|

市场调查报告书

商品编码

1876611

资料流人工智慧处理器市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Dataflow AI Processor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

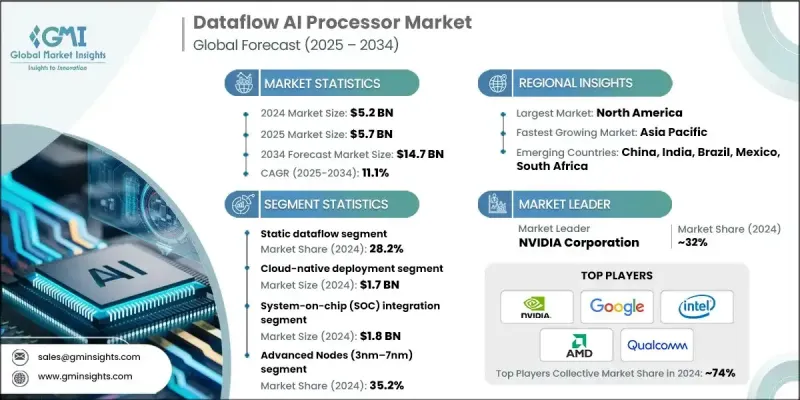

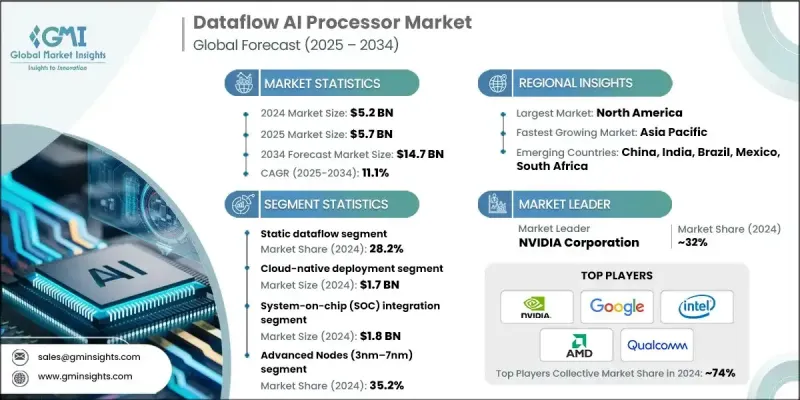

2024 年全球资料流 AI 处理器市值为 52 亿美元,预计到 2034 年将以 11.1% 的复合年增长率成长至 147 亿美元。

人工智慧推理、边缘运算和资料中心营运等领域对高效能运算的需求不断增长,推动了这一成长。业界正经历快速创新,包括节能架构、3nm 至 7nm 先进製程节点的整合以及系统级晶片 (SoC) 和晶片组 (chiplet) 设计的应用。资料流处理器凭藉其并行处理能力,尤其适合处理复杂的神经网络,从而支援关键领域更快地做出决策。随着人工智慧在边缘环境的应用不断扩展,对低延迟、高能源效率处理的需求也日益增长。这些处理器能够减少资料传输,最大限度地提高吞吐量,并正成为频宽受限环境中即时分析、物联网部署和机器人技术的关键应用。汽车、医疗保健和电信等行业正越来越多地利用人工智慧进行预测分析、自动化和智慧控制系统,从而持续推动对资料流人工智慧处理器的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 52亿美元 |

| 预测值 | 147亿美元 |

| 复合年增长率 | 11.1% |

到2024年,静态资料流架构的市占率将达到28.2%,成为最大的细分市场。其可预测的执行模型、简化的硬体需求和高效的资源利用率,确保了人工智慧工作负载的稳定性能,使其成为云端和边缘部署的首选方案。静态资料流架构因其确定性行为、可扩展性和可靠性而备受青睐,尤其是在需要高效能运算和一致执行的领域。

预计到2024年,云端原生部署市场规模将达17亿美元。其可扩展性、灵活性和成本效益使其能够与人工智慧平台无缝集成,实现动态工作负载管理,并加快模型训练和推理速度。云端原生解决方案还能简化基础架构维护,支援协作工作流程,并为企业提供满足日益增长的人工智慧应用需求所需的敏捷性。

预计到2024年,北美数据流人工智慧处理器市占率将达到40.2%。该地区市场扩张的主要驱动力是金融、医疗保健和自动驾驶系统等行业对即时人工智慧工作负载的强劲需求。先进的半导体研究、强大的云端基础设施以及领先科技公司的策略投资进一步推动了市场成长。政府推动人工智慧创新和边缘运算应用的倡议提升了该地区的竞争力,为製造商提供了部署高效、可扩展且针对即时效能优化的资料流架构的机会。

