|

市场调查报告书

商品编码

1876817

形状记忆聚合物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Shape Memory Polymers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

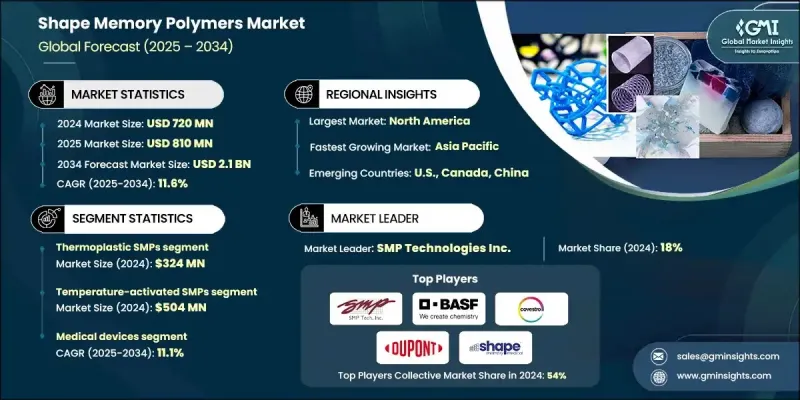

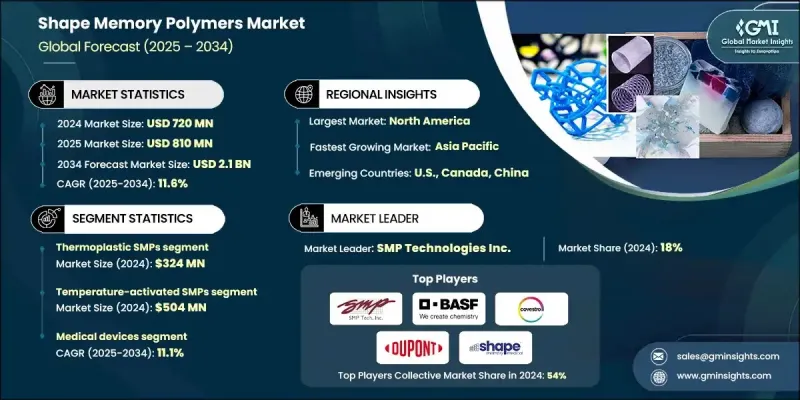

2024 年全球形状记忆聚合物市场价值为 7.2 亿美元,预计到 2034 年将以 11.6% 的复合年增长率增长至 21 亿美元。

随着各行业日益重视智慧响应材料的应用,市场也不断扩张。形状记忆聚合物(SMP)具有独特的恢復原状的能力,即在受到外部刺激后能够恢復到原始形状,这使其在需要高性能和自适应材料的先进领域中得到广泛应用。对智慧材料设计的日益重视正在推动SMP在製造业、医疗保健、汽车和航太等行业的应用。这些聚合物支持永续性、能源效率和自修復能力方面的创新,使製造商能够设计出更轻、更耐用的结构。在生物医学领域,SMP越来越多地用于先进医疗器材、自膨胀支架和微创植入物,从而提升性能并促进患者康復。航太和国防领域也大力投资于SMP基材料,因为它们重量轻、抗疲劳且具有可编程的机械性能,所有这些都有助于提高运作效率和长期可靠性。随着持续的研发投入和材料技术的突破,SMP正稳步成为下一代材料技术的基石。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.2亿美元 |

| 预测值 | 21亿美元 |

| 复合年增长率 | 11.6% |

热塑性形状记忆聚合物(SMP)市场预计在2024年将创造3.24亿美元的收入。这些材料因其可回收性、易加工性和在永续产品开发方面的潜力而日益受到欢迎。儘管热塑性SMP通常强度较低且耐温性有限,但配方创新以及混合型和多响应型SMP的引入正在提升其性能。随着永续性成为设计和製造的关键因素,市场对可生物降解和复合型SMP的兴趣也日益浓厚。随着聚合物化学和加工技术的不断进步,预计具有卓越功能的可编程SMP在工业应用领域的需求将持续成长。

2024年,温度活化形状记忆聚合物市场规模预计将达5.04亿美元。此类别之所以占据主导地位,是因为其活化过程简单,且与标准生产技术相容。这些材料对热刺激反应迅速,广泛应用于汽车、航太和生物医学等领域。其热激活特性使其能够更好地控制形状恢復、柔韧性和自修復性能,从而适用于多种工程和结构应用。

2024年,北美形状记忆聚合物市场规模达2.88亿美元,占全球40%的市占率。美国在该地区占据最大份额,这得益于其强大的工业基础、技术创新和完善的研发体系。航太、医疗器材和汽车等关键领域的广泛应用持续推动市场成长。此外,该地区还聚集了多家先进材料生产商和聚合物开发商,致力于将自适应聚合物商业化应用于工业和医疗领域。主要聚合物製造商的存在以及持续的研发投入,进一步巩固了该地区在全球形状记忆聚合物市场的领先地位。

