|

市场调查报告书

商品编码

1644339

北美钻桿:市场占有率分析、产业趋势与成长预测(2025-2030 年)North America Drill Pipe - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

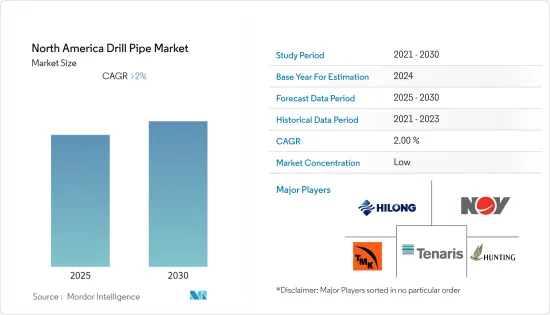

预计预测期内北美钻桿市场的复合年增长率将超过 2%。

2020 年,市场受到了 COVID-19 的不利影响。目前市场已经恢復到疫情前的水准。

关键亮点

- 从长远来看,探勘活动的活性化和对新油气天然气田开发的重视等因素预计将推动钻桿市场的发展。

- 另一方面,近年来油价波动导致探勘活动减少,进而引发钻桿市场放缓。

- 海上探勘和生产计划的增加预计将为市场相关人员创造巨大机会。这是因为所有易于采收的石油都已被发现,而且油井正在向更深、更恶劣的海洋环境发展。

- 由于美国页岩钻探活动的增加,美国成为最大的钻桿市场。页岩开发、水平钻井和水力压裂的最新趋势导致该地区对钻桿的需求增加。

北美钻桿市场趋势

境内市场占主导地位

- 由于原油价格波动,全球钻桿市场在过去几年增长缓慢,但随着原油价格稳定,预计在预测期内将会成长。

- 2021年北美石油产量将达2,390万桶/日,高于去年的2,350万桶/日。此外,截至2021年,美国陆上石油产量将占该国石油产量的约84%,占天然气产量的约3%。预测期内陆上探勘活动的活性化预计将促进钻桿市场的成长。

- 如今,钻井比以往任何时候都更深、更复杂,这推动了钻桿市场的成长。

- 美国最近的页岩气繁荣显着扩大了该地区的钻桿市场。美国能源资讯署(EIA)预计,2021年美国緻密油资源将直接生产约26.4亿桶原油(约723万桶/日)。这约占 2021 年美国原油总产量的 64%。

- 此外,2022 年 11 月,美国石油和天然气巨头埃克森美孚将在加拿大营运的合约授予了 SFL 公司(SFL)旗下的钻机,该钻井平台将由挪威钻井承包商 Odfjell Drilling 管理。钻井作业的扩大将带动全部区域钻桿市场的成长。

- 因此,原油需求的增加预计将促进石油和天然气探勘,这反过来有望促进北美钻桿市场的成长。

美国主导市场

- 美国是最大的油田服务市场,这主要归因于页岩和緻密蕴藏量中的钻井和水力压裂井数量不断增加。这是由该盆地较低的损益平衡价格所支持的。页岩气、水平钻井和水力压裂的最新发展大大增加了该地区对油田服务的需求。

- 加拿大是继委内瑞拉和沙乌地阿拉伯之后世界第三大原油蕴藏量,其中96%为沙田。加拿大开采的原油密度大,含有许多沙粒。这导致该国对钻桿的需求增加,因为需要高压和井下干预才能将石油从井孔输送到地面。

- 由于近年来美国在页岩气探勘方面的发展,美国是钻桿的主要市场。墨西哥湾的勘探活动也在增加,进一步补充了该地区的钻桿市场。 2021年,美国石油产量达1,660万桶/日,较前一年略有增加。目前,美国的石油产量比世界上任何其他国家都多。

- 2021年,美国石油产量约为每天1,650万桶,年总产量为7.13亿吨。德克萨斯州总合生产了17亿桶石油。新墨西哥州则位居第二,当年产量为 4.598 亿桶。维吉尼亚的产量为 3,000 桶,是全国最低的。

- 此外,2022年6月,美国政府宣布将举行拜登总统上任以来首次陆上石油和天然气钻探租约竞标。

- 此外,2022 年 12 月,海上钻油平臺所有者 Aquadrill 宣布已与钻井公司 Diamond Offshore 延长了 Vela 钻井船的租赁协议。该合约价值约6000万美元。 Vela 是配备 MPD 的第七代钻井船。

- 预计所有上述因素都将在预测期内推动该国对钻桿的需求。

北美钻桿产业概况

北美钻桿市场较为分散。主要参与企业包括(不分先后顺序)Hunting PLC、National-Oilwell Varco, Inc.、Hilong Holding Ltd、Tenaris SA 和 TMK Group。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 2020 年运作的钻机数量

- 历史和预测上游资本支出(十亿美元)(陆上和海上,2019 年至 2027 年)

- 最新趋势和发展

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 类型

- 标准钻桿

- 重型钻桿

- 钻头颜色

- 年级

- 优等品

- API 等级

- 扩张

- 陆上

- 海上

- 地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Hunting PLC

- Hilong Group

- TMK Group

- National Oilwell Varco, Inc.(NOV)

- Tenaris SA

- Drill Pipe International LLC

- Workstrings International

- Texas Steel Conversion, Inc.(TSC)

- Tejas Tubular Products, Inc.

- DP Master Manufacturing(S)Pte Ltd

- Challenger International, Inc.

