|

市场调查报告书

商品编码

1796195

全球后生元市场(按功能、製造技术、来源、应用、形式和地区划分)- 预测至 2030 年Postbiotics Market by Source (Bacteria, Yeast), Application (Functional Food & Beverages, Dietary Supplements, Animal Feed, Cosmetics & Personal Care, and Pharmaceuticals), Form, Function, Manufacturing Technology, and Region - Global Forecast to 2030 |

||||||

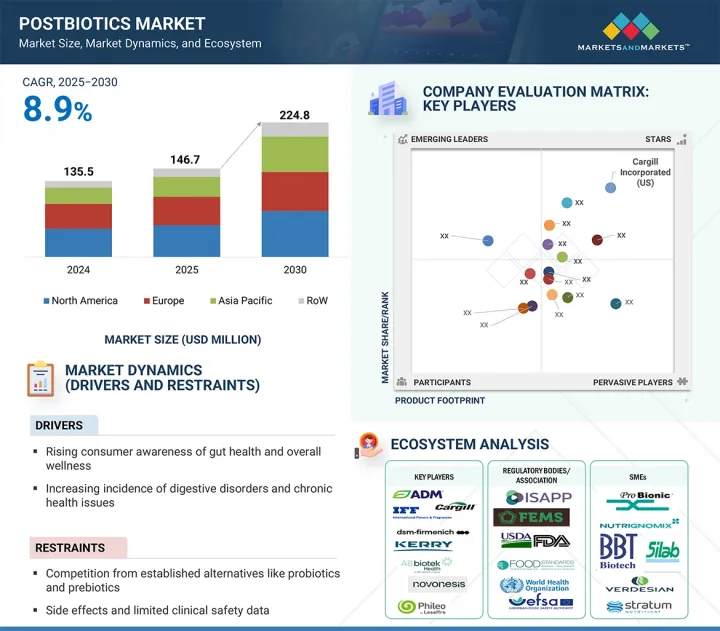

后生元市场规模预计在 2025 年达到 1.467 亿美元,预计到 2030 年将达到 2.248 亿美元,复合年增长率为 8.9%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元)及数量(吨) |

| 按细分市场 | 按功能、製造技术、产地、用途、形式和地区 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

全球后生元市场正经历显着的成长,这得益于消费者对肠道健康和免疫支持的日益关注,以及对洁净标示稳定成分的需求。机能性食品和饮料产品需求的不断增长,预计也将推动后生元成分在这些应用中的使用需求。由于消费者对增强健康的日常产品的偏好不断变化,机能性食品和饮料领域正在经历爆炸性增长。富含增强免疫力、消化、能量和思维清晰度成分的食品如今已成为主流,尤其是在新兴市场。

与需要低温运输物流且在加工条件下可能失效的益生菌不同,后生元耐热且耐储存,使其成为饮料、高蛋白棒、发酵乳製品和代餐的理想选择。后生元在肠道健康和免疫调节方面的益处已被证实,这使得品牌能够在包装上做出有科学依据的宣传,从而增强消费者信任并鼓励其采用。然而,消费者对后生元的熟悉程度低于益生菌和益生元,因此后生元市场预计将面临与现有益生菌和益生元替代品竞争的挑战。

微生物科学的发展、监管力度的转变以及对安全稳定的健康成分日益增长的需求,正在颠覆后生元成分市场。后生元,即非活性微生物细胞及其代谢产物,由于其安全性、货架稳定性和配方灵活性的提升,正日益成为益生菌的下一代替代品。这种转变在机能性食品、营养保健品、化妆品和宠物营养等应用领域尤为明显,在这些领域,后生元比活性益生菌有显着优势。发酵技术和微生物惰性技术的进步使开发人员能够开发客製化的、针对特异性菌株的后生元成分,从而提供特定的健康益处,例如肠道健康、免疫功能和皮肤屏障功能。

市场也正受到新形式和新混合物的影响,例如结合了益生菌、益生元和后生元的合益素产品。在动物营养领域,后生元正成为抗生素生长促进剂的功能性替代品;而在个人护理领域,微生物主导的护肤正在颠覆传统的活性成分。因此,个人化营养和微生物组检测的发展也促进了后生元解决方案的诞生,进一步推动了市场的演变和差异化。

营养保健品是一个不断成长的细分市场,满足了消费者日益增长的主动预防性健康实践需求。后生元产品具有多种功能益处,并促进整体健康,其设计旨在提供优于益生菌的关键优势,包括更长的保质期、无需冷藏,以及适合婴儿和老年人等敏感人群。消费者意识的提升和预防性健康措施的实施是推动营养补充品兴起的关键因素。为了保持最佳健康状态并降低慢性病的风险,人们对自我护理的日益重视以及医疗成本的不断上涨促使许多人转向补充剂。因此,营养补充品市场显着成长,提供种类繁多的产品,以解决各种健康问题。

酵母源后生元为动物营养产业带来了重大机会,尤其是在该产业面临日益严峻的挑战(例如病原体压力、热压力、高饲养密度以及减少抗生素使用)的情况下。酵母源后生元为家禽、水生动物和宠物等牲畜提供多种健康益处。它们有助于维持肠道健康、提高饲料效率并增强免疫力。此外,随着产业转向采用天然解决方案来维护动物福利和生产力,酵母源后生元正越来越多地被用于改善动物的整体健康状况,而无需依赖抗生素。

