|

市场调查报告书

商品编码

1876593

食品挤压设备市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Food Extrusion Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

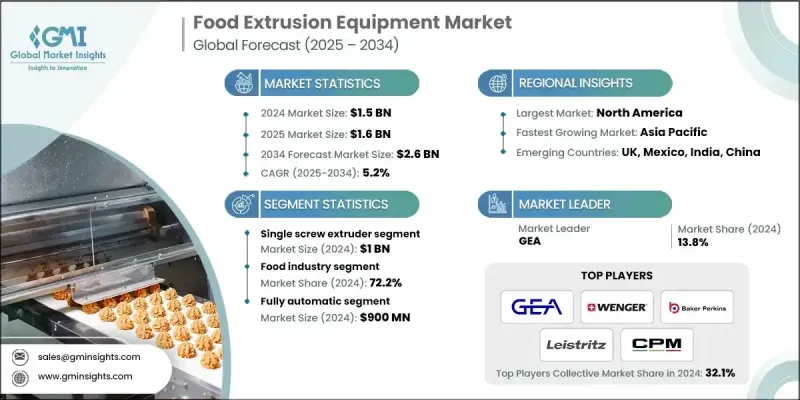

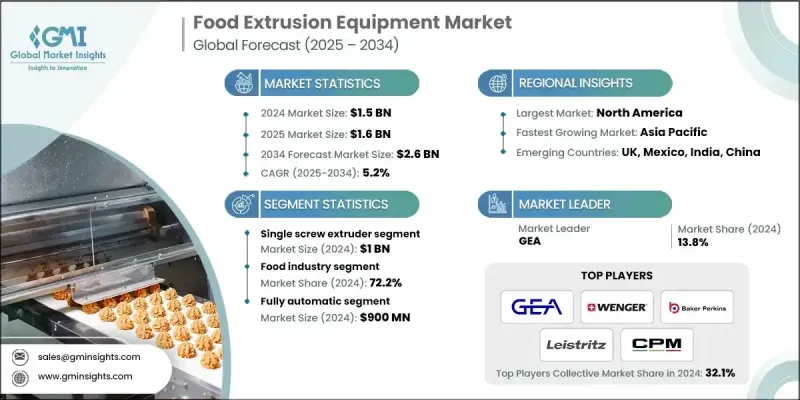

2024 年全球食品挤压设备市场价值为 15 亿美元,预计到 2034 年将以 5.2% 的复合年增长率增长至 26 亿美元。

消费者对植物性肉类和海鲜替代品的兴趣日益浓厚,为专业挤压技术创造了巨大的发展机会。高水分挤压烹饪 (HMEC) 技术使生产商能够在替代蛋白产品中获得纤维状、类似肉类的质地,从而推动了对专为高水分肉类替代品 (HMMA) 设计的高级双螺桿挤压机的需求。消费者寻求可持续的、不含动物性蛋白质的选择,推动了弹性素食饮食的兴起,进一步促进了这一趋势。同时,消费者对兼具美味和营养价值的零食的需求不断增长,这与挤压技术的需求不谋而合。此製程透过精确控制温度、压力和配料组成,能够生产低脂、高蛋白、高纤维食品。挤压製程是一种高效的连续生产方法,它将多个生产阶段合併为一个操作,显着降低了能源和水的消耗,同时优化了占地面积和生产速度。这些优势使得挤压製程在竞争激烈的食品製造环境中成为一种经济高效且可持续的选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 26亿美元 |

| 复合年增长率 | 5.2% |

2024年,单螺桿挤出机市场规模达10亿美元。其成长主要得益于较低的投资门槛和操作简便,使其成为发展中地区中小企业和製造商的理想选择。对于希望在不投入大量资金的情况下扩大或升级生产的企业而言,这些系统提供了一个切实可行且经济实惠的切入点。

2024年,全自动系统市场规模预计将达9亿美元。自动化挤出机的日益普及极大地提高了产品的一致性、精度和整体效率。先进的自动化技术,包括感测器、可程式逻辑控制器(PLC)和即时监控工具,使製造商能够严格控制温度、进料速度、压力和湿度等关键生产变数。这些系统只需极少的人工干预,即可显着降低人为错误的风险,并确保大批量生产中产品品质的一致性。

2024年,美国食品挤压设备市场占81.8%的市场份额,市场规模达4.2亿美元。美国市场的特点是拥有先进的製造能力、严格的监管标准,并高度重视自动化和食品安全。成熟的加工食品产业,包括休閒食品、谷物食品、宠物食品和替代蛋白等品类,持续推动对挤压系统的投资,这些系统能够提供高产量、稳定的质量,并符合美国食品药物管理局(FDA)和美国农业部(USDA)制定的监管准则。

全球食品挤压设备市场的主要企业包括 Bausano、Bonnot、GEA、Buhler、CPM、B&P Littleford、Cowin Extrusion、Leistritz、Baker Perkins、Wenger、Legris、Coperion、Steer World、Xtrutech 和 Xinda Corp.。这些企业致力于持续创新和技术进步,以在这个不断变化的市场中保持领先地位。全球食品挤压设备市场的主要製造商正着力采取一系列策略性倡议,以加强其全球影响力。许多企业正大力投资研发,以设计能够处理新型原料并为植物性产品提供更佳质地控制的机器。此外,各公司也积极建立策略合作伙伴关係和开展合作,以拓展其技术组合併进入新的区域市场。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 植物基革命

- 消费者对更健康、功能性点心的需求

- 营运效率和多功能性

- 产业陷阱与挑战

- 高资本投资及营运成本

- 营运复杂性与技能差距

- 机会

- 工业4.0的整合

- 新型原料与升级再造的开发

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依设备类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 差距分析

