|

市场调查报告书

商品编码

1876538

汽车循环经济追踪系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Circular Economy Tracking System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

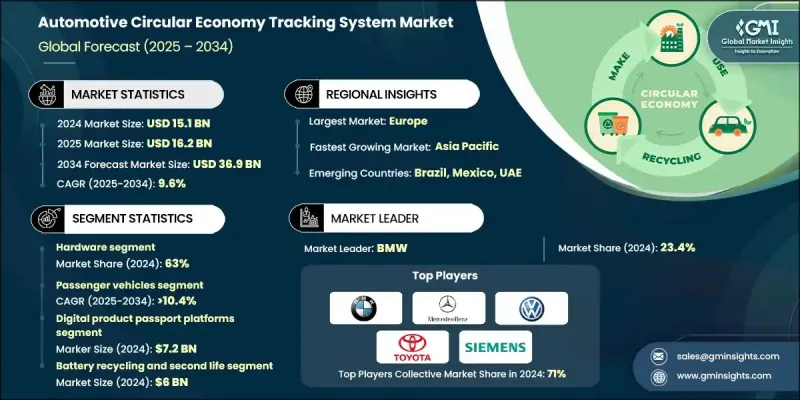

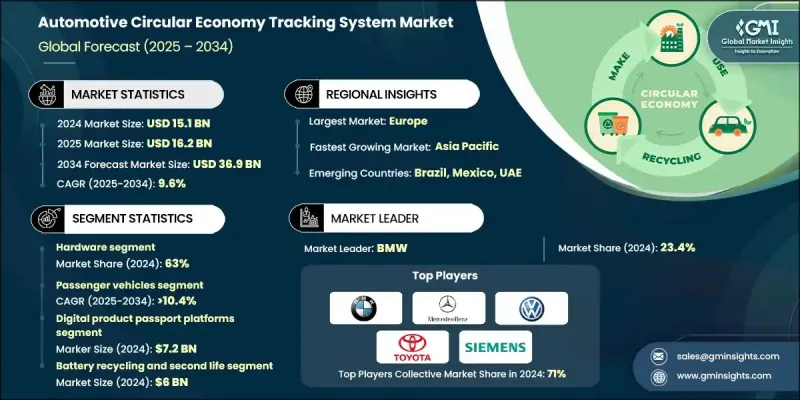

2024 年全球汽车循环经济追踪系统市场价值为 151 亿美元,预计到 2034 年将以 9.6% 的复合年增长率成长至 369 亿美元。

随着汽车製造商和供应商日益重视永续性、生命週期透明度和合规性,汽车产业正经历显着的扩张。数位转型、基于物联网的资产追踪和区块链赋能的可追溯性系统正在彻底改变汽车产业管理材料和资源的方式。这些先进的追踪解决方案可协助企业回收宝贵材料、提高回收效率并简化报废车辆管理,同时有助于减少碳排放和优化资源利用。互联技术、数位孪生和人工智慧分析的融合正在建立一个更智慧、数据驱动的循环经济,从而改变汽车产业衡量和管理永续性的方式。製造商正在采用端到端的可视化解决方案,以确保其价值链的问责制。物联网、企业资源计划 (ERP) 和永续发展平台之间的无缝资料连接进一步优化了运营,提升了环境、社会和治理 (ESG) 绩效,并增强了品牌信誉。基于云端和人工智慧整合系统的持续发展正推动全球市场朝向更智慧、更永续的製造生态系统迈进。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 151亿美元 |

| 预测值 | 369亿美元 |

| 复合年增长率 | 9.6% |

2024年,硬体细分市场占据63%的市场份额,预计2025年至2034年将以9.8%的复合年增长率成长。这一主导地位归功于硬体组件在汽车供应链中发挥的关键作用,它们能够实现即时资料采集、组件追踪和生命週期监控。此细分市场包括物联网感测器、RFID标籤、嵌入式控制器和资料撷取设备,所有这些对于确保可追溯性、合规性和营运效率至关重要。随着汽车製造商和回收商寻求更高的透明度和精确度,对先进硬体系统的投资预计将会加速,从而在整个预测期内推动持续成长。

2024年,乘用车细分市场占据47%的市场份额,预计到2034年将以10.4%的复合年增长率成长。该细分市场的领先地位得益于电动和混合动力汽车的快速普及、日益严格的回收和可持续发展监管压力,以及对生产和使用后流程中材料追踪需求的增长。汽车製造商正在部署智慧追踪技术,以符合严格的环境和循环经济标准,同时优化乘用车车队的资源再利用和电池生命週期管理。

