|

市场调查报告书

商品编码

1876549

胜肽合成试剂市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Peptide Synthesis Reagents Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

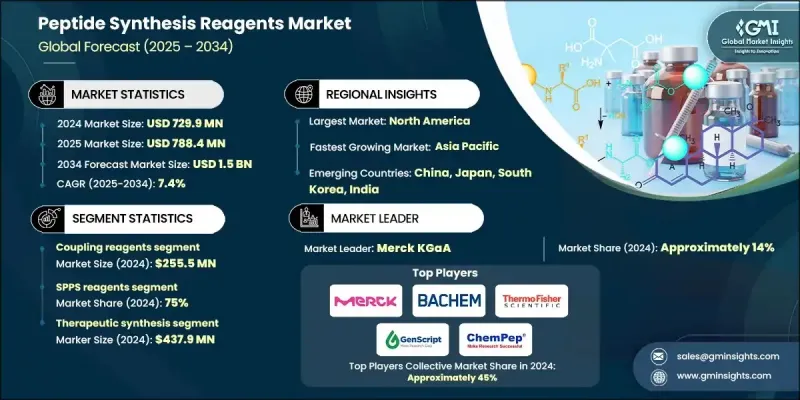

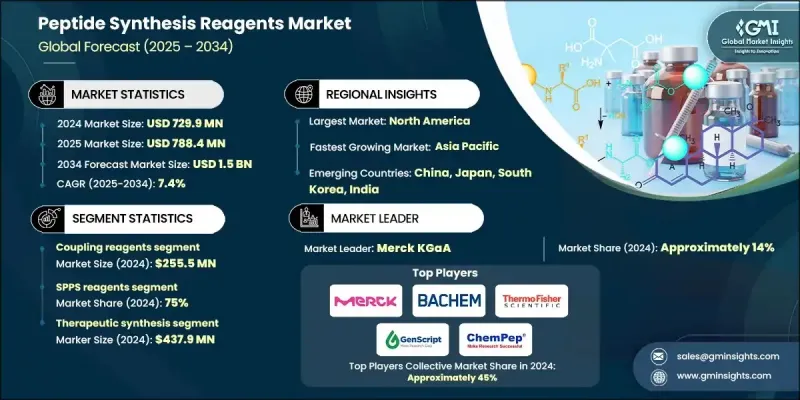

2024 年全球胜肽合成试剂市场价值为 7.299 亿美元,预计到 2034 年将以 7.4% 的复合年增长率增长至 15 亿美元。

基于Fmoc和碳二亚胺的偶联试剂需求最为强劲,而脲化合物和混合系统则为更广泛的市场应用铺平了道路。肽类药物的日益普及,加上生物基试剂替代品的出现以及自动化合成研究的大力投入,共同推动了这一增长。针对胜肽类药物的监管指导,以及精准医疗在製药、生物技术和诊断领域的日益广泛应用,正在加速胜肽类药物的商业化应用。个人化医疗计划正在将肽类合成的应用拓展到商业规模和先进的治疗性药物生产领域。基于Fmoc和固相合成技术具有高度可扩展性和高效性,能够支持下一代药物的开发和生物活性胜肽的生产。创新的试剂配方和与製药应用的无缝集成,使这些系统成为精准肽类药物生产的理想选择。试剂设计的进步如今能够提供更高的效率、可扩展性和更广泛的应用,尤其是在特殊药物生产中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.299亿美元 |

| 预测值 | 15亿美元 |

| 复合年增长率 | 7.4% |

混合合成和先进合成领域预计在2025年至2034年间将以7.1%的复合年增长率成长。其成长动力源自于该领域能够支援技术精湛、合成结构复杂且针对特定应用客製化的产品。与传统的固相合成技术相比,该领域凭藉连续流化学、汇聚合成和特种酶製剂等优势,实现了卓越的差异化,从而占据了高端市场地位。

预计2025年至2034年间,诊断与分析应用领域将以7.4%的复合年增长率成长。该领域对于开发针对分析应用最佳化的复杂生物标记结构产品至关重要。其重要性源自于生物标记胜肽合成、放射性药物前驱物和特种免疫测定製剂等方面的先进技术要求和显着差异化优势,而这些优势与传统治疗方法相比具有显着优势。

预计到2024年,北美胜肽合成试剂市场规模将达到2.674亿美元。市场扩张主要得益于政府对药物研发的大力支持、先进的胜肽合成基础设施以及产业领导者的存在。北美市场的成长也受到严格的安全标准、监管合规以及胜肽合成技术持续创新的推动。精准治疗和个人化医疗的需求持续推动下游企业对先进胜肽合成试剂系统的应用。