美国市场是全球最大的后生元市场之一。随着预防性医疗保健和营养的重要性日益提升,美国消费者对具有特定健康益处的机能性食品成分的兴趣日益浓厚。人口老化、医疗成本上涨以及人们对营养与健康之间联繫的认识不断提高等因素推动了这一需求。此外,食品加工流程的改进和创新使生产商能够生产出种类繁多的后生元产品,以满足各种消费者的个人偏好。这些因素预计将推动该地区对后生元的需求。

本报告研究了全球后生元市场,涵盖了功能、製造技术、来源、应用、形式和地区的趋势,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 总体经济指标

- 市场动态

- 生成式人工智慧对食品饮料成分和添加剂的影响

第六章 产业趋势

- 介绍

- 2025年美国关税的影响 - 后生元市场

- 介绍

- 主要关税税率

- 微生物成分产业和后生元的颠覆性变化

- 价格影响分析

- 对国家的影响

- 对终端产业的影响

- 价值链分析

- 研究与产品开发

- 原物料采购

- 生产加工

- 分配

- 行销和销售

- 最终用户

- 贸易分析

- 技术分析

- 定价分析

- 生态系分析

- 影响客户业务的趋势/中断

- 专利分析

- 2025-2026年主要会议和活动

- 监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 案例研究分析

- 帝斯曼-芬美意收购 ADARE BIOME,进军后生元领域

- ADM 在西班牙投资 3,000 万美元建造益生菌和后生元生产设施

- 嘉吉收购Epicor后生元原料业务并扩大规模

- 投资金筹措场景

7. 后生元市场(按功能)

- 介绍

- 消化器官系统健康

- 肠道健康

- 免疫健康

- 皮肤健康

- 心臟健康

- 其他的

8. 后生元市场(依製造技术)

- 介绍

- 热灭活

- 喷雾干燥

- 冷冻干燥

- 其他製造技术

9. 后生元市场(依来源)

- 介绍

- 细菌

- 酵母菌

第 10 章后生元市场(按应用)

- 介绍

- 机能性食品和饮料

- 营养补充品

- 动物饲料

- 化妆品和个人护理

- 製药

第 11 章后生元市场(按类型)

- 介绍

- 干燥

- 液体

第 12 章。按地区分類的后生元市场

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 其他的

- 其他地区

- 南美洲

- 中东

- 非洲

第十三章竞争格局

- 概述

- 主要参与企业的策略/优势,2022 年 - 2025 年 7 月

- 2022-2024年收益分析

- 2024年市场占有率分析

- 估值和财务指标

- 品牌/产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十四章:公司简介

- 主要参与企业

- ADM

- CARGILL, INCORPORATED

- DSM-FIRMENICH

- KERRY GROUP PLC

- ASSOCIATED BRITISH FOODS PLC

- BASF

- NOVONESIS GROUP

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- MCLS EUROPE BV

- PHILEO BY LESAFFRE

- LALLEMAND INC.

- SAMI-SABINSA GROUP

- CJ CHEILJEDANG CORP.

- MORINAGA MILK INDUSTRY CO., LTD.

- KIRIN HOLDINGS COMPANY, LIMITED

- 其他公司

- BIOTENOVA SDN. BHD.

- BIOPROX HEALTHCARE

- SILAB

- PROBIONIC CORP.

- NUTRIGNOMIX SDN. BHD.

- STRATUM NUTRITION

- BBT BIOTECH GMBH

- VERDESIAN LIFE SCIENCES

- SYNBIO TECH INC.

- NEO CREMAR

第十五章:邻近市场与相关市场

第十六章 附录

The postbiotics market is estimated at USD 146.7 million in 2025 and is projected to reach USD 224.8 million by 2030, at a CAGR of 8.9%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Ton) |

| Segments | By Source, Application, Form, Function (qualitative), Manufacturing Technology (qualitative), and Region |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World (RoW) |

The global postbiotics market is gaining significant traction, driven by increasing consumer awareness of gut health, immune support, and the demand for clean-label, shelf-stable ingredients. The growing demand for functional food & beverage products is also expected to drive the demand for the usage of postbiotic ingredients in these applications. The functional food & beverage sector has witnessed explosive growth, driven by a shift in consumer preferences toward health-enhancing everyday products. Foods fortified with ingredients that support immunity, digestion, energy, and mental clarity are now mainstream, especially in developed markets.

Unlike probiotics, which require cold-chain logistics and can lose efficacy under processing conditions, postbiotics are heat-stable and shelf-stable, making them an ideal fit for beverages, high-protein bars, fermented dairy alternatives, and meal replacements. Their proven benefits in gut health and immune modulation allow brands to include science-backed claims on packaging, boosting consumer trust and driving adoption. However, consumers are less familiar with postbiotics compared to probiotics and prebiotics; thus, competition from established alternatives such as probiotics and prebiotics is expected to pose a challenge in the postbiotics market.

"Disruptions in the postbiotics market may offer opportunities for players."

The postbiotic ingredients market is being disrupted by the development in microbial science, the shift in regulatory forces, and the growing need for safe & stable health ingredients. Postbiotics, or non-viable microbial cells or their metabolites, are becoming increasingly popular as a next-generation substitute for probiotics because of improved safety, shelf stability, and formulation flexibility. This transformation is especially evident in uses like functional foods, dietary supplements, cosmetics, and pet nutrition, where postbiotics provide distinctive benefits over live probiotics. Advances in fermentation technology and microbial inactivation are enabling developers to create customized, strain-specific postbiotic ingredients that provide specialized health benefits like gut health, immune function, and skin barrier function.

