|

市场调查报告书

商品编码

1876656

800V电动车架构市场机会、成长驱动因素、产业趋势分析及2025-2034年预测800V Electric Vehicle Architecture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

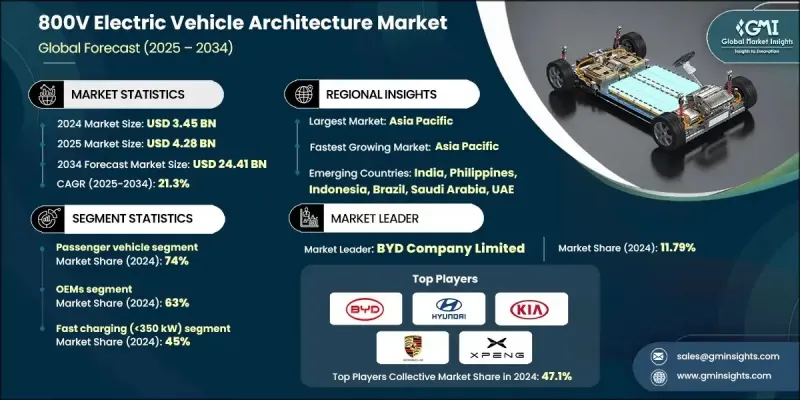

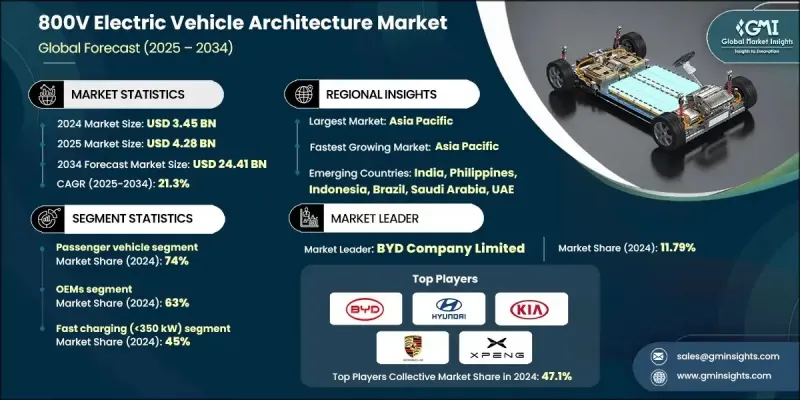

2024 年全球 800V 电动车架构市场价值为 34.5 亿美元,预计到 2034 年将以 21.3% 的复合年增长率增长至 244.1 亿美元。

800V架构的采用正在改变全球电动车产业,它能够实现更快的充电速度、更高的能源效率、更轻的线束重量和更优异的热管理。这些高压系统整合了电池、逆变器、马达和车载电子设备,支援超快速充电和更高的功率输出,使其成为下一代电动车的必备组件。原始设备製造商 (OEM)、半导体供应商、电池製造商和电力电子公司之间的投资和合作正在加速其部署。新冠疫情进一步推动了电动车的普及和基础设施建设,因为各国政府和製造商都将永续性、低排放和非接触式技术放在了优先位置。北美和欧洲凭藉其先进的法规、强大的OEM厂商网路和完善的充电基础设施,在电动车的普及方面处于领先地位。能够支援800V车辆的超快速充电网路正在全球扩展,将充电时间从数小时缩短到数分钟。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34.5亿美元 |

| 预测值 | 244.1亿美元 |

| 复合年增长率 | 21.3% |

2024年,乘用车市占率达到74%,预计到2034年将以20.8%的复合年增长率成长。这一成长主要得益于消费者对高性能电动车的需求,包括更长的续航里程、更快的充电速度和更高的能源效率。为了满足消费者对高端和技术先进电动车日益增长的需求,领先的汽车製造商正越来越多地采用800V平台,以提供更快的加速性能和更优异的充电性能。

2024年, OEM厂商占据了63%的市场份额,预计2025年至2034年将以20.4%的复合年增长率成长。 OEM厂商正迅速将高压架构整合到下一代电动车中,以提高效率、热管理和充电速度。各公司致力于开发专有系统,以降低布线复杂性并优化能源利用,从而增强其在不断发展的电动车市场中的竞争优势。

中国800V电动车架构市场占40%的份额,预计2024年市场规模将达到5.342亿美元。中国的领先地位源于其强大的製造业生态系统、政府的激励政策以及主要汽车製造商对高压平台的广泛采用。从电池到半导体再到充电基础设施的一体化供应链,使其能够实现大规模生产并降低成本。中国正积极拓展超快速充电网络,并在电池技术创新方面处于领先地位,进一步加速向800V系统的转型。

