极采取各种策略来巩固市场地位并维持成长。这些策略包括大力投资研发,以开发具有安全性、有效性和创新健康益处的临床验证配方。与学术机构和临床研究机构的合作有助于加速产品验证和监管批准。各公司致力于拓展产品组合,推出饮料、能量棒和即食产品等创新形式,以满足不断变化的消费者生活方式和偏好。与零售商和医疗保健机构建立策略伙伴关係,有助于扩大分销范围并提升消费者信任度。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 消费者对肠脑轴健康益处的认识不断提高

- 与益生菌相比,具有更优异的稳定性和更长的保质期。

- ISAPP共识定义后的监管清晰度

- 产业陷阱与挑战

- 产品表征的标准化分析方法有限

- 针对特定菌株的临床验证需要高额的研发成本

- 市场机会

- 尚未开发的儿科和老年人群体

- 拓展至功能性食品及饮料应用领域

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码说明:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 复杂的非活性微生物製剂(CX)

- 微生物代谢产物(MM)

- 完整的非活性微生物细胞(IC)

- 微生物细胞碎片(FC)

- 特殊配方

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 消化系统健康支持

- 免疫系统支持

- 代谢健康支持

- 心理健康与认知支持

- 皮肤健康与抗衰老

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 膳食补充剂行业

- 功能性食品和饮料

- 临床营养

- 化妆品及个人护理

- 动物营养与饲料

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- DSM-Firmenich

- Cargill, Incorporated

- Archer Daniels Midland (ADM)

- Kerry Group Plc

- Chr. Hansen A/S (now Novonesis)

- Immuse Health (Kirin Holdings/Kyowa Hakko Bio)

- SCD Probiotics

- Biofarma Group

- Probi AB

- Culturelle (i-Health, Inc.)

- VSL Pharmaceuticals

- Ritual

- Metagenics

The Global Postbiotic Supplements Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 21% to reach USD 12.9 billion by 2034.

Postbiotics, as officially defined by the International Scientific Association for Probiotics and Prebiotics (ISAPP) are preparations of non-living microorganisms and/or their components that provide health benefits to the host by preserving bioactivity despite the absence of viability. Mounting scientific evidence supports their positive effects on digestive, immune, and metabolic health across both healthy individuals and vulnerable groups. Clinical validation is gaining momentum, with studies showing improvements in stool quality, gut barrier function, and respiratory health. This growing body of proof is driving market confidence and broadening product offerings beyond traditional capsules and powders to include functional beverages, bars, and ready-to-eat products, leveraging the heat stability of postbiotics for daily nutrition integration. Their safety and stability make them especially suitable for infants, immunocompromised patients, and older adults, with clinical trials reinforcing their benefits for pediatric growth and healthy aging through metabolites like short-chain fatty acids that support gut health and inflammation control.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 21% |

The complex non-viable microbial preparations (CX) held a 27.6% share in 2024 and are expected to grow at a CAGR of 20.5% through 2034. These fully inactivated preparations maintain cellular structures and metabolites, enabling them to meet or even exceed the health benefits typically attributed to live probiotics. Manufacturers achieve this by employing controlled fermentation followed by validated inactivation methods, often thermal, which preserves the bioactive components used in capsule and food formulations.

The dietary supplements segment held a 49.8% share and is forecasted to grow at a CAGR of 20.8% through 2034. Postbiotic bioactive compounds are favored for their stability, safety, and adaptability, making them ideal for use in dietary supplements, functional foods, and beverages. Food producers are increasingly incorporating postbiotics to fortify snacks, drinks, and dairy alternatives, responding to consumer demand for clean-label and microbiome-supportive products. Supplements are offered in user-friendly forms like capsules, powders, and gummies, supporting immune health and metabolic function. The resilience of postbiotics under various processing conditions paves the way for innovation and wider commercial availability.

North America Postbiotic Supplements Market held a 41% share in 2024. This leadership is fueled by strong clinician acceptance, heightened consumer awareness, and extensive retail distribution across the U.S. and Canada. The U.S. market is driving growth through functional beverages and bars, supported by clear regulatory guidelines on labeling and health claims in dietary supplements. In Canada, the preference for clean-label products and growing interest in immune and digestive wellness sustain demand for stable, non-viable formats that do not require refrigeration and offer simple dosing. The ongoing premiumization within healthcare practitioner channels, combined with expanding mainstream product launches, is expected to propel market growth during the forecast period.

Key industry players in the Global Postbiotic Supplements Market include Immuse Health (Kirin Holdings/Kyowa Hakko Bio), Biofarma Group, Culturelle (i-Health, Inc.), DSM-Firmenich, Kerry Group Plc, Metagenics, Probi AB, Ritua, SCD Probiotics, Archer Daniels Midland (ADM), Cargill, Incorporated, Chr. Hansen A/S (now Novonesis), VSL Pharmaceuticals, and Labcorp. Companies in the Postbiotic Supplements Market are actively adopting strategies to strengthen their market presence and sustain growth. These include investing heavily in R&D to develop clinically validated formulations that highlight safety, efficacy, and novel health benefits. Collaborations with academic institutions and clinical research organizations help accelerate product validation and regulatory approval. Firms focus on expanding product portfolios by launching innovative formats such as beverages, bars, and ready-to-eat items that cater to evolving consumer lifestyles and preferences. Strategic partnerships with retailers and healthcare providers enhance distribution reach and consumer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing consumer awareness of gut-brain axis health benefits

- 3.2.1.2 Superior stability & shelf-life advantages over probiotics

- 3.2.1.3 Regulatory clarity following ISAPP consensus definition

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited standardized analytical methods for product characterization

- 3.2.2.2 High R&D costs for strain-specific clinical validation

- 3.2.3 Market opportunities

- 3.2.3.1 Untapped pediatric & elderly population segments

- 3.2.3.2 Expansion into functional foods & beverage applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Complex non-viable microbial preparations (CX)

- 5.3 Microbial metabolic products (MM)

- 5.4 Intact non-viable microbial cells (IC)

- 5.5 Fragmented microbial cells (FC)

- 5.6 Specialized formulations

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Digestive health support

- 6.3 Immune system support

- 6.4 Metabolic health support

- 6.5 Mental health & cognitive support

- 6.6 Skin health & anti-aging

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Dietary supplements industry

- 7.3 Functional foods & beverages

- 7.4 Clinical nutrition

- 7.5 Cosmetics & personal care

- 7.6 Animal nutrition & feed

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 DSM-Firmenich

- 9.2 Cargill, Incorporated

- 9.3 Archer Daniels Midland (ADM)

- 9.4 Kerry Group Plc

- 9.5 Chr. Hansen A/S (now Novonesis)

- 9.6 Immuse Health (Kirin Holdings/Kyowa Hakko Bio)

- 9.7 SCD Probiotics

- 9.8 Biofarma Group

- 9.9 Probi AB

- 9.10 Culturelle (i-Health, Inc.)

- 9.11 VSL Pharmaceuticals

- 9.12 Ritual

- 9.13 Metagenics