The market is also being formed by new formats and blends of products, such as synbiotic products combining probiotics, prebiotics, and postbiotics. Postbiotics are becoming a functional alternative to antibiotic growth promoters in animal nutrition, but in personal care, they are upending conventional actives in microbiome-driven skincare. Thus, the growth of personalized nutrition and microbiome testing is also allowing the creation of postbiotic solutions, further driving market evolution and differentiation.

The dietary supplement segment is projected to be one of the fastest-growing segments

Dietary supplements are a growing segment that serves the rising demand from consumers for proactive health management and preventive wellness methods. To address various functional benefits or promote general well-being, postbiotic products are designed to offer key advantages over probiotics, such as longer shelf life, no refrigeration requirement, and suitability for sensitive populations like infants and the elderly. Consumer awareness and adoption of preventative health measures are key factors propelling the rise of dietary supplements. In order to preserve optimal health and lower their risk of chronic diseases, many people are turning to supplements as a result of growing emphasis on self-care and rising healthcare costs. As a result, the market for dietary supplements has grown significantly, offering a wide range of offerings that address different health issues.

Yeast segment to grow at a significant rate among the sources in the postbiotics market

Postbiotics that are sourced from yeast hold a significant opportunity in the animal nutrition industry, particularly in the face of increasing challenges such as pathogen pressure, heat stress, high stocking densities, and the drive to reduce antibiotic use. Yeast-sourced postbiotics offer various health benefits for livestock, such as poultry, aquatic animals, as well as pets. It helps in supporting gut health, improving feed efficiency, and enhancing immunity. Additionally, as the industry is shifting toward natural solutions to maintain animal welfare and productivity, yeast-based postbiotics are gaining traction in terms of usage to improve the overall animal well-being without relying on antibiotics.

US to dominate the North American postbiotics market during forecast period

The US market is one of the largest global markets for postbiotics. Consumers in the US are becoming increasingly interested in functional food ingredients that provide certain health benefits as preventative healthcare and nutrition gain importance. This need has been driven by factors like an aging population, growing healthcare expenses, and increased awareness of the connection between nutrition and health. Furthermore, producers can now create a broad variety of postbiotic products customized to satisfy a wide range of consumer tastes due to technological improvements and innovations in food processing procedures. These factors are expected to drive the demand for postbiotics in the region.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the postbiotics market.

- By Company Type: Tier 1-25%, Tier 2-45%, and Tier 3-30%

- By Designation: CXOs-20%, Managers-50%, Executives-30%

- By Region: North America-30%, Europe-25%, Asia Pacific-35%, and Rest of the World-10%

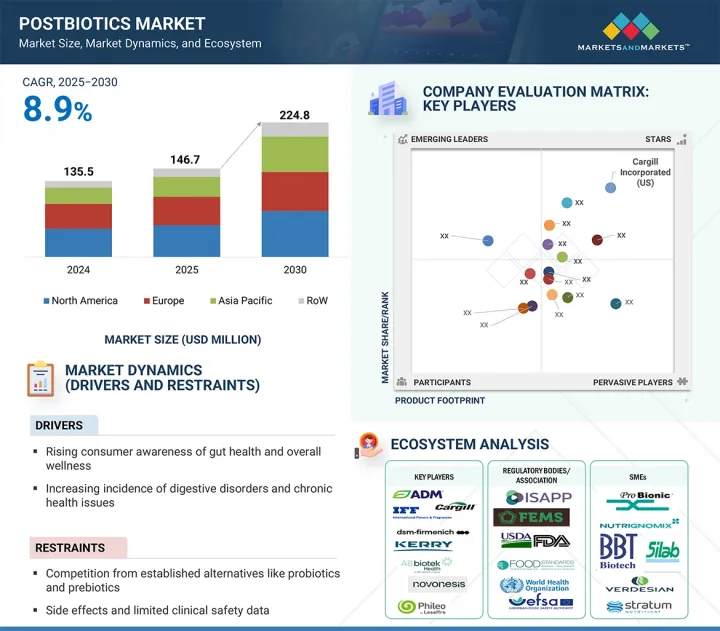

Prominent companies in the market include ADM (US), Cargill, Incorporated (US), dsm-firmenich (Netherlands), Kerry Group plc (Ireland), Associated British Foods plc (UK), BASF (Germany), Novozymes A/S, part of Novonesis Group (Denmark), International Flavors & Fragrances Inc (US), MCLS Europe B.V. (Netherlands), Phileo by Lesaffre (France), Lallemand Inc. (Canada), Sami-Sabinsa Group. (India), CJ CheilJedang Corp. (South Korea), Biotenova Sdn. Bhd. (Malaysia), Kirin Holdings Company, Limited (Japan), Bioprox Healthcare (France), MORINAGA MILK INDUSTRY CO., LTD. (Japan), SILAB (France), Probionic Corp (Korea), Nutrignomix Sdn. Bhd. (Malaysia), Stratum Nutrition (US), BBT Biotech GmbH (Germany), and Verdesian Life Sciences (US).

Research Coverage

This research report categorizes the postbiotics market by source (bacteria and yeast), by application (functional food & beverages, dietary supplements, cosmetics & personal care products, animal feed, and pharmaceutical), by form (dry and liquid), by function (qualitative) (digestive health, gut health, immune health, skin health, heart health, and other functions), by manufacturing technology (qualitative) (heat inactivation, spray drying, lyophilization, fermentation-derived fractionation, cell lysis & supernatant recovery, and encapsulation technologies), and region (North America, Europe, Asia Pacific, and Rest of the World).

