|

市场调查报告书

商品编码

1876616

车辆侧翻预防系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Vehicle Rollover Prevention System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

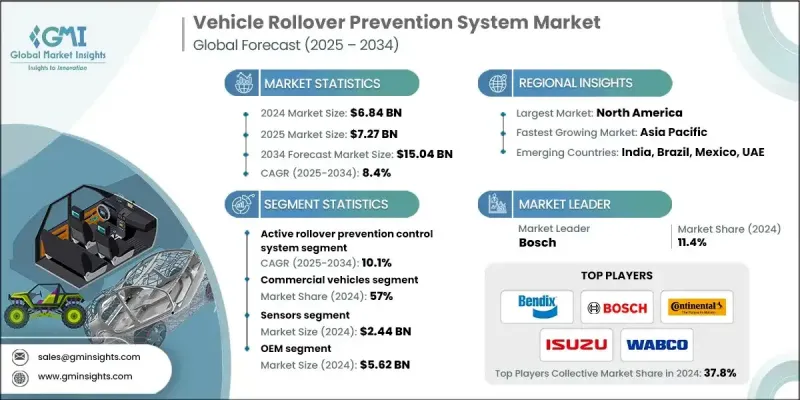

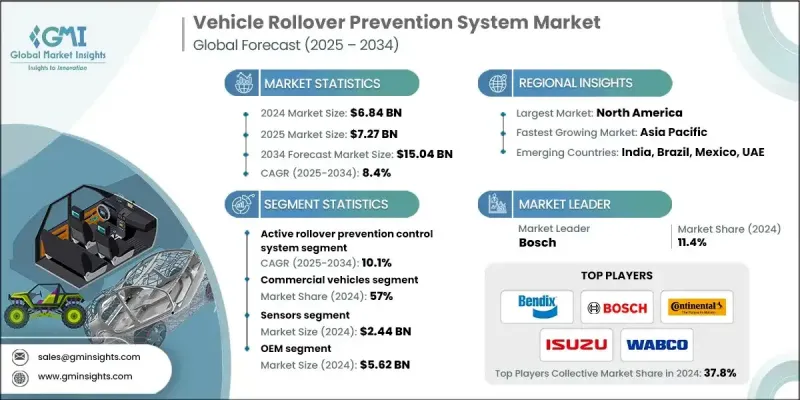

2024 年全球车辆翻车预防系统市场价值为 68.4 亿美元,预计到 2034 年将以 8.4% 的复合年增长率成长至 150.4 亿美元。

SUV、皮卡和重型商用车等高重心车辆的日益普及推动了市场的稳定扩张,这些车辆的翻车风险也随之增加。这一趋势促使汽车製造商和零件供应商将先进的电子稳定控制系统和侧翻预防系统整合到车辆设计中。现代安全解决方案采用运动感测技术、预测演算法和智慧煞车系统来侦测和减轻侧翻事故。全球范围内日益严格的政府安全法规,特别是那些强制要求配备电子稳定控制系统 (ESC) 和其他翻车预防措施的法规,正在加速此类系统在新车中的创新和应用。这些法规已在主要汽车市场实施,促使製造商开发高度整合且反应迅速的安全平台,旨在降低道路交通事故死亡率。 MEMS 感测器技术、即时资料分析和机器学习演算法的不断进步进一步提高了这些系统的精确度和响应速度。这些改进透过降低误报率、优化车辆稳定性以及提高系统经济性来推动市场需求,从而共同促进乘用车和商用车领域的更广泛应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 68.4亿美元 |

| 预测值 | 150.4亿美元 |

| 复合年增长率 | 8.4% |

主动防侧翻控制系统市场预计在2025年至2034年间将以10.1%的复合年增长率成长。这些系统将电子稳定控制系统(ESC)与智慧型感测器和执行器网路结合,提供主动式车辆稳定性管理。它们持续分析侧倾角、横向力和偏航运动,以检测潜在的侧翻情况。一旦识别到不稳定情况,系统会自动施加选择性煞车或降低引擎扭矩,以稳定车辆并防止侧翻,从而确保在动态驾驶条件下获得更好的操控性。

感测器领域占据35.7%的市场份额,预计2024年市场规模将达24.4亿美元。该领域的成长主要得益于微机电系统(MEMS)技术的快速发展,这项技术在提高感测器精度的同时降低了成本。诸如内建机器学习核心等创新技术使感测器能够自主检测驾驶模式并即时识别侧翻风险。这些进步为感测器与先进驾驶辅助系统(ADAS)和连网汽车平台的无缝整合铺平了道路,从而提升了车辆安全性和跨多个动态功能的性能协同效应。

