|

市场调查报告书

商品编码

1876614

钻井废弃物处理与处置市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Treatment and Disposal Drilling Waste Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

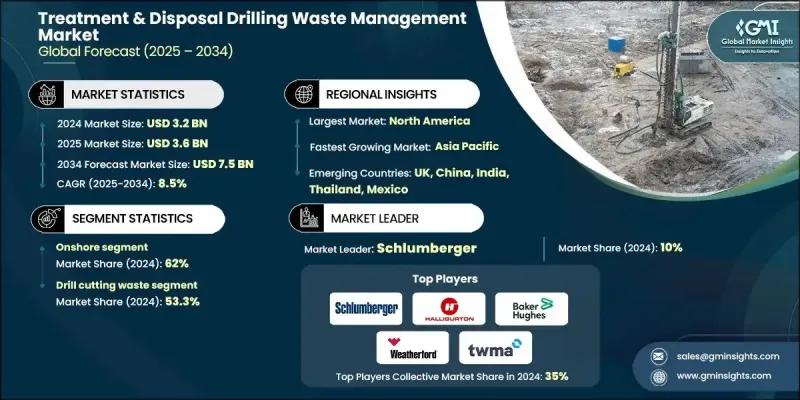

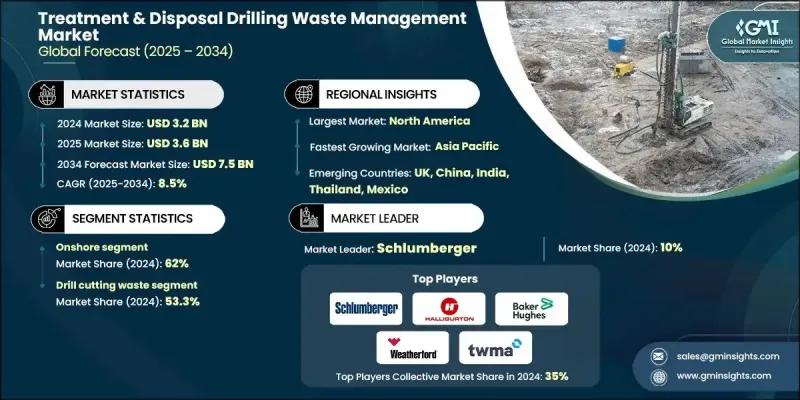

2024 年全球钻井废弃物处理和处置市场价值为 32 亿美元,预计到 2034 年将以 8.5% 的复合年增长率增长至 75 亿美元。

全球日益严格的环境法规推动了石油和天然气产业的扩张,迫使石油和天然气业者遵守更严格的危险废弃物处理、排放控制和水污染预防标准。这些不断变化的法规正在推动对创新废弃物处理系统和合规基础设施的大规模投资。强调减少垃圾掩埋、控制排放和回收利用的框架正在重塑整个产业的服务模式。此外,对生产者延伸责任和废弃物最小化目标的日益重视也促使油田业者将永续技术融入其工作流程。随着水力压裂和水平钻井等非常规钻井方法的日益普及,钻井废弃物的数量和复杂性显着增加。这些技术会产生更高浓度的受污染岩屑、泥浆和采出水,加剧了对先进处理、封存和回收系统的需求。预计未来几年,北美和亚洲页岩油和緻密油勘探的持续成长将加速对钻井废弃物管理解决方案的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 32亿美元 |

| 预测值 | 75亿美元 |

| 复合年增长率 | 8.5% |

2024年,陆上钻井业务占比达62%,预计到2034年将以8%的复合年增长率成长。陆上钻井废弃物管理需求激增源自于非常规能源生产的扩张,其产生的岩屑、采出水和钻井液量远超过传统勘探。緻密页岩地层产生的废弃物成分复杂,需采用离心、固化和生物修復等先进处理技术。

钻屑废弃物市场占有率占比达53.3%,预计到2034年将以7.8%的复合年增长率成长。作为钻井作业中产生的最主要废弃物之一,钻屑的处理方式正从传统的异地处置转向现场处理和再利用。热脱附和固控系统等技术正被越来越多地应用于钻井现场直接处理废弃物,回收可用流体,并最大限度地减少运输需求,从而提高效率和永续性。

2024年,美国钻井废弃物处理与处置市场规模预计将达7亿美元。该国市场成长的主要驱动力是监管力度加大以及主要油气产区钻井活动的增加。美国环保署(EPA)和土地管理局(BLM)已实施新的甲烷控制和废弃物处理指南,促使营运商采用固化、热脱附和生物修復等现代处理技术。

活跃于钻井废弃物处理与处置管理市场的知名企业包括贝克休斯(Baker Hughes)、奥吉安公司(Augean Plc)、洁净港湾公司(Clean Harbors, Inc.)、哈里伯顿公司(Halliburton)、斯伦贝谢公司(Schlumberger)、威德福公司(Weatherford Energy)、TWMA、Secverford Energy, Inc. Services、Derrick Equipment Company、Newpark Resources Inc.、NOV Inc.、GN Solids Control、Imdex Limited、Ridgeline Canada Inc.、Select Water Solutions、Soli-Bond, Inc.、Tidal Logistics 和 Environmental Development Company Ltd.。市场领导者正致力于技术创新、产能扩张和策略合作,以巩固其在钻井废弃物管理领域的地位。各公司正大力投资先进的处理技术,例如热脱附、生物修復和离心分离,以提供经济高效且符合环保要求的解决方案。许多公司正与勘探和生产公司建立长期服务联盟,以确保稳定的需求,同时扩大其区域影响力。向新兴钻井区域扩张以及数位化监控系统的整合,正在帮助企业提高营运效率和废弃物可追溯性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 新兴机会与趋势

- 数位化和物联网集成

- 新兴市场渗透

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争性标竿分析

- 战略仪錶板

- 创新与技术格局

第五章:市场规模及预测:依废弃物类型划分,2021-2034年

- 主要趋势

- 废滑油

- 钻屑

- 其他的

第六章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 陆上

- 离岸

第七章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Augean Plc

- Baker Hughes

- Clean Harbors, Inc.