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of postbiotic ingredients. A thorough analysis of the key industry players has been done to provide insights into their business, services, key strategies, contracts, partnerships, agreements, product launches, mergers & acquisitions, and recent developments associated with the postbiotics market. This report covers the competitive analysis of upcoming startups in the postbiotics market ecosystem. Furthermore, industry-specific trends such as technology analysis, ecosystem & market mapping, and patent & regulatory landscape, among others, are also covered in the study.

Reasons to Buy This Report

The report offers market leaders/new entrants information on the closest approximations of the revenue numbers for the overall postbiotics and subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rising consumer awareness of gut health and overall wellness), restraints (competition from established alternatives such as probiotics and prebiotics), opportunities (technological and economic advantages over probiotics), and challenges (regulatory uncertainty and lack of standardization) influencing the growth of the postbiotics market

- Product Development/Innovation: Detailed insights on research & development activities and new product launches in the postbiotics market

- Market Development: Comprehensive information about lucrative markets-the report analyzes postbiotics across varied regions

- Market Diversification: Exhaustive information about new product sources, untapped geographies, recent developments, and investments in the postbiotics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as ADM (US), Cargill, Incorporated (US), dsm-firmenich (Netherlands), Kerry Group plc (Ireland), Associated British Foods plc (UK), BASF (Germany), Novozymes A/S, part of Novonesis Group (Denmark), International Flavors & Fragrances Inc (US), MCLS Europe B.V. (Netherlands), Phileo by Lesaffre (France), Lallemand Inc. (Canada), Sami-Sabinsa Group. (India), CJ CheilJedang Corp. (South Korea), and other players in the postbiotics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONS CONSIDERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION AND MARKET BREAKUP

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POSTBIOTICS MARKET

- 4.2 NORTH AMERICA: POSTBIOTICS MARKET, BY SOURCE AND COUNTRY

- 4.3 POSTBIOTICS MARKET, BY SOURCE

- 4.4 POSTBIOTICS MARKET, BY FORM

- 4.5 POSTBIOTICS MARKET, BY APPLICATION AND REGION

- 4.6 POSTBIOTICS MARKET: REGIONAL SNAPSHOT

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISING DEMAND FOR NUTRACEUTICAL AND FUNCTIONAL FOOD

- 5.2.2 SUSTAINABILITY AND CLEAN LABEL TRENDS

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Rising consumer awareness of gut health and overall wellness

- 5.3.1.2 Increasing preference for natural, clean-label ingredients

- 5.3.1.3 Increasing incidence of digestive disorders and chronic health issues

- 5.3.1.4 Growing demand for functional food and beverages

- 5.3.2 RESTRAINTS

- 5.3.2.1 Competition from established alternatives like probiotics and prebiotics

- 5.3.2.2 Unclear clinical recommendations and prescription practices

- 5.3.2.3 Side effects and limited clinical safety data

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Therapeutic applications in nutrition

- 5.3.3.2 Technological and economic advantages over probiotics

- 5.3.3.3 Emerging applications in food preservation

- 5.3.3.4 Increasing R&D activities for postbiotics

- 5.3.4 CHALLENGES

- 5.3.4.1 Yield optimization, storage, and stability

- 5.3.4.2 Regulatory uncertainty and lack of standardization

- 5.3.4.3 High R&D and production costs

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.1 USE OF GEN AI IN FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.2 CASE STUDIES FOR GENERATIVE AI IN FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.2.1 Kerry Trendspotter leveraged AI and ML to analyze consumer-generated social media content, identifying and predicting food trends

- 5.4.2.2 IFF partners with Salus Optima to create personalized nutrition platform using AI to offer customized dietary recommendations based on metabolic health

- 5.4.2.3 Ingredion utilized cloud-based data analytics, AI, and cloud technology to address challenges in F&B industry

- 5.4.3 IMPACT OF GENERATIVE AI/AI ON POSTBIOTICS MARKET

- 5.4.4 ADJACENT ECOSYSTEM WORKING ON GENERATIVE AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 IMPACT OF 2025 US TARIFF - POSTBIOTICS MARKET

- 6.2.1 INTRODUCTION

- 6.2.2 KEY TARIFF RATES

- 6.2.3 DISRUPTION IN MICROBIAL INGREDIENTS INDUSTRY & POSTBIOTICS

- 6.2.4 PRICE IMPACT ANALYSIS

- 6.2.5 IMPACT ON COUNTRY/REGION

- 6.2.5.1 US

- 6.2.5.2 Europe

- 6.2.5.3 China

- 6.2.6 IMPACT ON END-USE INDUSTRIES

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.3.2 RAW MATERIAL SOURCING

- 6.3.3 PRODUCTION & PROCESSING

- 6.3.4 DISTRIBUTION

- 6.3.5 MARKETING & SALES

- 6.3.6 END USERS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO OF HS CODE 3002

- 6.4.2 EXPORT SCENARIO OF HS CODE 3002

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Heating-based inactivation technologies

- 6.5.1.2 Extraction technologies

- 6.5.1.3 Identification and characterization technologies

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Genomic and metabolomic profiling

- 6.5.2.2 Bioinformatics and machine learning

- 6.5.2.3 Bioprocess monitoring and automation

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Microbiome diagnostics: 16S rRNA sequencing

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF POSTBIOTIC PRODUCTS, BY KEY PLAYER

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.11.2.1 North America

- 6.11.2.2 Europe

- 6.11.2.3 Asia Pacific

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 DSM-FIRMENICH'S STRATEGIC LEAP INTO POSTBIOTICS THROUGH ADARE BIOME ACQUISITION