2024年,美国车辆翻车预防系统市场占87.3%的市场份额,营收达18.9亿美元。美国在该领域的领先地位得益于其完善的汽车安全法规、成熟的技术生态系统以及乘用车和商用车车队对先进安全系统的广泛应用。美国市场持续受益于其多元化的车辆结构和对创新的重视,未来十年将拥有巨大的成长潜力。

全球车辆翻车预防系统市场的主要参与者包括博世、大陆集团、威伯科、奥托立夫、皓龙、曼恩商用车、玛鲁蒂铃木、五十铃汽车和本迪克斯。这些领导企业正致力于透过技术进步、合作和市场扩张来提升自身的竞争优势。许多企业正大力投资研发,以开发更智慧、更具适应性的控制系统,利用机器学习和先进感测器实现车辆的即时监控。汽车製造商与技术供应商之间的策略合作正在推动整合安全平台的构建,将侧翻预防功能与更广泛的稳定性控制功能相结合。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预报

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- SUV和卡车需求不断成长

- 更严格的全球安全法规

- 感测器和人工智慧技术的进步

- 消费者和安全意识提高

- 商业和非道路应用领域的成长

- 产业陷阱与挑战

- 系统成本高且整合复杂

- 各地区标准化程度有限

- 市场机会

- 与自动驾驶和ADAS平台集成

- 电动和混合动力汽车的扩张

- 车队安全和远端资讯处理技术应用成长

- 透过在地化实现新兴市场采纳

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 资料隐私与监管合规

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术

- 新兴技术

- 感测器技术演进与路线图

- 按车辆细分市场分類的技术采纳曲线

- 专利分析

- 价格趋势分析

- 按组件

- 按地区

- 成本分解分析

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 车辆翻车事故统计及趋势

- 安全影响评估与生命挽救分析

- 软体演算法开发趋势

- 风险评估与市场波动框架

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重要新闻和倡议

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依系统划分,2021-2034年

- 主要趋势

- 翻车侦测及预警系统

- 主动防侧翻控制系统

- 横滚稳定性控制系统(RSC)

- 翻滚保护结构(ROPS)

第六章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- SUV

- 商用车辆

- 低容量性状

- MCV

- C型肝炎

第七章:市场估计与预测:依组件划分,2021-2034年

- 主要趋势

- 感应器

- 电子控制单元

- 执行器和煞车模组

- 其他的

第八章:市场估算与预测:依销售管道划分,2021-2034年

- 主要趋势

- 原始设备製造商(OEM)

- 售后市场

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 个人车辆所有者

- 车队营运商和物流公司

- 政府和公共交通机构

- 工业和建筑公司

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 荷兰

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 新加坡

- 泰国

- 越南

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 全球参与者

- Bosch

- Continental

- WABCO

- Knorr-Bremse

- Advics

- ZF Friedrichshafen

- Hyundai Mobis

- Mando

- 区域玩家

- Bendix

- Isuzu Motors

- MAN Truck & Bus

- Maruti Suzuki

- Autoliv

- Infineon Technologies

- STMicroelectronics

- 新兴及小众玩家

- Tenneco

- Schaeffler

- BorgWarner

- Haldex

- BWI

The Global Vehicle Rollover Prevention System Market was valued at USD 6.84 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 15.04 billion by 2034.

The steady expansion of the market is driven by the rising adoption of SUVs, pickup trucks, and heavy commercial vehicles with higher centers of gravity, which increases rollover risks. This trend has encouraged automakers and component suppliers to integrate advanced electronic stability and rollover prevention systems into vehicle design. Modern safety solutions now employ motion-sensing technologies, predictive algorithms, and intelligent braking systems to detect and mitigate rollover incidents. Increasingly stringent government safety mandates worldwide, particularly those enforcing electronic stability control (ESC) and other rollover countermeasures, are accelerating innovation and deployment of such systems in new vehicles. These mandates, implemented across major automotive regions, are pushing manufacturers to develop highly integrated and responsive safety platforms aimed at reducing road fatalities. Continuous advancements in MEMS sensor technology, real-time data analytics, and machine learning algorithms are further enhancing the precision and responsiveness of these systems. This improvement is driving market demand by lowering false alarms, optimizing vehicle stability performance, and improving system affordability, which collectively support broader adoption across both passenger and commercial vehicle segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.84 Billion |

| Forecast Value | $15.04 Billion |

| CAGR | 8.4% |

The active rollover prevention control system segment is projected to grow at a CAGR of 10.1% from 2025 to 2034. These systems merge electronic stability control (ESC) with smart sensors and actuator networks to provide proactive vehicle stability management. They continuously analyze roll angles, lateral forces, and yaw movements to detect potential rollover conditions. When instability is identified, the system automatically applies selective braking or reduces engine torque to stabilize the vehicle and prevent rollover, ensuring improved control under dynamic driving conditions.