第七章 市场机会与未来趋势

简介目录

Product Code: 71170

The North America Drill Pipe Market is expected to register a CAGR of greater than 2% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as increased exploration activity and a focus on the development of new oil and gas fields are expected to help drive the market for drill pipe.

- On the other hand, the volatile nature of oil prices in recent years has led to decreased exploration activity, causing a slowdown in the drill pipe market.

- Nevertheless, the rise in offshore exploration and production projects is expected to create an excellent opportunity for the market players, as all the easy oil is already found and wells are moving towards deeper and more extreme offshore environments.

- The United States is the biggest market for drill pipe, owing to the region's increased drilling activity in shale plays. The recent development of shale plays, horizontal drilling, and fracking has resulted in an increase in demand for drill pipe in the region.

North America Drill Pipe Market Trends

Onshore to Dominate the Market

- The global market for drill pipe saw a growth slowdown owing to the volatile oil prices in recent years, but with the oil prices becoming stable, the market is expected to show growth in the forecast period.

- In 2021, North America's oil production will amount to 23.9 million barrels per day, up from 23.5 million barrels per day in the previous year. Also, onshore oil production in the United States accounts for around 84% of the country's oil production and 3% of the country's natural gas production as of 2021. Increased onshore exploration activity in the forecasted period is expected to help grow the market for drill pipes.

- Almost all the easy oil has already been discovered; the wells now being drilled are deeper and more complex than before, which has led to a growth in the drill pipe market.

- The recent shale boom in the United States significantly increased the drilling pipe market in the region. The U.S. Energy Information Administration (EIA) estimates that in 2021, about 2.64 billion barrels (or about 7.23 million barrels per day) of crude oil will be produced directly from tight oil resources in the United States. This was equal to about 64% of total U.S. crude oil production in 2021.

- Moreover, in November 2022, United States oil and gas giant ExxonMobil awarded a deal for operations in Canada to a rig owned by SFL Corporation (SFL), which will be managed by the Norwegian drilling contractor, Odfjell Drilling. The growing drilling operations will in turn culminate in the growth of the drill pipe market across the region.

- Therefore, with the increase in the demand for crude oil, oil & gas exploration is expected to rise, and in turn, the market is expected to grow for drill pipe in North America.

United States to Dominate the Market

- United States in the region is the largest market for oilfield services, mainly due to the increasing number of wells being drilled and fracked in the shale and tight reserves. This is supported by the low breakeven price of the basins. The recent development of shale plays, horizontal drilling, and fracking has resulted in a massive increase in demand for oilfield services in the region.

- On a similar note, Canada has the world's third-largest crude oil reserves, after Venezuela and Saudi Arabia, of which 96% are oil sand reserves. The oil available in the country is of high density and has high sand particle content. Due to this, oil transport from the bottom hole of the oil well to the surface requires high pressure and wellbore intervention, thus increasing the demand for drill pipes in the country.

- United States is a major market for drill pipe, owing to the recent shale gas exploration in the region in recent years. Exploration in the Gulf of Mexico is also on the rise, further complimenting the drill pipe market in the region. In 2021, oil production in the United States reached 16.6 million barrels per day, a slight increase from the previous year. The United States currently produces more oil than any other country in the world.

- In 2021, the U.S. oil production totaled some 16.5 million barrels of oil per day, or a total annual oil production of 713 million metric tons. Texas produced a total of 1.7 billion barrels. In a distant second place is New Mexico, which produced 459.8 million barrels in the same year. Virginia is the smallest producing state in the country, at three thousand barrels.

- Moreover, in June 2022, The United States government has announced it is holding its first onshore oil and natural gas drilling lease auctions since President Joe Biden took office after a federal court blocked the administration's attempt to suspend such sales because of climate change worries.

- Furthermore, in December 2022, Offshore drilling rig owner Aquadrill announced it had extended a charter-hire deal with drilling firm Diamond Offshore for its Vela drillship.The Vela drillship will be provided to an end client in the U.S. Gulf of Mexico for a 150-day drilling contract as part of the extension. The contract is worth around USD 60 million. The Vela is an MPD-equipped 7th generation drillship.

- All of the above factors are likely to propel the demand for drill pipe in the country during the forecast period.

North America Drill Pipe Industry Overview

The North America drill pipe market is fragmented. Some of the key players being (in particular order) include Hunting PLC, National-Oilwell Varco, Inc., Hilong Holding Ltd, Tenaris S.A., TMK Group among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Active Rig Count, till 2020

- 4.4 Historic and Demand Forecast of Upstream CAPEX in USD billion, by Onshore and Offshore, 2019-2027

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Standard Drill Pipe

- 5.1.2 Heavy Weight Drill Pipe

- 5.1.3 Drill Collar

- 5.2 Grade

- 5.2.1 Premium Grade

- 5.2.2 API Grade

- 5.3 Deployment

- 5.3.1 Onshore

- 5.3.2 Offshore

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Hunting PLC

- 6.3.2 Hilong Group

- 6.3.3 TMK Group

- 6.3.4 National Oilwell Varco, Inc. (NOV)

- 6.3.5 Tenaris S.A.

- 6.3.6 Drill Pipe International LLC

- 6.3.7 Workstrings International

- 6.3.8 Texas Steel Conversion, Inc. (TSC)

- 6.3.9 Tejas Tubular Products, Inc.

- 6.3.10 DP Master Manufacturing (S) Pte Ltd

- 6.3.11 Challenger International, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219