全球胜肽合成试剂市场的主要参与者包括默克集团(Merck KGaA)、巴赫姆股份公司(Bachem AG)、赛默飞世尔科技(Thermo Fisher Scientific)、金斯瑞生物科技(GenScript Biotech)、ChemPep Inc.、AAPPTec / Advanced ChemTech、CSBio Company、Iris Biotech)、ChemPep Inc.、AAPPTec / Advanced ChemTech、CSBio Company、Iris Biotech)、ChemPep Inc.、AAPPTec / Advanced ChemTech、CSBio Company、Iris Biotech)、ChemPep Inc.、AAPPTec / Advanced ChemTech、CSBio Company、Iris Biotech)、ChemPep Inc.、AAPPTec / Advanced ChemTech、CSBio Company、Iris Biotech)、ChemPep . (Biosynth/vivitide)、Biosynth (vivitide、Pepscan、CRB、Pepceuticals)、AmbioPharm Inc.、Creative Peptides、Peptide Institute, Inc. 和 CEM Corporation。肽合成试剂市场企业采取的关键策略包括投资研发,以提高试剂效率、可扩展性以及与自动化合成平台的整合。各公司正在建立策略合作伙伴关係和合作,以扩大地域覆盖范围和产品供应。此外,各公司也专注于收购小型企业,以巩固市场份额并获得创新技术。进入新兴市场是抓住新增长机会的首要任务。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 陷阱与挑战

- 机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按产品规格

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码说明:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依试剂产品类型划分,2021-2034年

- 主要趋势

- 偶联试剂

- 基于碳二亚胺的

- 基于鏻的

- 铀基

- 基于亚胺的

- 下一代绿色

- 保护基试剂

- Fmoc试剂及衍生物

- Boc试剂及其衍生物

- 侧链保护

- 正交系统

- 固体支撑材料

- 聚苯乙烯基树脂

- 基于聚乙二醇和化学基质

- 特种树脂

- 可生物降解材料

- 去保护和裂解

- 基本系统

- 酸裂解试剂

- 清扫系统

- 乳汁分泌鸡尾酒配方

- 溶剂和反应介质

- 传统溶剂

- 绿色溶剂替代品

- 离子液体和低共熔晶体

- 水性且生物相容性

- 分析及品管试剂

- 高效液相层析标准品及参考品

- 凯撒试验和茚三酮

- 质谱标准品

- 纯度评估试剂

第六章:市场估计与预测:综合法,2021-2034年

- 主要趋势

- SPPS试剂

- Fmoc SPPS系统

- Boc SPPS系统

- 微波 SPPS

- 自动相容

- LPPS试剂

- 溶液相繫统

- 碎片凝聚

- 与纯化相容

- 混合型及先进型

- 连续流动化学

- 收敛合成

- 酶促连接

- 点击化学系统

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 治疗合成

- 符合GMP标准的生产

- 临床级(I-III期)

- 长胜肽特化

- 修饰胜肽试剂

- 研发应用

- 高通量筛选

- 文库合成

- 概念验证和领先选择

- 学术研究等级

- 诊断与分析

- 生物标誌物胜肽合成

- 放射性药物前驱

- 免疫测定标准

- 特殊应用

- 化妆品胜肽合成

- 食品级及营养保健品级

- 农业胜肽合成

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Merck KGaA

- Bachem AG

- Thermo Fisher Scientific

- GenScript Biotech

- ChemPep Inc.

- AAPPTec / Advanced ChemTech

- CSBio Company

- Iris Biotech GmbH

- GL Biochem (Shanghai) Ltd

- Peptides International (Biosynth/vivitide)

- Biosynth (vivitide, Pepscan, CRB, Pepceuticals)

- AmbioPharm Inc.

- Creative Peptides

- Peptide Institute, Inc.

- CEM Corporation

The Global Peptide Synthesis Reagents Market was valued at USD 729.9 million in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 1.5 billion by 2034.

Fmoc-based and carbodiimide-based coupling reagents are experiencing the strongest demand, while uronium compounds and hybrid systems are paving the way for broader market applications. Rising adoption of peptide drugs, coupled with bio-based reagent alternatives and strong funding for automated synthesis research, drives this growth. Regulatory guidance on peptides, along with the increasing application of precision medicine in pharmaceutical, biotech, and diagnostic sectors, is accelerating commercial adoption. Personalized medicine initiatives are expanding peptide synthesis applications into commercial-scale and advanced therapeutic processing. Fmoc-based and solid-phase synthesis technologies are highly scalable and efficient, enabling next-generation drug development and bioactive peptide production. Innovative reagent formulations and seamless integration for pharmaceutical applications make these systems ideal for precision peptide manufacturing. Advancements in reagent design now offer higher efficiency, scalability, and broader applications in specialty pharmaceutical operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $729.9 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 7.4% |

The hybrid and advanced synthesis segment is expected to grow at a CAGR of 7.1% from 2025 to 2034. Growth is driven by their ability to support technologically sophisticated products with complex synthetic architectures tailored for specialized applications. Their premium positioning reflects superior differentiation through continuous flow chemistry, convergent synthesis, and specialty enzymatic formulations compared to traditional solid-phase techniques.

The diagnostic and analytical application segment is projected to grow at a 7.4% CAGR from 2025 to 2034. This segment is critical for developing products with complex biomarker architectures optimized for analytical applications. Its prominence stems from the advanced technology requirements and exceptional differentiation offered in biomarker peptide synthesis, radiopharmaceutical precursors, and specialty immunoassay formulations relative to conventional therapeutic approaches.