The sensors segment held a 35.7% share, valued at USD 2.44 billion in 2024. The segment's growth is driven by rapid progress in Micro-Electro-Mechanical Systems (MEMS) technology, which enhances sensor accuracy while reducing costs. Innovations such as built-in machine learning cores enable sensors to autonomously detect driving patterns and identify rollover risks in real time. These advancements are paving the way for seamless integration into advanced driver assistance systems (ADAS) and connected vehicle platforms, promoting enhanced vehicle safety and performance synergy across multiple dynamic functions.

United States Vehicle Rollover Prevention System Market held 87.3% share in 2024, generating USD 1.89 billion in revenue. The country's leadership is supported by well-established automotive safety regulations, a mature technology ecosystem, and significant adoption of advanced safety systems in both passenger and commercial fleets. The US market continues to benefit from its robust vehicle mix and focus on innovation, offering substantial opportunities for further growth in the next decade.

Major companies active in the Global Vehicle Rollover Prevention System Market include Bosch, Continental, WABCO, Autoliv, Haldex, MAN Truck & Bus, Maruti Suzuki, Isuzu Motors, and Bendix. Leading companies in the Vehicle Rollover Prevention System Market are pursuing strategies focused on technological advancement, collaboration, and market expansion to enhance their competitive positioning. Many are investing heavily in R&D to develop smarter, more adaptive control systems that leverage machine learning and advanced sensors for real-time vehicle monitoring. Strategic partnerships between automakers and technology providers are fostering integrated safety platforms combining rollover prevention with broader stability control functions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 System

- 2.2.2 Vehicle

- 2.2.3 Component

- 2.2.4 Sales channel

- 2.2.5 End Use

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising SUV and truck demand

- 3.2.1.2 Stricter global safety regulations

- 3.2.1.3 Advancements in sensor and AI technologies

- 3.2.1.4 Increased consumer and safety awareness

- 3.2.1.5 Growth in commercial and off-road applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system cost and complex integration

- 3.2.2.2 Limited standardization across regions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with autonomous and ADAS platforms

- 3.2.3.2 Expansion in electric and hybrid vehicles

- 3.2.3.3 Growth in fleet safety and telematics adoption

- 3.2.3.4 Emerging market adoption through localization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.4.6 Data Privacy & Regulatory Compliance

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.7.3 Sensor Technology Evolution & Roadmap

- 3.7.4 Technology Adoption Curves by Vehicle Segment

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 By component

- 3.9.2 By region

- 3.10 Cost Breakdown Analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

- 3.14 Vehicle Rollover Accident Statistics & Trends

- 3.15 Safety Impact Assessment & Lives Saved Analysis

- 3.16 Software Algorithm Development Trends

- 3.17 Risk Assessment & Market Volatility Framework

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Rollover detection & warning system

- 5.3 Active rollover prevention control system

- 5.4 Roll stability control (RSC) system

- 5.5 Rollover protection structure (ROPS)

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Sedan

- 6.2.2 Hatchback

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 LCV

- 6.3.2 MCV

- 6.3.3 HCV

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Sensors

- 7.3 Electronic control unit

- 7.4 Actuators & braking module

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Original Equipment Manufacturer (OEM)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Individual Vehicle Owners

- 9.3 Fleet Operators & Logistics Companies

- 9.4 Government & Public Transport Agencies

- 9.5 Industrial & Construction Firms

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Netherlands

- 10.3.8 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 ANZ

- 10.4.5 Singapore

- 10.4.6 Thailand

- 10.4.7 Vietnam

- 10.4.8 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Bosch

- 11.1.2 Continental

- 11.1.3 WABCO

- 11.1.4 Knorr-Bremse

- 11.1.5 Advics

- 11.1.6 ZF Friedrichshafen

- 11.1.7 Hyundai Mobis

- 11.1.8 Mando

- 11.2 Regional Players

- 11.2.1 Bendix

- 11.2.2 Isuzu Motors

- 11.2.3 MAN Truck & Bus

- 11.2.4 Maruti Suzuki

- 11.2.5 Autoliv

- 11.2.6 Infineon Technologies

- 11.2.7 STMicroelectronics

- 11.3 Emerging & Niche Players

- 11.3.1 Tenneco

- 11.3.2 Schaeffler

- 11.3.3 BorgWarner

- 11.3.4 Haldex

- 11.3.5 BWI