- 6.14.2 ADM'S USD 30 MILLION INVESTMENT IN PROBIOTIC & POSTBIOTIC PRODUCTION FACILITY IN SPAIN

- 6.14.3 CARGILL'S ACQUISITION AND SCALE-UP OF EPICOR POSTBIOTIC INGREDIENT

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 POSTBIOTICS MARKET, BY FUNCTION

- 7.1 INTRODUCTION

- 7.2 DIGESTIVE HEALTH

- 7.3 GUT HEALTH

- 7.4 IMMUNE HEALTH

- 7.5 SKIN HEALTH

- 7.6 HEART HEALTH

- 7.7 OTHER FUNCTIONS

8 POSTBIOTIC MARKET, BY MANUFACTURING TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 HEAT INACTIVATION

- 8.3 SPRAY DRYING

- 8.4 LYOPHILIZATION

- 8.5 OTHER MANUFACTURING TECHNOLOGIES

9 POSTBIOTICS MARKET, BY SOURCE

- 9.1 INTRODUCTION

- 9.2 BACTERIA

- 9.2.1 VERSATILITY AND WIDE-RANGING APPLICATIONS IN FUNCTIONAL FOOD, SUPPLEMENTS, AND THERAPEUTIC PRODUCTS TO DRIVE DEMAND

- 9.2.2 LACTOBACILLUS

- 9.2.3 BIFIDOBACTERIUM

- 9.2.4 OTHER BACTERIA

- 9.3 YEAST

- 9.3.1 RISING UTILIZATION IN ANIMAL HEALTHCARE AND FEED APPLICATIONS TO DRIVE MARKET

- 9.3.2 SACCHAROMYCES CEREVISIAE

- 9.3.3 SACCHAROMYCES BOULARDII

10 POSTBIOTICS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 FUNCTIONAL FOOD & BEVERAGES

- 10.2.1 INCREASING FOCUS ON GUT AND IMMUNE HEALTH TO BOOST ADOPTION OF POSTBIOTIC INGREDIENTS

- 10.3 DIETARY SUPPLEMENTS

- 10.3.1 RISING EMPHASIS ON GUT AND IMMUNE HEALTH TO DRIVE DEMAND FOR POSTBIOTICS IN DIETARY SUPPLEMENTS

- 10.4 ANIMAL FEED

- 10.4.1 GROWING ADOPTION OF POSTBIOTICS IN ANIMAL FEED FOR IMPROVED HEALTH AND PERFORMANCE

- 10.5 COSMETICS & PERSONAL CARE

- 10.5.1 DEMAND FOR MICROBIOME-FRIENDLY FORMULATIONS IN COSMETICS & PERSONAL CARE TO DRIVE MARKET

- 10.6 PHARMACEUTICALS

- 10.6.1 THERAPEUTIC POTENTIAL TO DRIVE DEMAND FOR POSTBIOTICS IN PHARMACEUTICALS

11 POSTBIOTICS MARKET, BY FORM

- 11.1 INTRODUCTION

- 11.2 DRY

- 11.2.1 NEED FOR ENHANCED STABILITY, SHELF LIFE, AND APPLICATION FLEXIBILITY TO DRIVE DEMAND

- 11.3 LIQUID

- 11.3.1 EASE OF INCORPORATION INTO FUNCTIONAL BEVERAGES AND FERMENTED PRODUCTS TO DRIVE DEMAND

12 POSTBIOTICS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Clinical innovation and evolving health needs to steer market trends

- 12.2.2 CANADA

- 12.2.2.1 Health Canada approvals and pediatric research to drive market

- 12.2.3 MEXICO

- 12.2.3.1 Rising interest in immune-supportive and gut-health formulations to drive market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Robust life sciences infrastructure and advanced industrial fermentation capabilities to drive market

- 12.3.2 UK

- 12.3.2.1 Growing interest in incorporating postbiotic ingredients into mainstream food and beverage products to boost market

- 12.3.3 FRANCE

- 12.3.3.1 Fermentation expertise and growing interest in scientifically backed microbial ingredients to drive market

- 12.3.4 ITALY

- 12.3.4.1 Increasing focus of key startups on fermentation technologies to drive market

- 12.3.5 SPAIN

- 12.3.5.1 Strategic investments in functional ingredient space to drive market

- 12.3.6 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Growing consumer interest in gut health, functional foods, and wellness ingredients to drive market

- 12.4.2 JAPAN

- 12.4.2.1 Emphasis on gut health and functional nutrition to drive market

- 12.4.3 INDIA

- 12.4.3.1 Consumer shift toward functional and preventive nutrition products to drive market

- 12.4.4 AUSTRALIA & NEW ZEALAND

- 12.4.4.1 Increasing consumer demand for functional foods, clean-label ingredients, and gut health solutions to drive market

- 12.4.5 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 REST OF THE WORLD

- 12.5.1 SOUTH AMERICA

- 12.5.1.1 Rising consumer awareness around gut health, immunity, and functional nutrition to drive market

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Health and sustainability drives, including Vision 2030, to increase postbiotics adoption

- 12.5.3 AFRICA

- 12.5.3.1 Rising focus on gut health and preventive nutrition to drive market

- 12.5.1 SOUTH AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-JULY 2025

- 13.3 REVENUE ANALYSIS, 2022-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Regional footprint

- 13.7.5.3 Source footprint

- 13.7.5.4 Form footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ADM

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Services/Solutions offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.3.3 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 CARGILL, INCORPORATED