德国汽车循环经济追踪系统市场占40%的份额,预计2024年市场规模将达29亿美元。德国的领先地位得益于其强大的原始设备製造商(OEM)、一级供应商和技术提供商,这些企业都在部署先进的追踪和分析平台。人工智慧赋能的生命週期分析、基于区块链的透明化工具、物联网驱动的状态监测以及整合云端报告解决方案的日益普及,正在推动生产、回收和车辆回收环节的广泛应用。德国企业正着力打造模组化、可互通且可扩展的系统,以满足欧盟的永续发展要求,同时最大限度地提高效率、循环性和材料回收率。

汽车循环经济追踪系统市场的主要参与者包括丰田汽车、西门子、梅赛德斯-奔驰、大众汽车、雷诺汽车、宝马汽车、电装汽车、福特汽车和现代汽车。这些市场领导者正透过创新、永续发展倡议和策略合作来提升其市场地位。他们大力投资人工智慧驱动的分析、物联网基础设施和区块链可追溯性,以实现端到端的材料追踪和合规性报告。各公司正在汽车供应链上建立合作伙伴关係,以开发可互通的云端循环经济平台,并与製造和回收营运无缝整合。数位孪生技术和生命週期分析的扩展正在帮助实现决策自动化和资源回收优化。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 欧盟报废车辆法规和数位护照强制令

- 电池法规合规要求

- 关键物资短缺与资源安全

- 生产者延伸责任实施

- 产业陷阱与挑战

- 资料隐私和竞争性保密问题

- 传统IT基础设施的局限性

- 市场机会

- 数位产品护照市场扩张

- 人工智慧驱动的循环材料优化

- 跨境监管协调

- 中小企业整合与民主化

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 欧盟报废车辆(ELV)指令

- 欧盟电池法规

- 生产者延伸责任制(EPR)

- 数位产品护照(DPP)强制令

- 国家循环经济政策

- 资料隐私和安全法规

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 基于区块链的追踪系统

- 协作资料生态系统

- 企业回收管理系统

- 数位产品护照平台

- 基于物联网的状态监测

- 价格趋势

- 按地区

- 副产品

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 风险评估框架

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 硬体

- 感应器

- 标籤

- 闸道

- 装置

- 软体

- 生命週期管理

- 数据分析

- 区块链平台

- 服务

- 一体化

- 咨询

- 维护

第六章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 多用途乘用车

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

- 两轮车

第七章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 数位产品护照平台

- 基于区块链的追踪系统

- 基于物联网的状态监测

- 协作资料生态系统

- 企业回收管理系统

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 电池回收和二次利用

- 汽车製造

- 供应链透明度

- 备件追踪

- 材料回收再利用

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 原始设备製造商(OEM)

- 一级和二级供应商

- 技术平台提供者

- 回收拆解设施

- 监理与合规组织

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十一章:公司简介

- Global Player

- BMW

- Denso

- Ford Motor

- Hyundai Motor

- Mercedes-Benz

- Renault

- Toyota Motor

- Volkswagen

- Regional Player

- BASF

- Covestro

- Siemens

- Stellantis

- Umicore

- 新兴参与者

- CGI

- CircularTree

- ScrapRight

The Global Automotive Circular Economy Tracking System Market was valued at USD 15.1 billion in 2024 and is estimated to grow at a CAGR of 9.6% to reach USD 36.9 billion by 2034.

The industry is experiencing significant expansion as automotive manufacturers and suppliers intensify their focus on sustainability, lifecycle transparency, and regulatory compliance. The shift toward digital transformation, IoT-based asset tracking, and blockchain-enabled traceability systems is revolutionizing how the automotive sector manages materials and resources. These advanced tracking solutions help companies recover valuable materials, improve recycling efficiency, and streamline end-of-life vehicle management while contributing to carbon reduction and resource optimization. The integration of connected technologies, digital twins, and AI-powered analytics is enabling a smarter, data-driven circular economy, transforming how the automotive industry measures and manages sustainability. Manufacturers are adopting end-to-end visibility solutions to ensure accountability throughout their value chains. Seamless data connectivity between IoT, ERP, and sustainability platforms is further optimizing operations, strengthening ESG performance, and reinforcing brand credibility. The ongoing evolution of cloud-based and AI-integrated systems is pushing the market toward more intelligent and sustainable manufacturing ecosystems worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.1 Billion |

| Forecast Value | $36.9 Billion |

| CAGR | 9.6% |

The hardware segment held a 63% share in 2024 and is projected to grow at a CAGR of 9.8% from 2025 to 2034. This dominance is attributed to the critical role hardware components play in enabling real-time data collection, component tracking, and lifecycle monitoring across the automotive supply chain. The segment comprises IoT sensors, RFID tags, embedded controllers, and data acquisition devices, all essential for ensuring traceability, compliance, and operational efficiency. As automakers and recyclers seek improved transparency and precision, investments in advanced hardware systems are expected to accelerate, driving consistent growth throughout the forecast period.