800V电动车架构市场的主要参与者包括现代汽车、Lucid Motors、比亚迪、Kia、小鹏汽车、博格华纳、Zeekr Automobile、蔚来汽车、大众汽车和保时捷。这些企业正采取多种策略来提升其市场地位。他们大力投资研发,以优化高压平台、改善热管理并降低布线复杂性。与电池製造商、半导体供应商和基础设施供应商的策略合作正在加速技术部署和生态系统整合。此外,汽车製造商也致力于推出具有超快充电功能的高端高性能电动车车型,以吸引精通技术且注重性能的客户。同时,地理扩张、在地化生产和供应链优化也帮助企业降低成本、增强可扩展性,并巩固其在这个快速成长的市场中的全球影响力。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对更快充电速度和更长续航里程的需求不断增长

- 高性能电动车产量激增

- 政府加强对电动车的激励措施和监管支持力度

- 原始设备製造商和半导体供应商之间的合作成长

- 消费者对节能型和高端电动车的偏好日益增强

- 产业陷阱与挑战

- 800V元件和整合成本高昂

- 相容的充电基础设施数量有限

- 市场机会

- 商用和车队电动车中800V系统的应用日益普及

- 对下一代电池技术的投资激增

- 对支援 800V 电压的自动驾驶和连网车辆的需求不断增长

- 新兴经济体电动车製造业的扩张

- 轻量化、高效能电力电子研发投入成长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利分析

- 价格趋势

- 按地区

- 按组件

- 成本細項分析

- 永续性和环境影响分析

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 未来展望与机会

- 新兴应用

- 下一代创新

- 投资机会

- 消费者接受度与市场准备度

- 总拥有成本 (TCO) 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第六章:市场估算与预测:依建筑类型划分,2021-2034年

- 主要趋势

- 完整的800V系统

- 混合/增压系统

第七章:市场估算与预测:以收费方式划分,2021-2034年

- 主要趋势

- 超快速充电(>350千瓦)

- 快速充电(<350千瓦)

- 标准充电

第八章:市场估算与预测:以推进方式划分,2021-2034年

- 主要趋势

- 电池电动车(BEV)

- 插电式混合动力车(PHEV)

- 燃料电池电动车(FCEV)

第九章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- OEM

- 售后市场

第十章:市场估价与预测:依组件划分,2021-2034年

- 主要趋势

- 电池

- 逆变器

- 车用充电器

- 电动机

- 配电模组

- 其他的

第十一章:市场估计与预测:依最终用途划分,2021-2034年

- 主要趋势

- 私人的

- 商业/车队

第十二章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- 全球参与者

- Audi (Volkswagen)

- BMW

- BYD Company

- General Motors Company

- Hyundai Motor

- Kia

- Lucid Motors

- Mercedes-Benz

- NIO

- Porsche

- Xpeng

- Power Electronics & Semiconductor Suppliers

- Hitachi

- Infineon Technologies

- ON Semiconductor

- ROHM Semiconductor

- STMicroelectronics

- Wolfspeed

- Charging Infrastructure Providers

- ABB

- ChargePoint

- EVgo

- Tritium DCFC

- Battery & Energy Storage Suppliers

- CATL

- LG Energy Solution

- Panasonic

The Global 800V Electric Vehicle Architecture Market was valued at USD 3.45 billion in 2024 and is estimated to grow at a CAGR of 21.3% to reach USD 24.41 billion by 2034.

The adoption of 800V architectures is transforming the global EV industry by enabling faster charging, higher energy efficiency, reduced wiring weight, and superior thermal management. These high-voltage systems integrate batteries, inverters, motors, and onboard electronics to support ultra-fast charging and enhanced power output, making them essential for next-generation EVs. Investments and collaborations among OEMs, semiconductor suppliers, battery manufacturers, and power electronics companies are accelerating their deployment. The COVID-19 pandemic further boosted EV adoption and infrastructure development, as governments and manufacturers prioritized sustainability, low emissions, and contactless technologies. North America and Europe lead adoption due to advanced regulations, strong OEM presence, and charging infrastructure readiness. Ultra-fast charging networks capable of supporting 800V vehicles are expanding worldwide, reducing charging times from hours to minutes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.45 Billion |

| Forecast Value | $24.41 Billion |

| CAGR | 21.3% |

The passenger vehicle segment held a 74% share in 2024 and is forecasted to grow at a 20.8% CAGR through 2034. The growth is driven by consumer demand for high-performance EVs with extended driving ranges, rapid charging, and improved energy efficiency. Leading automakers are increasingly adopting 800V platforms to deliver faster acceleration and superior charging performance, responding to the rising preference for premium and technologically advanced EVs.

