|

市场调查报告书

商品编码

1876826

类器官及球状体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Organoids and Spheroids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

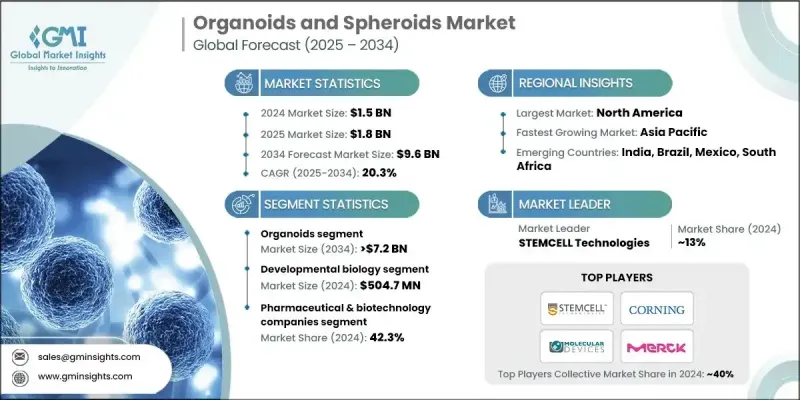

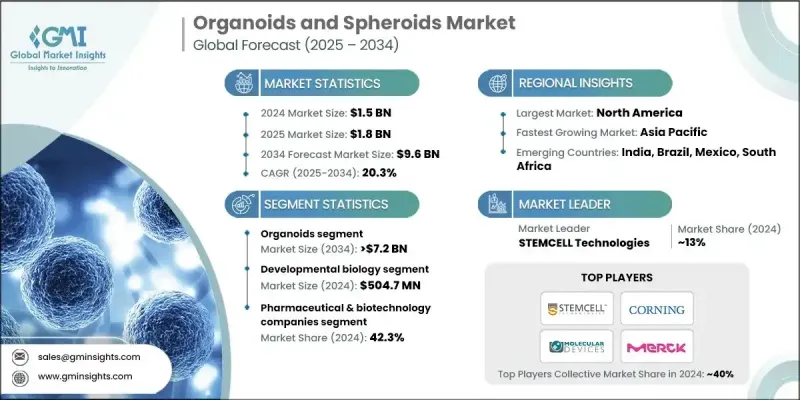

2024 年全球类器官和球状体市场价值为 15 亿美元,预计到 2034 年将以 20.3% 的复合年增长率增长至 96 亿美元。

随着研究人员和开发人员越来越依赖比传统二维系统更能模拟人体生理的先进三维细胞培养模型,市场扩张正在加速。这项转变主要源自于再生医学、肿瘤学和神经病学等领域对更精确、可扩展且符合伦理规范的临床前解决方案的需求。患者来源的类器官和球状体模型的日益普及也推动了产业发展,因为这些模型能够提供关于个体治疗反应和生物标记识别的宝贵资讯。这些平台透过让科学家真实了解疾病特异性突变的行为方式以及患者细胞对药物的反应,正在改变标靶治疗的开发方式。它们的广泛应用提高了预测的准确性,并减少了试误法测试中常见的低效性。类器官和球状体市场涵盖广泛的应用领域,包括药物发现、毒性评估、再生医学、疾病建模和个人化治疗策略,从而推动了学术界、临床和商业领域的强劲需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 96亿美元 |

| 复合年增长率 | 20.3% |

2024年,类器官市场占了76.2%的份额。其主导地位源自于类器官能够重现人体组织的功能和结构特征,进而更可靠地模拟疾病机制和药物反应。随着研究人员越来越多地将类器官整合到个人化医疗流程中,尤其是在肿瘤学领域,患者特异性组织有助于更精准地选择治疗方案,因此对类器官的需求持续成长。类器官在再生医学领域日益广泛的应用也推动了其在肝臟、神经和肠道组织工程领域的应用。

由于药物发现、毒性评估和个人化治疗开发越来越依赖3D系统,预计到2024年,製药和生物技术公司板块将占据42.3%的市场份额。这些公司正在整合基于类器官和球状体的平台,以提高早期开发阶段的预测准确性并减少临床试验失败。各公司正在对高通量筛选系统进行大量投资,这些系统能够利用3D培养同时测试多种化合物。