- Derrick Equipment Company

- GN Solids Control

- Halliburton

- Imdex Limited

- Newpark Resources Inc.

- NOV Inc.

- Ridgeline Canada Inc.

- Schlumberger

- Secure Energy Services, Inc.

- Select Water Solutions

- Soli-Bond, Inc.

- TWMA

- Weatherford

- Ecoserv LLC

- Milestone Environmental Services

- Pure Environmental

- Tidal Logistics

- Environmental Development Company Ltd

The Global Treatment & Disposal Drilling Waste Management Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 7.5 billion by 2034.

The industry's expansion is influenced by the growing stringency of environmental laws worldwide, which are compelling oil and gas operators to comply with tighter standards on hazardous waste handling, emissions mitigation, and water contamination prevention. These evolving regulations are driving large-scale investments in innovative waste treatment systems and compliance infrastructure. Frameworks emphasizing landfill diversion, emission controls, and recycling initiatives are reshaping service models across the sector. In addition, the increasing focus on extended producer responsibility and waste minimization goals is prompting oilfield operators to integrate sustainable technologies into their workflows. As unconventional drilling methods such as hydraulic fracturing and horizontal drilling become more prevalent, the quantity and complexity of drilling waste have increased significantly. These techniques produce higher levels of contaminated cuttings, muds, and produced water, intensifying the need for advanced treatment, containment, and recycling systems. The continued rise of shale and tight oil exploration across North America and Asia is expected to accelerate demand for drilling waste management solutions over the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 8.5% |

The onshore segment accounted for a 62% share in 2024 and is projected to grow at an 8% CAGR through 2034. The surge in onshore drilling waste management stems from the expansion of unconventional energy production, which generates greater volumes of cuttings, produced water, and drilling fluids than traditional exploration. The complexity of waste generated from dense shale formations calls for sophisticated treatment technologies such as centrifugation, solidification, and bioremediation.

The drill cuttings segment held a 53.3% share and is projected to grow at a CAGR of 7.8% through 2034. As one of the most significant waste types produced during drilling operations, drill cuttings are undergoing a shift from conventional offsite disposal to onsite treatment and reuse. Technologies such as thermal desorption and solids control systems are being increasingly utilized to process waste directly at drilling locations, recover usable fluids, and minimize transportation requirements, improving both efficiency and sustainability.

United States Treatment & Disposal Drilling Waste Management Market captured USD 700 million in 2024. The country's growth is driven by regulatory enforcement and elevated drilling activity across key oil- and gas-producing regions. The Environmental Protection Agency (EPA) and the Bureau of Land Management (BLM) have implemented new guidelines addressing methane control and waste containment, pushing operators to adopt modern treatment technologies like solidification, thermal desorption, and bioremediation.

Prominent companies active in the Treatment & Disposal Drilling Waste Management Market include Baker Hughes, Augean Plc, Clean Harbors, Inc., Halliburton, Schlumberger, Weatherford, TWMA, Secure Energy Services, Inc., Ecoserv LLC, Pure Environmental, Milestone Environmental Services, Derrick Equipment Company, Newpark Resources Inc., NOV Inc., GN Solids Control, Imdex Limited, Ridgeline Canada Inc., Select Water Solutions, Soli-Bond, Inc., Tidal Logistics, and Environmental Development Company Ltd. Leading market players are focusing on technological innovation, capacity expansion, and strategic partnerships to reinforce their presence in the drilling waste management landscape. Companies are investing heavily in advanced treatment technologies such as thermal desorption, bioremediation, and centrifugation to deliver cost-effective and environmentally compliant solutions. Many are forming long-term service alliances with exploration and production firms to secure steady demand while enhancing their regional footprint. Expansions into emerging drilling regions and the integration of digital monitoring systems are helping firms improve operational efficiency and waste traceability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Waste trends

- 2.1.3 Application trends

- 2.1.4 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Waste, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Waste lubricants

- 5.3 Drill cuttings

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Onshore

- 6.3 Offshore

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 South Africa

- 7.5.3 UAE

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Augean Plc

- 8.2 Baker Hughes

- 8.3 Clean Harbors, Inc.

- 8.4 Derrick Equipment Company

- 8.5 GN Solids Control

- 8.6 Halliburton

- 8.7 Imdex Limited

- 8.8 Newpark Resources Inc.

- 8.9 NOV Inc.

- 8.10 Ridgeline Canada Inc.

- 8.11 Schlumberger

- 8.12 Secure Energy Services, Inc.

- 8.13 Select Water Solutions

- 8.14 Soli-Bond, Inc.

- 8.15 TWMA

- 8.16 Weatherford

- 8.17 Ecoserv LLC

- 8.18 Milestone Environmental Services

- 8.19 Pure Environmental

- 8.20 Tidal Logistics

- 8.21 Environmental Development Company Ltd