全球形状记忆聚合物市场的主要活跃企业包括 Coating Place Inc.、赢创工业集团 (Evonik Industries AG)、3M 公司、帝斯曼集团 (DSM NV)、先正达集团 (Syngenta AG)、Aveka Inc.、巴斯夫公司 (BASF SE)、亚什兰全球控股公司 (Ashland Global Holdings Inc.)、陶氏康宁公司Capsugel(龙沙集团旗下)。全球形状记忆聚合物市场的领导者正采取多种策略来巩固其市场地位。这些策略包括加强研发投入,以提升聚合物的柔韧性、可重编程性和生物降解性等性能。企业也积极寻求与学术机构和产业伙伴进行策略合作,以加速材料创新和应用拓展。许多公司正致力于产品多元化,开发多重刺激响应型形状记忆聚合物,并将其应用于医疗保健和航太等高成长领域。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 智慧材料的需求不断增长

- 生物医学应用的进展

- 不断发展的航太和国防领域

- 产业陷阱与挑战

- 与形状记忆合金相比,其復原力有限

- 特殊配方产品生产成本高

- 温度敏感度和环境稳定性挑战

- 市场机会

- 气候适应建筑围护结构系统

- 永续和生物基配方开发

- 物联网整合和智慧基础设施应用

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 材料类型

- 刺激类型

- 应用

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依材料类型划分,2021-2034年

- 主要趋势

- 热塑性形状记忆聚合物

- 聚氨酯基体系

- 聚酯基体系

- 聚己内酯体系

- 热固性形状记忆聚合物

- 环氧树脂基体系

- 氰酸酯体系

- 聚酰亚胺体系

- 可生物降解的SMPs

- 聚己内酯基

- 基于PLGA的系统

- 基于PHA的系统

- 复合形状记忆聚合物

- 碳纤维增强

- 玻璃纤维增强

- 奈米颗粒增强

第六章:市场估算与预测:依刺激类型划分,2021-2034年

- 主要趋势

- 温度启动型SMP

- 玻璃转换触发系统

- 熔点触发系统

- 体温活化系统

- 光激活SMP

- 紫外线触发系统

- 可见光系统

- 近红外线激活系统

- 电激活SMP

- 焦耳加热系统

- 导电填料集成

- 电阻加热应用

- 磁激活形状记忆聚合物

- 氧化铁奈米颗粒体系

- 铁磁性填料集成

- 远端启动应用程式

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 医疗器材

- 血管栓塞装置

- 支架和导管

- 骨科植入物

- 手术器械

- 药物输送系统

- 航太与国防

- 可部署结构

- 变形飞机部件

- 空间应用

- 自修復复合材料

- 执行器系统

- 汽车

- 自修復组件

- 自适应空气动力学

- 室内应用

- 安全系统

- 轻量化应用

- 建筑与基础设施

- 管道改造系统

- 自适应建筑围护结构

- 抗震韧性应用

- 智慧基础设施系统

- 自癒混凝土

- 工业与製造业

- 执行器系统

- 智慧组件

- 製程设备

- 自动化应用

- 纺织应用

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Shape Memory Medical Inc.

- Covestro AG

- BASF SE

- SMP Technologies Inc.

- Dupont De Nemours, Inc.

- Natureworks LLC

- Lubrizol Corporation

- Evonik Industries AG

- Spintech, LLC

- Huntsman International LLC

The Global Shape Memory Polymers Market was valued at USD 720 million in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 2.1 billion by 2034.

The market is expanding as industries increasingly focus on the use of smart and responsive materials. The unique ability of shape memory polymers (SMPs) to return to their original form when exposed to external stimuli has led to their adoption in advanced sectors requiring high-performance and adaptive materials. Growing emphasis on intelligent material design is promoting their use across manufacturing, healthcare, automotive, and aerospace industries. These polymers support innovations in sustainability, energy efficiency, and self-healing capabilities, allowing manufacturers to design lighter and more durable structures. In the biomedical field, SMPs are increasingly being used for advanced medical devices, self-expanding stents, and minimally invasive implants, offering enhanced performance and patient recovery. The aerospace and defense sectors are also investing heavily in SMP-based materials due to their low weight, fatigue resistance, and programmable mechanical behavior, all of which contribute to operational efficiency and long-term reliability. With ongoing R&D initiatives and material breakthroughs, SMPs are steadily becoming a cornerstone of next-generation material technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $720 Million |

| Forecast Value | $2.1 Billion |

| CAGR | 11.6% |

Thermoplastic shape memory polymers segment generated USD 324 million in 2024. These materials are gaining popularity due to their recyclability, ease of processing, and potential in sustainable product development. Although thermoplastic SMPs generally have lower strength and limited temperature tolerance, innovations in formulation and the introduction of hybrid and multi-responsive variants are improving their performance. The market is also witnessing growing interest in biodegradable and composite SMPs, as sustainability becomes a key factor in design and manufacturing. With continuous advancements in polymer chemistry and processing, the demand for reprogrammable SMPs with superior functionality is expected to expand across industrial applications.