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Services/Solutions offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.3.3 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 DSM-FIRMENICH

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Services/Solutions offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 KERRY GROUP PLC

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Services/Solutions offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 ASSOCIATED BRITISH FOODS PLC

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Services/Solutions offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 BASF

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Services/Solutions offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.4 MnM view

- 14.1.7 NOVONESIS GROUP

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Services/Solutions offered

- 14.1.7.3 MnM view

- 14.1.8 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Services/Solutions offered

- 14.1.8.3 MnM view

- 14.1.9 MCLS EUROPE B.V.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Services/Solutions offered

- 14.1.9.3 MnM view

- 14.1.10 PHILEO BY LESAFFRE

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Services/Solutions offered

- 14.1.10.3 MnM view

- 14.1.11 LALLEMAND INC.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Services/Solutions offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.4 MnM view

- 14.1.12 SAMI-SABINSA GROUP

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Services/Solutions offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.12.4 MnM view

- 14.1.13 CJ CHEILJEDANG CORP.

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Services/Solutions offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product launches

- 14.1.13.3.2 Deals

- 14.1.13.4 MnM view

- 14.1.14 MORINAGA MILK INDUSTRY CO., LTD.

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Services/Solutions offered

- 14.1.14.3 MnM view

- 14.1.15 KIRIN HOLDINGS COMPANY, LIMITED

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Services/Solutions offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Other developments

- 14.1.15.4 MnM view

- 14.1.1 ADM

- 14.2 OTHER PLAYERS

- 14.2.1 BIOTENOVA SDN. BHD.

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Services/Solutions offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Deals

- 14.2.1.4 MnM view

- 14.2.2 BIOPROX HEALTHCARE

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Services/Solutions offered

- 14.2.2.3 MnM view

- 14.2.3 SILAB

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Services/Solutions offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Expansions

- 14.2.3.4 MnM view

- 14.2.4 PROBIONIC CORP.

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Services/Solutions offered

- 14.2.4.3 MnM view

- 14.2.5 NUTRIGNOMIX SDN. BHD.

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Services/Solutions offered

- 14.2.5.3 MnM view

- 14.2.6 STRATUM NUTRITION

- 14.2.7 BBT BIOTECH GMBH

- 14.2.8 VERDESIAN LIFE SCIENCES

- 14.2.9 SYNBIO TECH INC.

- 14.2.10 NEO CREMAR

- 14.2.1 BIOTENOVA SDN. BHD.

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 STUDY LIMITATIONS

- 15.3 FUNCTIONAL FOOD INGREDIENTS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 PROBIOTICS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 POSTBIOTICS MARKET SNAPSHOT, 2025 VS. 2030 (USD MILLION)

- TABLE 3 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 4 EXPECTED IMPACT LEVEL ON TARGET INGREDIENTS WITH RELEVANT HS CODES DUE TO US TARIFF IMPACT

- TABLE 5 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES: POSTBIOTICS MARKET

- TABLE 6 IMPORT SCENARIO FOR HS CODE: 3002, BY COUNTRY, 2020-2024 (TONS)

- TABLE 7 EXPORT SCENARIO FOR HS CODE: 3002, BY COUNTRY, 2020-2024 (TONS)

- TABLE 8 AVERAGE SELLING PRICE OF POSTBIOTIC PRODUCTS, BY KEY PLAYER, 2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF POSTBIOTICS, BY REGION, 2021-2024 (USD/KG)

- TABLE 10 POSTBIOTIC MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 11 LIST OF MAJOR PATENTS PERTAINING TO POSTBIOTICS MARKET, 2022-2025

- TABLE 12 POSTBIOTICS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 PORTER'S FIVE FORCES IMPACT ON POSTBIOTICS MARKET

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- TABLE 20 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 21 POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 22 POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 23 POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (TONS)

- TABLE 24 POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (TONS)

- TABLE 25 BACTERIA: POSTBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 BACTERIA: POSTBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 BACTERIA: POSTBIOTICS MARKET, BY REGION, 2021-2024 (TONS)

- TABLE 28 BACTERIA: POSTBIOTICS MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 29 BACTERIA: POSTBIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 30 BACTERIA: POSTBIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 31 YEAST: POSTBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 YEAST: POSTBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 YEAST: POSTBIOTICS MARKET, BY REGION, 2021-2024 (TONS)

- TABLE 34 YEAST: POSTBIOTICS MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 35 YEAST: POSTBIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 36 YEAST: POSTBIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 37 POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 38 POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 39 FUNCTIONAL FOOD & BEVERAGES: POSTBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 FUNCTIONAL FOOD & BEVERAGES: POSTBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 DIETARY SUPPLEMENTS: POSTBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 DIETARY SUPPLEMENTS: POSTBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 ANIMAL FEED: POSTBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 ANIMAL FEED: POSTBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 COSMETICS & PERSONAL CARE: POSTBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 COSMETICS & PERSONAL CARE: POSTBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 PHARMACEUTICALS: POSTBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 PHARMACEUTICALS: POSTBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 POSTBIOTICS MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 50 POSTBIOTICS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 51 DRY: POSTBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 DRY: POSTBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 LIQUID: POSTBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 LIQUID: POSTBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 POSTBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 POSTBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 POSTBIOTICS MARKET, BY REGION, 2021-2024 (TONS)

- TABLE 58 POSTBIOTICS MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 59 NORTH AMERICA: POSTBIOTICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 NORTH AMERICA: POSTBIOTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (TONS)