2024年,北美类器官和球状体市场占据42.7%的市场。强大的生物医学研究能力、突破性技术的快速应用以及领先的製药和生物技术开发商的积极参与,共同推动了该地区的成长。癌症、神经系统疾病和胃肠道疾病的日益普遍,促使人们更深入地应用与人体相关的临床前模型。此外,由于充足的研究经费、不断扩大的患者来源生物样本库以及类器官在精准医疗计画中的广泛应用,美国和加拿大基于类器官的研究活动也日益活跃。

类器官和球状体市场的主要参与者包括ACROBiosystems、AMSBIO、ATCC、Corning、Lonza、DefiniGEN、Molecular Devices、Merck KGaA、Prellis Biologics和STEMCELL Technologies。这些公司正透过扩展其3D培养平台、加强与製药和生物技术公司的合作以及投资自动化筛选技术来巩固其竞争地位。许多公司正在开发针对特定疾病的类器官模型,以支持精准医疗计画并打造差异化的产品组合。此外,各公司也正在改进其生产工艺,以确保可扩展性、可重复性和合规性,这对于在药物发现和临床研究中更广泛地应用至关重要。与学术机构和医疗保健提供者的策略合作有助于公司获得多样化的患者来源样本,从而改善个人化治疗工具。此外,成像、培养基和生物列印系统的技术升级也使该公司能够提供更先进、更具商业可行性的3D细胞培养解决方案。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 细胞培养技术的进步

- 对个人化医疗的需求不断增长

- 慢性病盛行率上升

- 三维球体系统的技术进步

- 产业陷阱与挑战

- 缺乏可靠的疾病模型

- 开发和维护成本高昂

- 市场机会

- 类器官生物样本库和罕见疾病建模的扩展

- 人工智慧与数位平台的融合

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 未来市场趋势

- 技术格局

- 目前技术

- 新兴技术

- 专利分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 类器官

- 按类型

- 神经类器官

- 肝臟类器官

- 肠道类器官

- 其他类器官类型

- 透过方法

- 类器官培养的通用浸没法

- 隐窝类器官培养技术

- 气液界面(ALI)法

- 其他类器官培养方法

- 按来源

- 原代组织

- 干细胞

- 按类型

- 球状体

- 按类型

- 多细胞肿瘤球体

- 神经球

- 乳腺球体

- 肝球

- 透过方法

- 微图案板

- 低细胞黏附板

- 悬滴法

- 其他球状体培养方法

- 按来源

- 细胞系

- iPSCs衍生细胞

- 按类型

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 发育生物学

- 个人化医疗

- 再生医学

- 疾病病理学研究

- 药物毒性和疗效测试

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 製药和生物技术公司

- 学术和研究机构

- 医院和诊断中心

- 其他最终用途

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ACROBiosystems

- AMSBIO

- ATCC

- Corning

- DefiniGEN

- Lonza

- Merck KGaA

- Molecular Devices

- Prellis Biologics

- STEMCELL Technologies

The Global Organoids and Spheroids Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 20.3% to reach USD 9.6 billion by 2034.

Market expansion is accelerating as researchers and developers increasingly depend on advanced 3D cell culture models that mirror human physiology better than traditional 2D systems. This transition is largely fueled by the need for more accurate, scalable, and ethically acceptable preclinical solutions across areas such as regenerative medicine, oncology, and neurology. Growing adoption of patient-derived organoids and spheroids is also contributing to industry momentum, as these models deliver valuable insights into individual treatment responses and biomarker identification. These platforms are transforming targeted therapy development by giving scientists a realistic view of how disease-specific mutations behave and how patient cells react to drugs. Their growing use provides stronger predictability and decreases the inefficiencies often seen in trial-and-error testing. The organoids and spheroids market covers a broad spectrum of applications, including drug discovery, toxicity evaluation, regenerative medicine, disease modelling, and personalized therapeutic strategies, driving strong demand across academic, clinical, and commercial sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 20.3% |

The organoids segment held a 76.2% share in 2024. Its dominance stems from the ability of organoids to recreate functional and structural features of human tissues, resulting in more reliable modelling of disease mechanisms and drug responses. Demand continues to rise as researchers increasingly integrate organoids into personalized medicine workflows, particularly in oncology, where patient-specific tissue helps guide more precise therapy selection. Their expanding role in regenerative medicine is also spurring adoption across liver, neural, and intestinal tissue engineering initiatives.