全球资料流人工智慧处理器市场的主要参与者包括英伟达公司、英特尔公司、AMD公司、高通技术公司、苹果公司、谷歌有限责任公司、微软公司、IBM公司、三星电子有限公司、华为技术有限公司、Graphcore Limited、Mythic, Inc.、Cerebras Systems、Arm Holdings plc、联发科公司、富士公司、百度银行公司控股有限公司、百度公司和公司控股有限公司。这些公司正致力于策略性研发投资,以提高处理器的效率、可扩展性和能源效率。它们积极寻求合作与伙伴关係,以加强供应链并将处理器整合到更广泛的人工智慧生态系统中。此外,各公司也透过开发针对边缘、云端和混合部署最佳化的专用架构,实现产品组合的多元化。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 对即时资料处理和分析的需求日益增长

- 人工智慧和机器学习技术的应用日益普及

- 对节能高效和高效能运算解决方案的需求日益增长

- 物联网 (IoT) 设备和应用的扩展

- 云端运算和巨量资料分析的进步

- 产业陷阱与挑战

- 来自传统硬体加速器的竞争

- 人工智慧应用开发与最佳化的复杂性

- 市场机会

- 将资料流人工智慧处理器整合到边缘运算设备中

- 与人工智慧软体开发商和云端服务供应商建立合作关係

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

- 技术格局

- 当前趋势

- 新兴技术

- 管道分析

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 静态资料流

- 动态资料流

- 神经形态/脉衝

- 空间运算阵列

- 粗粒度可重构阵列(CGRA)

- 混合资料流控制流

第六章:市场估算与预测:依部署模式划分,2021-2034年

- 主要趋势

- 云端原生部署

- 边缘运算部署

- 嵌入式系统集成

- 混合云端边缘

- 本地部署企业

第七章:市场估算与预测:依处理器整合度划分,2021-2034年

- 主要趋势

- 分立处理器

- 系统单晶片 (SoC) 集成

- 基于晶片组的系统

- IP核心授权

- 基于FPGA的解决方案

第八章:市场估算与预测:依节点规模划分,2021-2034年

- 主要趋势

- 先进製程(3nm-7nm)

- 成熟节点(14nm-28nm)

- 特殊节点(40nm+)

- 先进封装集成

第九章:市场估算与预测:依记忆体类型划分,2021-2034年

- 主要趋势

- 记忆体计算

- 近记忆体处理

- 传统记忆层级

- 混合储存系统

第十章:市场估价与预测:依性能等级划分,2021-2034年

- 主要趋势

- 超低功耗(边缘/物联网)

- 高效能(资料中心)

- 即时(嵌入式/关键型)

- 极致效能(高效能运算/超级运算)

第十一章:市场估计与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 汽车与运输

- 医疗保健与生命科学

- 金融服务

- 电信

- 航太航太

- 能源与公用事业

- 其他的

第十二章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- AI推理工作负载

- 图分析与网路处理

- 科学计算

- 自主系统控制

- 工业自动化

- 其他的

第十三章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十四章:公司简介

- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices, Inc. (AMD)

- Qualcomm Technologies, Inc.

- Apple Inc.

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- Graphcore Limited

- Mythic, Inc.

- Cerebras Systems

- Arm Holdings plc

- MediaTek Inc.

- Fujitsu Limited

- Alibaba Group Holding Limited

- Baidu, Inc.

- Synaptics Incorporated

- CEVA, Inc.

The Global Dataflow AI Processor Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 11.1% to reach USD 14.7 billion by 2034.

The growth is fueled by the increasing demand for high-performance computing across AI inference, edge computing, and data center operations. The industry is witnessing rapid innovation through energy-efficient architectures, integration of advanced nodes ranging from 3nm to 7nm, and adoption of system-on-chip and chiplet-based designs. Dataflow processors are particularly well-suited for handling complex neural networks due to their parallel processing capabilities, supporting faster decision-making in critical sectors. As AI adoption expands in edge environments, the need for low-latency, energy-efficient processing is rising. These processors reduce data movement, maximize throughput, and are becoming essential for real-time analytics, IoT deployments, and robotics in bandwidth-constrained locations. Industries including automotive, healthcare, and telecommunications are increasingly leveraging AI for predictive analytics, automation, and intelligent control systems, driving sustained demand for dataflow AI processors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $14.7 Billion |

| CAGR | 11.1% |

The static dataflow segment held a 28.2% share in 2024, making it the largest segment. Its predictable execution model, simplified hardware requirements, and efficient resource utilization ensure consistent performance for AI workloads, making it a preferred choice for both cloud and edge deployments. Static dataflow architectures are highly valued for deterministic behavior, scalability, and reliability, especially in sectors requiring high-performance computing and consistent execution.

The cloud-native deployment segment generated USD 1.7 billion in 2024. Its scalability, flexibility, and cost-effectiveness allow seamless integration with AI platforms, dynamic workload management, and faster model training and inference. Cloud-native solutions also simplify infrastructure maintenance, enable collaborative workflows, and provide enterprises with the agility needed to meet growing AI adoption demands.

North America Dataflow AI Processor Market held a 40.2% share in 2024. The region's market expansion is driven by high demand for real-time AI workloads across sectors such as finance, healthcare, and autonomous systems. Advanced semiconductor research, strong cloud infrastructure, and strategic investments by leading technology companies further support growth. Government initiatives promoting AI innovation and edge computing adoption enhance the region's competitive position, creating opportunities for manufacturers to deploy highly efficient, scalable dataflow architectures optimized for real-time performance.