- TABLE 64 NORTH AMERICA: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (TONS)

- TABLE 65 NORTH AMERICA: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 66 NORTH AMERICA: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: POSTBIOTICS MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: POSTBIOTICS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 69 US: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 70 US: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 71 US: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 72 US: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 CANADA: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 74 CANADA: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 75 CANADA: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 76 CANADA: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 77 MEXICO: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 78 MEXICO: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 79 MEXICO: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 80 MEXICO: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 EUROPE: POSTBIOTICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 EUROPE: POSTBIOTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 EUROPE: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 84 EUROPE: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (TONS)

- TABLE 86 EUROPE: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (TONS)

- TABLE 87 EUROPE: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 88 EUROPE: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: POSTBIOTICS MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 90 EUROPE: POSTBIOTICS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 91 GERMANY: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 92 GERMANY: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 93 GERMANY: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 94 GERMANY: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 95 UK: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 96 UK: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 97 UK: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 98 UK: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 FRANCE: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 100 FRANCE: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 101 FRANCE: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 102 FRANCE: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 103 ITALY: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 104 ITALY: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 105 ITALY: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 106 ITALY: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 SPAIN: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 108 SPAIN: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 109 SPAIN: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 110 SPAIN: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 REST OF EUROPE: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 112 REST OF EUROPE: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 REST OF EUROPE: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: POSTBIOTICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 ASIA PACIFIC: POSTBIOTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (TONS)

- TABLE 120 ASIA PACIFIC: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (TONS)

- TABLE 121 ASIA PACIFIC: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: POSTBIOTICS MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: POSTBIOTICS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 125 CHINA: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 126 CHINA: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 127 CHINA: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 128 CHINA: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 JAPAN: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 130 JAPAN: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 131 JAPAN: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 132 JAPAN: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 INDIA: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 134 INDIA: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 135 INDIA: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 136 INDIA: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 AUSTRALIA & NEW ZEALAND: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 138 AUSTRALIA & NEW ZEALAND: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 139 AUSTRALIA & NEW ZEALAND: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 140 AUSTRALIA & NEW ZEALAND: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 REST OF THE WORLD: POSTBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 REST OF THE WORLD: POSTBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147 REST OF THE WORLD: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 148 REST OF THE WORLD: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 149 REST OF THE WORLD: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (TONS)

- TABLE 150 REST OF THE WORLD: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (TONS)

- TABLE 151 REST OF THE WORLD: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 152 REST OF THE WORLD: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 REST OF THE WORLD: POSTBIOTICS MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 154 REST OF THE WORLD: POSTBIOTICS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 155 SOUTH AMERICA: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 156 SOUTH AMERICA: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 157 SOUTH AMERICA: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 158 SOUTH AMERICA: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 163 AFRICA: POSTBIOTICS MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 164 AFRICA: POSTBIOTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 165 AFRICA: POSTBIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 166 AFRICA: POSTBIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 167 OVERVIEW OF STRATEGIES ADOPTED BY KEY POSTBIOTICS MARKET PLAYERS, 2022-JULY 2025

- TABLE 168 PLANT-BASED PROTEIN MARKET: MARKET SHARE ANALYSIS, 2024

- TABLE 169 POSTBIOTICS MARKET: REGIONAL FOOTPRINT

- TABLE 170 POSTBIOTICS MARKET: SOURCE FOOTPRINT

- TABLE 171 POSTBIOTICS MARKET: FORM FOOTPRINT

- TABLE 172 POSTBIOTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 173 POSTBIOTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 174 POSTBIOTICS MARKET: PRODUCT LAUNCHES, JUNE 2022-MARCH 2025

- TABLE 175 POSTBIOTICS MARKET: DEALS, DECEMBER 2022-FEBRUARY 2025

- TABLE 176 POSTBIOTICS MARKET: EXPANSIONS, FEBRUARY 2020-NOVEMBER 2024

- TABLE 177 ADM: COMPANY OVERVIEW

- TABLE 178 ADM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 179 ADM: DEALS

- TABLE 180 ADM: EXPANSIONS

- TABLE 181 ADM: OTHER DEVELOPMENTS

- TABLE 182 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 183 CARGILL, INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 184 CARGILL, INCORPORATED: DEALS

- TABLE 185 CARGILL, INCORPORATED: EXPANSIONS

- TABLE 186 CARGILL, INCORPORATED: OTHER DEVELOPMENTS

- TABLE 187 DSM-FIRMENICH: COMPANY OVERVIEW

- TABLE 188 DSM-FIRMENICH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 189 DSM-FIRMENICH: DEALS

- TABLE 190 KERRY GROUP PLC: COMPANY OVERVIEW

- TABLE 191 KERRY GROUP PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 192 KERRY GROUP PLC: PRODUCT LAUNCHES

- TABLE 193 KERRY GROUP PLC: DEALS

- TABLE 194 ASSOCIATED BRITISH FOODS PLC: COMPANY OVERVIEW

- TABLE 195 ASSOCIATED BRITISH FOODS PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 196 ASSOCIATED BRITISH FOODS PLC: DEALS

- TABLE 197 BASF: COMPANY OVERVIEW

- TABLE 198 BASF: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 199 BASF: PRODUCT LAUNCHES

- TABLE 200 NOVONESIS GROUP: COMPANY OVERVIEW

- TABLE 201 NOVONESIS GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 202 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY OVERVIEW

- TABLE 203 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 204 MCLS EUROPE B.V.: COMPANY OVERVIEW