The passenger vehicles segment held a 47% share in 2024 and is forecasted to grow at a CAGR of 10.4% through 2034. This segment's leadership is fueled by the rapid adoption of electric and hybrid vehicles, increased regulatory pressure on recycling and sustainability, and growing demand for material tracking in production and post-use processes. Automotive manufacturers are deploying smart tracking technologies to comply with strict environmental and circular economy standards while optimizing resource reuse and battery lifecycle management within passenger vehicle fleets.

Germany Automotive Circular Economy Tracking System Market held a 40% share, generating USD 2.9 billion in 2024. The country's dominance is supported by a strong presence of OEMs, tiered suppliers, and technology providers implementing sophisticated tracking and analytics platforms. The growing use of AI-enabled lifecycle analytics, blockchain-based transparency tools, IoT-driven condition monitoring, and integrated cloud reporting solutions is driving adoption across production, recycling, and vehicle recovery operations. Companies in Germany are emphasizing modular, interoperable, and scalable systems designed to meet EU sustainability mandates while maximizing efficiency, circularity, and material recovery rates.

Key companies participating in the Automotive Circular Economy Tracking System Market include Toyota Motor, Siemens, Mercedes-Benz, Volkswagen, Renault, BMW, Denso, Ford Motor, and Hyundai Motor. Leading players in the Automotive Circular Economy Tracking System Market are enhancing their market position through innovation, sustainability initiatives, and strategic collaboration. They are investing heavily in AI-powered analytics, IoT infrastructure, and blockchain traceability to enable end-to-end material tracking and compliance reporting. Companies are forming partnerships across the automotive supply chain to develop interoperable, cloud-based circular economy platforms that integrate seamlessly with manufacturing and recycling operations. Expansion of digital twin technology and lifecycle analytics is helping automate decision-making and optimize resource recovery.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 EU ELV regulation & digital passport mandates

- 3.2.1.2 Battery regulation compliance requirements

- 3.2.1.3 Critical material scarcity & resource security

- 3.2.1.4 Extended producer responsibility implementation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy & competitive confidentiality concerns

- 3.2.2.2 Legacy IT infrastructure limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Digital product passport market expansion

- 3.2.3.2 AI-driven circular material optimization

- 3.2.3.3 Cross-border regulatory harmonization

- 3.2.3.4 SME integration & democratization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 EU end-of-life vehicle (ELV) directive

- 3.4.2 EU battery regulation

- 3.4.3 Extended producer responsibility (EPR)

- 3.4.4 Digital product passport (DPP) mandates

- 3.4.5 National circular economy policies

- 3.4.6 Data privacy & security regulations

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Blockchain-based tracking systems

- 3.7.2 Collaborative data ecosystems

- 3.7.3 Enterprise recycling management systems

- 3.7.4 Digital product passport platforms

- 3.7.5 IoT-enabled condition monitoring

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Risk assessment framework

- 3.14 Best case scenarios

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensor

- 5.2.2 Tags

- 5.2.3 Gateways

- 5.2.4 Devices

- 5.3 Software

- 5.3.1 Lifecycle management

- 5.3.2 Data analytics

- 5.3.3 Blockchain platforms

- 5.4 Services

- 5.4.1 Integration

- 5.4.2 Consulting

- 5.4.3 Maintenance

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUV

- 6.2.4 MPVs

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

- 6.4 Two-Wheelers

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Digital product passport platforms

- 7.3 Blockchain-based tracking systems

- 7.4 IoT-enabled condition monitoring

- 7.5 Collaborative data ecosystems

- 7.6 Enterprise recycling management systems

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn, Units)

- 8.1 Key trends

- 8.2 Battery recycling and second life

- 8.3 Vehicle manufacturing

- 8.4 Supply chain transparency

- 8.5 Spare parts tracking

- 8.6 Material recovery and reuse

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($ Bn, Units)

- 9.1 Key trends

- 9.2 Original equipment manufacturers (OEMs)

- 9.3 Tier 1 & tier 2 suppliers

- 9.4 Technology platform providers

- 9.5 Recycling & dismantling facilities

- 9.6 Regulatory & compliance organizations

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 BMW

- 11.1.2 Denso

- 11.1.3 Ford Motor

- 11.1.4 Hyundai Motor

- 11.1.5 Mercedes-Benz

- 11.1.6 Renault

- 11.1.7 Toyota Motor

- 11.1.8 Volkswagen

- 11.2 Regional Player

- 11.2.1 BASF

- 11.2.2 Covestro

- 11.2.3 Siemens

- 11.2.4 Stellantis

- 11.2.5 Umicore

- 11.3 Emerging Players

- 11.3.1 CGI

- 11.3.2 CircularTree

- 11.3.3 ScrapRight