The temperature-activated shape memory polymers segment generated USD 504 million in 2024. This category dominates due to its simple activation process and compatibility with standard production techniques. These materials respond efficiently to thermal triggers and are widely used in automotive, aerospace, and biomedical applications. Their thermal activation enables superior control over shape recovery, flexibility, and self-healing behavior, making them suitable for multiple engineering and structural applications.

North America Shape Memory Polymers Market accounted for USD 288 million in 2024 and held 40% share. The United States holds the largest share in the region, supported by a strong industrial foundation, technological innovation, and a well-established R&D framework. Extensive usage in key sectors such as aerospace, medical devices, and automotive continues to drive market growth. Additionally, the region is home to several advanced material producers and polymer developers focusing on the commercialization of adaptive polymers for industrial and medical use. The presence of major polymer manufacturers and ongoing investments in research are further enhancing the region's leadership position in the Global Shape Memory Polymers Market.

Major companies active in the Global Shape Memory Polymers Market include Coating Place Inc., Evonik Industries AG, 3M Company, DSM N.V., Syngenta AG, Aveka Inc., BASF SE, Ashland Global Holdings Inc., DOW Corning, Balchem Corporation, and Capsugel (Lonza Group). Leading companies in the Global Shape Memory Polymers Market are adopting multiple strategies to strengthen their market foothold. These include investments in R&D to enhance polymer properties such as flexibility, reprogramming capability, and biodegradability. Strategic collaborations with academic institutions and industrial partners are being pursued to accelerate material innovation and application expansion. Many firms are focusing on product diversification by developing multi-stimuli-responsive SMPs and integrating them into high-growth sectors like healthcare and aerospace.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Stimulus Type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for smart materials

- 3.2.1.2 Advancements in biomedical applications

- 3.2.1.3 Growing aerospace and defense sector

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited recovery force compared to shape memory alloys

- 3.2.2.2 High production costs for specialty formulations

- 3.2.2.3 Temperature sensitivity & environmental stability challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Climate-adaptive building envelope systems

- 3.2.3.2 Sustainable & bio-based formulation development

- 3.2.3.3 IoT integration & smart infrastructure applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Material Type

- 3.7.3 Stimulus Type

- 3.7.4 Application

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Thermoplastic SMPs

- 5.2.1 Polyurethane-based systems

- 5.2.2 Polyester-based systems

- 5.2.3 Polycaprolactone systems

- 5.3 Thermoset SMPs

- 5.3.1 Epoxy-based systems

- 5.3.2 Cyanate ester systems

- 5.3.3 Polyimide systems

- 5.4 Biodegradable SMPs

- 5.4.1 Poly(ε-caprolactone) based

- 5.4.2 PLGA-based systems

- 5.4.3 PHA-based systems

- 5.5 Composite SMPs

- 5.5.1 Carbon fiber reinforced

- 5.5.2 Glass fiber reinforced

- 5.5.3 Nanoparticle enhanced

Chapter 6 Market Estimates and Forecast, By Stimulus Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Temperature-activated SMPs

- 6.2.1 Glass transition triggered systems

- 6.2.2 Melting temperature triggered systems

- 6.2.3 Body temperature activated systems

- 6.3 Light-activated SMPs

- 6.3.1 UV-triggered systems

- 6.3.2 Visible light systems

- 6.3.3 Nir-activated systems

- 6.4 Electrically activated SMPs

- 6.4.1 Joule heating systems

- 6.4.2 Conductive filler integration

- 6.4.3 Resistive heating applications

- 6.5 Magnetically activated SMPs

- 6.5.1 Iron oxide nanoparticle systems

- 6.5.2 Ferromagnetic filler integration

- 6.5.3 Remote activation applications

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Medical devices

- 7.2.1 Vascular embolization devices

- 7.2.2 Stents & catheters

- 7.2.3 Orthopedic implants

- 7.2.4 Surgical instruments

- 7.2.5 Drug delivery systems

- 7.3 Aerospace & defense

- 7.3.1 Deployable structures

- 7.3.2 Morphing aircraft components

- 7.3.3 Space applications

- 7.3.4 Self-healing composites

- 7.3.5 Actuator systems

- 7.4 Automotive

- 7.4.1 Self-repairable components

- 7.4.2 Adaptive aerodynamics

- 7.4.3 Interior applications

- 7.4.4 Safety systems

- 7.4.5 Lightweighting applications

- 7.5 Construction & infrastructure

- 7.5.1 Pipeline renovation systems

- 7.5.2 Adaptive building envelopes

- 7.5.3 Seismic resilience applications

- 7.5.4 Smart infrastructure systems

- 7.5.5 Self-healing concrete

- 7.6 Industrial & manufacturing

- 7.6.1 Actuator systems

- 7.6.2 Smart components

- 7.6.3 Process equipment

- 7.6.4 Automation applications

- 7.6.5 Textile applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Shape Memory Medical Inc.

- 9.2 Covestro AG

- 9.3 BASF SE

- 9.4 SMP Technologies Inc.

- 9.5 Dupont De Nemours, Inc.

- 9.6 Natureworks LLC

- 9.7 Lubrizol Corporation

- 9.8 Evonik Industries AG

- 9.9 Spintech, LLC

- 9.10 Huntsman International LLC