The pharmaceutical and biotechnology companies segment held 42.3% share in 2024 due to growing reliance on 3D systems for drug discovery, toxicity evaluation, and personalized therapy development. These organizations are incorporating organoid- and spheroid-based platforms to enhance prediction accuracy during early development and reduce clinical trial failures. Companies are making sizable investments in high-throughput screening systems that allow simultaneous testing of multiple compounds using 3D cultures.

North America Organoids and Spheroids Market accounted for a 42.7% share in 2024. Regional growth is supported by strong biomedical research capabilities, rapid adoption of breakthrough technologies, and significant participation from leading pharmaceutical and biotech developers. The rising prevalence of cancer, neurological disorders, and gastrointestinal diseases is leading to deeper integration of human-relevant preclinical models. The U.S. and Canada are also witnessing increased activity in organoid-based research because of robust research funding, expanding patient-derived biobanks, and widespread use of organoids in precision medicine programs.

Key Organoids and Spheroids Market participants include ACROBiosystems, AMSBIO, ATCC, Corning, Lonza, DefiniGEN, Molecular Devices, Merck KGaA, Prellis Biologics, and STEMCELL Technologies. Companies in the Organoids and Spheroids Market are strengthening their competitive position by expanding their 3D culture platforms, increasing partnerships with pharmaceutical and biotech firms, and investing in automated screening technologies. Many are developing specialized, disease-focused organoid models to support precision medicine initiatives and create differentiated product portfolios. Firms are also enhancing their manufacturing processes to ensure scalability, reproducibility, and regulatory compliance, which is essential for broader adoption in drug discovery and clinical research. Strategic collaborations with academic institutes and healthcare providers help companies access diverse patient-derived samples, allowing them to refine personalized therapy tools. Additionally, technological upgrades in imaging, culture media, and bioprinting systems are enabling companies to deliver more advanced and commercially viable 3D cell culture solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Application trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancement in cell culture technologies

- 3.2.1.2 Increase in demand for personalized medicine

- 3.2.1.3 Rise in prevalence of chronic diseases

- 3.2.1.4 Technological advancement in 3D spheroid systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of robust disease models

- 3.2.2.2 High cost of development and maintenance

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of organoid biobanks and rare disease modeling

- 3.2.3.2 Integration of AI and digital platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Organoids

- 5.2.1 By Type

- 5.2.1.1 Neural organoids

- 5.2.1.2 Hepatic organoids

- 5.2.1.3 Intestinal organoids

- 5.2.1.4 Other organoid types

- 5.2.2 By Method

- 5.2.2.1 General submerged method for organoid culture

- 5.2.2.2 Crypt organoid culture techniques

- 5.2.2.3 Air Liquid Interface (ALI) method

- 5.2.2.4 Other organoid culture methods

- 5.2.3 By Source

- 5.2.3.1 Primary tissues

- 5.2.3.2 Stem cells

- 5.2.1 By Type

- 5.3 Spheroids

- 5.3.1 By Type

- 5.3.1.1 Multicellular tumor spheroids

- 5.3.1.2 Neurospheres

- 5.3.1.3 Mammospheres

- 5.3.1.4 Hepatospheres

- 5.3.2 By Method

- 5.3.2.1 Micropatterned plates

- 5.3.2.2 Low cell attachment plates

- 5.3.2.3 Hanging drop method

- 5.3.2.4 Other spheroid culture methods

- 5.3.3 By Source

- 5.3.3.1 Cell line

- 5.3.3.2 iPSCs derived cells

- 5.3.1 By Type

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Developmental biology

- 6.3 Personalized medicine

- 6.4 Regenerative medicine

- 6.5 Disease pathology studies

- 6.6 Drug toxicity & efficacy testing

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pharmaceutical & biotechnology companies

- 7.3 Academic & research institutes

- 7.4 Hospitals and diagnostic centers

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ACROBiosystems

- 9.2 AMSBIO

- 9.3 ATCC

- 9.4 Corning

- 9.5 DefiniGEN

- 9.6 Lonza

- 9.7 Merck KGaA

- 9.8 Molecular Devices

- 9.9 Prellis Biologics

- 9.10 STEMCELL Technologies