- TABLE 205 MCLS EUROPE B.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 206 PHILEO BY LESAFFRE: COMPANY OVERVIEW

- TABLE 207 PHILEO BY LESAFFRE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 208 LALLEMAND INC.: COMPANY OVERVIEW

- TABLE 209 LALLEMAND INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 210 LALLEMAND INC.: DEALS

- TABLE 211 SAMI-SABINSA GROUP: COMPANY OVERVIEW

- TABLE 212 SAMI-SABINSA GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 213 SAMI-SABINSA GROUP: DEALS

- TABLE 214 CJ CHEILJEDANG CORP.: COMPANY OVERVIEW

- TABLE 215 CJ CHEILJEDANG CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 216 CJ CHEILJEDANG CORP.: PRODUCT LAUNCHES

- TABLE 217 CJ CHEILJEDANG CORP.: DEALS

- TABLE 218 MORINAGA MILK INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 219 MORINAGA MILK INDUSTRY CO., LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 220 KIRIN HOLDINGS COMPANY, LIMITED: COMPANY OVERVIEW

- TABLE 221 KIRIN HOLDINGS COMPANY, LIMITED: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 222 KIRIN HOLDINGS COMPANY, LIMITED: OTHER DEVELOPMENTS

- TABLE 223 BIOTENOVA SDN. BHD.: COMPANY OVERVIEW

- TABLE 224 BIOTENOVA SDN. BHD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 225 BIOTENOVA SDN. BHD.: DEALS

- TABLE 226 BIOPROX HEALTHCARE: COMPANY OVERVIEW

- TABLE 227 BIOPROX HEALTHCARE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 228 SILAB: COMPANY OVERVIEW

- TABLE 229 SILAB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 230 SILAB: EXPANSIONS

- TABLE 231 PROBIONIC CORP.: COMPANY OVERVIEW

- TABLE 232 PROBIONIC CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 233 NUTRIGNOMIX SDN. BHD.: COMPANY OVERVIEW

- TABLE 234 NUTRIGNOMIX SDN. BHD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 235 MARKETS ADJACENT TO POSTBIOTICS MARKET

- TABLE 236 FUNCTIONAL FOOD INGREDIENTS MARKET, BY SOURCE, 2019-2023 (USD MILLION)

- TABLE 237 FUNCTIONAL FOOD INGREDIENTS MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 238 PROBIOTICS MARKET, BY END USER, 2020-2023 (USD BILLION)

- TABLE 239 PROBIOTICS MARKET, BY END USER, 2024-2029 (USD BILLION)

List of Figures

- FIGURE 1 POSTBIOTICS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 SUPPLY-SIDE ANALYSIS: SOURCES OF INFORMATION AT EVERY STEP

- FIGURE 5 POSTBIOTICS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 POSTBIOTICS MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 8 POSTBIOTICS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 9 POSTBIOTICS MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 10 POSTBIOTICS MARKET SHARE AND GROWTH RATE, BY REGION

- FIGURE 11 INCREASING DEMAND FOR FORTIFIED AND HEALTH-POSITIONED FOODS AND BEVERAGES TO DRIVE MARKET

- FIGURE 12 US AND BACTERIA SEGMENT TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2025

- FIGURE 13 BACTERIA SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 DRY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 FUNCTIONAL FOOD & BEVERAGES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 US TO RECORD LARGEST MARKET SHARE IN 2025

- FIGURE 17 POSTBIOTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 ADOPTION OF GEN AI IN FOOD & BEVERAGE PRODUCTION PROCESS

- FIGURE 19 POSTBIOTICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 IMPORT OF HS CODE 3002, BY KEY COUNTRY, 2020-2024 (TONS)

- FIGURE 21 EXPORT OF HS CODE 3002, BY KEY COUNTRY, 2020-2024 (TONS)

- FIGURE 22 AVERAGE SELLING PRICE OF POSTBIOTIC PRODUCTS, BY KEY PLAYER, 2024 (USD)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF POSTBIOTICS, BY REGION, 2021-2024 (USD/KG)

- FIGURE 24 POSTBIOTIC MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 NUMBER OF PATENTS APPLIED AND GRANTED, 2017-2025

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED FOR POSTBIOTICS

- FIGURE 28 POSTBIOTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 30 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 31 POSTBIOTIC MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 32 POSTBIOTICS MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 33 POSTBIOTICS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 34 POSTBIOTICS MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 35 INDIA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: POSTBIOTICS MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: POSTBIOTICS MARKET SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2022-2024 (USD BILLION)

- FIGURE 39 MARKET SHARE ANALYSIS, 2024

- FIGURE 40 COMPANY VALUATION

- FIGURE 41 FINANCIAL METRICS

- FIGURE 42 POSTBIOTICS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 43 POSTBIOTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 POSTBIOTICS MARKET: COMPANY FOOTPRINT

- FIGURE 45 POSTBIOTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 ADM: COMPANY SNAPSHOT

- FIGURE 47 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 48 DSM-FIRMENICH: COMPANY SNAPSHOT

- FIGURE 49 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 50 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- FIGURE 51 BASF: COMPANY SNAPSHOT

- FIGURE 52 NOVONESIS GROUP: COMPANY SNAPSHOT

- FIGURE 53 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 54 CJ CHEILJEDANG CORP.: COMPANY SNAPSHOT

- FIGURE 55 MORINAGA MILK INDUSTRY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 56 KIRIN HOLDINGS COMPANY, LIMITED: COMPANY SNAPSHOT