- 风险评估与缓解

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依设备类型划分,2021-2034年

- 主要趋势

- 单螺桿挤出机

- 双螺桿挤出机

第六章:市场估算与预测:依营运模式类型划分,2021-2034年

- 主要趋势

- 手动的

- 半自动

- 全自动

第七章:市场估计与预测:依产能划分,2021-2034年

- 主要趋势

- 低于 3,000 公斤/小时

- 3,000-10,000公斤/小时

- 超过10,000公斤/小时

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 宠物食品和水产饲料

- 谷物和零食

- 植物蛋白

- 食品原料

- 其他(糖果製品等)

第九章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 食品工业

- 动物饲料业

- 其他(研究机构等)

第十章:市场估价与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直销

- 间接销售

第十一章:市场估计与预测:按地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- B&P Littleford

- Baker Perkins

- Bausano

- Bonnot

- Buhler

- Coperion

- Cowin Extrusion

- CPM

- GEA

- Legris

- Leistritz

- Steer World

- Wenger

- Xinda Corp.

- Xtrutech

The Global Food Extrusion Equipment Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 2.6 billion by 2034.

Increasing consumer interest in plant-based alternatives to meat and seafood is creating substantial opportunities for specialized extrusion technologies. High moisture extrusion cooking (HMEC) is enabling manufacturers to achieve fibrous, meat-like textures in alternative protein products, fueling demand for advanced twin-screw extruders designed for high moisture meat analogues (HMMA). The shift toward flexitarian diets, driven by consumers looking for sustainable, animal-free protein options, is further supporting this trend. At the same time, the rising preference for snacks that combine great taste with nutritional benefits aligns well with extrusion technology. This process enables the creation of low-fat, high-protein, and high-fiber foods through precise control of temperature, pressure, and ingredient composition. Extrusion offers an efficient, continuous method that merges several manufacturing stages into a single operation, significantly reducing energy and water consumption while optimizing floor space and production speed. These advantages make extrusion a cost-effective and sustainable choice in a highly competitive food manufacturing environment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 5.2% |

In 2024, the single-screw extruders segment generated USD 1 billion. Their growth is largely driven by lower investment requirements and operational simplicity, making them an attractive choice for small and medium-sized enterprises (SMEs) and manufacturers in developing regions. These systems provide a practical and affordable entry point for businesses seeking to expand or modernize production without large capital expenditures.

The fully automatic systems segment generated USD 900 million in 2024. The increasing adoption of automated extruders has greatly enhanced product consistency, precision, and overall efficiency. Advanced automation technologies, including sensors, programmable logic controllers (PLCs), and real-time monitoring tools, allow manufacturers to maintain strict control over key production variables such as temperature, feed rate, pressure, and moisture. With minimal operator intervention, these systems significantly reduce the risk of human error and ensure uniform product quality across large production volumes.

United States Food Extrusion Equipment Market accounted for 81.8% share in 2024, generating USD 420 million. The country's market is characterized by advanced manufacturing capabilities, stringent regulatory standards, and a strong focus on automation and food safety. A mature processed food sector, including categories like snacks, cereals, pet food, and alternative proteins, continues to drive investments in extrusion systems that offer high throughput, consistent quality, and compliance with regulatory guidelines set by the FDA and USDA.

Leading companies operating in the Global Food Extrusion Equipment Market include Bausano, Bonnot, GEA, Buhler, CPM, B&P Littleford, Cowin Extrusion, Leistritz, Baker Perkins, Wenger, Legris, Coperion, Steer World, Xtrutech, and Xinda Corp. These players are focusing on continuous innovation and technical advancement to stay ahead in this evolving landscape. Major manufacturers in the Global Food Extrusion Equipment Market are focusing on a mix of strategic initiatives to strengthen their global presence. Many are investing heavily in research and development to design machines capable of handling novel ingredients and delivering enhanced texture control for plant-based products. Companies are also entering strategic partnerships and collaborations to expand their technology portfolios and reach new regional markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Mode of operation

- 2.2.4 Capacity

- 2.2.5 Application

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 The plant-based revolution

- 3.2.1.2 Demand for better for you and functional snacks

- 3.2.1.3 Operational efficiency and versatility

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital investment and operating costs

- 3.2.2.2 Operational complexity and skill gap

- 3.2.3 Opportunities

- 3.2.3.1 Integration of industry 4.0

- 3.2.3.2 Development for novel ingredients and upcycling

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Gap Analysis

- 3.9 Risk assessment and mitigation

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single screw extruder

- 5.3 Twin screw extruder

Chapter 6 Market Estimates and Forecast, By Mode of Operation Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 3,000 kg/hr

- 7.3 3,000-10,000 kg/hr

- 7.4 Above 10,000 kg/hr

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Pet food & aqua feed

- 8.3 Cereals & snacks

- 8.4 Plant-based proteins

- 8.5 Food ingredients

- 8.6 Others (confectionery products, etc.)

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Food industry

- 9.3 Animal feed industry

- 9.4 Others (research institutions, etc.)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 B&P Littleford

- 12.2 Baker Perkins

- 12.3 Bausano

- 12.4 Bonnot

- 12.5 Buhler

- 12.6 Coperion

- 12.7 Cowin Extrusion

- 12.8 CPM

- 12.9 GEA

- 12.10 Legris

- 12.11 Leistritz

- 12.12 Steer World

- 12.13 Wenger

- 12.14 Xinda Corp.

- 12.15 Xtrutech