North America Peptide Synthesis Reagents Market reached USD 267.4 million in 2024. Market expansion is fueled by robust government support for pharmaceutical research, advanced peptide synthesis infrastructure, and the presence of key industry players. North American growth is influenced by stringent safety standards, regulatory compliance, and ongoing innovation in peptide synthesis technologies. The demand for precision therapeutics and personalized medicine continues to sustain downstream adoption of advanced peptide synthesis reagent systems.

Leading players in the Global Peptide Synthesis Reagents Market include Merck KGaA, Bachem AG, Thermo Fisher Scientific, GenScript Biotech, ChemPep Inc., AAPPTec / Advanced ChemTech, CSBio Company, Iris Biotech GmbH, GL Biochem (Shanghai) Ltd, Peptides International (Biosynth/vivitide), Biosynth (vivitide, Pepscan, CRB, Pepceuticals), AmbioPharm Inc., Creative Peptides, Peptide Institute, Inc., and CEM Corporation. Key strategies adopted by companies in the Peptide Synthesis Reagents Market include investing in research and development to improve reagent efficiency, scalability, and integration into automated synthesis platforms. Firms are forming strategic partnerships and collaborations to expand geographic reach and product offerings. Companies also focus on acquiring smaller players to consolidate market presence and gain access to innovative technologies. Entry into emerging markets is a priority to capture new growth opportunities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Reagent product type trends

- 2.2.2 Synthesis method trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers

- 3.2.2 Pitfalls & Challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product format

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Reagent Product Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Coupling reagents

- 5.2.1 Carbodiimide-based

- 5.2.2 Phosphonium-based

- 5.2.3 Uronium-based

- 5.2.4 Immonium-based

- 5.2.5 Next-gen green

- 5.3 Protecting group reagents

- 5.3.1 Fmoc reagents & derivatives

- 5.3.2 Boc reagents & derivatives

- 5.3.3 Side-chain protecting

- 5.3.4 Orthogonal systems

- 5.4 Solid support materials

- 5.4.1 Polystyrene-based resins

- 5.4.2 Peg-based & chemmatrix

- 5.4.3 Specialty resins

- 5.4.4 Biodegradable materials

- 5.5 Deprotection & cleavage

- 5.5.1 Base systems

- 5.5.2 Acid cleavage reagents

- 5.5.3 Scavenger systems

- 5.5.4 Cleavage cocktail formulations

- 5.6 Solvents & reaction media

- 5.6.1 Traditional solvents

- 5.6.2 Green solvent alternatives

- 5.6.3 Ionic liquids & deep eutectic

- 5.6.4 Aqueous & bio-compatible

- 5.7 Analytical & QC reagents

- 5.7.1 HPLC Standards & reference

- 5.7.2 Kaiser test & ninhydrin

- 5.7.3 Mass spectrometry standards

- 5.7.4 Purity assessment reagents

Chapter 6 Market Estimates and Forecast, By Synthesis Method, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 SPPS Reagents

- 6.2.1 Fmoc SPPS systems

- 6.2.2 Boc SPPS systems

- 6.2.3 Microwave SPPS

- 6.2.4 Automated compatible

- 6.3 LPPS reagents

- 6.3.1 Solution-phase systems

- 6.3.2 Fragment condensation

- 6.3.3 Purification-compatible

- 6.4 Hybrid & advanced

- 6.4.1 Continuous flow chemistry

- 6.4.2 Convergent synthesis

- 6.4.3 Enzymatic ligation

- 6.4.4 Click chemistry systems

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Therapeutic synthesis

- 7.2.1 GMP-grade manufacturing

- 7.2.2 Clinical-grade (phase I-III)

- 7.2.3 Long peptide specialized

- 7.2.4 Modified peptide reagents

- 7.3 R&D applications

- 7.3.1 High-throughput screening

- 7.3.2 Library synthesis

- 7.3.3 Proof-of-concept & lead Opt

- 7.3.4 Academic research grade

- 7.4 Diagnostic & analytical

- 7.4.1 Biomarker peptide synthesis

- 7.4.2 Radiopharmaceutical precursor

- 7.4.3 Immunoassay standards

- 7.5 Specialty applications

- 7.5.1 Cosmetic peptide synthesis

- 7.5.2 Food & nutraceutical grade

- 7.5.3 Agricultural peptide synthesis

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Merck KGaA

- 9.2 Bachem AG

- 9.3 Thermo Fisher Scientific

- 9.4 GenScript Biotech

- 9.5 ChemPep Inc.

- 9.6 AAPPTec / Advanced ChemTech

- 9.7 CSBio Company

- 9.8 Iris Biotech GmbH

- 9.9 GL Biochem (Shanghai) Ltd

- 9.10 Peptides International (Biosynth/vivitide)

- 9.11 Biosynth (vivitide, Pepscan, CRB, Pepceuticals)

- 9.12 AmbioPharm Inc.

- 9.13 Creative Peptides

- 9.14 Peptide Institute, Inc.

- 9.15 CEM Corporation