The OEM segment accounted for a 63% share in 2024 and is expected to grow at a CAGR of 20.4% from 2025 to 2034. OEMs are rapidly integrating high-voltage architectures into next-generation EVs to improve efficiency, thermal management, and charging speed. Companies are focusing on developing proprietary systems that reduce wiring complexity and optimize energy use, strengthening their competitive edge in the evolving EV market.

China 800V Electric Vehicle Architecture Market held a 40% share, generating USD 534.2 million in 2024. The country's leadership stems from a strong manufacturing ecosystem, government-backed incentives, and widespread adoption of high-voltage platforms by key automakers. Its integrated supply chain, from batteries to semiconductors and charging infrastructure, allows large-scale production and cost efficiency. China is aggressively expanding ultra-fast charging networks and leading innovations in battery technologies, further accelerating the transition to 800V systems.

Major players in the 800V Electric Vehicle Architecture Market include Hyundai Motor Company, Lucid Motors, BYD Company, Kia, Xpeng Motors, BorgWarner, Zeekr Automobile, NIO, Volkswagen, and Porsche. Companies in the 800V Electric Vehicle Architecture Market are adopting multiple strategies to enhance their market position. They are investing heavily in research and development to optimize high-voltage platforms, improve thermal management, and reduce wiring complexity. Strategic partnerships and collaborations with battery manufacturers, semiconductor suppliers, and infrastructure providers are accelerating technology deployment and ecosystem integration. OEMs are also focusing on launching premium, high-performance EV models with ultra-fast charging capabilities to attract tech-savvy and performance-oriented customers. Additionally, geographic expansion, local production, and supply chain optimization are helping companies lower costs, enhance scalability, and strengthen their global footprint in this rapidly growing market.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Charging

- 2.2.4 Propulsion

- 2.2.5 Application

- 2.2.6 Architecture

- 2.2.7 Component

- 2.2.8 End Use

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in demand for faster charging and extended driving range

- 3.2.1.2 Surge in production of high-performance electric vehicles

- 3.2.1.3 Increase in government incentives and regulatory support for EVs

- 3.2.1.4 Growth in collaboration between OEMs and semiconductor suppliers

- 3.2.1.5 Rise in consumer preference for energy-efficient and premium EVs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of 800V components and integration

- 3.2.2.2 Limited availability of compatible charging infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Rise in adoption of 800V systems in commercial and fleet EVs

- 3.2.3.2 Surge in investment toward next-generation battery technologies

- 3.2.3.3 Increase in demand for 800V-ready autonomous and connected vehicles

- 3.2.3.4 Expansion of EV manufacturing in emerging economies

- 3.2.3.5 Growth in R&D toward lightweight, efficient power electronics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental impact analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Future outlook & opportunities

- 3.13.1 Emerging Applications

- 3.13.2 Next-Generation Innovations

- 3.13.3 Investment Opportunities

- 3.14 Consumer Adoption & Market Readiness

- 3.15 Total Cost of Ownership (TCO) Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LAMEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Architecture, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Full 800V System

- 6.3 Hybrid / Boosted System

Chapter 7 Market Estimates & Forecast, By Charging, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Ultra-Fast Charging (>350 kW)

- 7.3 Fast Charging (<350 kW)

- 7.4 Standard Charging

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery electric vehicles (BEVs)

- 8.3 Plug-in hybrid electric vehicles (PHEVs)

- 8.4 Fuel cell electric vehicles (FCEVs)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Battery

- 10.3 Inverter

- 10.4 On-board Charger

- 10.5 Electric Motor

- 10.6 Power Distribution Module

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 Private

- 11.3 Commercial/Fleet

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Philippines

- 12.4.7 Indonesia

- 12.5 LAMEA

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 South Africa

- 12.5.5 Saudi Arabia

- 12.5.6 UAE

Chapter 13 Company Profiles

- 13.1 Global Players

- 13.1.1 Audi (Volkswagen)

- 13.1.2 BMW

- 13.1.3 BYD Company

- 13.1.4 General Motors Company

- 13.1.5 Hyundai Motor

- 13.1.6 Kia

- 13.1.7 Lucid Motors

- 13.1.8 Mercedes-Benz

- 13.1.9 NIO

- 13.1.10 Porsche

- 13.1.11 Xpeng

- 13.2 Power Electronics & Semiconductor Suppliers

- 13.2.1 Hitachi

- 13.2.2 Infineon Technologies

- 13.2.3 ON Semiconductor

- 13.2.4 ROHM Semiconductor

- 13.2.5 STMicroelectronics

- 13.2.6 Wolfspeed

- 13.3 Charging Infrastructure Providers

- 13.3.1 ABB

- 13.3.2 ChargePoint

- 13.3.3 EVgo

- 13.3.4 Tritium DCFC

- 13.4 Battery & Energy Storage Suppliers

- 13.4.1 CATL

- 13.4.2 LG Energy Solution

- 13.4.3 Panasonic