Key companies operating in the Global Dataflow AI Processor Market include NVIDIA Corporation, Intel Corporation, Advanced Micro Devices, Inc. (AMD), Qualcomm Technologies, Inc., Apple Inc., Google LLC, Microsoft Corporation, IBM Corporation, Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Graphcore Limited, Mythic, Inc., Cerebras Systems, Arm Holdings plc, MediaTek Inc., Fujitsu Limited, Alibaba Group Holding Limited, Baidu, Inc., Synaptics Incorporated, and CEVA, Inc. Companies in the Dataflow AI Processor Market are focusing on strategic R&D investments to improve processor efficiency, scalability, and energy performance. Collaborations and partnerships are being pursued to strengthen supply chains and integrate processors into broader AI ecosystems. Firms are diversifying their portfolios by developing specialized architectures optimized for edge, cloud, and hybrid deployments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Type Trends

- 2.2.2 Deployment Mode Trends

- 2.2.3 Processor Integration Level Trends

- 2.2.4 Node Size Trends

- 2.2.5 Memory Type Trends

- 2.2.6 Performance Class Trends

- 2.2.7 End Use Industry Trends

- 2.2.8 Application Trends

- 2.2.9 Regional Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for real-time data processing and analysis

- 3.2.1.2 Growing adoption of artificial intelligence and machine learning technologies

- 3.2.1.3 Rising need for energy-efficient and high-performance computing solutions

- 3.2.1.4 Expansion of Internet of Things (IoT) devices and applications

- 3.2.1.5 Advancements in cloud computing and big data analytics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from traditional hardware accelerators

- 3.2.2.2 Complexity in developing and optimizing AI applications

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of Dataflow AI processors in edge computing devices

- 3.2.3.2 Partnerships with AI software developers and cloud service providers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Static dataflow

- 5.3 Dynamic dataflow

- 5.4 Neuromorphic/spiking

- 5.5 Spatial computing arrays

- 5.6 Coarse-Grained Reconfigurable Arrays (CGRAs)

- 5.7 Hybrid dataflow-control flow

Chapter 6 Market Estimates and Forecast, By Deployment Mode, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Cloud-native deployment

- 6.3 Edge computing deployment

- 6.4 Embedded systems integration

- 6.5 Hybrid cloud-edge

- 6.6 On-premises enterprise

Chapter 7 Market Estimates and Forecast, By Processor Integration Level, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Discrete processors

- 7.3 System-on-Chip (SoC) Integration

- 7.4 Chiplet-based systems

- 7.5 IP core licensing

- 7.6 FPGA-based solutions

Chapter 8 Market Estimates and Forecast, By Node Size, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Advanced nodes (3nm-7nm)

- 8.3 Mature nodes (14nm-28nm)

- 8.4 Specialty nodes (40nm+)

- 8.5 Advanced packaging integration

Chapter 9 Market Estimates and Forecast, By Memory Type, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 In-memory computing

- 9.3 Near-memory processing

- 9.4 Traditional memory hierarchy

- 9.5 Hybrid memory systems

Chapter 10 Market Estimates and Forecast, By Performance Class, 2021 - 2034 ($ Bn)

- 10.1 Key trends

- 10.2 Ultra-low power (Edge/IoT)

- 10.3 High-performance (data center)

- 10.4 Real-time (embedded/critical)

- 10.5 Extreme performance (HPC/Supercomputing)

Chapter 11 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Bn)

- 11.1 Key trends

- 11.2 Automotive & transportation

- 11.3 Healthcare & life sciences

- 11.4 Financial services

- 11.5 Telecommunications

- 11.6 Aerospace & space

- 11.7 Energy & utilities

- 11.8 Others

Chapter 12 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Bn)

- 12.1 Key trends

- 12.2 AI inference workloads

- 12.3 Graph analytics & network processing

- 12.4 Scientific computing

- 12.5 Autonomous systems control

- 12.6 Industrial automation

- 12.7 Others

Chapter 13 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.3.6 Netherlands

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 Middle East and Africa

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 NVIDIA Corporation

- 14.2 Intel Corporation

- 14.3 Advanced Micro Devices, Inc. (AMD)

- 14.4 Qualcomm Technologies, Inc.

- 14.5 Apple Inc.

- 14.6 Google LLC

- 14.7 Microsoft Corporation

- 14.8 IBM Corporation

- 14.9 Samsung Electronics Co., Ltd.

- 14.10 Huawei Technologies Co., Ltd.

- 14.11 Graphcore Limited

- 14.12 Mythic, Inc.

- 14.13 Cerebras Systems

- 14.14 Arm Holdings plc

- 14.15 MediaTek Inc.

- 14.16 Fujitsu Limited

- 14.17 Alibaba Group Holding Limited

- 14.18 Baidu, Inc.

- 14.19 Synaptics Incorporated

- 14.20 CEVA, Inc.